Sanofi Acquires Dren Bio's Myeloid Cell Engager: Expanding Immunology Portfolio

Table of Contents

Details of the Dren Bio Acquisition

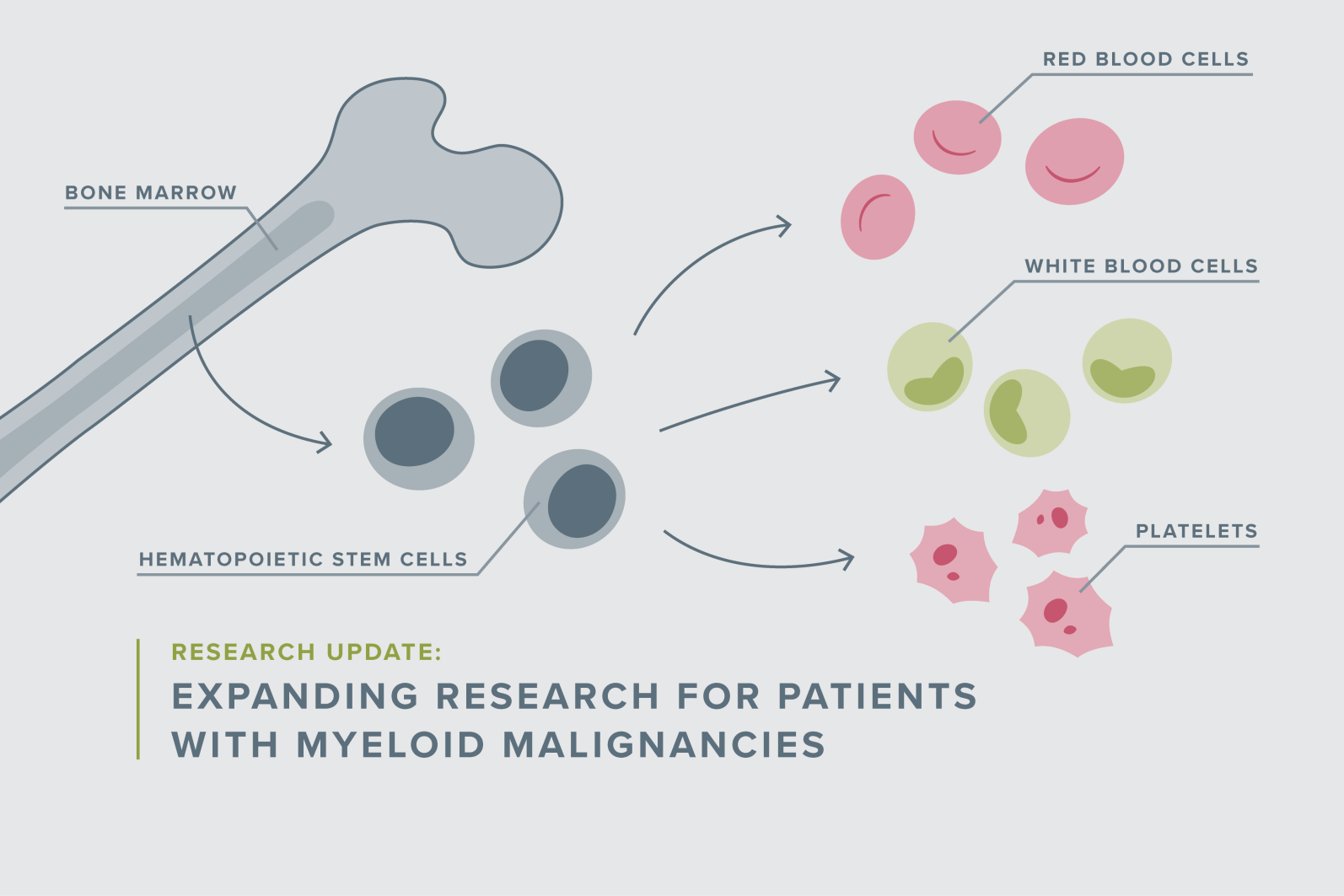

Dren Bio is a privately held biotechnology company focused on developing novel therapies using myeloid cell engager technology. This technology harnesses the power of the body's immune system to target and destroy cancer cells. While the exact financial terms of the acquisition remain undisclosed, the deal highlights Sanofi's confidence in Dren Bio's platform and its potential to revolutionize cancer treatment. The strategic rationale behind Sanofi’s purchase is clear: gaining access to a cutting-edge technology that complements its existing oncology and immunology pipeline.

