Trump Tariffs Weigh On Infineon (IFX) Sales; Guidance Revised Downward

Table of Contents

The Impact of Trump Tariffs on Infineon's (IFX) Revenue Streams

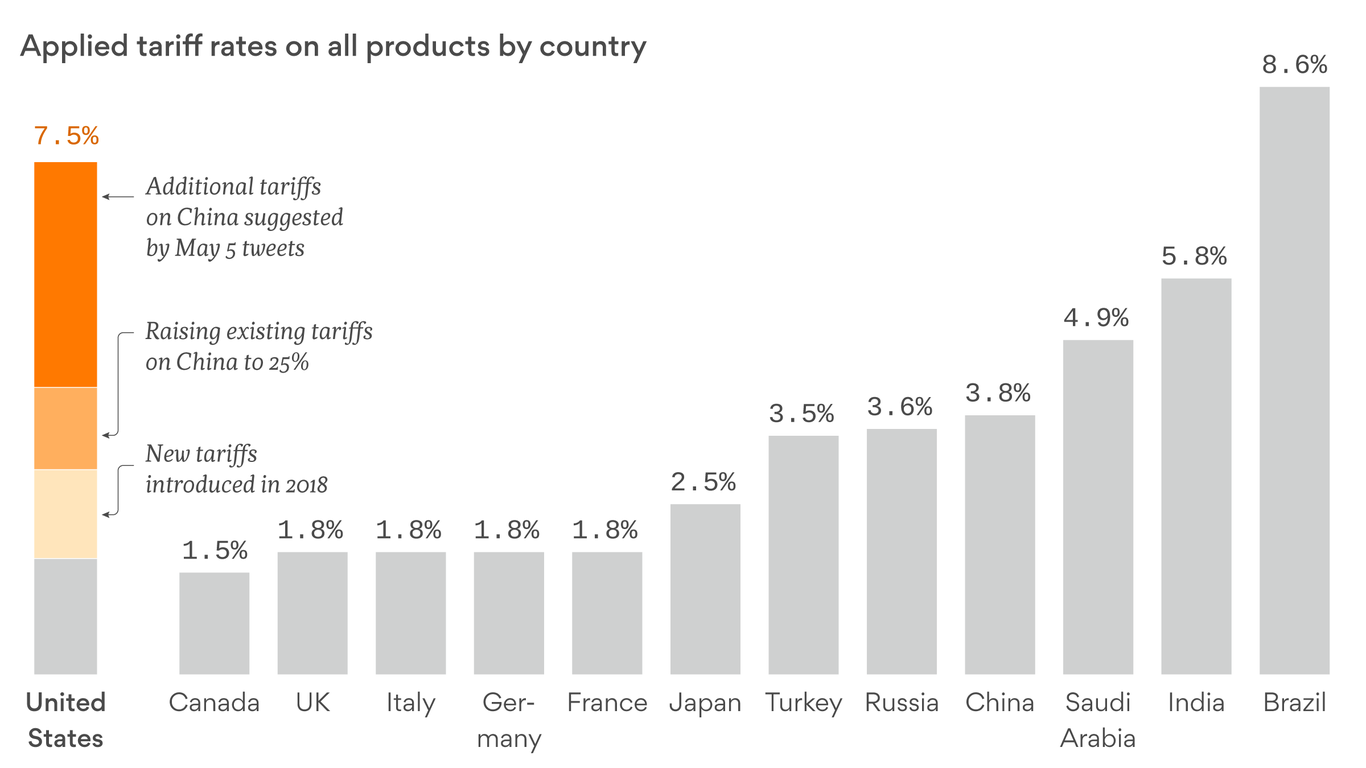

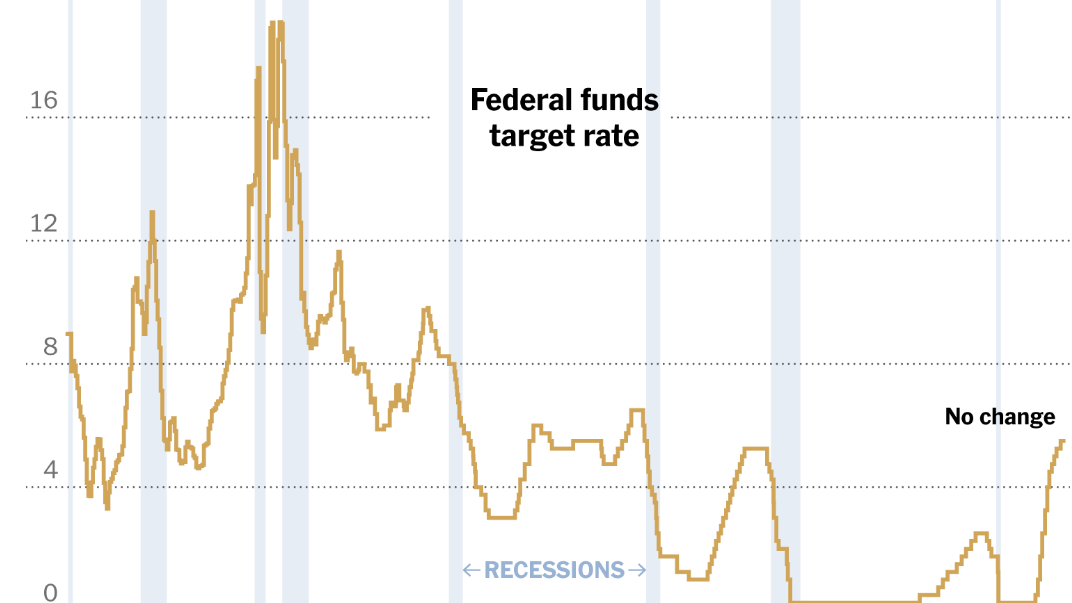

The Trump administration's tariffs, particularly those targeting Chinese goods, significantly impacted Infineon's revenue streams. These tariffs created a cascade of negative consequences that directly affected the company's bottom line. The "tariff impact" wasn't simply a minor inconvenience; it represented a substantial challenge to Infineon's operations and profitability.

-

Increased production costs: Tariffs on imported materials, crucial for Infineon's manufacturing process, led to a notable increase in production costs. This directly impacted Infineon revenue, squeezing profit margins. The increased cost of raw materials, coupled with logistical complexities, significantly hampered the company's ability to maintain previous profit levels.

-

Reduced demand from impacted sectors: Many of Infineon's key customers operate in sectors heavily affected by tariffs, such as the automotive and industrial industries. Reduced demand from these sectors translated to lower sales for Infineon, further exacerbating the situation. The resulting supply chain disruption also played a significant role in this reduction.

-

Price increases passed on to customers: To offset the increased production costs, Infineon was forced to pass some of these expenses on to its customers through price increases. This reduced price competitiveness, making Infineon's products less attractive compared to competitors who were less affected by the tariffs. The loss of price competitiveness directly impacted Infineon revenue and market share.

