Potential Ripple Effects Of Rising Long-Term Yields: Ueda's Warning

Table of Contents

Keywords: Rising long-term yields, Ueda's warning, Japanese economy, global markets, interest rate hikes, inflation, bond yields, economic impact, financial markets, monetary policy.

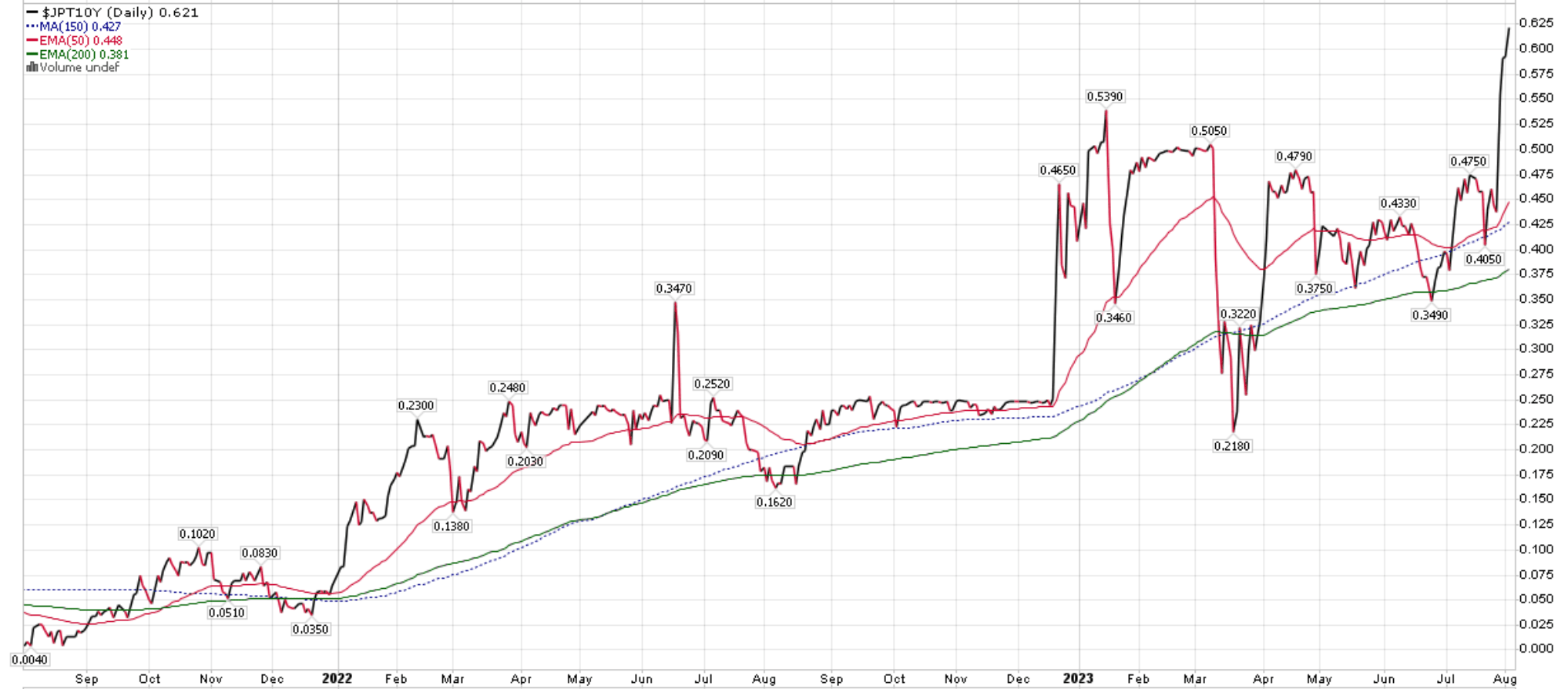

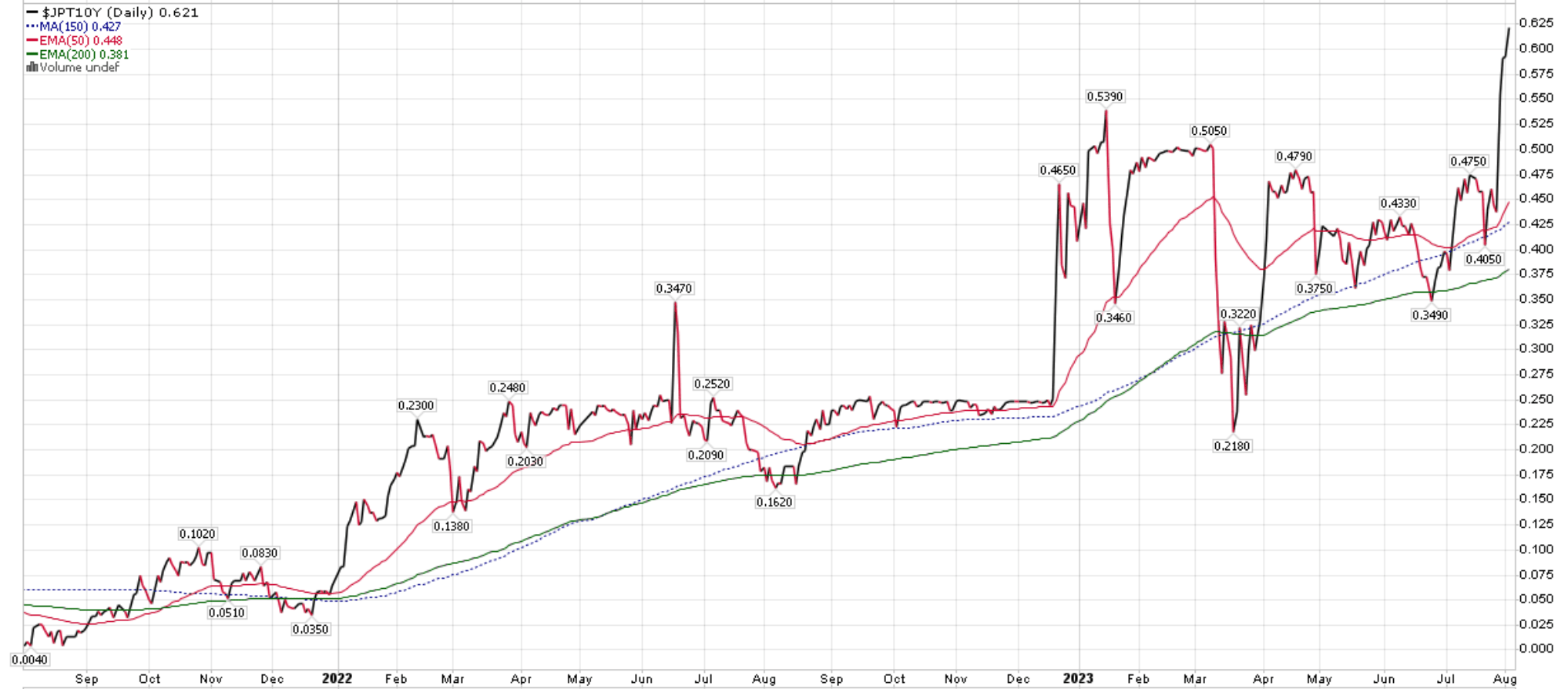

Governor Kazuo Ueda's recent pronouncements regarding rising long-term yields have sent ripples through financial markets worldwide. His warnings underscore a growing concern about the potential destabilizing effects of increasing bond yields, not just for Japan's economy but for the global financial system as a whole. This article delves into the potential ripple effects of rising long-term yields, examining Ueda's concerns and their broader implications.

Ueda's Concerns and the Current Economic Climate

Governor Ueda's statements reflect a growing unease about the pace of increase in long-term yields. He has expressed worry about the impact of sustained yield increases on the Japanese economy's delicate recovery. This concern is set against a backdrop of persistent, albeit moderating, inflation and relatively sluggish economic growth.

- Summary of Ueda's key concerns: Ueda has voiced concern that rapidly rising long-term yields could stifle economic activity by increasing borrowing costs for businesses and consumers, potentially undermining the fragile recovery. He has also highlighted the risk of increased volatility in the financial markets.

- Current inflation rate in Japan: While inflation has eased from its peak, it remains above the Bank of Japan's target, adding complexity to the monetary policy challenge.

- Recent economic growth figures: Japan's economic growth has been moderate, hampered by persistent global uncertainties and weak consumer spending.

- Impact of global economic slowdown: The global economic slowdown poses a significant external risk to Japan's economic outlook, further complicating the response to rising long-term yields.

