Uber Stock Soared In April: Analyzing The Double-Digit Gains

Table of Contents

Strong Q1 2024 Earnings Report Exceeded Expectations

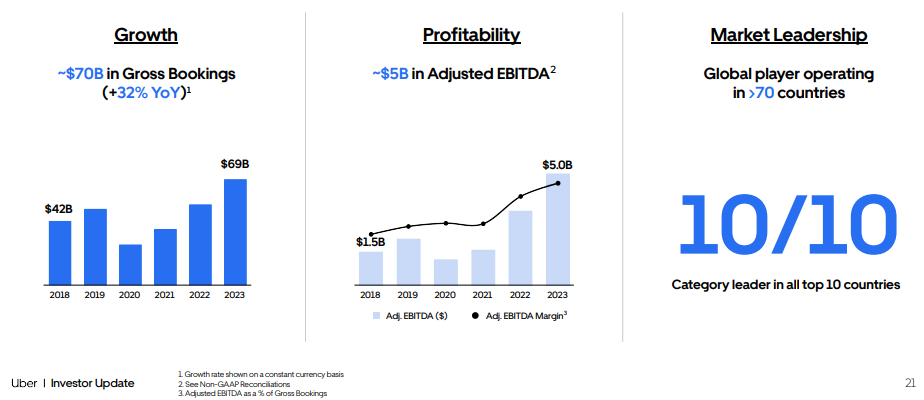

Uber's impressive April performance was largely fueled by its exceptionally strong Q1 2024 earnings report, which significantly exceeded analyst expectations. This positive surprise sent a powerful signal to investors, contributing to the surge in Uber stock price.

-

Increased Revenue and Ridership: Uber reported a substantial increase in revenue, significantly outpacing projections. Ride-sharing revenue grew by X%, exceeding analyst estimates of Y%. Similarly, delivery revenue saw a Z% increase, further bolstering overall performance. Gross bookings also surpassed expectations, indicating strong demand for Uber's services. This robust growth showcases the company's ability to capitalize on market opportunities and expand its user base.

-

Improved Profitability: Beyond revenue growth, Uber demonstrated significant improvements in profitability. Adjusted EBITDA increased by A%, exceeding forecasts by B%. This marked a substantial step towards sustained profitability, a key factor in attracting investors seeking long-term growth and stability. The improved profitability metrics solidified investor confidence in Uber's ability to manage costs effectively and generate sustainable returns.

-

Positive Guidance for Future Quarters: Uber's management offered positive guidance for the coming quarters, further boosting investor sentiment. Their optimistic outlook, based on the strong Q1 performance and anticipated continued growth, fueled confidence in the company's future prospects. This positive outlook played a crucial role in driving the April surge in Uber stock.

Positive Market Sentiment and Sector-Wide Growth

The April surge in Uber stock wasn't solely attributable to the company's performance; broader market conditions and industry trends also played a role.

-

Overall Market Conditions: April saw a generally positive market sentiment, with major indices experiencing growth. This positive market environment created a favorable backdrop for Uber's stock, allowing its strong earnings to translate into more significant price gains.

-

Competition and Industry Trends: While Uber's competitors in the ride-sharing and food delivery sectors also experienced growth, Uber's performance significantly outpaced many, showcasing its competitive advantage and strong market position. This relative outperformance cemented Uber's status as a leader in the industry and contributed to the positive investor perception.

-

Investor Confidence: Leading up to and following the earnings report, several major investment firms upgraded their ratings and price targets for Uber stock. This positive analyst sentiment reflects growing confidence in the company's long-term growth potential and contributed significantly to the April rally.

Strategic Initiatives and Operational Improvements

Beyond the strong Q1 results, several strategic initiatives and operational improvements likely contributed to the surge in Uber stock.

-

New Product Launches or Features: While specific new product launches might not have directly impacted Q1 earnings, the ongoing development and improvement of Uber's platform, including new features and partnerships, demonstrates a commitment to innovation and strengthens investor confidence in the company's long-term competitiveness.

-

Cost-Cutting Measures and Efficiency Improvements: Uber has been actively implementing cost-cutting measures and streamlining its operations, enhancing efficiency and improving profitability. These initiatives, while not always immediately visible in quarterly reports, contribute to long-term value creation and investor confidence.

-

Expansion into New Markets or Services: Continued expansion into new geographic markets and diversification into new service offerings further contributes to Uber's overall growth potential and strengthens its position as a dominant player in the transportation and delivery sectors.

Conclusion

Uber's double-digit stock gains in April can be attributed to a combination of factors, including strong Q1 earnings that surpassed expectations, positive market sentiment, and strategic initiatives driving operational improvements. The company's improved profitability, coupled with optimistic future guidance, significantly boosted investor confidence. Understanding these contributing elements is crucial for assessing the sustainability of this growth and predicting future performance of Uber stock. Staying informed on Uber's financial reports and market analysis will be essential for investors to make informed decisions about this dynamic company. Further research into Uber's investment prospects is strongly recommended.