-

Loss of market share: The combination of higher prices and reduced demand ultimately led to a loss of market share for Infineon. Competitors who sourced materials from regions unaffected by tariffs gained a significant advantage, leading to a shift in the market landscape. The analysis of Infineon revenue reveals a clear correlation between the imposition of tariffs and the decline in market share.

Infineon's (IFX) Response to the Tariff Challenges

Facing these substantial challenges, Infineon implemented a multifaceted strategy to mitigate the negative effects of the tariffs. These "mitigation strategies" were crucial to navigating the difficult economic climate.

-

Restructuring supply chains: Infineon actively worked to diversify its supply chains, reducing its reliance on tariff-affected regions. This involved identifying alternative suppliers and establishing new sourcing arrangements to enhance supply chain resilience.

-

Negotiations with customers: Infineon engaged in extensive negotiations with its key customers to share the burden of increased costs. This involved carefully explaining the situation and working towards mutually agreeable solutions that prevented excessive price increases and maintained business relationships. The success of these negotiations significantly impacted the company's ability to minimize revenue loss.

-

Investment in domestic production: To reduce its dependence on imports, Infineon invested in expanding its domestic production capabilities. This involved significant capital expenditure but reduced the vulnerability of its operations to future trade disputes. This strategic investment demonstrates Infineon's commitment to long-term cost optimization.

