Second-Order Effects Of Reciprocal Tariffs On The Indian Economy

Table of Contents

Impact on Domestic Industries and Production

Reciprocal tariffs significantly impact domestic industries, creating a complex interplay of benefits and drawbacks. While some industries might experience increased competitiveness due to protection from cheaper imports, others could face substantial challenges.

Potential Benefits:

- Protection from Cheaper Imports Leading to Higher Domestic Production: Tariffs make imported goods more expensive, boosting demand for domestically produced alternatives. This can stimulate domestic production and create opportunities for import substitution.

- Increased Employment in Protected Sectors: The increased production in protected sectors naturally leads to higher employment levels in those industries.

Potential Drawbacks:

- Higher Prices for Consumers Due to Reduced Import Competition: Reduced import competition can lead to higher prices for consumers, potentially eroding their purchasing power.

- Reduced Access to Essential Raw Materials or Intermediate Goods: If essential inputs for domestic industries are imported, tariffs on these inputs can increase production costs significantly, negatively impacting competitiveness.

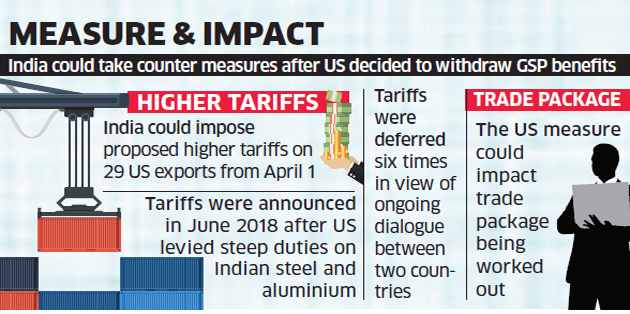

- Potential for Retaliation from Trading Partners Leading to Further Economic Disruptions: Imposing tariffs can trigger retaliatory measures from trading partners, leading to trade wars that harm both economies involved. This can severely restrict market access for Indian exporters.

The overall net impact on domestic production and industrial growth depends on several factors, including the specific industries affected, the magnitude of the tariffs, and the response of trading partners. A nuanced analysis considering the interconnectedness of industries is crucial for assessing the true effect on industrial growth and competitiveness. Empirical data on specific sectors are necessary for a thorough evaluation.

Effects on Inflation and Consumer Prices

Reciprocal tariffs exert considerable influence on inflation and consumer prices. The increased cost of imported goods directly translates into a higher Consumer Price Index (CPI).

- Increased Prices of Imported Goods Directly Affect Consumer Price Index (CPI): Tariffs increase the landed cost of imports, directly affecting the CPI and reducing purchasing power.

- Increased Input Costs for Domestic Industries Lead to Higher Prices for Domestically Produced Goods: Higher input costs due to tariffs on imported raw materials or intermediate goods lead to higher prices for domestically produced goods, further contributing to inflationary pressure.

This increase in inflationary pressure disproportionately affects lower-income groups who have a higher proportion of their income allocated to essential goods and services, leading to a widening income inequality. Careful monitoring of the CPI and its components is crucial for policymakers to assess the impact of reciprocal tariffs on purchasing power across various income brackets.

Consequences for Foreign Investment and Trade

Reciprocal tariffs significantly impact foreign direct investment (FDI) and India's trade balance.

Impact on FDI:

- Reduced Attractiveness for Foreign Investors Due to Increased Trade Barriers: Increased trade barriers created by reciprocal tariffs make India a less attractive destination for foreign investors seeking easy access to markets.

- Potential Shift in Investment Destinations to Countries with More Open Trade Policies: Investors might divert their investments to countries with more open and predictable trade policies.

Impact on Export Competitiveness:

- Retaliatory Tariffs from Trading Partners Impacting Indian Exports: Retaliatory tariffs imposed by trading partners severely reduce the competitiveness of Indian exports in those markets.

- Reduced Market Access for Indian Goods in International Markets: This loss of market access can have serious consequences for export-oriented industries and the overall trade balance.

The combined impact of reduced FDI inflow and decreased export competitiveness can negatively affect India’s trade balance and overall economic growth. The potential for trade wars and disruptions to global supply chains necessitates a cautious approach to reciprocal tariff policies.

Socio-economic Implications

The socio-economic implications of reciprocal tariffs are far-reaching and complex. They affect employment across different sectors and exacerbate existing inequalities.

- Job Losses in Import-Dependent Sectors: Industries heavily reliant on imported goods or components may face job losses due to increased input costs and reduced competitiveness.

- Job Creation in Protected Sectors (Potentially Offsetting Job Losses): Conversely, protected sectors may see job creation due to increased domestic production. However, these jobs may not always compensate for job losses in other sectors.

The distribution of costs and benefits is not uniform across different socio-economic groups. Lower-income households are disproportionately affected by higher prices due to inflation, while higher-income households might benefit from increased protection for certain industries. The impact on poverty and inequality needs careful assessment to understand the overall societal impact of reciprocal tariffs. Comprehensive social impact assessments are critical to mitigate negative consequences and support vulnerable populations.

Conclusion: Navigating the Complexities of Reciprocal Tariffs on the Indian Economy

The second-order effects of reciprocal tariffs on the Indian economy are complex and far-reaching. This analysis highlights the significant impact on domestic industries, inflation, foreign investment, and socio-economic conditions. While some sectors might benefit from increased protection, others face increased costs and reduced competitiveness. The potential for retaliatory tariffs and trade wars underscores the need for caution in implementing such policies. Understanding these indirect consequences is crucial for formulating effective trade policies that balance the potential benefits with the significant risks. Further research is essential to fully grasp the long-term implications of reciprocal tariffs on the Indian economy, promoting a nuanced and data-driven approach to trade policy that considers the full spectrum of second-order effects. The need for a balanced approach to trade policy, considering the second-order effects of reciprocal tariffs on the Indian economy, remains paramount.

Featured Posts

-

Israels Airstrike Targets Hamas Leader Sinwar In Gaza

May 15, 2025

Israels Airstrike Targets Hamas Leader Sinwar In Gaza

May 15, 2025 -

Loi Ich Va Thoi Gian Xong Hoi Phu Hop Voi The Trang

May 15, 2025

Loi Ich Va Thoi Gian Xong Hoi Phu Hop Voi The Trang

May 15, 2025 -

Rays Sweep Padres In Dominant Series

May 15, 2025

Rays Sweep Padres In Dominant Series

May 15, 2025 -

Padres Vs Cubs Match Preview And Prediction For An Exciting Showdown

May 15, 2025

Padres Vs Cubs Match Preview And Prediction For An Exciting Showdown

May 15, 2025 -

Colorado Rapids Triumph Over San Jose Earthquakes Steffens Subpar Game

May 15, 2025

Colorado Rapids Triumph Over San Jose Earthquakes Steffens Subpar Game

May 15, 2025