Post-Election Australian Assets: Market Analysts' Predictions

Table of Contents

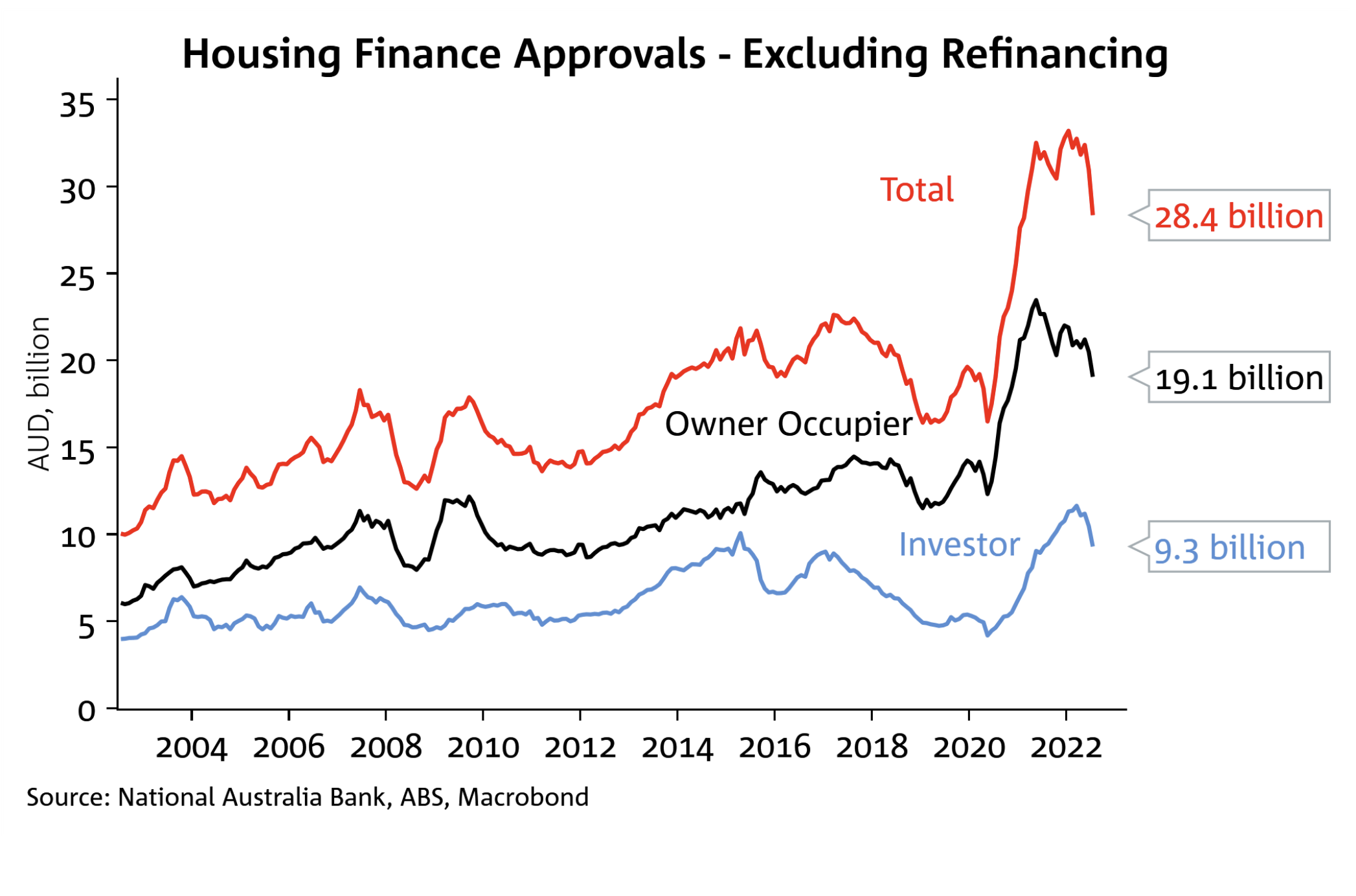

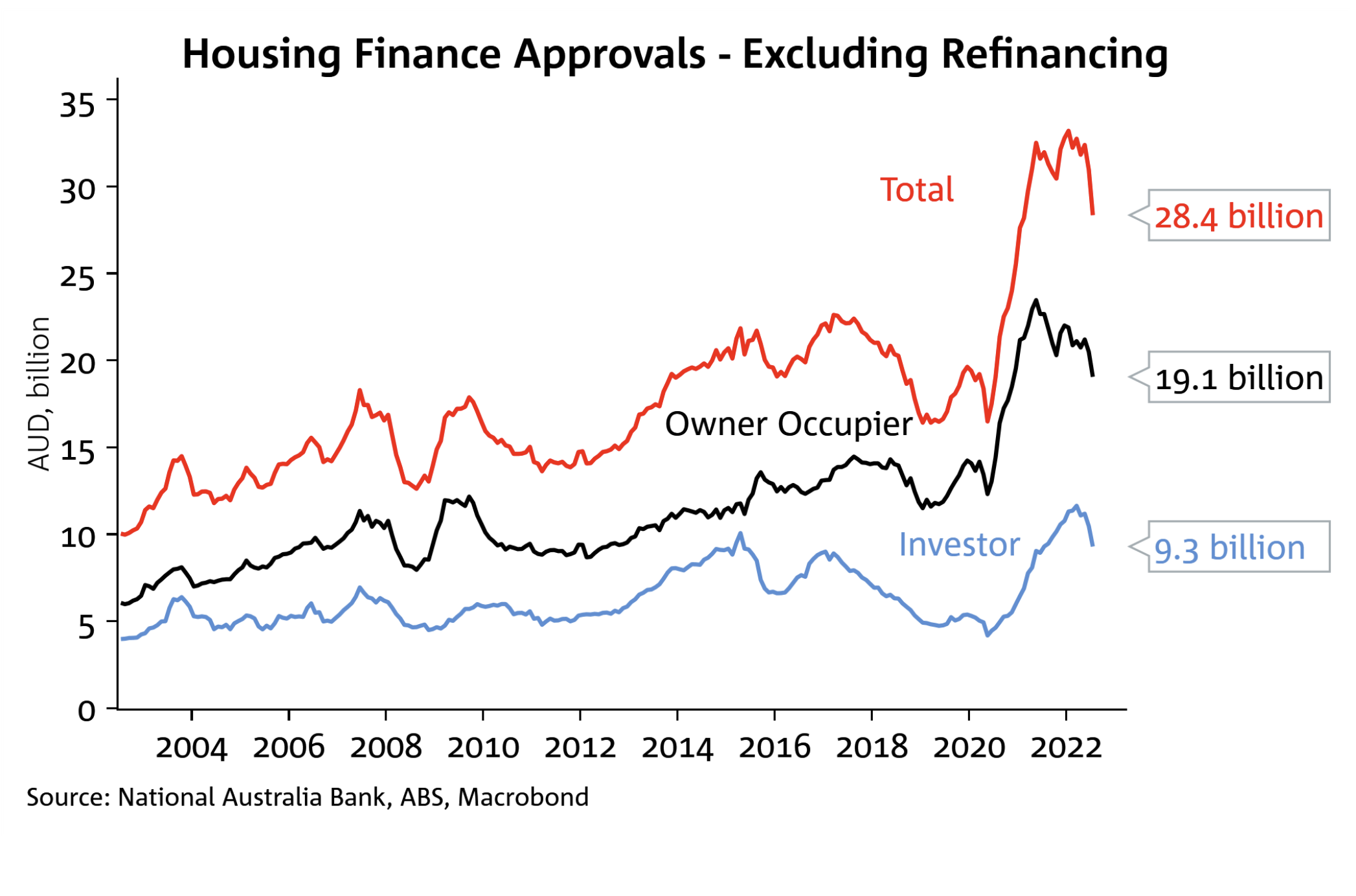

Impact on the Australian Property Market

The Australian property market, a significant component of many investment portfolios, is expected to experience considerable shifts following the election. Keywords like "Australian property market forecast," "post-election property prices," and "property investment Australia" are on the minds of many investors.

-

Interest Rate Sensitivity: Analysts predict that changes in interest rates will significantly impact property values. A rise in interest rates, often implemented by the Reserve Bank of Australia (RBA) to combat inflation, typically cools the market, potentially leading to price corrections. Conversely, lower rates can stimulate growth. The RBA's post-election stance will be closely watched.

-

Government Policy Influence: Government policies concerning housing affordability, tax incentives for property investors, and regulations affecting foreign investment will all play a crucial role. Recent policies aimed at cooling the market, like changes to negative gearing, continue to be debated and may be adjusted.

-

Regional Variations: The property market is far from homogenous. Sydney and Melbourne, traditionally strong performers, might experience different trends than regional areas. Analysts predict continued strong performance in certain regional markets driven by lifestyle changes and increased remote work opportunities.

-

Rental Yields and Capital Growth: Projections for rental yields and capital growth vary widely depending on location and property type. Investors need to carefully assess individual market segments and factor in these projections when formulating their investment strategies. Commercial property, for instance, might be more resilient to interest rate changes than residential property.

