Ripple's XRP: A Look At The $3.40 Resistance Level

Table of Contents

Technical Analysis of the $3.40 Resistance Level

Chart Patterns and Indicators

Analyzing XRP's price chart reveals interesting patterns around the $3.40 level. Historically, this price point has acted as strong resistance, repeatedly pushing back attempts by buyers to break through. Let's examine some key indicators:

- Relative Strength Index (RSI): The RSI often shows overbought conditions as XRP approaches $3.40, suggesting potential price corrections. A bearish divergence between price and RSI could further confirm resistance.

- Moving Averages: The 50-day and 200-day moving averages have historically coincided with the $3.40 resistance, acting as significant barriers. A decisive break above these averages would be a bullish signal.

- MACD (Moving Average Convergence Divergence): The MACD histogram often shows bearish momentum around the $3.40 level, indicating selling pressure. A bullish crossover above the zero line would signal a shift in momentum.

! (Replace with actual chart)

Volume Analysis

Volume analysis provides crucial insights into the strength of the $3.40 resistance.

- High Volume Rejections: Previous attempts to break above $3.40 have often been accompanied by high trading volume, suggesting strong selling pressure at this level.

- Low Volume Consolidations: Periods of sideways price movement around $3.40 with low volume might indicate a weakening of the resistance. A breakout on increased volume would be a more significant signal.

- Volume Breakouts: A significant increase in trading volume accompanying a break above $3.40 would strongly confirm the overcoming of this resistance.

Support and Resistance Levels

Understanding the broader context of support and resistance levels is crucial.

- Key Support Levels: $2.50 and $2.00 have acted as significant support levels in the past. A break below these levels could signal a more bearish outlook.

- Key Resistance Levels: Besides $3.40, levels like $4.00 and $5.00 could pose further challenges to XRP's upward momentum.

Fundamental Factors Influencing XRP Price

Ripple's Legal Battle

The ongoing legal battle between Ripple and the SEC remains a major factor influencing XRP's price.

- Positive Scenario: A favorable court ruling could lead to a significant price surge, potentially breaking through the $3.40 resistance and beyond.

- Negative Scenario: An unfavorable ruling could negatively impact XRP's price, potentially pushing it below key support levels.

- Key Developments: Closely monitoring the progress of the case and any significant legal developments is crucial for assessing the risk/reward profile of XRP.

