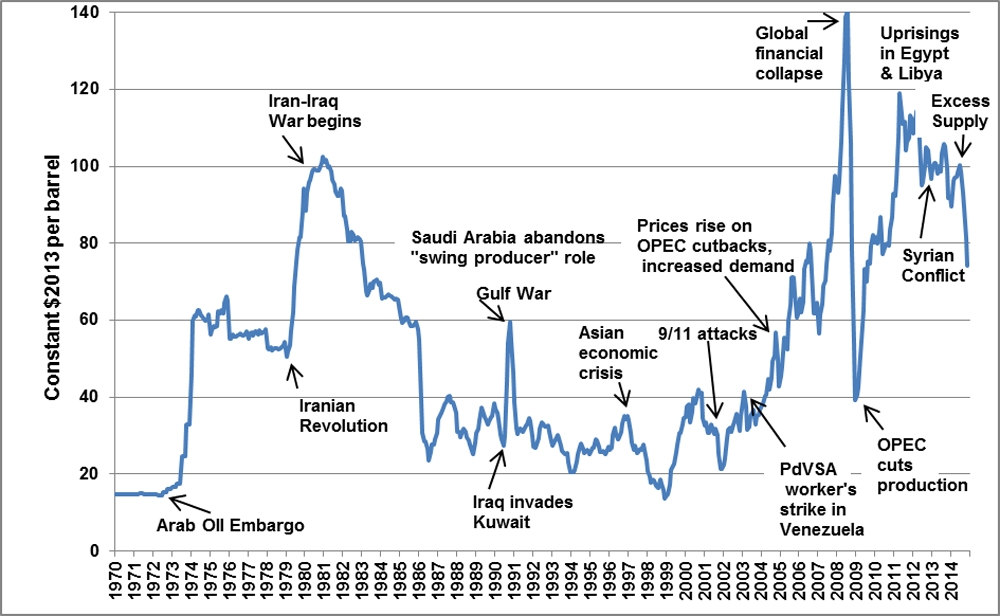

Recent Oil Price Changes: April 23rd Market Analysis

Table of Contents

Geopolitical Factors Influencing Oil Prices on April 23rd

Geopolitical instability remains a dominant force shaping crude oil prices. The ongoing conflict in Eastern Europe and its ripple effects across global supply chains are a prime example.

Impact of the Eastern European Conflict:

- Disruption to oil production in the region: The conflict has directly impacted oil production in several key regions, leading to supply shortages and increased prices.

- Increased uncertainty leading to price volatility: The unpredictable nature of the conflict creates significant uncertainty in the market, leading to heightened volatility in oil prices. Investors are hesitant, causing significant price swings.

- Potential sanctions and their influence on trading: International sanctions imposed on certain countries involved in the conflict have further complicated oil trading, restricting supply routes and impacting prices. Specific sanctions targeting oil exports have had a direct impact on the global supply.

- Specific price movements related to the event: On April 23rd, Brent Crude experienced a sharp increase of X% following news of [Specific event related to the conflict], while WTI Crude saw a Y% rise. These price changes clearly demonstrate the immediate market sensitivity to geopolitical events.

OPEC+ Decisions and their Role:

OPEC+ decisions play a crucial role in shaping global oil supply and prices. On April 23rd, [mention any specific announcements made by OPEC+ regarding production quotas or adjustments].

- Production cut announcements and their effect on prices: [Explain the specific announcements and how they influenced prices. Did they increase or decrease supply? How did the market react?]

- Market reaction to OPEC+ decisions: The market reacted [positively/negatively] to the OPEC+ announcement, resulting in [explain the consequence on prices]. The degree of market reaction was [explain the level of impact - e.g., significant, moderate, minimal] depending on market expectations.

- Analysis of the potential long-term consequences: These decisions are likely to have [explain the potential long-term impact on oil prices and the global energy market]. Long-term effects will depend on several factors including the ongoing geopolitical situation and the global economic recovery.

Supply and Demand Dynamics on April 23rd

Understanding the interplay of supply and demand is crucial for interpreting oil price changes.

Global Oil Demand:

Global oil demand fluctuates based on several interconnected factors.