Australian Stock Market Outlook Post-Election

The Australian Stock Exchange (ASX) is also expected to feel the ripple effects of the election. Keywords such as "Australian share market forecast," "ASX predictions," and "post-election stock market" are key terms to consider when analysing the situation.

-

Sectoral Impact: The impact on various ASX sectors will vary significantly. Resources, heavily reliant on global commodity prices and government policies, may see shifts in performance depending on the new government's focus. Financials will be keenly sensitive to interest rate movements. The technology sector might be influenced by government investment in technological infrastructure and digital economy initiatives.

-

Investor Sentiment and Volatility: The election outcome might cause significant shifts in investor sentiment, leading to increased market volatility in the short term. Analysts are predicting a period of uncertainty followed by a gradual stabilization once the government's economic policy becomes clearer.

-

Company Performance Predictions: Individual company performance will be shaped by specific policy changes relevant to their industry. Analysts are closely monitoring the performance of key ASX-listed companies, offering insights into their potential trajectory.

-

Risk Management and Capitalisation: Investors need robust risk management strategies to navigate the potential volatility. Understanding the strengths and weaknesses of their investment portfolios is crucial, alongside identifying opportunities to capitalise on potential market downturns or sector-specific growth.

The Future of Australian Infrastructure Assets

Government spending on infrastructure is another crucial aspect influencing post-election Australian assets. Keywords like "Australian infrastructure investment," "government spending on infrastructure," and "post-election infrastructure projects" will drive analysis.

-

Government Spending Plans: The newly elected government's budget and infrastructure spending plans will significantly impact this sector. Projects already underway may face revisions, and new projects might be initiated.

-

Private Sector Involvement: The level of private sector involvement in infrastructure projects is expected to increase. Public-private partnerships (PPPs) will play a critical role in financing and delivering these projects.

-

Long-Term Growth Prospects: Infrastructure assets traditionally offer relatively stable, long-term growth prospects. However, the specific rate of growth will depend on government policy and economic conditions. Renewable energy infrastructure, in particular, is expected to attract significant investment.

-

Investment Types: Infrastructure investments encompass diverse assets, such as toll roads, railways, ports, renewable energy projects, and telecommunications networks. Each carries a unique risk-reward profile that investors must evaluate.

Australian Bond Market Predictions

The Australian bond market is intrinsically linked to interest rate movements and government borrowing. Keywords like "Australian bond yields," "government bonds Australia," and "post-election bond market" highlight its importance.

-

Interest Rate Impact on Bond Yields: Changes in interest rates directly affect bond yields. Higher rates generally lead to higher yields, making bonds more attractive but potentially reducing their capital value.

-

Demand for Government Bonds: Demand for government bonds fluctuates based on investor sentiment and perceived risk. Following an election, demand can be influenced by market expectations regarding the government's fiscal policy and debt management strategy.

-

Risk and Return Characteristics: Different types of bonds carry different levels of risk and return. Government bonds are usually considered less risky than corporate bonds, but they typically offer lower yields. Investors need to carefully consider this trade-off.

Conclusion

This article has highlighted key predictions from market analysts concerning post-election Australian assets across various sectors. Understanding these predictions is vital for navigating the current economic landscape and making informed investment decisions regarding post-election Australian assets. The impact on Australian property, the ASX, infrastructure, and the bond market will all depend heavily on the new government's policies and the broader global economic climate.

Call to Action: Stay informed about the evolving post-election Australian assets landscape by regularly reviewing market analysis and adapting your investment strategy accordingly. For expert guidance on navigating the complexities of the post-election Australian assets market, consult with a financial advisor.

Featured Posts

-

Rachel Zeglers Met Gala Appearance Amidst Snow White Backlash

May 06, 2025

Rachel Zeglers Met Gala Appearance Amidst Snow White Backlash

May 06, 2025 -

The Ultimate Sabrina Carpenter Fortnite Guide Outfits Emotes And More

May 06, 2025

The Ultimate Sabrina Carpenter Fortnite Guide Outfits Emotes And More

May 06, 2025 -

Revealed Kim Kardashians Laser Treatment Before The 2025 Met Gala

May 06, 2025

Revealed Kim Kardashians Laser Treatment Before The 2025 Met Gala

May 06, 2025 -

Gigi Hadids 30th Birthday Instagram Reveal Of Bradley Cooper Relationship

May 06, 2025

Gigi Hadids 30th Birthday Instagram Reveal Of Bradley Cooper Relationship

May 06, 2025 -

Dismissing Valuation Concerns Bof As View On The Current Stock Market

May 06, 2025

Dismissing Valuation Concerns Bof As View On The Current Stock Market

May 06, 2025