Understanding The Oil Market: Price Developments On April 23rd

Table of Contents

Global Supply and Demand Dynamics on April 23rd

OPEC+ Production Decisions:

OPEC+ decisions significantly impact crude oil supply and, consequently, oil market price developments. Prior to and around April 23rd, assessing these decisions is crucial for understanding price fluctuations. Let's examine the specifics:

- Production Adjustments: [Insert details on any production cuts or increases announced by OPEC+ around April 23rd. Quantify the changes in barrels per day (bpd) if possible. For example: "OPEC+ announced a 500,000 bpd production cut, effective May 1st."]

- Compliance Levels: [Discuss the level of compliance with previous production agreements. Were member countries adhering to their quotas? Any significant deviations would impact the overall supply and influence price movements.] For example: "Compliance with the previous agreement was reported at 95%, indicating a relatively strong adherence to the production targets."

- Internal Disagreements: [Mention any disagreements among OPEC+ members and their potential consequences. Internal tensions can lead to production uncertainties and price volatility.] For example: "Disagreements between Saudi Arabia and the UAE regarding production quotas created uncertainty within the market, contributing to price fluctuations."

Unexpected Supply Disruptions:

Unforeseen events can dramatically shift oil market price developments. On April 23rd, any disruptions would have played a significant role:

- Specific Disruptions: [Details on any specific disruptions. Examples include refinery outages due to maintenance or accidents, pipeline disruptions due to damage or sabotage, or natural disasters impacting oil production.] For example: "A major pipeline explosion in [Country] temporarily halted oil flow, causing a short-term supply shock."

- Geographical Impact: [Analyze the geographical location of the disruption and its relevance to global supply chains. A disruption in a key oil-producing region will have a more significant impact than one in a smaller, less influential area.] For example: "The disruption in [Country] significantly impacted European oil supplies, driving up prices."

- Short and Long-Term Consequences: [Analyze the short-term and long-term consequences of the disruptions. Short-term effects may involve immediate price spikes, while long-term effects could involve changes in investment decisions and supply chain adjustments.] For example: "The pipeline explosion led to an immediate price surge, while the long-term impact may include increased investment in alternative pipeline routes."

Demand-Side Factors:

Global economic conditions and seasonal demand significantly influence oil prices. Analyzing these factors is critical for understanding oil market price developments.

- Economic Indicators: [Analyze relevant economic indicators such as GDP growth, manufacturing activity, and consumer confidence. Stronger economic growth generally translates to higher oil demand.] For example: "Robust manufacturing data from China suggested strong future oil demand, putting upward pressure on prices."

- Seasonal Demand: [Discuss the impact of seasonal factors. For instance, increased driving during summer months typically leads to higher gasoline demand.] For example: "The approaching summer driving season in the Northern Hemisphere was anticipated to increase gasoline demand, supporting higher oil prices."

- Energy Consumption Patterns: [Mention any significant changes in global energy consumption patterns that might impact oil demand.] For example: "A shift towards renewable energy sources could lead to a decrease in long-term oil demand, although the short-term effect on April 23rd may have been negligible."

Geopolitical Influences on April 23rd Oil Prices

Geopolitical Tensions and their Impact:

Geopolitical events significantly impact oil price volatility. Analyzing these events helps in understanding oil market price developments:

- Specific Events: [Provide specific examples of geopolitical events that may have affected oil prices on April 23rd. This could include conflicts, political instability in oil-producing regions, or escalating tensions between nations.] For example: "Rising tensions in the [Region] created uncertainty in the market, leading to a risk premium reflected in higher oil prices."

- Market Reaction: [Analyze how the market reacted to these events. Did prices spike due to a risk premium? Was there increased volatility? ] For example: "The market reacted to the tensions with a sharp price increase, indicating a high degree of risk aversion."

- Long-Term Implications: [Discuss the potential for prolonged geopolitical instability and its effect on future oil prices. Ongoing instability often keeps prices elevated due to persistent uncertainty.] For example: "Continued instability in the [Region] could keep oil prices elevated for an extended period."

Sanctions and Embargoes:

Sanctions and embargoes on oil-producing nations significantly impact global oil supply and prices:

- Changes in Sanctions: [Mention any changes in sanctions or embargoes around April 23rd that may have influenced oil market price developments.] For example: "The announcement of new sanctions on [Country] tightened oil supplies, increasing prices."

- Impact on Supply and Prices: [Analyze the impact of these measures on global oil supply and prices. Sanctions reduce supply, which often leads to price increases.] For example: "The sanctions contributed to a supply shortage, thereby raising oil prices."

