Sensex Today: 700+ Point Surge, Nifty Reclaims 23,800

Table of Contents

Main Points: Unpacking the Sensex and Nifty's Rally

Key Factors Driving the Sensex and Nifty's Surge:

Several factors contributed to today's impressive market surge. A confluence of global and domestic influences propelled the Sensex and Nifty to record gains.

-

Global Market Influences: Positive global cues played a significant role. The strong performance of the US markets, fueled by positive corporate earnings and a generally upbeat economic outlook, injected confidence into global investors. This positive global sentiment, coupled with increased Foreign Institutional Investment (FII) flows into Indian equities, contributed substantially to the market rally. Improved global economic data, particularly from key trading partners, also boosted investor confidence. Tracking global market trends is crucial for understanding the broader context of these gains.

-

Domestic Economic Indicators: Positive domestic economic data further fueled the rally. Recent reports suggesting a moderation in inflation rates and continued robust industrial production provided a positive backdrop for investors. The anticipation of strong GDP growth forecasts for the upcoming quarters further solidified the optimistic outlook. A healthy Indian economy is a key driver of domestic market strength.

-

Sector-Specific Performance: The surge wasn't uniform across all sectors. Strong performance in key sectors like IT, Banking, and FMCG significantly boosted the overall indices. IT stocks, in particular, benefited from positive global technology trends and robust order books. Banking stocks also saw significant gains, driven by improved credit growth and positive regulatory developments. The robust performance of FMCG stocks reflected sustained consumer demand. Analyzing sectoral performance is crucial for understanding the nuances of the market movement.

-

Specific Stock Performances: Several prominent stocks experienced remarkable gains, contributing significantly to the overall market surge. TCS and Reliance, for example, saw substantial increases in their share prices, reflecting strong investor confidence in these companies. Tracking top gainers and understanding the reasons behind their performance provides valuable insights into market dynamics. Individual stock analysis can reveal specific catalysts driving the overall market trend.

Analyzing Nifty's Reclaim of 23,800:

The Nifty's successful reclaiming of the 23,800 mark holds significant technical and psychological importance.

-

Technical Analysis: While detailed technical analysis requires a deeper dive, some indicators suggest a strengthening bullish trend. The breaking of key resistance levels, coupled with positive chart patterns, supported the Nifty's upward movement. Further technical analysis is necessary to gauge the sustainability of this trend.

-

Investor Sentiment: The market rally reflects a significant shift in investor sentiment. Increased buying pressure and reduced selling pressure indicate growing confidence in the market's future prospects. This positive investor confidence is a crucial indicator of market health and sustainability.

-

Future Outlook: While the current market sentiment is positive, it's crucial to maintain a balanced outlook. Potential risks, including global geopolitical uncertainties and domestic regulatory changes, could impact the market's trajectory. Market volatility is inherent, and investors should remain cautious and diversify their portfolios. Careful monitoring of market outlook and future predictions is critical for informed investment decisions.

Conclusion: Sensex Today's Implications and Next Steps

Today's significant Sensex and Nifty gains were driven by a combination of positive global cues, strong domestic economic indicators, robust sectoral performance, and a shift in investor sentiment. The Nifty's successful crossing of the 23,800 mark is a significant milestone. While the current upward trend is encouraging, investors should approach the market with a balanced perspective, acknowledging the potential for volatility. To stay informed about the latest "Sensex Today" updates and for in-depth Nifty analysis, along with comprehensive stock market news, make sure to follow our site regularly. Stay tuned for further updates and insightful analyses on Sensex and Nifty movements. Keep checking back for the latest Sensex updates and market analysis.

