RBC Reports Lower-Than-Expected Earnings, Prepares For Loan Defaults

Table of Contents

Reasons Behind RBC's Lower-Than-Expected Earnings

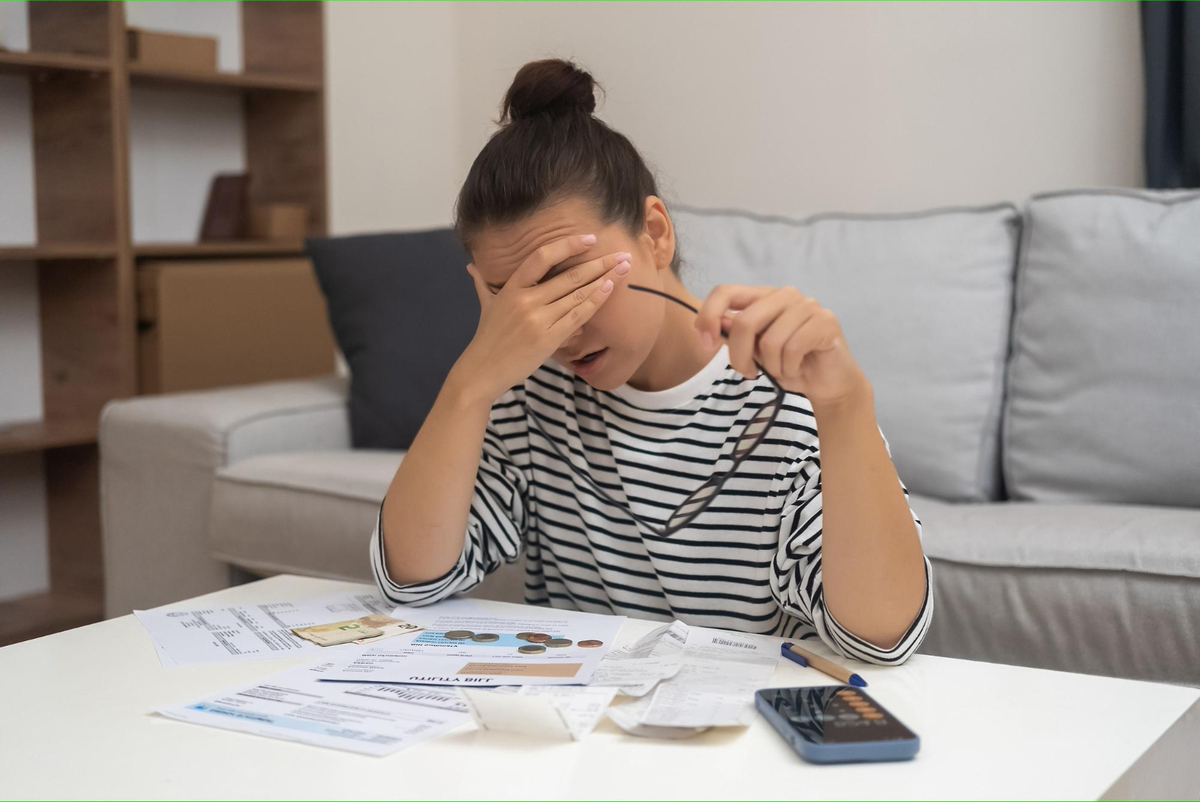

RBC's recent financial report revealed a decline in profitability, a trend impacting the Canadian banking sector and sparking concerns about the overall economic outlook. Several interconnected factors contributed to this unexpected downturn in RBC financial performance:

-

Increased Loan Loss Provisions: A weakening economy has led to increased loan loss provisions. The bank anticipates a rise in borrowers struggling to meet their repayment obligations, necessitating setting aside more capital to cover potential defaults. This directly impacts profitability and reflects the challenging economic climate facing many Canadians. The rising number of loan defaults is a significant concern for RBC's financial health and the stability of the Canadian banking sector as a whole.

-

Lower Investment Banking Revenues: Decreased activity in the global investment banking sector has impacted RBC's revenues from this segment. The volatility in financial markets and a slowdown in mergers and acquisitions have reduced the demand for RBC's investment banking services. This reduction in revenue streams adds further pressure on the bank's overall profitability. Understanding the interplay between global economic conditions and RBC's investment banking performance is crucial for analyzing the bank's overall financial health.

