Reduced Steel Production In China: The Plunge In Iron Ore Prices

Table of Contents

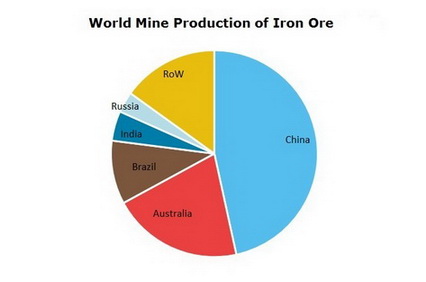

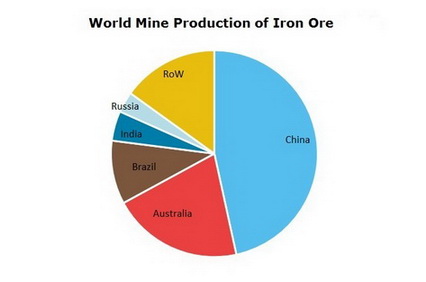

The Impact of China's Steel Production Slowdown on Iron Ore Prices

The slowdown in Chinese steel production has a direct and significant impact on iron ore prices. This interconnectedness stems from the fundamental relationship between steel manufacturing and its key raw material: iron ore.

Decreased Demand

- Direct Correlation: Less steel production directly translates to less demand for iron ore. Steel mills, the primary consumers of iron ore, reduce their purchases as their output decreases. This reduced demand is the primary driver behind the falling iron ore prices.

- Impact on Mining Companies: Iron ore mining companies, particularly those heavily reliant on the Chinese market, are facing significant challenges. Decreased demand leads to lower prices, impacting their profitability and stock prices. For example, [insert example of a mining company and its stock performance].

- Statistical Evidence: Reports suggest a [insert percentage]% decrease in Chinese steel production in [insert timeframe], directly correlating with a [insert percentage]% drop in iron ore prices during the same period. These figures highlight the sensitivity of iron ore markets to changes in Chinese steel output.

Government Regulations and Environmental Concerns

The Chinese government's commitment to environmental sustainability is playing a crucial role in the reduction of steel production. Stringent regulations aimed at curbing pollution are impacting the steel industry's operational capacity.

- Environmental Regulations: Policies focusing on carbon emission reduction targets and stricter environmental inspections are forcing steel mills to either reduce production or invest heavily in cleaner technologies. These measures often lead to temporary or permanent shutdowns of less efficient facilities.

- Carbon Emission Targets: China's ambitious carbon neutrality goals necessitate a significant overhaul of its steel industry, pushing towards cleaner production methods and potentially reducing overall output in the short term. This transition period contributes to the decreased steel production and subsequent decline in iron ore demand.

- Impact of Inspections: Increased scrutiny through stricter environmental inspections results in penalties for non-compliance, leading many steel mills to temporarily or permanently curtail their operations, further exacerbating the decline in steel production.

The Real Estate Market Slowdown

China's struggling real estate sector is another significant contributor to reduced steel demand. The construction industry, a major consumer of steel, is experiencing a slowdown, impacting steel consumption considerably.

- Decline in Construction Projects: A decrease in housing starts and infrastructure projects directly translates to lower demand for steel used in construction materials. This reduced demand further pressures iron ore prices downwards.

- Data on Housing Starts: [Insert data on the decline in housing starts in China]. This significant drop reflects the weakening property market and its cascading effect on steel demand.

- Ripple Effect: The slowdown in the real estate sector ripples through related industries, creating a domino effect that impacts the entire steel value chain, from iron ore mining to steel processing and manufacturing.

Global Implications of Reduced Steel Production in China

The reduction in Chinese steel production has far-reaching global implications, affecting iron ore producers, the global steel market, and broader economic conditions.

Impact on Iron Ore Producers

The decreased demand from China creates significant challenges for iron ore mining companies worldwide. Australia, Brazil, and other major iron ore producers are feeling the pressure.

- Affected Countries and Companies: [Insert examples of specific countries and companies affected, e.g., BHP, Rio Tinto]. These companies are facing reduced revenue and pressure on profit margins due to lower iron ore prices.

- Price Volatility and Potential Bankruptcies: The price volatility in the iron ore market poses significant risks for smaller mining companies, potentially leading to bankruptcies if prices remain depressed for an extended period.

- Global Iron Ore Trade: The decrease in demand from China is reshaping global iron ore trade patterns, with producers seeking alternative markets and facing increased competition.

Effects on the Global Steel Market

Reduced Chinese steel output impacts the global steel supply chain and prices, creating both opportunities and challenges.

- Increased Competition: Other steel-producing nations, such as India and Japan, may see increased demand and opportunities to expand their market share.

- Price Fluctuations: The reduced supply from China could lead to price fluctuations in the international steel markets, depending on the responsiveness of other steel-producing countries.

- Impact on Steel-Consuming Industries: Industries globally that rely on steel, like automotive and construction, will be affected by any price increases or supply chain disruptions.

Economic Consequences

The slowdown in China's steel industry has broader economic implications, potentially impacting employment and economic growth both in China and globally.

- Job Losses: Reduced steel production can lead to job losses in the steel industry and related sectors like mining and transportation.

- Economic Growth Impact: The slowdown could dampen economic growth in China, a major global economic power, and affect global trade and investment.

- Global Trade and Investment: Uncertainty in the Chinese steel market can lead to decreased investment in the steel sector globally, impacting related industries and potentially slowing down economic growth.

Conclusion

The reduction in steel production in China is significantly impacting iron ore prices and creating ripples throughout the global economy. The interplay of government regulations, environmental concerns, and a slowing real estate market has led to decreased demand for steel, resulting in lower iron ore prices and affecting producers and consumers worldwide. Understanding these dynamics is crucial for navigating the complexities of the global commodity markets.

Call to Action: Stay informed about the evolving dynamics of reduced steel production in China and its impact on global markets. Regularly check for updates on [link to relevant news/analysis website] to stay abreast of the latest developments related to reduced steel production in China and the future of iron ore prices.

Featured Posts

-

Babysitting Bill Leads To Even Higher Daycare Costs A Financial Burden

May 09, 2025

Babysitting Bill Leads To Even Higher Daycare Costs A Financial Burden

May 09, 2025 -

Kraujosruvos Ant Dakota Johnson Nuotrauku Naujausia Informacija

May 09, 2025

Kraujosruvos Ant Dakota Johnson Nuotrauku Naujausia Informacija

May 09, 2025 -

Trumps Billionaire Friends How Tariffs Impacted Their Fortunes After Liberation Day

May 09, 2025

Trumps Billionaire Friends How Tariffs Impacted Their Fortunes After Liberation Day

May 09, 2025 -

Maldives Holiday Elizabeth Hurleys Bikini Photos

May 09, 2025

Maldives Holiday Elizabeth Hurleys Bikini Photos

May 09, 2025 -

Na Dobar Fudbaler Na Site Vreminja Zoshto Bekam E Nepobiten

May 09, 2025

Na Dobar Fudbaler Na Site Vreminja Zoshto Bekam E Nepobiten

May 09, 2025