Ripple XRP Settlement: Latest News On SEC Commodity Classification

Table of Contents

Key Takeaways from the Ripple XRP Settlement

The Ripple case concluded with a partial victory for Ripple. While the court didn't definitively classify XRP as a security in all instances, the ruling offered nuanced distinctions that significantly impact the cryptocurrency landscape. The judge's decision hinged on the method of XRP distribution.

-

SEC's Arguments Regarding XRP as a Security: The SEC argued that all sales of XRP constituted unregistered securities offerings, violating federal securities laws. They based their argument primarily on the Howey Test, which defines an investment contract as an investment of money in a common enterprise with a reasonable expectation of profits derived from the efforts of others.

-

Court's Decision on Programmatic Sales vs. Institutional Sales of XRP: The court ruled that programmatic sales of XRP on digital asset exchanges were not securities offerings. However, the court found that direct sales of XRP by Ripple to institutional investors did constitute unregistered securities offerings. This distinction is crucial and impacts how other crypto projects might be classified.

-

Impact on Exchanges that Listed XRP: The ruling's impact on exchanges that listed XRP varied. Some exchanges delisted XRP immediately following the SEC's lawsuit, while others maintained its listing. The settlement created a clearer path for exchanges to relist XRP, albeit with careful consideration of jurisdictional differences and regulatory compliance.

-

Ripple's Future Plans and Potential Legal Challenges: Ripple plans to continue operating and developing its payment solutions using XRP. However, the company may still face potential legal challenges and regulatory hurdles in different jurisdictions. The settlement doesn't entirely shield Ripple from future lawsuits or regulatory actions.

Implications for the Crypto Market

The Ripple XRP settlement has significant implications for the broader cryptocurrency market and its regulatory landscape. The ruling isn't just about XRP; it sets a precedent that could influence how other cryptocurrencies are classified and regulated.

-

Increased Regulatory Scrutiny on Other Cryptocurrencies: The SEC's actions against Ripple have intensified regulatory scrutiny on other crypto projects, particularly those with similar token distribution models. Many projects are now reevaluating their tokenomics and legal compliance strategies in light of the Ripple ruling.

-

The "Howey Test" and its Application to Other Digital Assets: The Howey Test remains the primary legal framework for determining whether a digital asset is a security. The Ripple case has highlighted the complexities of applying this test to the decentralized and evolving nature of the crypto space, creating uncertainty for other projects.

-

Impact on Investor Confidence and Market Volatility: The Ripple XRP settlement initially caused significant market volatility, with XRP's price experiencing considerable fluctuations. Investor confidence has been affected, leading to a period of uncertainty and caution. The long-term impact on investor confidence remains to be seen.

-

Potential for Future Legal Battles and Regulatory Clarity: The Ripple case is unlikely to be the last major legal battle concerning cryptocurrency regulation. Further litigation and regulatory actions are expected, potentially leading to greater clarity—or further uncertainty—in the future.

XRP Price Volatility and Trading Activity

The Ripple XRP settlement significantly impacted XRP's price and trading activity.

-

Price Fluctuations Before, During, and After the Ruling: Prior to the ruling, XRP's price was highly volatile, reflecting the uncertainty surrounding the legal battle. The initial reaction to the settlement was mixed, with the price fluctuating dramatically. However, the price has since shown signs of stabilization, though volatility remains.

-

Trading Volume Changes: XRP trading volume surged during the period leading up to and immediately following the settlement announcement. However, the long-term impact on trading volume will depend on market sentiment and regulatory developments.

-

Investor Sentiment and Market Speculation: Investor sentiment toward XRP is cautiously optimistic. While some investors are encouraged by the partial victory, others remain concerned about the ongoing regulatory uncertainty. Market speculation continues, influencing price movements.

-

Long-term Price Predictions (with cautionary statements): Predicting the long-term price of XRP is inherently speculative. While the settlement could lead to price appreciation, several factors—including regulatory developments, market adoption, and broader economic conditions—could impact its future trajectory.

Future Outlook for XRP and Ripple

The Ripple XRP settlement marks a new chapter for Ripple Labs and XRP.

-

Ripple's Strategic Initiatives Following the Settlement: Ripple plans to continue focusing on its payment solutions and global expansion. The company will likely prioritize compliance efforts to navigate the evolving regulatory landscape.

-

Potential Partnerships and Collaborations: The settlement could open doors for new partnerships and collaborations, particularly with financial institutions seeking compliant and efficient cross-border payment solutions.

-

The Ongoing Role of XRP in the Payment Solutions Space: XRP’s role in Ripple's payment technology remains significant. The company will continue to explore and develop its utility within its broader payment ecosystem.

-

Uncertainties and Potential Challenges Ahead: Despite the settlement, uncertainties remain. Further legal challenges, regulatory changes, and market dynamics could impact Ripple's future success.