-

Impact of Rising Interest Rates on Net Interest Margins: While rising interest rates generally benefit banks, the rapid increase in rates has had a complex impact. It has squeezed net interest margins, reducing the difference between the interest earned on loans and the interest paid on deposits. The speed and magnitude of these rate hikes created challenges for managing profitability effectively. The impact of rising interest rates on RBC's net interest margins necessitates a closer examination of their lending and deposit strategies.

-

Increased Operating Expenses: Inflationary pressures have increased RBC's operating expenses, impacting its overall profitability. The cost of maintaining operations, including salaries, technology, and compliance, has risen, eating into the bank's earnings. Managing these increased expenses effectively remains a challenge for maintaining healthy profit margins.

-

Competition from Other Financial Institutions: Intense competition within the Canadian banking sector continues to pressure profit margins for all players, including RBC. The strategies of other financial institutions and the innovative fintech sector contribute to the competitive landscape, influencing RBC's market share and profitability.

RBC's Strategies for Managing Potential Loan Defaults

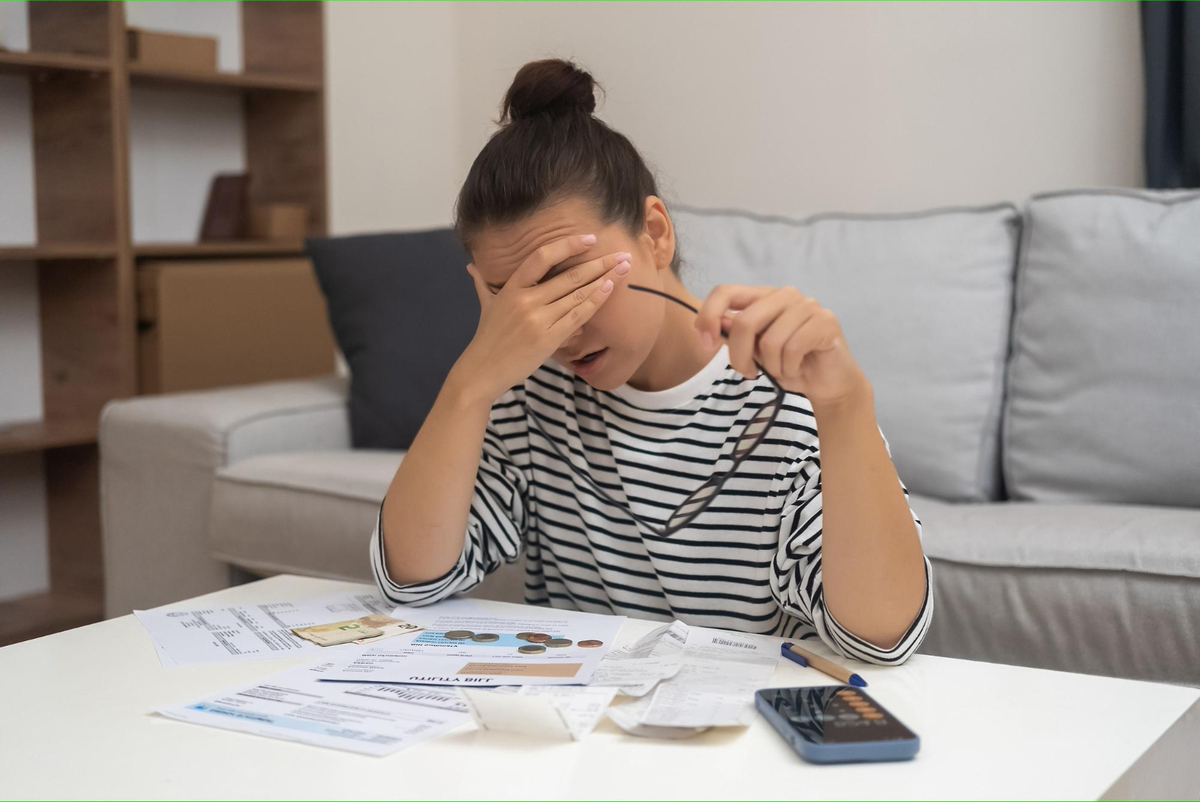

To mitigate the risk of increased loan defaults and safeguard its financial stability, RBC is implementing several proactive strategies:

-

Strengthening Credit Underwriting Standards: RBC is tightening its lending criteria, conducting more thorough due diligence on loan applications to minimize the risk of lending to borrowers who may struggle to repay. This focuses on improved risk assessment and better selection of loan applicants.