Featured Posts

-

Improving Wheelchair Access On The Elizabeth Line A Users Guide

May 10, 2025

Improving Wheelchair Access On The Elizabeth Line A Users Guide

May 10, 2025 -

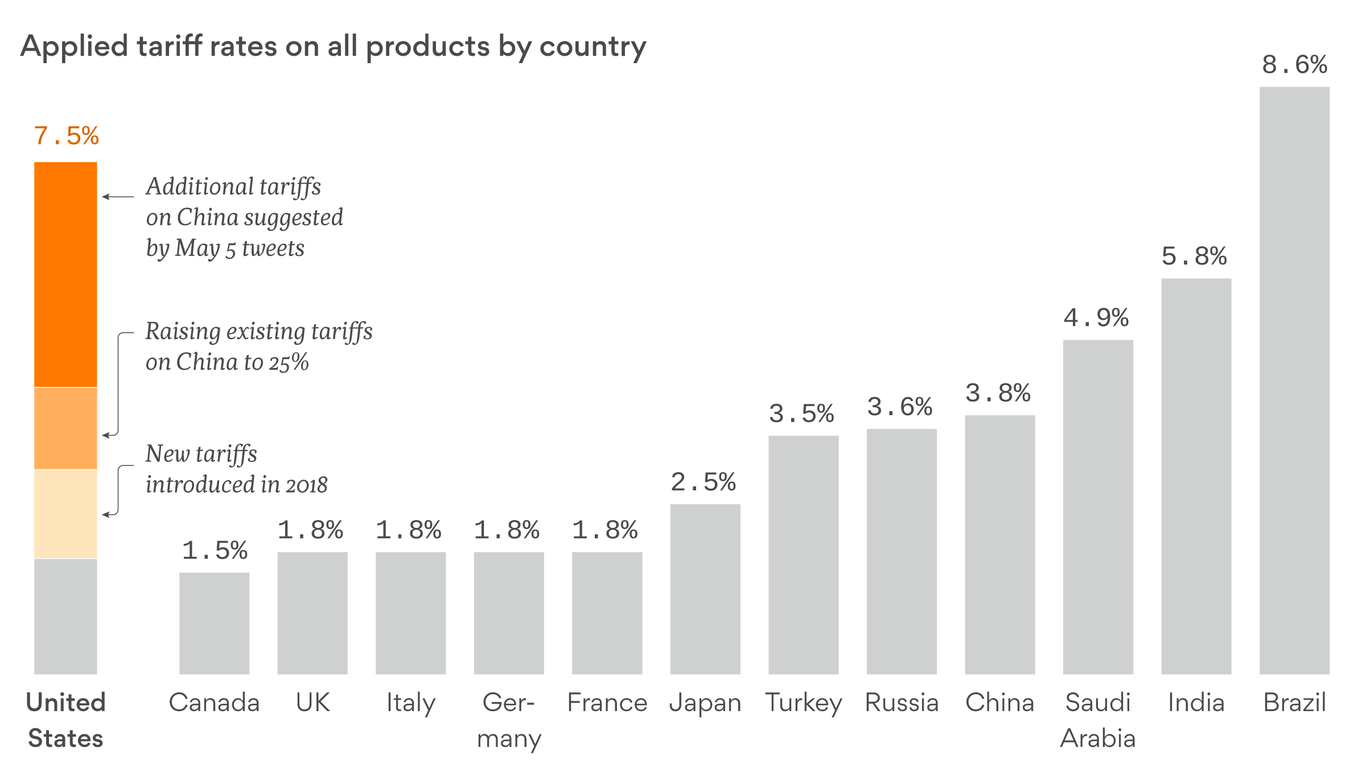

Trump Tariffs Weigh On Infineon Ifx Sales Guidance Revised Downward

May 10, 2025

Trump Tariffs Weigh On Infineon Ifx Sales Guidance Revised Downward

May 10, 2025 -

Mediatheque Champollion A Dijon Degats Apres Un Depart De Feu

May 10, 2025

Mediatheque Champollion A Dijon Degats Apres Un Depart De Feu

May 10, 2025 -

The Cost Of Supporting Trump Tech Billionaires 194 Billion Loss

May 10, 2025

The Cost Of Supporting Trump Tech Billionaires 194 Billion Loss

May 10, 2025 -

The Whats App Spyware Case Metas 168 Million Fine And Its Significance

May 10, 2025

The Whats App Spyware Case Metas 168 Million Fine And Its Significance

May 10, 2025

Latest Posts

-

Mediatheque Champollion A Dijon Degats Apres Un Depart De Feu

May 10, 2025

Mediatheque Champollion A Dijon Degats Apres Un Depart De Feu

May 10, 2025 -

Dijon Intervention Urgente Des Pompiers Pour Un Incendie A La Mediatheque Champollion

May 10, 2025

Dijon Intervention Urgente Des Pompiers Pour Un Incendie A La Mediatheque Champollion

