Rethinking Your Finances: A Podcast On Money Management

Table of Contents

Are you ready to take control of your financial future? Feeling overwhelmed by debt or unsure about your savings? Our new podcast, "Rethinking Your Finances," offers practical, actionable advice on money management to help you achieve your financial goals. This article highlights key takeaways from the podcast, providing you with the essential steps toward building a secure financial future. We'll cover budgeting basics, debt reduction strategies, and investing for the future – all crucial elements of effective personal finance planning and achieving financial literacy.

Budgeting Basics: Creating a Realistic Budget

Effective money management starts with a solid budget. Understanding where your money goes is the first step towards controlling your spending and achieving your financial goals.

Tracking Your Spending: Understanding Your Money Habits

Before you can create a budget, you need to understand your current spending habits. This involves meticulously tracking every dollar you spend.

- Identify fixed expenses: These are expenses that remain relatively consistent each month, such as rent or mortgage payments, loan repayments, insurance premiums, and subscriptions.

- Track variable expenses: These expenses fluctuate from month to month. Examples include groceries, utilities, transportation costs, entertainment, dining out, and clothing.

- Utilize budgeting apps: Several budgeting apps, like Mint, YNAB (You Need A Budget), and Personal Capital, can automate this process, providing valuable insights into your spending patterns and helping you categorize transactions. Alternatively, a simple spreadsheet or even a notebook can work effectively.

Setting Financial Goals: Defining Your Financial Future

Creating a budget without clear financial goals is like sailing without a map. Setting both short-term and long-term goals provides direction and motivation.

- Prioritize your goals: Rank your goals based on importance and urgency. Do you need to pay off high-interest debt first, or save for a down payment on a house?

- Set SMART goals: Ensure your goals are Specific, Measurable, Achievable, Relevant, and Time-bound. Instead of "save more money," aim for "save $500 per month for a down payment within 12 months."

- Regularly review and adjust: Your financial situation and goals will change over time. Regularly review your budget and adjust your goals as needed.

Allocating Your Resources: The 50/30/20 Rule and Beyond

Once you understand your spending and have defined your goals, it's time to allocate your income effectively. A popular guideline is the 50/30/20 rule:

- 50% Needs: Allocate 50% of your after-tax income to essential expenses like housing, food, transportation, and utilities.

- 30% Wants: Allocate 30% to discretionary spending, such as entertainment, dining out, and hobbies.

- 20% Savings & Debt Repayment: Dedicate 20% to savings and debt repayment. Prioritize high-interest debt repayment to minimize interest charges. Automate savings to make it effortless.

Debt Reduction Strategies: Getting Out of Debt

High-interest debt can significantly hinder your financial progress. Developing a strategic debt reduction plan is crucial for improving your financial wellness.

Understanding Your Debt: Knowing Your Enemy

Before tackling your debt, you need a clear picture of your debt landscape.

- List all your debts: Include credit cards, student loans, personal loans, and any other outstanding debts.

- Calculate total debt and interest payments: This will provide a clear understanding of the overall financial burden.

- Prioritize high-interest debts: Focus on paying off debts with the highest interest rates first to minimize long-term interest costs.

Debt Repayment Methods: Choosing the Right Strategy

Several methods can accelerate debt repayment. Two popular approaches are:

- Debt Snowball: Pay off the smallest debt first, regardless of interest rate. This provides psychological motivation by quickly achieving small wins.

- Debt Avalanche: Pay off the debt with the highest interest rate first, regardless of size. This minimizes the total interest paid over time.

Avoiding Future Debt: Developing Healthy Spending Habits

Preventing future debt accumulation is just as important as paying off existing debt.

- Create a detailed spending plan: Stick to your budget and track your spending closely.

- Avoid impulsive purchases: Pause before making non-essential purchases. Ask yourself if the purchase is truly necessary or aligns with your financial goals.

- Use credit cards responsibly: Only spend what you can afford to pay back in full each month. Avoid carrying a balance to minimize interest charges.

Investing for the Future: Building Wealth

Investing is a crucial aspect of long-term financial planning. It allows your money to grow over time and helps you achieve your financial goals, such as retirement planning.

