Pre-Turmoil Cracks In The Private Credit Market: A Credit Weekly Report

Table of Contents

Rising Interest Rates and Their Impact on Private Credit

Rising interest rates are significantly impacting the private credit market, increasing borrowing costs and creating challenges for both borrowers and investors. These interest rate hikes directly translate into higher refinancing costs for existing private debt, potentially jeopardizing the financial stability of highly leveraged companies. The increased cost of capital naturally reduces investor appetite for new private credit investments, leading to a slowdown in deal flow and downward pressure on valuations.

This effect is particularly pronounced in sectors with high levels of existing debt, such as:

- Leveraged buyouts: Companies financed with significant amounts of debt through leveraged buyouts (LBOs) are acutely vulnerable to rising interest rates. Their ability to service debt becomes strained, increasing the likelihood of default.

- Commercial real estate: The commercial real estate sector is facing a double whammy: rising interest rates increase borrowing costs for new developments and refinancing existing properties, while simultaneously impacting property valuations as investors demand higher returns.

Bullet Points:

- Increased refinancing risk for existing private debt.

- Reduced investor appetite for new private credit investments, impacting private credit valuations.

- Potential for increased defaults among highly leveraged borrowers, particularly in interest-rate sensitive sectors.

Increased Scrutiny of Creditworthiness and Due Diligence

The current environment has spurred a significant tightening of lending standards within the private credit market. Lenders are undertaking far more rigorous due diligence and credit underwriting, focusing intensely on risk assessment. This increased scrutiny translates into more stringent requirements for borrowers seeking private credit financing.

This heightened focus on creditworthiness manifests in several ways:

- More stringent collateral requirements: Lenders are demanding greater collateral to mitigate potential losses in case of default.

- Heightened focus on borrower financial health and future projections: Detailed financial analysis and robust forward-looking projections are now paramount to securing financing.

- Increased use of sophisticated credit scoring models: Lenders are leveraging advanced analytics and credit scoring models to more accurately assess credit risk.

Keywords: Credit underwriting, due diligence, risk assessment, loan covenants, default rates

Early Warning Signs of Distress in Specific Sectors

Several sectors are exhibiting early warning signs of distress within the private credit market. Among the most vulnerable are:

- Commercial real estate: Rising vacancy rates in certain commercial real estate markets, coupled with higher borrowing costs, are creating significant challenges for property owners, leading to an increased risk of defaults on private debt.

- Leveraged buyouts: The high levels of leverage inherent in many leveraged buyout transactions make these companies highly susceptible to rising interest rates and economic downturns. The ability to refinance existing debt is becoming a major concern, potentially leading to distress.

Bullet Points:

- Rising vacancy rates in certain commercial real estate markets, notably office space in major urban centers.

- Increased leverage in leveraged buyout transactions, leaving little room for error in the face of economic headwinds.

- Challenges in refinancing high-yield debt due to limited investor appetite and higher borrowing costs. This creates a significant risk of distressed debt situations.

Keywords: Commercial real estate, leveraged buyouts, distressed debt, sector-specific risk, default analysis

The Role of Regulatory Scrutiny and Potential Reforms

The private credit market is facing increasing regulatory scrutiny. This increased attention reflects concerns about transparency, risk management, and the potential systemic implications of distress within this segment of the financial system. Potential regulatory changes could significantly impact the market, including:

- Increased capital requirements for private credit lenders: Higher capital requirements would force lenders to hold more capital against their loan portfolios, potentially limiting lending activity.

- Enhanced disclosure requirements for private credit investments: Improved transparency would provide investors with a clearer picture of the risks associated with private credit investments.

- Stronger oversight of private credit fund managers: Increased regulatory oversight aims to improve risk management practices and enhance investor protection.

Keywords: Financial regulation, regulatory scrutiny, transparency, risk management, compliance

Conclusion: Navigating the Challenges in the Private Credit Market

This report has highlighted several pre-turmoil cracks in the private credit market, including the impact of rising interest rates, increased scrutiny of creditworthiness, sector-specific distress, and the evolving regulatory landscape. Careful risk assessment and due diligence are crucial for navigating the current challenging environment. Investors and borrowers need to proactively assess their exposure to these risks and adapt their strategies accordingly. This may involve diversifying investments, focusing on more resilient sectors, and engaging with experienced financial advisors. Staying informed about developments in the private credit market is paramount. Subscribe to our future credit weekly reports for ongoing analysis and insights to help you navigate the complexities of this dynamic market. Understanding and responding to these evolving dynamics within the private credit market is key to mitigating risk and achieving success in this challenging landscape.

