Rockwell Automation's Strong Earnings Drive Market Uptick: Analysis Of Wednesday's Stock Movers

Table of Contents

Rockwell Automation's Q[Quarter] Earnings Report: Key Highlights

Rockwell Automation's Q[Quarter] earnings report exceeded expectations across the board, solidifying its position as a leader in the industrial automation market.

Revenue Growth and Beat of Expectations

Rockwell Automation reported a [Insert Percentage]% increase in revenue, significantly surpassing analyst expectations of a [Insert Percentage]% growth. This robust performance was driven by strong growth across multiple segments, particularly in industrial automation and process solutions. The company's ability to navigate supply chain challenges and meet increasing demand contributed significantly to this success.

- Key Financial Metrics:

- Earnings Per Share (EPS): $[Insert EPS] (vs. expected $[Insert Expected EPS])

- Revenue: $[Insert Revenue] (vs. expected $[Insert Expected Revenue])

- Operating Margins: [Insert Percentage]%

- Order Backlog: [Insert Value]

Strong Order Backlog and Future Outlook

The substantial increase in Rockwell Automation's order backlog signals continued strong demand and promising future growth. Management expressed confidence in maintaining this momentum, providing positive guidance for the next quarter and fiscal year. They highlighted increased investments in digital transformation initiatives and strategic partnerships as key drivers for future growth.

- Positive Projections:

- [Insert Projected Revenue Growth Percentage] revenue growth for next quarter.

- [Insert Projected EPS Growth Percentage] EPS growth for next fiscal year.

- Continued expansion into key market segments like renewable energy and sustainable manufacturing.

Market Reaction and Stock Price Movement

The positive earnings report triggered an immediate and significant positive market reaction.

Immediate Impact on Rockwell Automation Stock (ROK)