Adoption and Partnerships

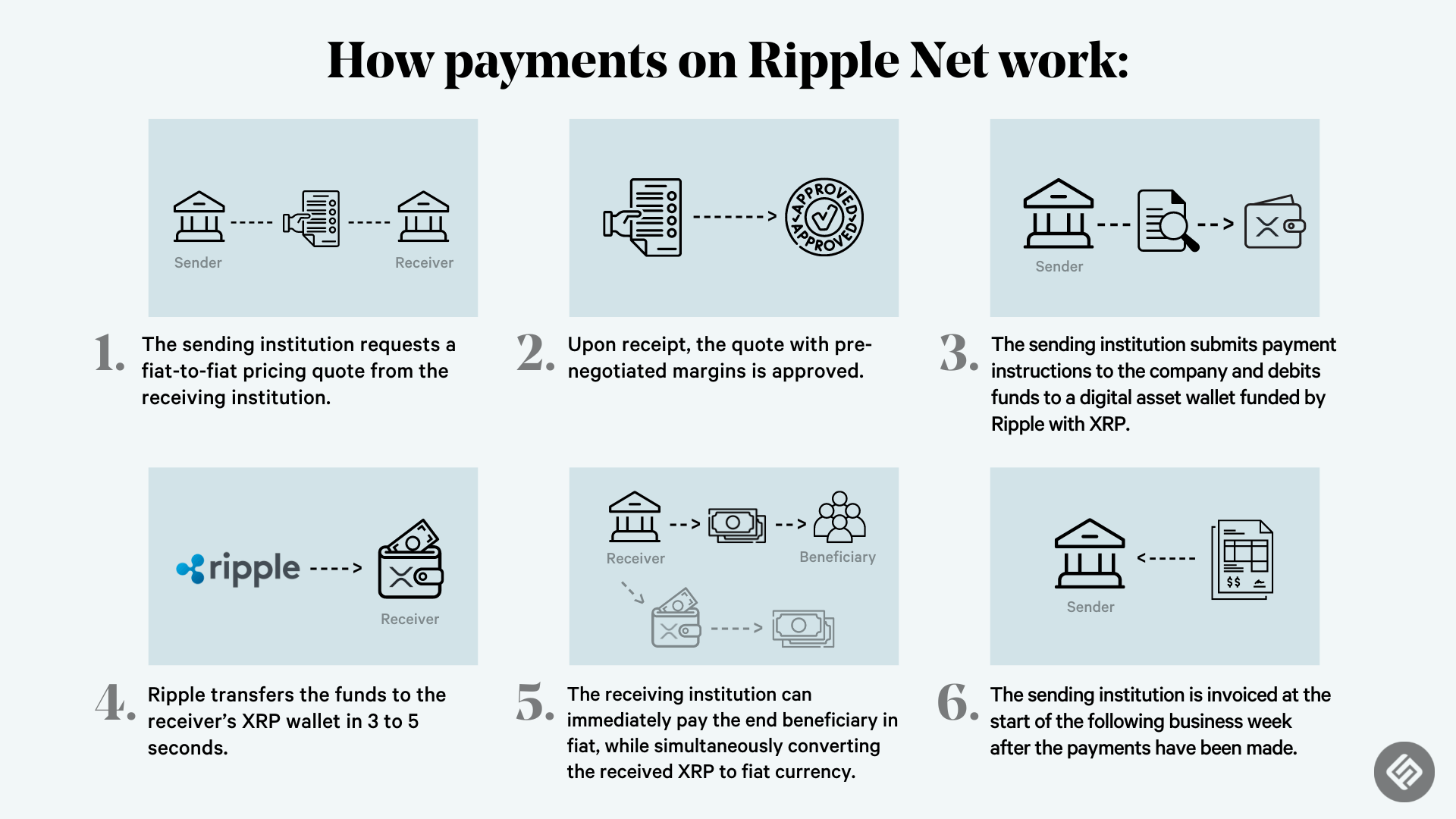

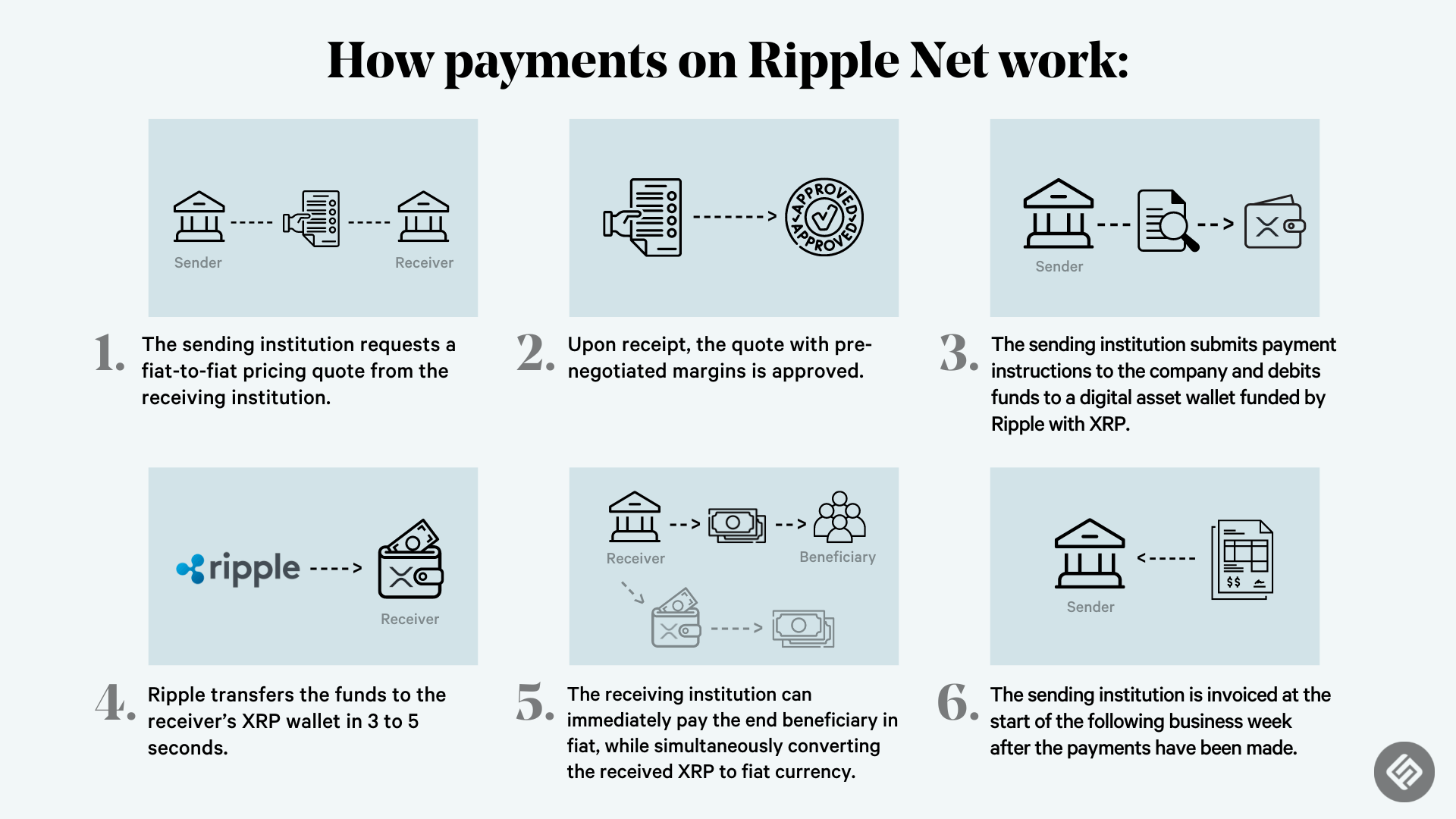

Increased adoption of XRP by financial institutions could drive its price upward.

- On-Demand Liquidity (ODL): Ripple's ODL solution continues to gain traction, facilitating faster and cheaper cross-border payments.

- Strategic Partnerships: New partnerships with banks and payment providers could significantly boost XRP's demand and price.

Market Sentiment and Overall Crypto Market

The overall cryptocurrency market and general sentiment heavily influence XRP's price.

- Bitcoin's Influence: XRP often correlates with Bitcoin's price movements. A bullish trend in Bitcoin generally supports XRP's price, while a bearish trend can lead to declines.

- Market Events: Major events such as regulatory announcements, technological breakthroughs, or macroeconomic shifts can significantly impact the cryptocurrency market and XRP's price.

Navigating the Future of XRP Beyond $3.40

Our analysis reveals that the $3.40 resistance level for XRP is a significant hurdle. While technical indicators suggest potential resistance, fundamental factors like Ripple's legal battle and adoption rate remain key drivers. A breakout above $3.40 would likely be accompanied by increased trading volume and positive market sentiment. However, a failure to break through could lead to further consolidation or even a price correction. Therefore, a cautious approach is advised.