Ripple Effects on the Japanese Economy

The implications of rising long-term yields for the Japanese economy are multifaceted and potentially severe. The increase in borrowing costs directly affects several key sectors.

- Impact on corporate borrowing costs: Higher yields make it more expensive for businesses to borrow money, potentially hindering investment and expansion plans. This could lead to reduced job creation and slower economic growth.

- Effect on housing market: Rising mortgage rates, a direct consequence of higher long-term yields, could cool down the already relatively subdued Japanese housing market, impacting construction activity and consumer confidence.

- Potential for decreased consumer spending: Increased borrowing costs for consumers can lead to reduced spending, further dampening economic activity. This can create a deflationary spiral, counteracting the BOJ's efforts to stimulate inflation.

- Volatility in the Yen exchange rate: Rising yields could attract foreign investment into Japanese government bonds (JGBs), potentially strengthening the Yen. However, rapid and unpredictable shifts could also lead to significant exchange rate volatility, impacting exports and imports.

Global Market Implications of Rising Long-Term Yields in Japan

Japan's economy is deeply intertwined with the global financial system. Therefore, changes in Japanese bond yields have far-reaching consequences.

- Potential for capital flight from Japan: If yields rise significantly in other developed economies, investors might shift their capital away from Japan, potentially weakening the Yen and impacting financial stability.

- Impact on other Asian currencies: Changes in Japanese interest rates and bond yields can influence capital flows in other Asian economies, creating ripple effects throughout the region.

- Effect on global investor confidence: The situation in Japan could impact global investor sentiment, affecting risk appetite and potentially leading to broader market volatility.

