Ryanair's Response To Tariff Wars: A Stock Buyback Initiative

Table of Contents

The Impact of Tariff Wars on the Airline Industry

Tariff wars create a ripple effect across the airline industry, impacting profitability and stock prices. The increased costs associated with these trade disputes directly affect airlines in several ways:

- Increased fuel prices due to import tariffs: Fuel is a major operational expense for airlines. Tariffs on imported fuel or components used in its production directly translate to higher operating costs.

- Higher aircraft maintenance and parts costs: Many aircraft parts are manufactured internationally. Tariffs on these imports increase maintenance and repair expenses, squeezing profit margins.

- Reduced passenger numbers due to economic uncertainty and higher travel costs: Economic uncertainty stemming from tariff wars can lead to reduced consumer spending, impacting travel demand. Furthermore, higher prices for goods and services, including airfare, can deter passengers from booking flights.

These factors collectively diminish airline profitability. Reduced profits, in turn, often lead to lower stock prices, as investors react to decreased earnings potential. Other airlines have responded to similar challenges with cost-cutting measures, route reductions, or attempts to pass increased costs onto consumers through higher fares.

Ryanair's Stock Buyback: A Detailed Overview

Ryanair's response to these challenges has been a substantial stock buyback program. While the exact amounts and timelines can vary and should be verified through official Ryanair announcements, the initiative represents a significant financial commitment. The buyback, typically announced over a period (e.g., a year or more), allows Ryanair to repurchase its own shares from the open market.

Ryanair's rationale behind this Ryanair stock buyback is multifaceted:

- Demonstration of confidence in the company's future: The buyback signals Ryanair's belief in its ability to navigate the current economic climate and maintain profitability despite the headwinds.

- Return of value to shareholders: By repurchasing shares, Ryanair effectively returns capital to its shareholders, increasing the value of the remaining shares.

- Potential for increased earnings per share (EPS): Reducing the number of outstanding shares can boost earnings per share, making the stock more attractive to investors.

A stock buyback works by reducing the number of outstanding shares. When a company buys back its shares, it reduces the total number of shares available for trading. This means that the earnings of the company are distributed among fewer shares, potentially increasing the earnings per share (EPS).

Analyzing the Strategic Implications of Ryanair's Move

Ryanair's stock buyback strategy carries both potential benefits and risks:

Potential Benefits:

- Improved shareholder returns: Increased EPS and potentially higher stock prices translate to better returns for existing shareholders.

- Increased stock price (potential): A successful buyback can signal confidence and potentially lead to increased investor demand, driving up the stock price.

- Stronger balance sheet (depending on financing methods): If funded appropriately, the buyback could improve the company's financial position.

- Signaling long-term financial stability: The buyback can demonstrate Ryanair’s commitment to its long-term financial health and stability.

Potential Risks and Drawbacks:

- Opportunity cost of using capital for buybacks instead of other investments: The money used for the buyback could have been invested in other growth opportunities, such as expanding into new markets or upgrading its fleet.

- Potential negative market reaction if the buyback is poorly timed: If the buyback occurs during a period of significant economic downturn or unforeseen challenges, it could be perceived negatively by investors.

- Impact on company’s future expansion plans: Significant capital allocated to the buyback might limit resources available for future growth and expansion.

Alternative Strategies Considered (or Rejected)

While Ryanair opted for the stock buyback, alternative strategies might have been considered, such as aggressive expansion into new, less-affected markets, fleet modernization with more fuel-efficient aircraft, or further cost-cutting measures beyond those already implemented. However, the buyback reflects Ryanair's assessment of the most effective use of its capital in the current environment.

Conclusion

Ryanair's stock buyback is a notable response to the challenges of global tariff wars. This move demonstrates confidence in its future profitability and aims to return value to shareholders. The strategic implications are multifaceted, presenting both potential benefits like improved shareholder returns and potential risks like opportunity costs. Understanding the intricacies of this Ryanair stock buyback is crucial for investors and those interested in the airline industry's response to global trade tensions. Stay informed on the progress of Ryanair's stock buyback and its impact on the company's performance. Follow our updates on the latest developments in Ryanair's financial strategies and the wider airline industry's response to global trade tensions. Learn more about the intricacies of Ryanair stock buyback strategies and their implications for investors.