May 10, 2025 -

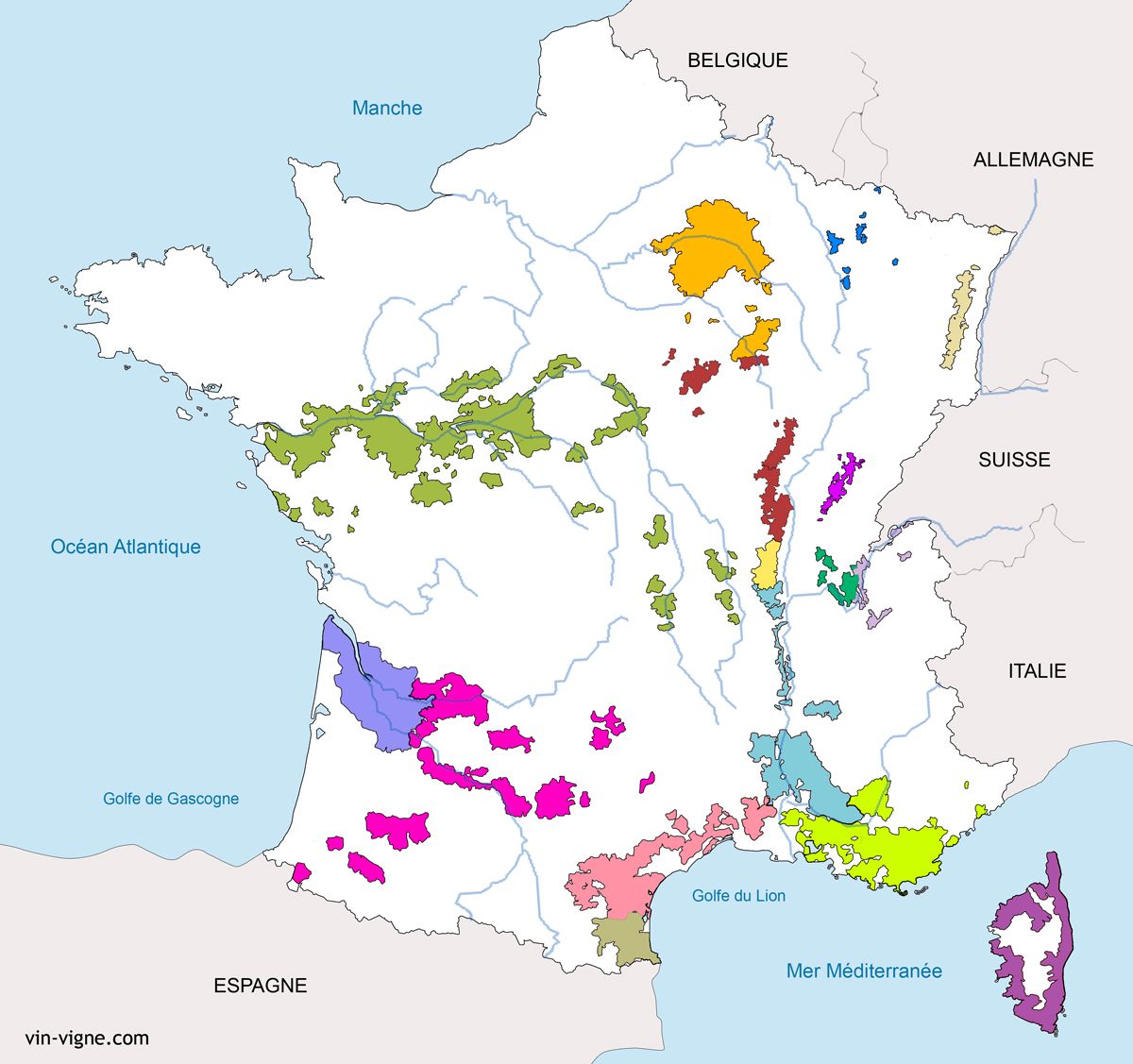

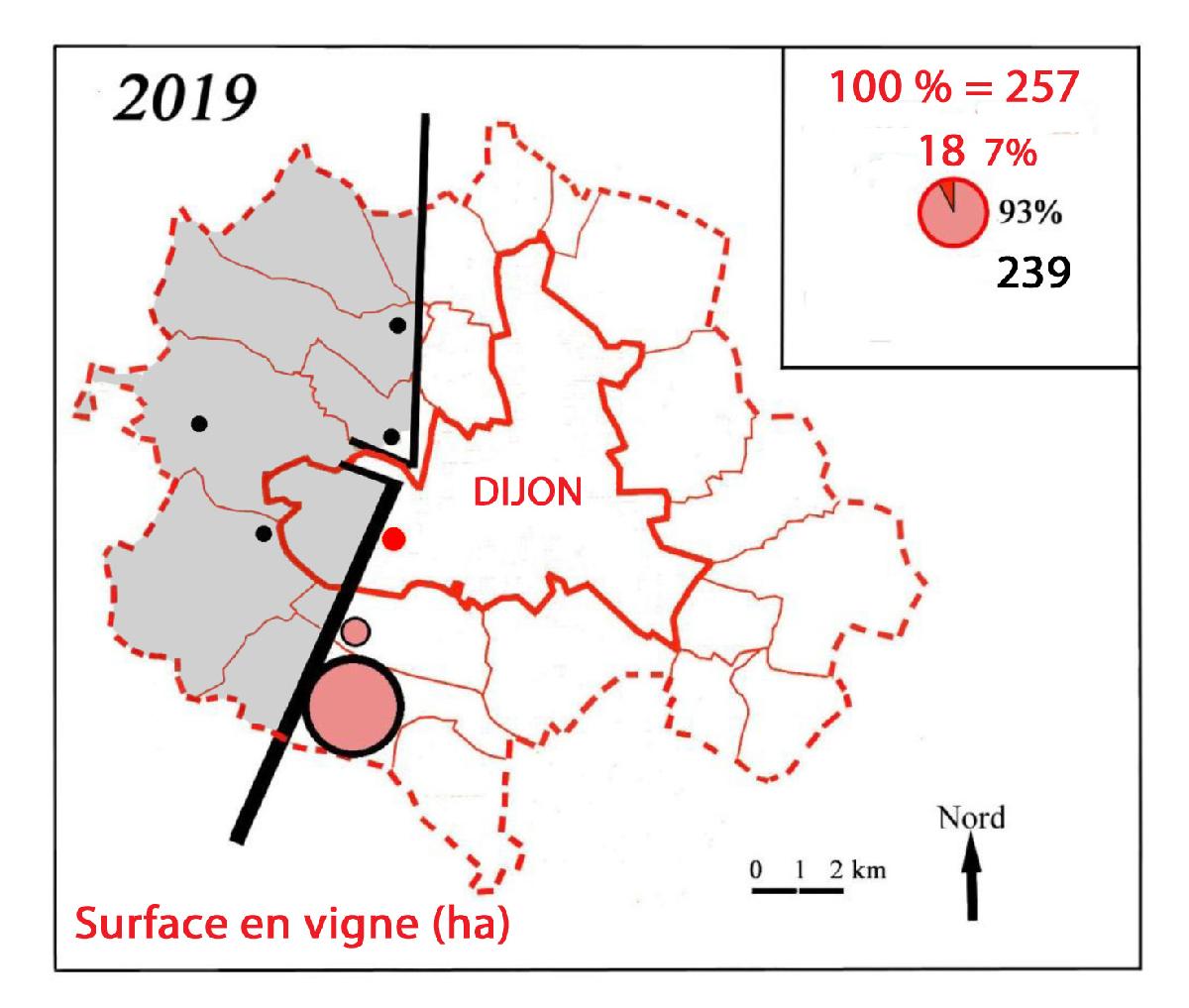

Developpement Viticole A Dijon 2 500 M De Vignes Aux Valendons

May 10, 2025

Developpement Viticole A Dijon 2 500 M De Vignes Aux Valendons

May 10, 2025 -

Projet Viticole A Dijon 2 500 M Aux Valendons

May 10, 2025

Projet Viticole A Dijon 2 500 M Aux Valendons

May 10, 2025 -

Dijon 2 500 M De Vignes Plantes Au Secteur Des Valendons

May 10, 2025

Dijon 2 500 M De Vignes Plantes Au Secteur Des Valendons

May 10, 2025