Featured Posts

-

Victoria De Talleres Ante Alianza Lima 2 0 Goles Y Analisis Del Partido

May 17, 2025

Victoria De Talleres Ante Alianza Lima 2 0 Goles Y Analisis Del Partido

May 17, 2025 -

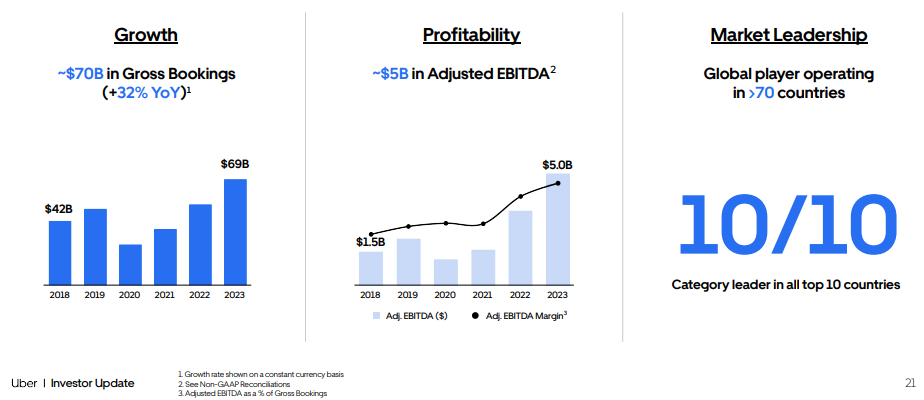

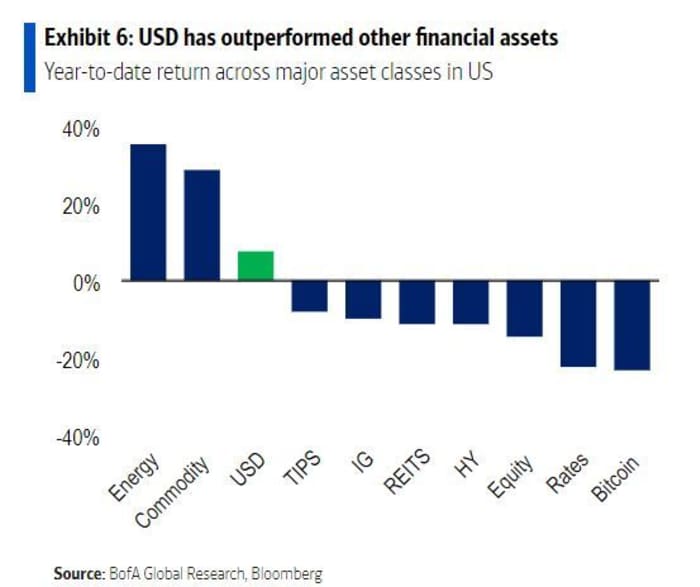

Should Investors Worry About Current Stock Market Valuations Bof As Answer

May 17, 2025

Should Investors Worry About Current Stock Market Valuations Bof As Answer

May 17, 2025 -

Did Jim Morrison Fake His Death The New York Maintenance Man Theory

May 17, 2025

Did Jim Morrison Fake His Death The New York Maintenance Man Theory

May 17, 2025 -

Knicks Season Update Jalen Brunson Injury Tyler Koleks Impact And Upcoming Games

May 17, 2025

Knicks Season Update Jalen Brunson Injury Tyler Koleks Impact And Upcoming Games

May 17, 2025 -

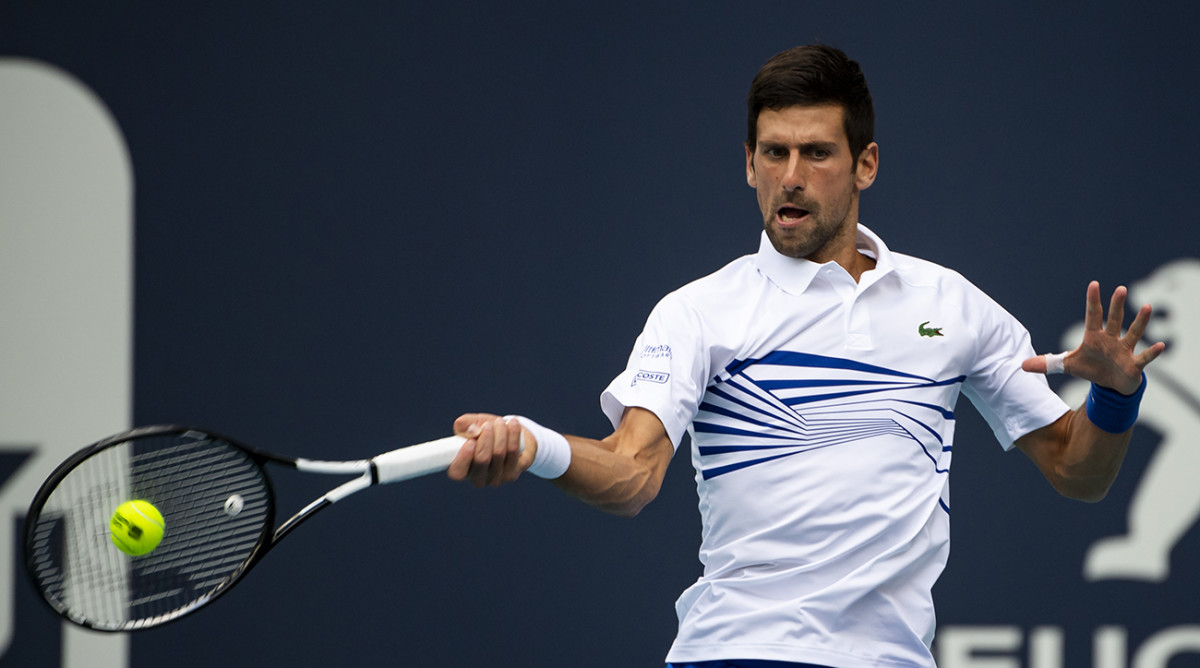

Djokovic Miami Acik Final E Yuekseldi

May 17, 2025

Djokovic Miami Acik Final E Yuekseldi

May 17, 2025