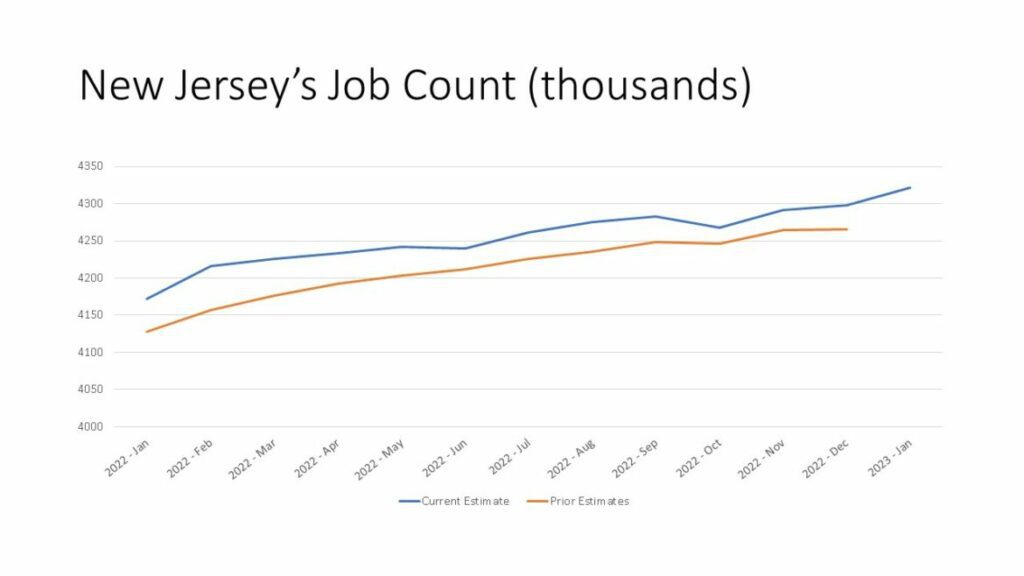

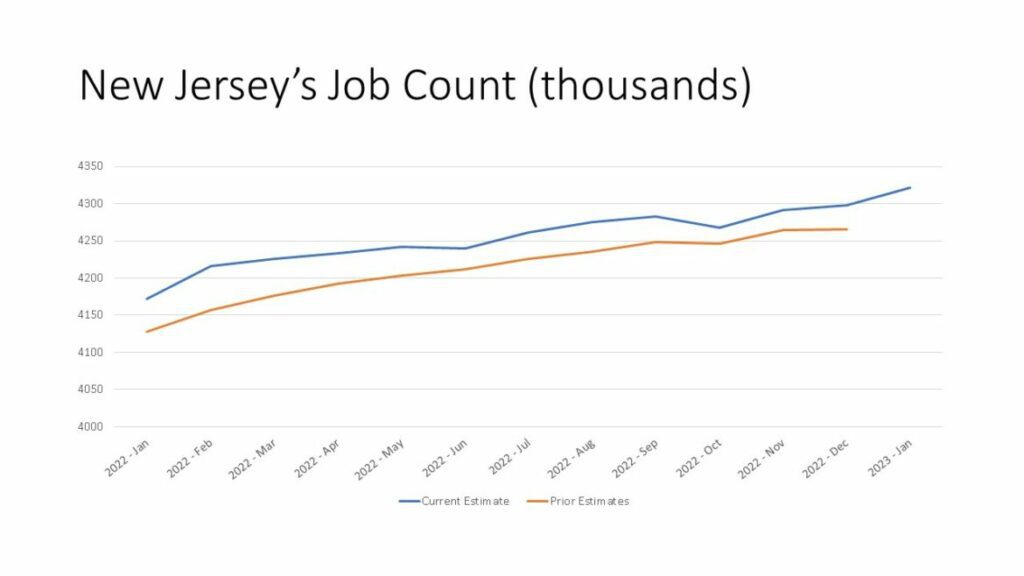

Rockwell Automation's stock price (ROK) surged by [Insert Percentage]% on Wednesday following the release of the earnings report. Trading volume was exceptionally high, indicating strong investor interest and confidence in the company's future prospects. [Insert Chart or Graph illustrating stock price movement].

Broader Market Implications

The strong performance of Rockwell Automation had a ripple effect on other industrial automation stocks, boosting overall investor sentiment in the sector. The news contributed positively to the broader market, particularly within the S&P 500 industrial sector.

- Competitor Comparison:

- [Competitor A]: [Performance compared to ROK]

- [Competitor B]: [Performance compared to ROK]

Factors Contributing to Rockwell Automation's Success

Several key factors contributed to Rockwell Automation's outstanding Q[Quarter] performance and subsequent stock surge.

Strong Demand in Key Sectors

Increased demand across various sectors fueled Rockwell Automation's growth. The automotive, food and beverage, and pharmaceutical industries, in particular, experienced significant growth, driving demand for automation solutions.

- Market Drivers:

- Increased automation needs to enhance efficiency and productivity.

- Growing adoption of Industry 4.0 technologies.

- Supply chain optimization initiatives.

Successful Innovation and Product Launches

Rockwell Automation's commitment to innovation and technological advancement is evident in its successful product launches and strategic partnerships. [Mention specific examples of new technologies or products]. This continuous improvement helps the company to stay ahead in the competitive landscape of industrial automation.

Effective Cost Management and Operational Efficiency

Rockwell Automation's focus on cost management and operational efficiency contributed significantly to its profitability. The company implemented strategies to streamline processes, optimize supply chains, and enhance productivity, resulting in improved margins.

- Efficiency Initiatives:

- [Example 1: e.g., Lean manufacturing principles]

- [Example 2: e.g., Digitalization of operations]

- [Example 3: e.g., Strategic sourcing agreements]

Conclusion

Rockwell Automation's strong Q[Quarter] earnings report significantly exceeded expectations, leading to a substantial stock price increase and positive market sentiment. This success can be attributed to robust revenue growth, a strong order backlog, strategic innovation, and effective cost management. Understanding Rockwell Automation's earnings is crucial for navigating the industrial automation market. Stay tuned for further updates on Rockwell Automation's performance and continue to monitor this key player in the industrial automation market.

Featured Posts

-

J Jocytes Sugrizimas I Lietuvos Rinktine Laukiama Europos Cempionato

May 17, 2025

J Jocytes Sugrizimas I Lietuvos Rinktine Laukiama Europos Cempionato

May 17, 2025 -

Arenda Ploschadey V Industrialnykh Parkakh Tseny I Usloviya

May 17, 2025

Arenda Ploschadey V Industrialnykh Parkakh Tseny I Usloviya

May 17, 2025 -

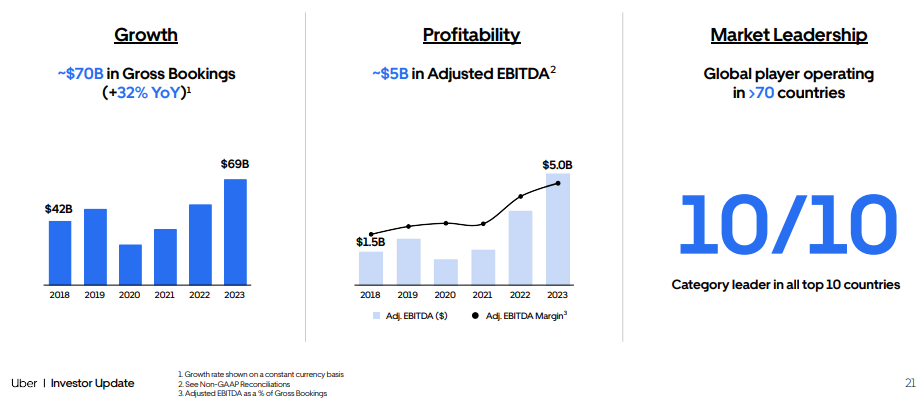

Uber Stock Soared In April Analyzing The Double Digit Gains

May 17, 2025

Uber Stock Soared In April Analyzing The Double Digit Gains

May 17, 2025 -

Mati Donalda Trampa Khto Bula Meri Enn Maklaud

May 17, 2025

Mati Donalda Trampa Khto Bula Meri Enn Maklaud

May 17, 2025 -

Bridges And Thibodeaus Public Dispute A Resolution

May 17, 2025

Bridges And Thibodeaus Public Dispute A Resolution

May 17, 2025