Selling On EBay, Vinted, Or Depop? Understand HMRC's Nudge Letters

Table of Contents

What are HMRC's Nudge Letters?

An HMRC nudge letter isn't a scary demand for immediate payment; it's a friendly (but firm) reminder that you may have a tax liability you haven't yet addressed. It indicates that HMRC has information suggesting you may have unreported income from selling goods online, whether through eBay, Vinted, Depop, or other online selling platforms. While not a formal demand, ignoring it could lead to more serious consequences down the line. Different types of letters might exist, but they all share the same core purpose: to encourage voluntary tax compliance.

- Situations triggering a nudge letter: Significant sales volume on online platforms, inconsistent reporting of income, or discrepancies between reported income and HMRC's data.

- Information HMRC might have received: Data directly from online marketplaces like eBay, Vinted, and Depop, information from third-party reporting services, or even tips from other sources.

- The letter's purpose: To gently remind you of your responsibility to declare and pay tax on your profits from selling online, encouraging you to rectify any omissions before things escalate.

Tax Implications of Selling on Online Marketplaces

Selling goods online, whether it's vintage clothing on Depop, electronics on eBay, or pre-loved books on Vinted, has tax implications. HMRC considers the income you generate from these sales taxable, and you must declare this income accurately. The key difference lies in whether your online selling is a hobby or a business.

- Business vs. Hobby: If your online selling activities are regular, frequent, and generate significant profit, HMRC is likely to consider it a business, requiring you to pay Income Tax on your profits. If it's more occasional and generates small profits, it might be considered a hobby, with profits potentially subject to Capital Gains Tax. The line can be blurred, and it's important to understand where you stand.

- Keeping Accurate Records: Meticulous record-keeping is crucial. Maintain detailed records of all your sales, including dates, amounts received, buyer information (for potential disputes), and all associated costs.

- Key Considerations:

- Profit Limits: There's no specific sales limit that automatically triggers a tax liability. However, consistent profits over a certain threshold will increase your chances of attracting attention from HMRC.

- Deductible Expenses: Keep receipts for all business-related expenses, including postage, packaging materials, advertising fees (if applicable), and any other costs directly related to your online sales. These are deductible from your income to calculate your taxable profit.

- Record-Keeping Tools: Use accounting software (like Xero or FreeAgent) or spreadsheets to effectively track your income and expenses. Good organization simplifies tax calculations.

How to Respond to an HMRC Nudge Letter

Receiving an HMRC nudge letter shouldn't cause panic, but it demands prompt action. Ignoring it will only exacerbate the situation.

- Act Quickly: Don't delay. Review the letter carefully, and take the necessary steps to understand your tax obligations.

- Check Your Records: Thoroughly review your sales records and expenses to accurately calculate your profits for the relevant period.

- Contact HMRC (if necessary): If you're unsure about anything in the letter, contact HMRC directly for clarification. They're usually helpful and can guide you through the process.

- Gather Documentation: Collect all relevant documentation, including sales records, receipts for expenses, bank statements, and any other supporting evidence.

- Self-Assessment Tax Return: If you haven't already, you'll likely need to file a self-assessment tax return to declare your online selling income. This is an essential part of complying with your tax obligations.

- Penalties for Non-Compliance: Failure to address your tax obligations can result in penalties, interest charges, and even legal action.

Avoiding HMRC Nudge Letters in the Future

The best way to avoid future nudge letters is to proactively manage your tax affairs.

- Regular Record Keeping: Maintain detailed and up-to-date records of all sales and expenses.

- Timely Tax Returns: File your self-assessment tax return on time each year. This avoids late filing penalties and keeps your tax affairs in order.

- Utilize Accounting Software: Using accounting software streamlines record-keeping and helps to avoid costly errors.

- Professional Advice: If you're struggling with the complexities of self-assessment or unsure of your obligations, consider seeking advice from an accountant or tax advisor.

Selling on eBay, Vinted, or Depop – Tax Compliance is Key

Successfully selling on online marketplaces like eBay, Vinted, and Depop requires more than just listing appealing items; it involves understanding and meeting your tax obligations. Ignoring HMRC communications can lead to significant financial penalties. Don't wait for an HMRC nudge letter! Take control of your online selling tax obligations by learning more about your responsibilities when selling on eBay, Vinted, or Depop today. For further information, visit the official HMRC website ([link to HMRC website]) and consider consulting a tax professional for personalized advice.

