PwC's Global Retreat: Exit From Dozen+ Countries Amidst Scandal

Table of Contents

The Scandal's Impact: Trigger for PwC's Global Restructuring

A series of high-profile scandals have significantly eroded public trust in PwC, triggering a global restructuring effort. These incidents, ranging from data breaches to conflicts of interest and regulatory violations, have resulted in substantial financial penalties, reputational damage, and client losses. The scale of the crisis has forced PwC to reassess its global strategy and operational practices.

- Specific examples of scandals and their locations: While specific details of each scandal often remain confidential due to ongoing investigations, reports indicate instances of data breaches impacting client confidentiality, conflicts of interest related to audits of major corporations, and failures to comply with regulatory requirements in various jurisdictions. These incidents have spanned multiple continents, impacting PwC's reputation worldwide.

- Financial penalties and reputational damage incurred by PwC: The financial penalties levied against PwC for its involvement in these scandals have reached millions of dollars. Beyond the financial repercussions, the reputational damage has been immense, leading to diminished trust from clients, investors, and regulatory bodies. This damage has severely impacted PwC's ability to attract and retain talent and secure new business.

- Client losses and decreased market share due to the scandals: The fallout from these scandals has resulted in significant client losses for PwC. Existing clients have switched to competing auditing firms, and prospective clients have expressed concerns about entrusting their financial information to a firm marred by controversy. This has contributed to a noticeable decrease in PwC's market share in several key regions. The resulting PwC scandal has shaken confidence in the firm's abilities and ethical standards.

Countries Affected by PwC's Retreat: A Global Restructuring

PwC's response to the scandals has involved a significant scaling back of its operations in multiple countries. This PwC global footprint reduction reflects a strategic retreat designed to mitigate further risks and focus resources on core markets.

- List of countries where PwC is scaling back or completely withdrawing: While the exact list of countries remains fluid and not always publicly released, media reports suggest withdrawals or significant downsizing in several countries across Europe, Asia, and South America. This market withdrawal is not uniform; some markets see partial reductions, while others experience complete exits.

- Reason for withdrawal in each specific country (e.g., market conditions, regulatory pressure): The reasons behind the withdrawals vary based on local market dynamics and regulatory pressures. In some instances, unfavorable market conditions contributed to the decision, while others reflect increasing regulatory scrutiny and stricter compliance requirements. The country-specific exits highlight the challenges faced by PwC in navigating diverse regulatory environments.

- Impact on local employees and clients: The decision to withdraw from these markets has resulted in job losses for local PwC employees. Clients in these affected countries have to find new auditing and consulting services, potentially causing disruption to their business operations. PwC's official statements often emphasize efforts to support affected employees and to ensure a smooth transition for clients.

Strategic Implications: The Future of PwC's Global Strategy

The PwC restructuring represents a critical juncture for the firm. Its long-term success depends on its ability to effectively address the underlying causes of the scandals and regain public trust. This requires significant changes in corporate governance, risk management, and its overall global strategy.

- Potential changes in corporate governance and risk management: PwC is likely to implement significant changes to its corporate governance structure, enhancing oversight and accountability at all levels. This includes strengthening its risk management frameworks to prevent similar incidents in the future. This improved transparency in auditing will hopefully restore client confidence.

- Rebranding or repositioning strategies employed by PwC: To regain its reputation, PwC may undertake a rebranding or repositioning campaign emphasizing ethical practices and commitment to client service. This will involve substantial investment in communications and transparency initiatives.

- Impact on competition within the accounting and auditing industry: PwC's challenges have created opportunities for its competitors. Rival accounting firms are likely to capitalize on PwC's weakened position, potentially gaining market share and attracting clients. The increased regulatory pressure on all firms may also lead to industry consolidation. The outcome of this strategic review will significantly impact the future of global accounting.

The Role of Regulation and Increased Scrutiny

The increased regulatory scrutiny facing the accounting industry is playing a significant role in PwC's decision-making. Globally, there is a heightened focus on improving accountability and transparency in auditing.

- Examples of new regulations affecting auditing firms globally: New regulations are mandating stricter compliance standards, enhanced oversight of auditing practices, and increased penalties for non-compliance.

- Increased public and governmental pressure for greater transparency and accountability: There is growing public demand for greater transparency and accountability within the accounting industry. Governments are responding by implementing stricter regulations and increasing enforcement efforts. This wave of auditing regulations is forcing firms like PwC to adapt and improve their practices.

Conclusion

The PwC global retreat, triggered by a confluence of damaging scandals and increased regulatory scrutiny, marks a turning point for the firm and the wider auditing industry. The strategic implications are far-reaching, impacting not only PwC's global footprint but also the landscape of global accounting and auditing. The firm's response to this crisis, including its restructuring efforts and commitment to improved governance, will be crucial in determining its future success. Understanding the details of this PwC global retreat is essential for anyone interested in the auditing industry, corporate governance, or the impact of scandals on multinational corporations. Stay informed about the unfolding situation and the future trajectory of this accounting giant. Learn more about the ongoing implications of this significant PwC global retreat.