-

Increasing Provisions for Loan Losses: The bank is proactively increasing its loan loss provisions to account for the anticipated rise in defaults. This conservative approach aims to absorb potential losses and maintain financial stability.

-

Proactive Engagement with Borrowers Facing Financial Difficulties: RBC is actively engaging with borrowers who show signs of financial distress, offering tailored solutions such as loan modifications or restructuring options to prevent defaults wherever possible. This proactive approach aids in preserving customer relationships and minimizing potential losses.

-

Investing in Technology to Improve Risk Management: RBC is investing in advanced technologies to enhance its risk management capabilities. This includes sophisticated data analytics and artificial intelligence to better predict and manage credit risk.

-

Potential Restructuring of Loans: As a last resort, RBC may need to restructure loans for borrowers facing severe financial hardship. This involves modifying loan terms to make repayment more manageable, aiming to avoid outright defaults.

Impact on Investors and the Broader Economy

RBC's lower-than-expected earnings and preparations for loan defaults have significant implications for investors and the broader Canadian economy:

-

Impact on RBC's Stock Price: The announcement is likely to impact RBC's stock price, potentially leading to short-term volatility and reflecting investor sentiment towards the bank's future prospects. The overall market reaction to the earnings report and the outlook for loan defaults will shape the stock price trajectory.

-

Investor Confidence in the Banking Sector: RBC's performance will influence investor confidence in the entire Canadian banking sector. Concerns about potential widespread loan defaults could trigger a negative sentiment ripple effect across the financial sector.

-

Potential Ripple Effects on Other Canadian Banks: If RBC's experience reflects a broader trend in the Canadian economy, other banks may also face challenges with increasing loan defaults and reduced profitability, triggering a domino effect across the banking sector.

-

Overall Impact on the Canadian Economy: A significant increase in loan defaults across the Canadian banking sector could negatively impact economic growth. It could lead to decreased consumer spending and business investment, potentially slowing down the overall economy. The interplay between the banking sector's health and the broader economy's performance is critical to consider.

RBC Reports Lower-Than-Expected Earnings, Prepares for Loan Defaults – Key Takeaways and Call to Action

In summary, RBC's lower-than-expected earnings are attributable to a confluence of factors, including increased loan loss provisions, reduced investment banking revenues, the impact of rising interest rates, increased operating expenses, and competitive pressures. The bank is responding proactively with various strategies to manage potential loan defaults and maintain financial stability. The implications for investors and the broader Canadian economy are significant, requiring close monitoring of the situation. Stay informed about RBC's financial performance and the implications of potential loan defaults by following RBC's financial reports, industry news, and economic forecasts. Understanding the nuances of RBC's financial health and its impact on the Canadian economy is crucial for making informed decisions.

Featured Posts

-

Faizan Zaki From Runner Up To Scripps National Spelling Bee Champion

May 31, 2025

Faizan Zaki From Runner Up To Scripps National Spelling Bee Champion

May 31, 2025 -

Banksy Auction Iconic Broken Heart Artwork On Sale

May 31, 2025

Banksy Auction Iconic Broken Heart Artwork On Sale

May 31, 2025 -

Etude De L Ingenierie Castor Dans Deux Cours D Eau De La Drome

May 31, 2025

Etude De L Ingenierie Castor Dans Deux Cours D Eau De La Drome

May 31, 2025 -

The Link Between Corporate Targets And Increasing Vet Bills In The Uk

May 31, 2025

The Link Between Corporate Targets And Increasing Vet Bills In The Uk

May 31, 2025 -

Alcarazs Path To The Monte Carlo Final

May 31, 2025

Alcarazs Path To The Monte Carlo Final

May 31, 2025