- Specific details about the myeloid cell engager technology: Dren Bio’s technology employs engineered molecules that precisely target specific myeloid cells, which play a crucial role in the immune response against cancer. This targeted approach aims to minimize off-target effects and maximize efficacy.

- Target cancer types: While precise details may be limited at this stage, the technology is likely to be initially targeted towards hematological malignancies, leveraging the role of myeloid cells in these cancers.

- Stage of development: The acquired technology is likely in the preclinical or early clinical trial phase, representing a long-term investment for Sanofi.

- Potential benefits compared to existing therapies: Myeloid cell engagers offer the potential for improved efficacy and reduced side effects compared to traditional cancer therapies, making them a highly attractive area for investment.

Strengthening Sanofi's Oncology and Immunology Pipeline

This acquisition perfectly aligns with Sanofi's broader R&D strategy, bolstering its commitment to developing innovative immunotherapies. The addition of Dren Bio's myeloid cell engager technology significantly enhances Sanofi's existing oncology and immunology portfolio, creating potential synergies with ongoing research programs.

- Examples of other Sanofi immunology and oncology drugs: Sanofi already possesses a substantial portfolio of immunology and oncology drugs, offering a strong foundation for potential combination therapies with the newly acquired myeloid cell engager technology.

- Potential for combined therapies: The new technology could be combined with other Sanofi therapies, creating synergistic effects and enhanced treatment outcomes. This approach could lead to more effective and targeted cancer treatments.

- Expected timeline for clinical trials or market launch: The timeline for clinical trials and potential market launch will depend on the successful completion of various development milestones and regulatory approvals.

Impact on the Myeloid Cell Engager Market

Sanofi's acquisition of Dren Bio's myeloid cell engager technology has significant implications for the competitive landscape of this emerging therapeutic area. It is expected to increase investment and accelerate research and development in myeloid cell engager therapies.

- Market size and growth projections: The market for myeloid cell engager therapies is projected to experience substantial growth in the coming years, driven by the increasing demand for effective cancer treatments.

- Key competitors and their products: Several other pharmaceutical and biotechnology companies are actively pursuing the development of myeloid cell engager therapies, creating a dynamic and competitive market.

- Potential for future collaborations and partnerships: Sanofi's acquisition may trigger further collaborations and partnerships within the myeloid cell engager space, accelerating innovation and improving access to these potentially life-saving treatments.

Future Implications for Patients

The successful development and commercialization of Dren Bio's myeloid cell engager technology hold the potential to significantly benefit patients suffering from various cancers.

- Potential improvements in efficacy and safety: Myeloid cell engagers offer the potential for improved efficacy and reduced toxicity compared to existing therapies.

- Potential reduction in side effects: Targeted therapies such as myeloid cell engagers can lead to a reduction in debilitating side effects commonly associated with traditional cancer treatments.

- Access to innovative therapies for patients: This acquisition may accelerate the development and availability of innovative therapies for patients with limited treatment options.

Conclusion

Sanofi's acquisition of Dren Bio's myeloid cell engager technology represents a pivotal moment in the fight against cancer. This strategic move significantly expands Sanofi's immunology portfolio, adding a powerful new tool to its arsenal in the battle against various cancers. The acquisition highlights the growing importance of myeloid cell engagers in oncology and underscores Sanofi's commitment to delivering innovative cancer treatments to patients worldwide. Stay informed about the latest advancements in myeloid cell engager technology and Sanofi's contributions to the fight against cancer.