Featured Posts

-

International Porsche Enthusiasm An Australian Comparison

Apr 29, 2025

International Porsche Enthusiasm An Australian Comparison

Apr 29, 2025 -

Convicted Cardinal Seeks Role In Next Papal Election

Apr 29, 2025

Convicted Cardinal Seeks Role In Next Papal Election

Apr 29, 2025 -

Where To Invest Mapping The Countrys Top Business Destinations

Apr 29, 2025

Where To Invest Mapping The Countrys Top Business Destinations

Apr 29, 2025 -

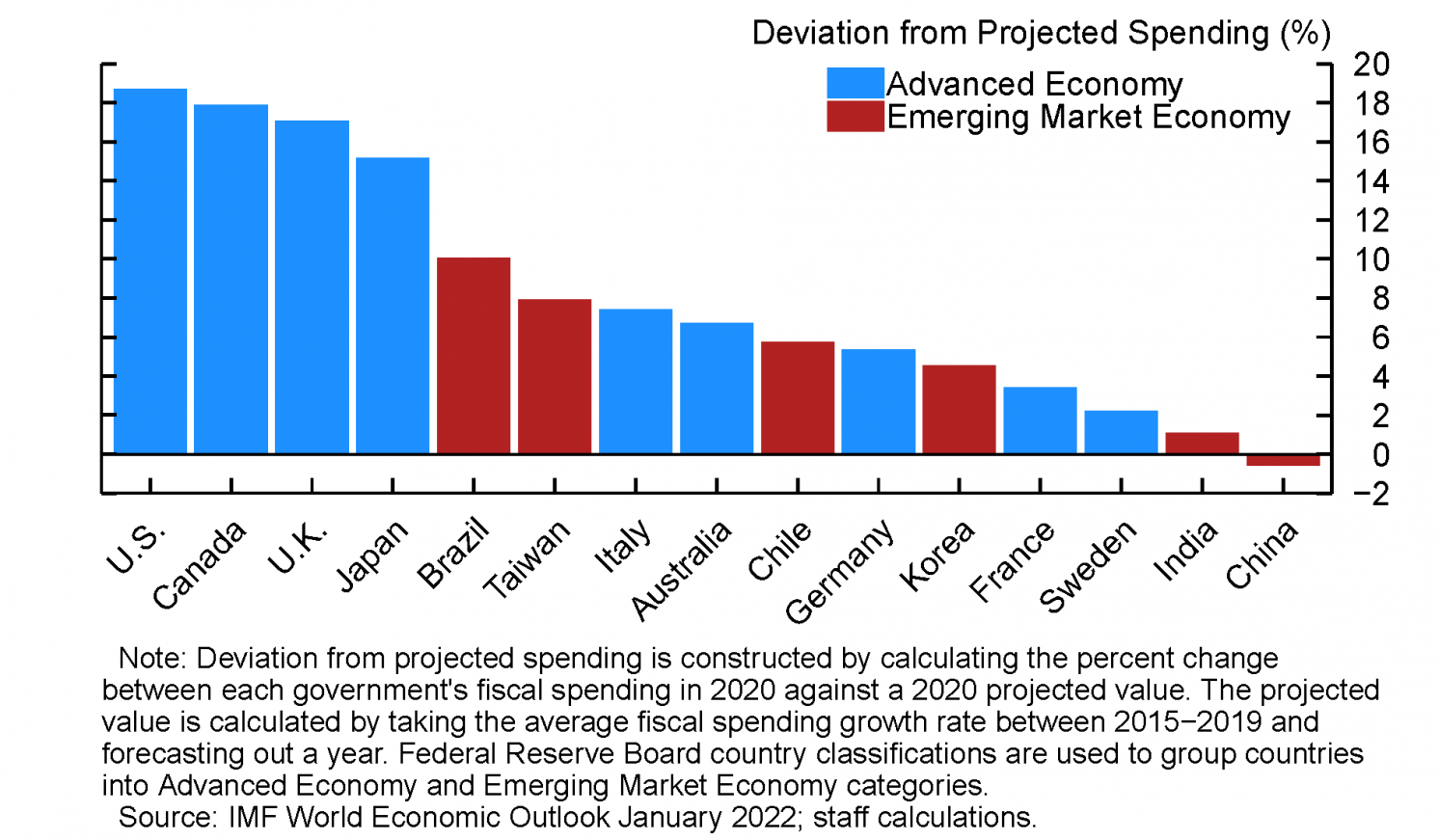

Ecb Lingering Pandemic Fiscal Support Fuels Inflation

Apr 29, 2025

Ecb Lingering Pandemic Fiscal Support Fuels Inflation

Apr 29, 2025 -

The Illusion Of Intelligence Unveiling The Reality Of Ais Thought Processes

Apr 29, 2025

The Illusion Of Intelligence Unveiling The Reality Of Ais Thought Processes

Apr 29, 2025

Latest Posts

-

Increase In Adhd Diagnoses At Aiims Opd Understanding The Factors Contributing To The Rise

Apr 29, 2025

Increase In Adhd Diagnoses At Aiims Opd Understanding The Factors Contributing To The Rise

Apr 29, 2025 -

Aiims Opd Sees Rise In Young People With Adhd Whats The Cause

Apr 29, 2025

Aiims Opd Sees Rise In Young People With Adhd Whats The Cause

Apr 29, 2025 -

Adhd

Apr 29, 2025

Adhd

Apr 29, 2025 -

Coping With A Potential Adult Adhd Diagnosis Resources And Strategies

Apr 29, 2025

Coping With A Potential Adult Adhd Diagnosis Resources And Strategies

Apr 29, 2025 -

Understanding Adult Adhd Diagnosis Treatment And Coping Strategies

Apr 29, 2025

Understanding Adult Adhd Diagnosis Treatment And Coping Strategies

Apr 29, 2025