- Potential for increased global volatility: Increased volatility in Japanese financial markets could contribute to broader global market instability, affecting investor confidence worldwide.

Potential Mitigation Strategies and Policy Responses

The Bank of Japan (BOJ) faces a complex challenge in managing rising long-term yields. Several policy responses could be considered.

- Possible adjustments to yield curve control: The BOJ might adjust its yield curve control (YCC) policy, potentially allowing for greater flexibility in long-term yields.

- Potential for further interest rate hikes: While unlikely in the near term given the current economic climate, further interest rate hikes could be considered if inflation continues to exceed expectations.

- Effectiveness of quantitative easing programs: The effectiveness of past quantitative easing (QE) programs in managing long-term yields is now being re-evaluated in light of the current situation.

- Government fiscal policy responses: Fiscal policy measures, such as infrastructure spending, could be used to support economic growth and counter the negative impacts of higher borrowing costs.

Conclusion

Governor Ueda's warning about rising long-term yields highlights significant risks for the Japanese economy and global financial markets. The potential impact includes decreased investment, reduced consumer spending, exchange rate volatility, and broader global market instability. Monitoring these developments closely is crucial. Understanding the dynamics of rising long-term yields is vital for informed financial decision-making. Stay informed about the evolving situation and the potential ripple effects of rising long-term yields. Regularly check for updates on Ueda's warning and its implications for the global economy.

Featured Posts

-

Police Respond To Beacon Hill Shooting One Man Injured

May 29, 2025

Police Respond To Beacon Hill Shooting One Man Injured

May 29, 2025 -

Ahtfalyt Alastqlal Fkhr Waetzaz

May 29, 2025

Ahtfalyt Alastqlal Fkhr Waetzaz

May 29, 2025 -

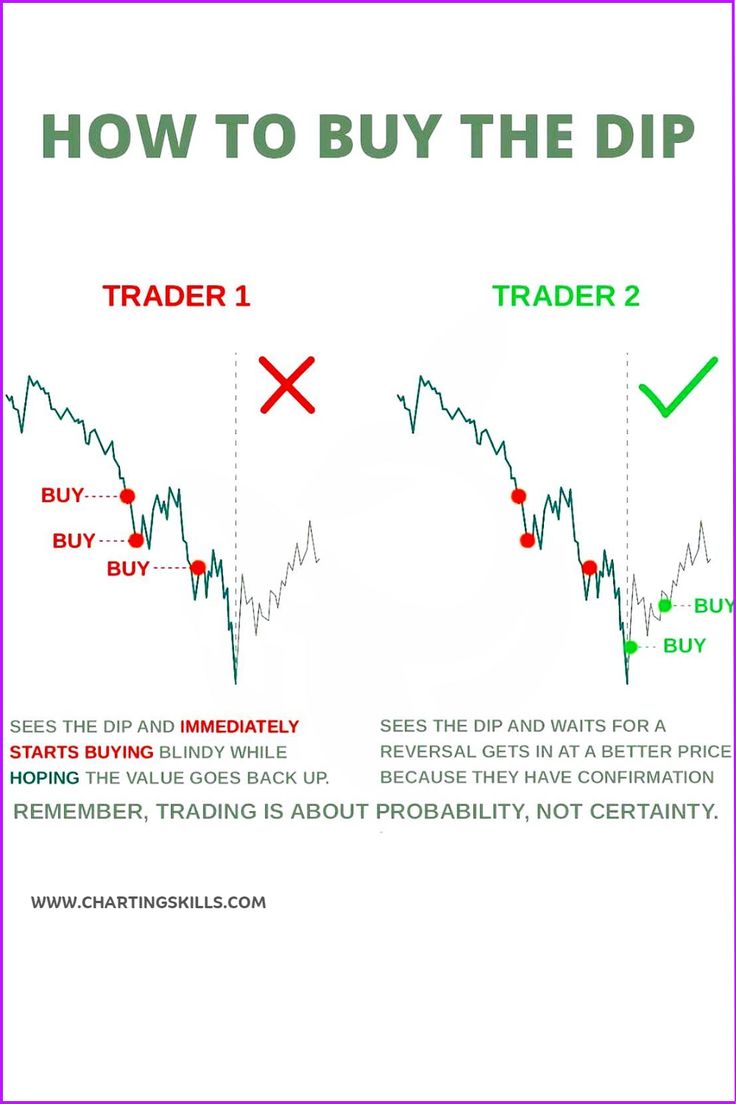

Should You Buy The Dip In This Promising Entertainment Stock

May 29, 2025

Should You Buy The Dip In This Promising Entertainment Stock

May 29, 2025 -

I Deyteri T Hiteia Tramp 10 Simantika Gegonota Ypothetika

May 29, 2025

I Deyteri T Hiteia Tramp 10 Simantika Gegonota Ypothetika

May 29, 2025 -

Diddy Trial Update Ex Employee Claims Combs Threatened To Kill Kid Cudi

May 29, 2025

Diddy Trial Update Ex Employee Claims Combs Threatened To Kill Kid Cudi

May 29, 2025