Stay informed about the ongoing developments concerning XRP and the $3.40 resistance level to make strategic decisions regarding your XRP investments. Conduct your own thorough research, monitor XRP's price action closely, and consider diverse XRP trading strategies, keeping your risk tolerance in mind when making XRP price predictions and investment decisions. Remember that cryptocurrency investments are inherently volatile.

Featured Posts

-

Bitcoin Soars Trumps Crypto Chief Issues Surprise Prediction

May 08, 2025

Bitcoin Soars Trumps Crypto Chief Issues Surprise Prediction

May 08, 2025 -

Psg Dominon Por Fiton Minimalisht

May 08, 2025

Psg Dominon Por Fiton Minimalisht

May 08, 2025 -

Winning Numbers Daily Lotto Friday April 18th 2025

May 08, 2025

Winning Numbers Daily Lotto Friday April 18th 2025

May 08, 2025 -

Kyle Kuzmas Instagram Comment On Jayson Tatum Sparks Debate

May 08, 2025

Kyle Kuzmas Instagram Comment On Jayson Tatum Sparks Debate

May 08, 2025 -

1 Mdb Scandal Malaysias Push To Extradite Former Goldman Sachs Partner

May 08, 2025

1 Mdb Scandal Malaysias Push To Extradite Former Goldman Sachs Partner

May 08, 2025