Featured Posts

-

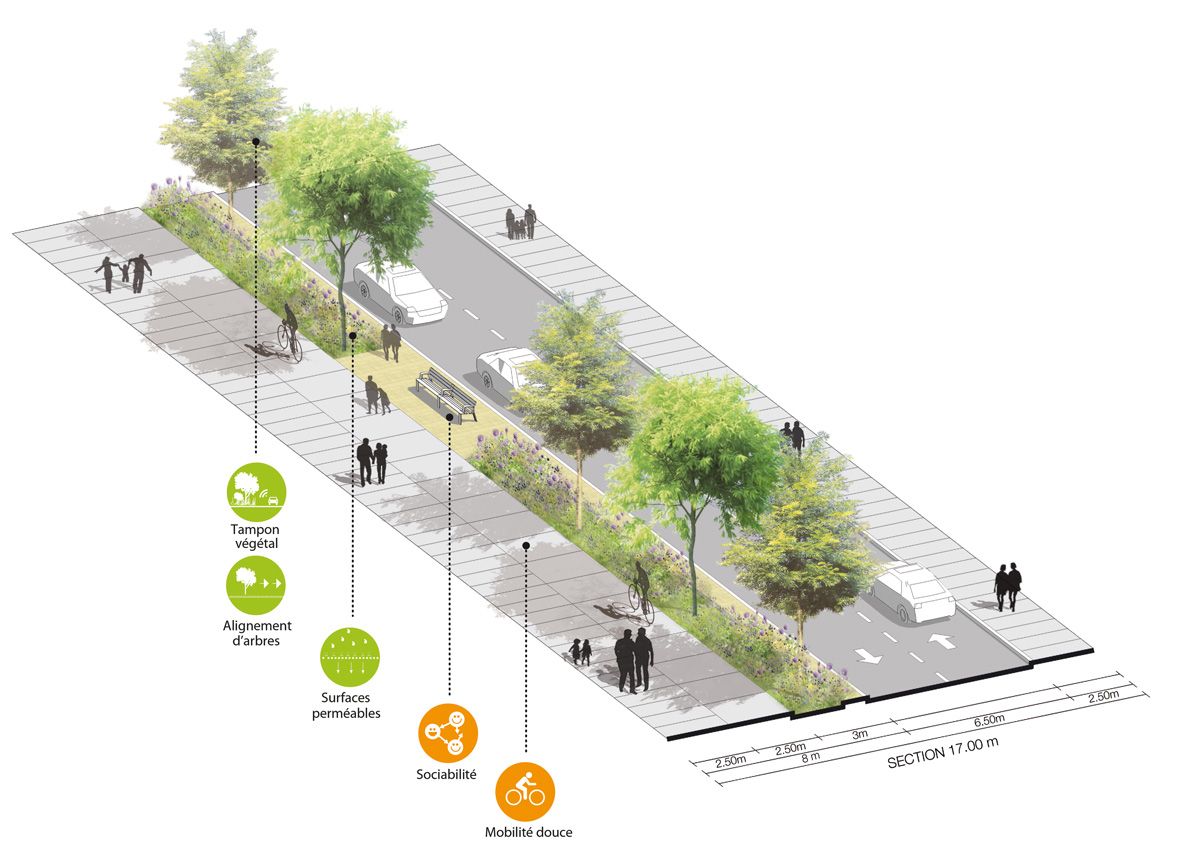

Bruno Kone Et Les Plans D Urbanisme De Detail Developpement Urbain En Cote D Ivoire

May 20, 2025

Bruno Kone Et Les Plans D Urbanisme De Detail Developpement Urbain En Cote D Ivoire

May 20, 2025 -

Understanding The D Wave Quantum Qbts Stock Crash On Monday

May 20, 2025

Understanding The D Wave Quantum Qbts Stock Crash On Monday

May 20, 2025 -

Manchester Uniteds Fa Cup Victory Rashfords Brace Sinks Aston Villa

May 20, 2025

Manchester Uniteds Fa Cup Victory Rashfords Brace Sinks Aston Villa

May 20, 2025 -

Canada Posts Financial Troubles Report Calls For Phased Elimination Of Door To Door Mail Delivery

May 20, 2025

Canada Posts Financial Troubles Report Calls For Phased Elimination Of Door To Door Mail Delivery

May 20, 2025 -

Agatha Christies Poirot Character Analysis And Case Studies

May 20, 2025

Agatha Christies Poirot Character Analysis And Case Studies

May 20, 2025