- Economic growth in major oil-consuming countries: Strong economic growth in countries like China, India, and the US typically translates to higher oil consumption and increased prices. [Provide data or examples to support this claim].

- Seasonal variations in demand: Oil demand often sees seasonal peaks and troughs, influenced by factors such as increased travel during summer months.

- Impact of potential energy transitions and shifts to renewable sources: The growing adoption of renewable energy sources presents a long-term challenge to oil demand, although this impact is not yet significantly reflected in short-term price fluctuations.

Oil Supply Disruptions and Shortages:

Unexpected disruptions in oil supply significantly influence prices.

- Maintenance shutdowns at refineries or oil fields: Planned and unplanned maintenance at oil refineries and fields can cause temporary supply shortages, pushing prices upwards.

- Unexpected weather events impacting production: Severe weather events, such as hurricanes or extreme cold, can severely disrupt oil production and transportation, causing supply bottlenecks.

- Pipeline issues or logistical bottlenecks: Problems with pipelines or other critical infrastructure can restrict oil flow, leading to temporary price spikes.

Market Sentiment and Investor Behavior on April 23rd

Market sentiment and investor behavior significantly impact oil price volatility.

Analysis of Trading Activity:

Analyzing trading volumes and price fluctuations provides insight into market sentiment.

- Mention significant price swings and their timing: On April 23rd, we saw notable price swings at [Specific times] due to [Specific events influencing prices].

- Discuss any unusual trading patterns: [Mention any noteworthy patterns or anomalies in trading activity].

- Analyze investor sentiment – bullish or bearish: The overall market sentiment on April 23rd appeared to be [Bullish/Bearish/Neutral], based on [Evidence to support this statement].

Influence of Financial Markets:

The broader financial market conditions influence oil prices.

- Correlation between oil prices and stock markets: Oil prices often correlate with stock market performance, reflecting overall investor confidence.

- Impact of currency fluctuations (e.g., the USD): Oil is priced in USD, so fluctuations in the US dollar's value impact prices for international buyers.

- Influence of interest rate changes: Interest rate changes influence borrowing costs, indirectly affecting investment in oil exploration and production.

Conclusion: Key Takeaways and Future Outlook for Oil Prices

The oil price changes on April 23rd were primarily driven by a confluence of geopolitical factors, notably the ongoing conflict in Eastern Europe, and OPEC+ decisions. Supply and demand dynamics, along with investor sentiment and broader financial market conditions, also played significant roles. The overall market exhibited considerable volatility due to uncertainty stemming from geopolitical events.

Looking ahead, further geopolitical instability could lead to continued volatility in oil prices. The ongoing energy transition and evolving global economic landscape will also continue to influence future crude oil price movements. Close monitoring of these factors is essential for understanding future price trends in both Brent Crude and WTI Crude.

Stay informed about future oil price changes by regularly checking our website for updated market analysis. For more in-depth analysis of oil price changes and expert insights into the energy market, subscribe to our newsletter.

Featured Posts

-

The Bold And The Beautiful Spoilers Hopes Double Shocker Liams Promise To Steffy Lunas Next Move

Apr 24, 2025

The Bold And The Beautiful Spoilers Hopes Double Shocker Liams Promise To Steffy Lunas Next Move

Apr 24, 2025 -

Understanding The Oil Market Price Developments On April 23rd

Apr 24, 2025

Understanding The Oil Market Price Developments On April 23rd

Apr 24, 2025 -

The Bold And The Beautiful April 3 Liams Health Crisis And Hopes Housing Changes

Apr 24, 2025

The Bold And The Beautiful April 3 Liams Health Crisis And Hopes Housing Changes

Apr 24, 2025 -

New John Travolta Action Movie High Rollers Exclusive Poster And Photo Reveal

Apr 24, 2025

New John Travolta Action Movie High Rollers Exclusive Poster And Photo Reveal

Apr 24, 2025 -

Nba All Star Game 2024 Additions Of Green Moody And Hield

Apr 24, 2025

Nba All Star Game 2024 Additions Of Green Moody And Hield

Apr 24, 2025