Featured Posts

-

Understanding The Uptick The Potential Role Of A New Covid 19 Variant

May 31, 2025

Understanding The Uptick The Potential Role Of A New Covid 19 Variant

May 31, 2025 -

Receta Simple Y Paso A Paso Croque Monsieur Perfecto

May 31, 2025

Receta Simple Y Paso A Paso Croque Monsieur Perfecto

May 31, 2025 -

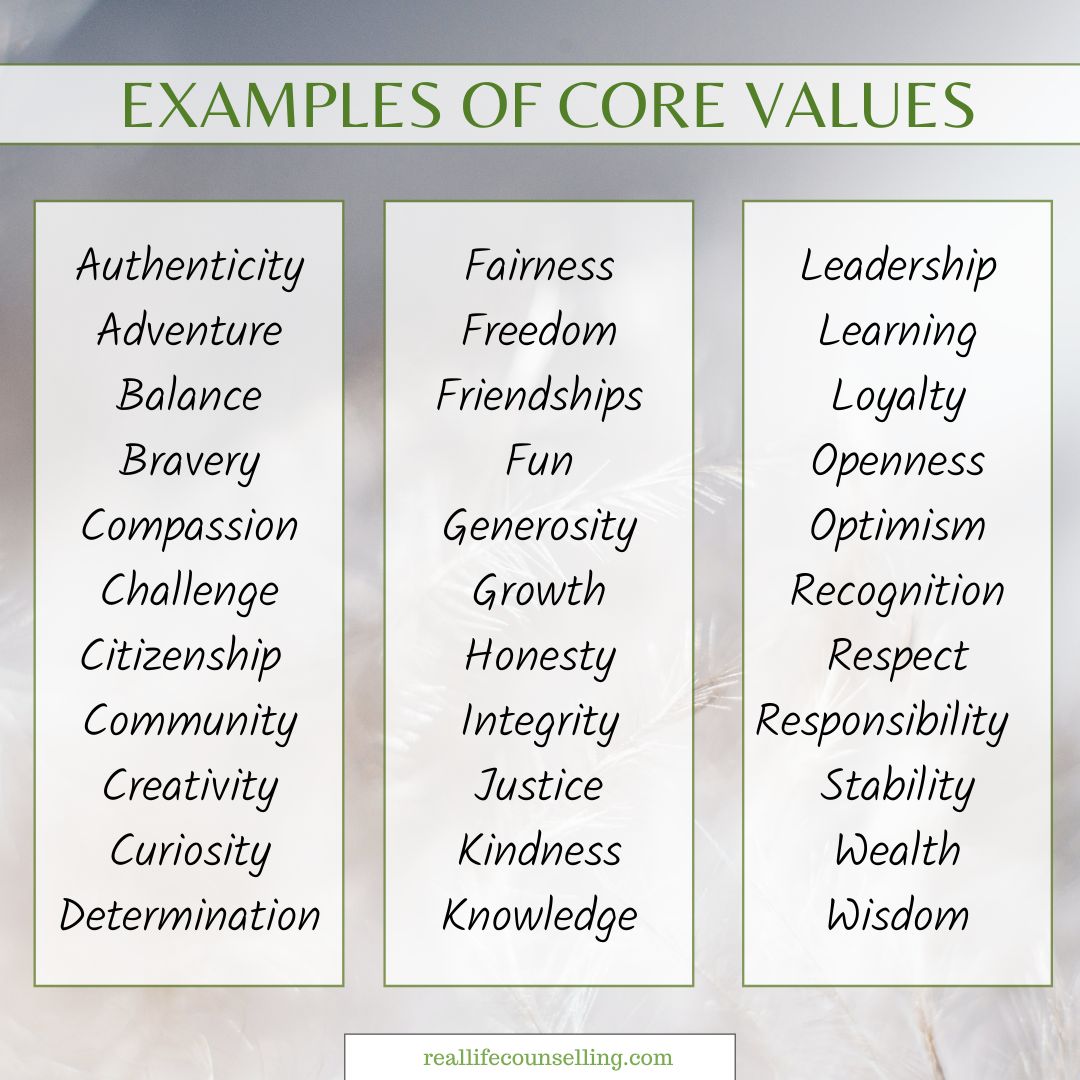

Understanding The Good Life Defining Your Values And Goals

May 31, 2025

Understanding The Good Life Defining Your Values And Goals

May 31, 2025 -

Fed Chair Powell And President Trumps Economic Discussion At The White House

May 31, 2025

Fed Chair Powell And President Trumps Economic Discussion At The White House

May 31, 2025 -

Yankees Tigers Underdog Alert And Betting Odds For Detroit

May 31, 2025

Yankees Tigers Underdog Alert And Betting Odds For Detroit

May 31, 2025