Featured Posts

-

February 16 2025 Open Thread And Community Conversation

Apr 27, 2025

February 16 2025 Open Thread And Community Conversation

Apr 27, 2025 -

New Hair New Tattoos Ariana Grandes Professional Style Evolution

Apr 27, 2025

New Hair New Tattoos Ariana Grandes Professional Style Evolution

Apr 27, 2025 -

Russia Blames Ukraine For Generals Death Near Moscow In Attack

Apr 27, 2025

Russia Blames Ukraine For Generals Death Near Moscow In Attack

Apr 27, 2025 -

High Stock Market Valuations Bof As Case For Why Investors Shouldnt Panic

Apr 27, 2025

High Stock Market Valuations Bof As Case For Why Investors Shouldnt Panic

Apr 27, 2025 -

Top Seed Pegula Claims Charleston Championship After Collins Match

Apr 27, 2025

Top Seed Pegula Claims Charleston Championship After Collins Match

Apr 27, 2025

Latest Posts

-

Pace Of Rent Increases Slows In Metro Vancouver Housing Costs Still High

Apr 28, 2025

Pace Of Rent Increases Slows In Metro Vancouver Housing Costs Still High

Apr 28, 2025 -

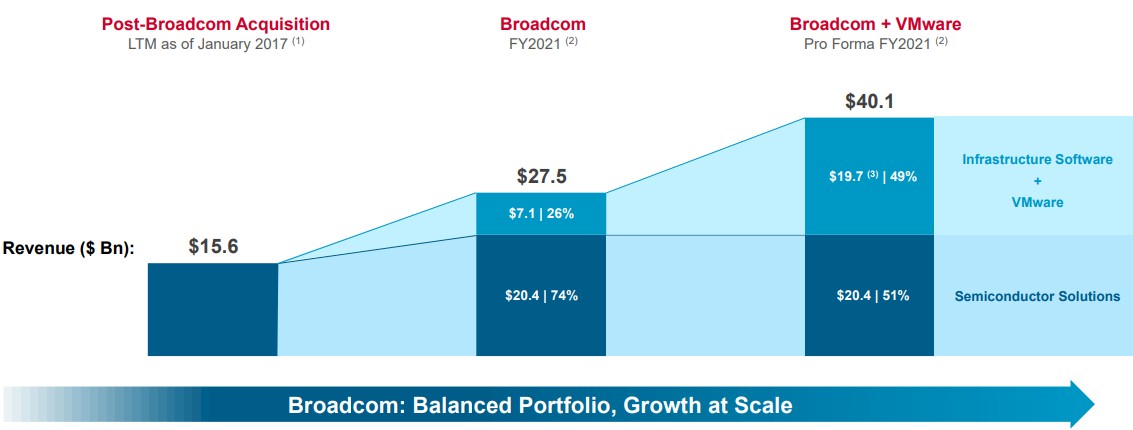

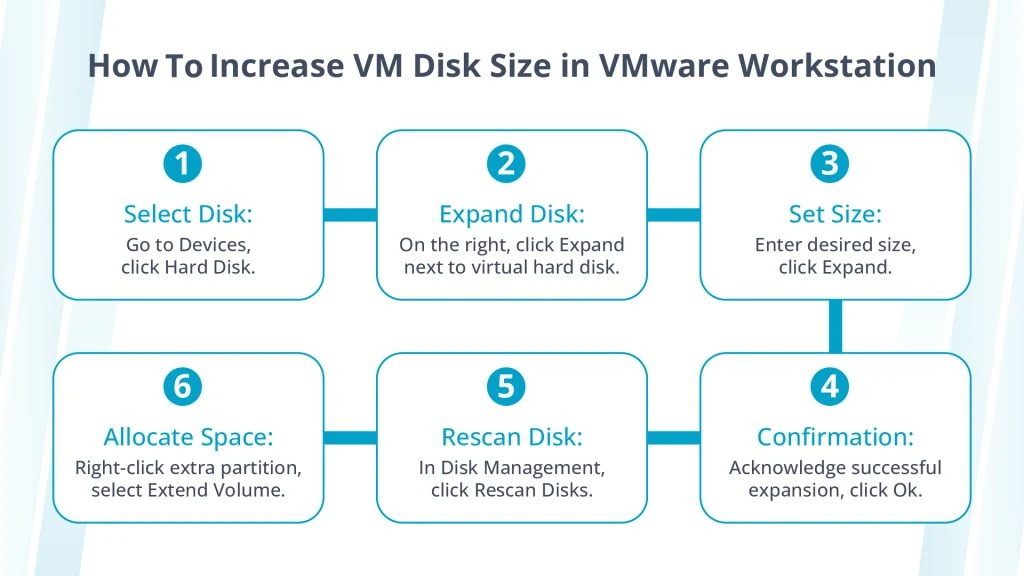

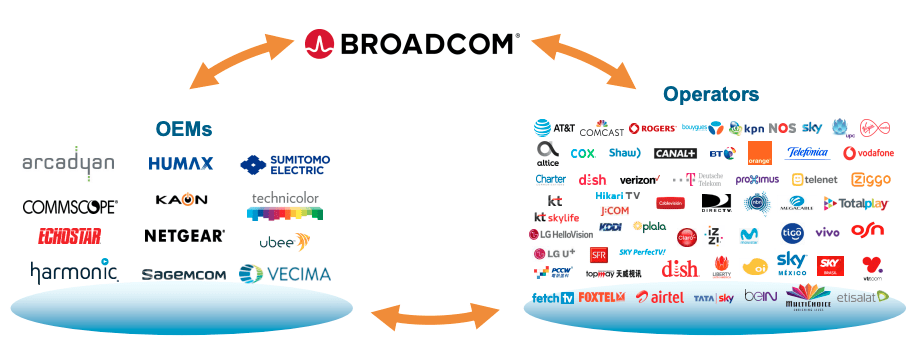

The V Mware Price Shock At And T Highlights A 1 050 Increase From Broadcom

Apr 28, 2025

The V Mware Price Shock At And T Highlights A 1 050 Increase From Broadcom

Apr 28, 2025 -

Broadcoms V Mware Deal At And T Sounds Alarm Over Extreme Cost Increase

Apr 28, 2025

Broadcoms V Mware Deal At And T Sounds Alarm Over Extreme Cost Increase

Apr 28, 2025 -

Extreme Price Increase For V Mware At And Ts Reaction To Broadcoms Proposal

Apr 28, 2025

Extreme Price Increase For V Mware At And Ts Reaction To Broadcoms Proposal

Apr 28, 2025 -

Broadcoms V Mware Acquisition At And T Details Extreme Price Increase

Apr 28, 2025

Broadcoms V Mware Acquisition At And T Details Extreme Price Increase

Apr 28, 2025