Featured Posts

-

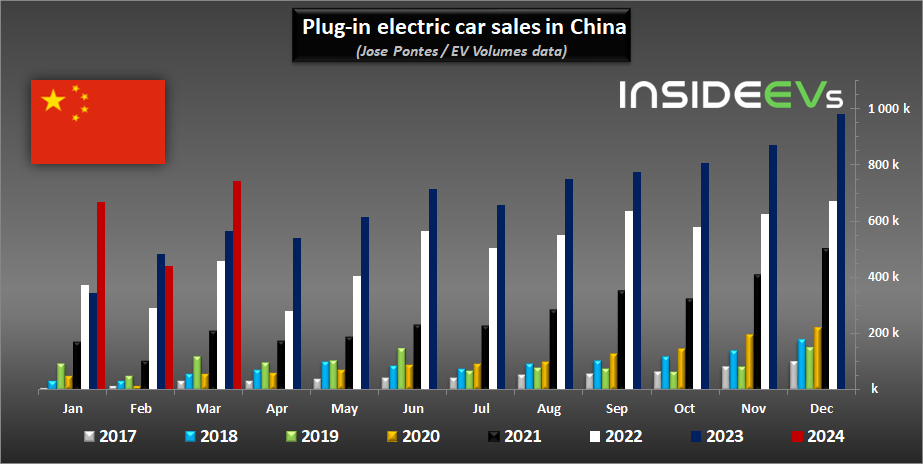

Luxury Car Sales In China Why Bmw And Porsche Face Difficulties

May 21, 2025

Luxury Car Sales In China Why Bmw And Porsche Face Difficulties

May 21, 2025 -

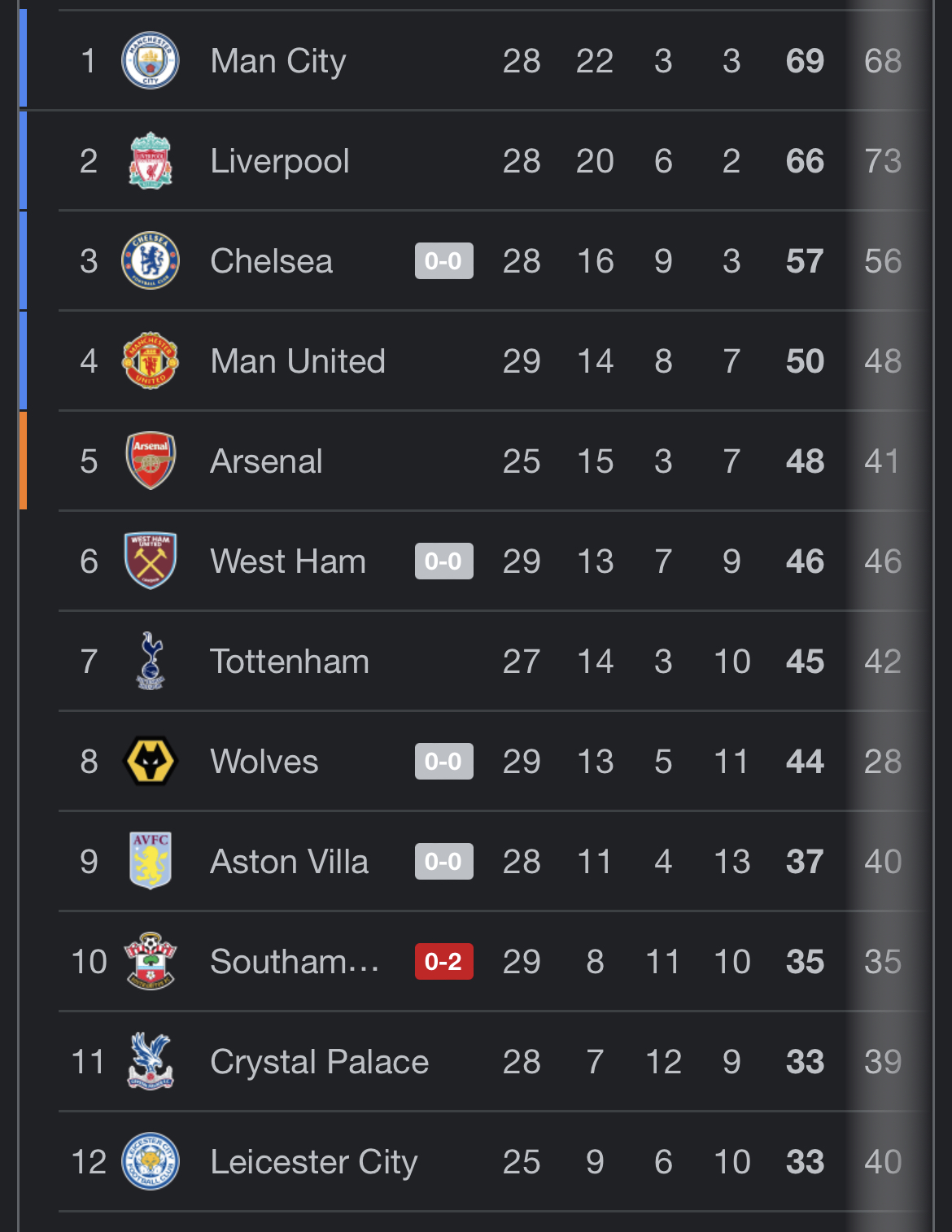

Premier League 2024 25 Champions Photo Highlights

May 21, 2025

Premier League 2024 25 Champions Photo Highlights

May 21, 2025 -

Gbr Top Stories Grocery Deals 2 K Quarter And Doge Poll Results

May 21, 2025

Gbr Top Stories Grocery Deals 2 K Quarter And Doge Poll Results

May 21, 2025 -

D Wave Quantum Inc Qbts Stock Investment Potential And Risks

May 21, 2025

D Wave Quantum Inc Qbts Stock Investment Potential And Risks

May 21, 2025 -

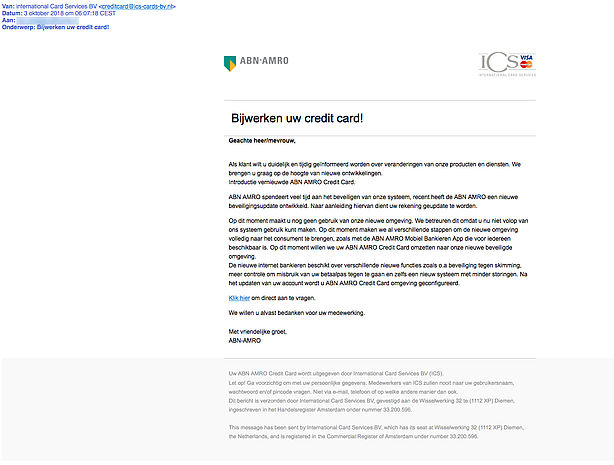

Risicos Voor De Voedingsindustrie Abn Amro Over Afhankelijkheid Van Arbeidsmigranten

May 21, 2025

Risicos Voor De Voedingsindustrie Abn Amro Over Afhankelijkheid Van Arbeidsmigranten

May 21, 2025