Understanding Investment Options: Diversifying Your Portfolio

The investment world offers a variety of options, each with its own risk and reward profile.

- Research different investment options: Stocks, bonds, mutual funds, and exchange-traded funds (ETFs) are common investment vehicles. Understand their characteristics and potential risks before investing.

- Consider your risk tolerance: Your investment strategy should align with your risk tolerance and time horizon. Younger investors generally have a higher risk tolerance and longer time horizons.

- Diversify your investments: Don't put all your eggs in one basket. Diversification helps reduce risk by spreading your investments across different asset classes.

Long-Term Investment Strategies: Planning for the Long Haul

Building wealth through investing requires a long-term perspective.

- Set realistic expectations: Investing involves risk, and returns are not guaranteed.

- Invest consistently over time: Regular investing, even small amounts, through dollar-cost averaging can significantly benefit your portfolio over the long term.

- Seek professional advice: Consider consulting a financial advisor for personalized investment advice, especially if you lack investment experience.

Retirement Planning: Securing Your Future

Retirement planning is crucial, and starting early is key.

- Maximize employer matching contributions: Take advantage of employer matching contributions in your 401(k) plan to boost your retirement savings.

- Consider a Roth IRA: A Roth IRA allows for tax-free withdrawals in retirement.

- Regularly review and adjust your retirement plan: Your retirement plan should be regularly reviewed and adjusted to reflect changes in your income, expenses, and financial goals.

Conclusion: Embark on Your Journey to Financial Wellness

Taking control of your finances doesn't have to be daunting. By implementing the money management strategies discussed in our "Rethinking Your Finances" podcast, you can build a strong financial foundation for a secure future. From mastering budgeting techniques to developing effective debt reduction strategies and planning for a comfortable retirement, this podcast equips you with the knowledge and tools you need. Start listening today and begin your journey towards financial wellness! Learn more about effective money management techniques by subscribing to our podcast now!

Featured Posts

-

When Algorithms Radicalize Assigning Blame In Mass Shootings

May 31, 2025

When Algorithms Radicalize Assigning Blame In Mass Shootings

May 31, 2025 -

Broadcoms V Mware Acquisition At And T Highlights A Potential 1 050 Cost Surge

May 31, 2025

Broadcoms V Mware Acquisition At And T Highlights A Potential 1 050 Cost Surge

May 31, 2025 -

Tudor Pelagos Fxd Chrono Pink Release Everything We Know

May 31, 2025

Tudor Pelagos Fxd Chrono Pink Release Everything We Know

May 31, 2025 -

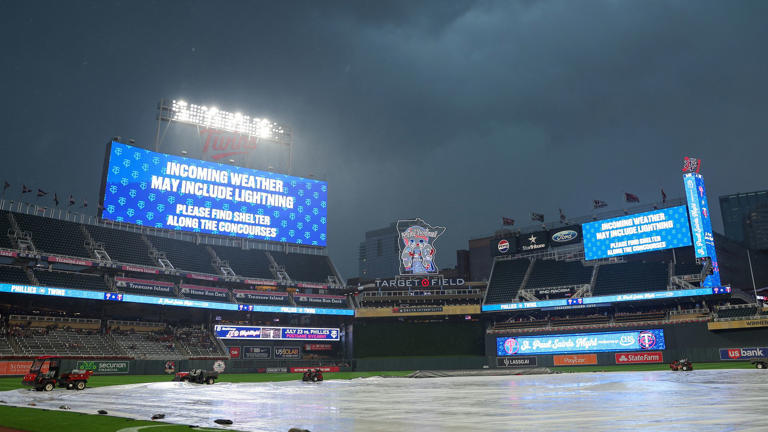

April 29th Twins Vs Guardians Rain Delay Impact On Game Start Time

May 31, 2025

April 29th Twins Vs Guardians Rain Delay Impact On Game Start Time

May 31, 2025 -

Banksys Immersive Vancouver Exhibit What To Expect

May 31, 2025

Banksys Immersive Vancouver Exhibit What To Expect

May 31, 2025