Regulatory Relief Urged By Indian Insurers For Bond Forwards

Table of Contents

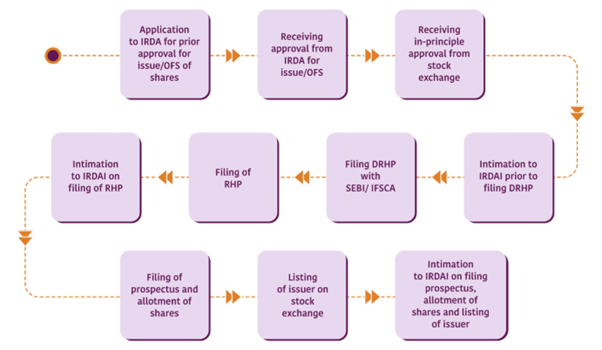

The Current Regulatory Landscape for Bond Forwards in India

The current regulatory framework governing bond forwards for insurance companies in India presents significant limitations. These restrictions, stemming from concerns about systemic risk and capital adequacy, significantly impact investment strategies and risk management capabilities. Key aspects of the existing insurance regulations India regarding bond forwards include:

-

Stringent Investment Restrictions: Indian insurers face limitations on investing in overseas bond markets, restricting access to a wider range of diversification opportunities and potentially higher returns. This contrasts sharply with global competitors who benefit from more liberal

bond market regulations. -

Hedging Limitations: Current regulations severely restrict the use of derivatives, such as bond forwards, for hedging purposes. This limits the ability of insurers to effectively manage interest rate risk and other financial exposures associated with their long-term liabilities. The use of

forward contractsremains constrained, particularly concerning overseas assets. -

Capital Adequacy Constraints: The capital adequacy requirements for bond forward positions are often stringent, requiring insurers to hold significant capital reserves, potentially reducing their investment capacity and profitability. This impacts their ability to deploy capital efficiently and limits their competitive edge.

Arguments for Regulatory Relief: Why Insurers Need More Flexibility

Indian insurers argue convincingly that the existing investment restrictions are unnecessarily restrictive and stifle growth. They advocate for regulatory relief to enable them to adopt more sophisticated risk management strategies and enhance their investment portfolios. The key benefits they highlight include:

-

Enhanced Risk Management: Greater flexibility in using bond forwards would significantly improve insurers’ ability to manage interest rate risk and currency risk, leading to more stable profitability and a reduced likelihood of unexpected losses. Effective

risk managementis paramount for the financial stability of insurance companies. -

Improved Portfolio Diversification and Returns: Access to a broader range of global bond markets would allow insurers to diversify their investment portfolios, potentially leading to higher returns and improved overall performance. This

portfolio diversificationis crucial for long-term sustainability. -

Increased Global Competitiveness: Easing restrictions would level the playing field, enabling Indian insurers to compete more effectively with their international counterparts, attracting foreign investment and strengthening the domestic market.

-

Better Meeting Long-Term Liabilities: The ability to strategically manage interest rate risk through bond forwards is crucial for insurers to ensure they can meet their long-term liabilities to policyholders reliably.

Potential Impacts of Regulatory Changes

Granting Regulatory Relief for Bond Forwards would undoubtedly have significant impacts, both positive and negative. A careful assessment of the potential consequences is essential:

-

Increased Market Liquidity: Greater participation by insurers in the bond market, facilitated by relaxed regulations, could significantly improve market liquidity and depth, benefiting all participants.

-

Potential Systemic Risk: While increased participation is positive, there's a risk of increased systemic risk if not carefully managed. Robust

regulatory frameworkand enhanced supervision are necessary to mitigate this potential downside. -

Financial Innovation and Product Development: Increased flexibility could stimulate financial innovation and the development of new insurance products tailored to evolving market needs, benefiting both insurers and consumers.

-

Impact on Insurance Costs: The efficiency gains from improved risk management could potentially lower the overall cost of insurance for consumers, making insurance more accessible.

Recommendations and Future Outlook for Bond Forwards in India

To address the insurers’ concerns while mitigating risks, a phased approach to regulatory reform is recommended. This could involve:

-

Gradual Easing of Restrictions: A step-by-step relaxation of existing limitations, allowing for a period of monitoring and adaptation, would minimize the risk of unforeseen negative consequences.

-

Increased Supervisory Oversight: Enhanced regulatory scrutiny and supervision would be crucial to manage potential systemic risks associated with increased insurer participation in the bond market. This should focus on

risk managementpractices and reporting requirements. -

Collaboration between Regulators and Insurers: Open dialogue and collaboration between regulators and insurers are vital to develop a regulatory framework that balances the need for flexibility with the need to maintain financial stability.

The future of insurance in India depends, in part, on the success of this reform. The absence of regulatory changes for bond forwards will hinder growth, but a balanced approach is vital.

The Need for Action: Securing a Future with Eased Regulatory Relief for Bond Forwards

In conclusion, the arguments for easing restrictions on bond forwards for Indian insurers are compelling. The potential benefits – enhanced risk management, improved portfolio diversification, increased global competitiveness, and better ability to meet long-term liabilities – outweigh the potential risks, provided appropriate safeguards are put in place. Policymakers must consider the insurers’ plea for Regulatory Relief for Bond Forwards seriously. A failure to act risks stifling the growth of the Indian insurance sector and hindering its contribution to the broader economy. We urge policymakers to engage in constructive dialogue with insurers to implement sensible regulatory changes for bond forwards that foster a dynamic, competitive, and stable financial landscape. Share your thoughts and opinions on this critical issue using #BondForwardsIndia #InsuranceRegulation #FinancialReform. Let’s work together to ensure a future where Indian insurers have the flexibility they need to thrive.

Featured Posts

-

Iron Ore Price Decline Chinas Steel Output Restrictions

May 10, 2025

Iron Ore Price Decline Chinas Steel Output Restrictions

May 10, 2025 -

Elon Musks Net Worth A Comparative Analysis Of Trumps First 100 Days

May 10, 2025

Elon Musks Net Worth A Comparative Analysis Of Trumps First 100 Days

May 10, 2025 -

Transznemu No Letartoztatasa Floridaban Illegalis Noi Mosdohasznalat

May 10, 2025

Transznemu No Letartoztatasa Floridaban Illegalis Noi Mosdohasznalat

May 10, 2025 -

Expansion Viticole A Dijon 2 500 M De Vignes Aux Valendons

May 10, 2025

Expansion Viticole A Dijon 2 500 M De Vignes Aux Valendons

May 10, 2025 -

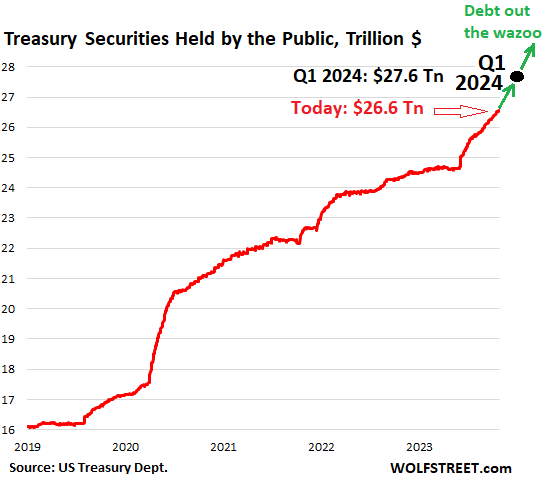

Potential August Expiration Of Us Debt Limit Measures Treasury Alert

May 10, 2025

Potential August Expiration Of Us Debt Limit Measures Treasury Alert

May 10, 2025