- Potential for Further Sanctions: [Discuss the potential for further sanctions and their market implications. The anticipation of future sanctions can also influence current prices.] For example: "The possibility of further sanctions against [Country] kept the market on edge, contributing to price volatility."

Economic Indicators and their Influence on April 23rd Oil Prices

The US Dollar's Role:

The US dollar's strength significantly impacts oil prices (as oil is priced in USD):

- USD Movements: [Details on USD movements around April 23rd. A stronger dollar typically leads to lower oil prices, and vice versa.] For example: "A strengthening US dollar on April 23rd put downward pressure on oil prices."

- Inverse Relationship: [Explain the inverse relationship between the USD and oil prices. When the dollar strengthens, oil becomes more expensive for holders of other currencies, reducing demand.] For example: "The inverse relationship between the USD and oil prices is a key factor to consider when analyzing oil market price developments."

- Future USD Predictions: [Prediction of future USD movements and their potential impact on oil prices.] For example: "Continued strengthening of the US dollar could lead to further decreases in oil prices in the coming weeks."

Inflation and Interest Rates:

Inflation and interest rates influence investor sentiment and oil demand:

- Prevailing Rates: [Analysis of prevailing inflation rates and interest rate policies on April 23rd.] For example: "High inflation rates and rising interest rates created uncertainty within the market, impacting investor sentiment towards oil."

- Impact on Investor Sentiment: [Discussion of the impact of these economic factors on investor sentiment and oil demand.] For example: "Rising interest rates made alternative investments more attractive, potentially reducing investment in oil and lowering prices."

- Future Changes and Impact: [Forecast of potential future changes and their impact on the oil market.] For example: "Further interest rate hikes could potentially dampen oil demand and put downward pressure on prices."

Investor Sentiment and Speculation:

Investor sentiment and speculation significantly influence oil price fluctuations:

- Market Activity: [Analysis of market trading volumes and activity on April 23rd. High trading volumes often indicate increased volatility.] For example: "High trading volumes on April 23rd indicated significant market activity and heightened volatility."

- Bullish vs. Bearish Sentiment: [Discussion of the impact of investor sentiment (bullish vs. bearish) on oil prices.] For example: "A predominantly bearish sentiment among investors could lead to a decline in oil prices."

- Significant Investment Decisions: [Mention any significant investment decisions influencing prices.] For example: "Large-scale sell-offs by institutional investors contributed to the downward pressure on oil prices."

Conclusion:

The oil market's price developments on April 23rd were a complex interplay of global supply and demand, geopolitical uncertainties, and macroeconomic factors. Understanding these dynamics is crucial for navigating the volatile oil market. To stay informed about future oil market price developments, continue to monitor global news, economic indicators, and OPEC+ announcements. Regularly checking for updates on oil market price developments and analyzing factors like crude oil supply and global oil demand will help you make informed decisions in this dynamic sector.

Featured Posts

-

Stock Market Rally Trumps Influence On Us Futures

Apr 24, 2025

Stock Market Rally Trumps Influence On Us Futures

Apr 24, 2025 -

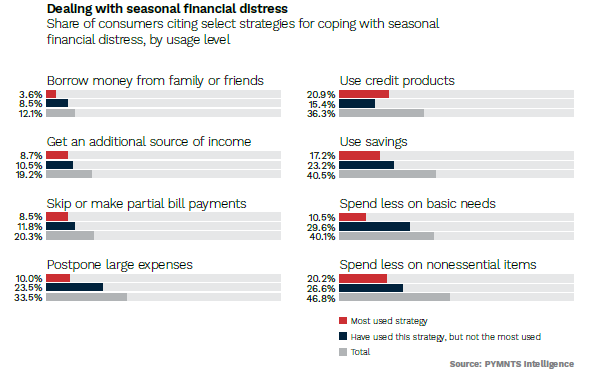

Nonessential Spending Decline A Challenge For Credit Card Companies

Apr 24, 2025

Nonessential Spending Decline A Challenge For Credit Card Companies

Apr 24, 2025 -

Bold And The Beautiful Recap April 3 Liams Health Crisis Following Fight With Bill

Apr 24, 2025

Bold And The Beautiful Recap April 3 Liams Health Crisis Following Fight With Bill

Apr 24, 2025 -

Blue Origin Cancels Launch Vehicle Subsystem Issue Delays Mission

Apr 24, 2025

Blue Origin Cancels Launch Vehicle Subsystem Issue Delays Mission

Apr 24, 2025 -

The Countrys Newest Business Hotspots Where To Invest Now

Apr 24, 2025

The Countrys Newest Business Hotspots Where To Invest Now

Apr 24, 2025