Conclusion

The Ripple XRP settlement marks a significant turning point in the crypto regulatory landscape. While offering some clarity regarding XRP's classification in certain contexts, it also highlights the ongoing complexities of regulating digital assets. The long-term implications for XRP, Ripple, and the broader crypto market remain to be seen. This evolving situation underscores the need for continued monitoring and informed decision-making by investors and participants in the cryptocurrency space.

Call to Action: Stay informed on the latest developments surrounding the Ripple XRP settlement and its implications for your crypto investments. Continue researching the Ripple XRP Settlement to make well-informed decisions. Follow reputable news sources for up-to-date information on this dynamic situation.

Featured Posts

-

Increased Measles Cases Spur Us Vaccine Monitoring Initiative

May 02, 2025

Increased Measles Cases Spur Us Vaccine Monitoring Initiative

May 02, 2025 -

Xrp Momentum Builds Analyzing The Ripple Lawsuit And Us Etf Outlook

May 02, 2025

Xrp Momentum Builds Analyzing The Ripple Lawsuit And Us Etf Outlook

May 02, 2025 -

Ekonomik Ve Siyasi Is Birligi Tuerkiye Endonezya Anlasmalari

May 02, 2025

Ekonomik Ve Siyasi Is Birligi Tuerkiye Endonezya Anlasmalari

May 02, 2025 -

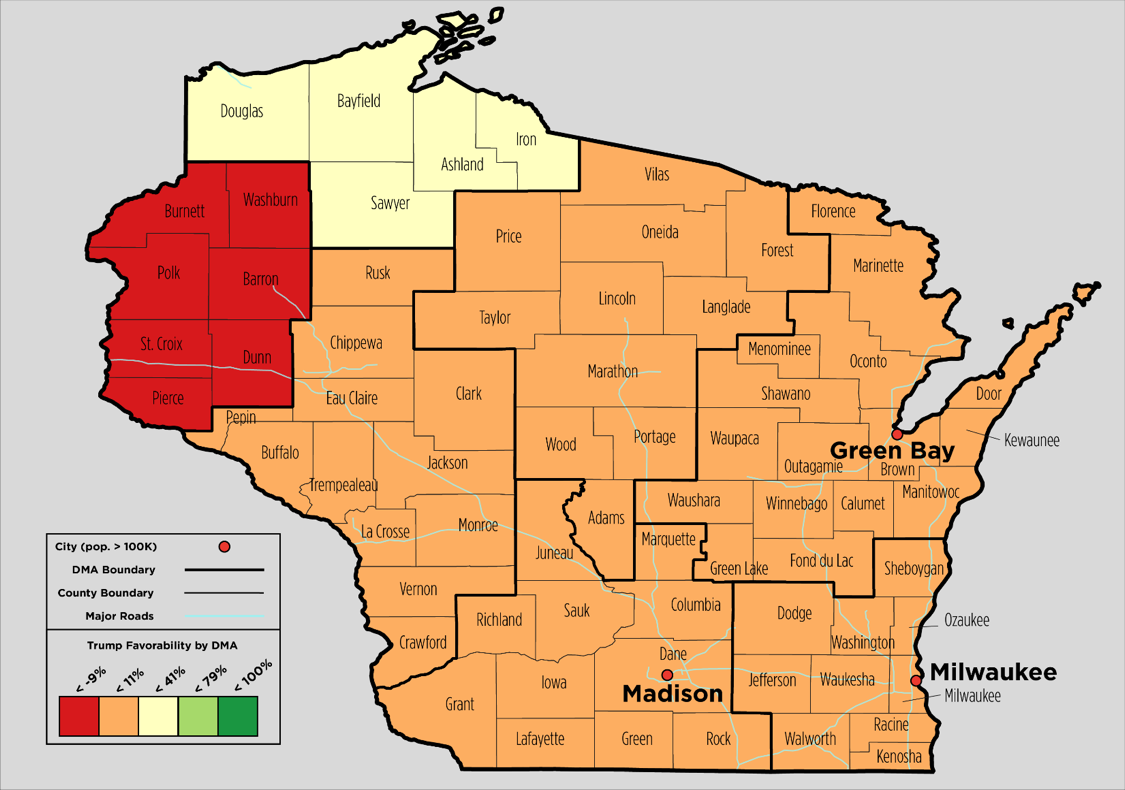

Florida And Wisconsin Voter Turnout A Deep Dive Into The Current Political Climate

May 02, 2025

Florida And Wisconsin Voter Turnout A Deep Dive Into The Current Political Climate

May 02, 2025 -

Is Xrp A Commodity The Secs Decision And Ongoing Debate

May 02, 2025

Is Xrp A Commodity The Secs Decision And Ongoing Debate

May 02, 2025