-

Lobbying efforts to influence trade policy: Infineon actively participated in lobbying efforts to advocate for changes in trade policy. This involved working with industry associations and engaging with policymakers to influence future trade decisions.

Analysis of the Downward Revision of Sales Guidance

The downward revision of Infineon's sales guidance is directly attributable to a complex interplay of factors. While the tariffs played a significant role, other contributing factors should not be ignored.

-

Quantifying the tariff impact: While precise figures are often difficult to isolate, analyses suggest a significant portion of the downward revision can be attributed to the increased costs and reduced demand stemming from the tariffs. This impact is reflected in the reduced "Infineon revenue" figures compared to pre-tariff forecasts.

-

Other contributing factors: Beyond tariffs, the global economic slowdown and increased competition within the semiconductor industry also contributed to the downward revision. The broader macroeconomic climate significantly impacted demand, adding another layer of complexity to the challenge.

-

Implications for investors and future stock performance: The revised guidance sent shockwaves through the market, leading to a negative impact on IFX stock price. Investors are understandably concerned about the company's ability to navigate these challenging circumstances and achieve future growth. The "earnings forecast" has been significantly revised downward, reflecting this uncertainty.

-

Comparison to previous forecasts: The revised guidance represents a substantial deviation from previous forecasts, highlighting the severity of the challenges facing Infineon. This dramatic shift underscores the significant impact of both tariffs and the broader economic climate on the company's financial performance.

Long-Term Implications for Infineon (IFX) and the Semiconductor Industry

The long-term effects of the Trump-era tariffs extend far beyond Infineon's immediate financial performance. They point to significant shifts within the semiconductor industry as a whole.

-

Increased regionalization of semiconductor production: The tariffs accelerated a trend towards regionalizing semiconductor production, with companies seeking to reduce their reliance on single-source manufacturing hubs. This "geographical diversification" is expected to continue shaping the industry landscape.

-

Long-term shifts in global supply chains: The disruption caused by the tariffs has forced companies to reassess and restructure their global supply chains, emphasizing greater resilience and diversification. These "global supply chain" changes will likely persist for years to come.

-

Impact on innovation and technological advancement: The increased costs and complexities associated with tariffs could potentially hinder innovation and technological advancement in the semiconductor sector, as companies allocate resources to mitigate risk rather than pursue cutting-edge developments.

-

Changes in industry competition: The tariffs reshaped the competitive landscape, giving an advantage to companies with diversified supply chains and less exposure to tariff-affected regions. These changes in "semiconductor industry trends" will likely have lasting implications.

Conclusion: The Lasting Effects of Trump Tariffs on Infineon (IFX)

The Trump-era tariffs had a significant and lasting impact on Infineon (IFX), affecting its revenue streams, forcing strategic responses, and contributing to a downward revision of sales guidance. The implications of the revised "sales guidance revision" are far-reaching, impacting both the company's short-term and long-term prospects. Understanding the "tariff impact" on Infineon is crucial for investors seeking to analyze the company's future performance and the broader shifts within the semiconductor industry. To stay informed about Infineon's ongoing challenges and the evolving landscape of global trade, continue to research "Infineon's tariff challenges" and analyze the impact of future trade policies on IFX and the semiconductor sector. Analyzing the impact of tariffs on IFX and the future of Infineon in a changing trade environment is crucial for informed decision-making.

Featured Posts

-

Weight Watchers Bankruptcy Filing Amidst Weight Loss Drug Rise

May 10, 2025

Weight Watchers Bankruptcy Filing Amidst Weight Loss Drug Rise

May 10, 2025 -

Ray Epps Sues Fox News For Defamation Jan 6th Falsehoods At The Center Of The Lawsuit

May 10, 2025

Ray Epps Sues Fox News For Defamation Jan 6th Falsehoods At The Center Of The Lawsuit

May 10, 2025 -

The Untimely Death Of Americas First Nonbinary Individual

May 10, 2025

The Untimely Death Of Americas First Nonbinary Individual

May 10, 2025 -

Trumps Reluctance To Drop Tariffs Warners Assessment

May 10, 2025

Trumps Reluctance To Drop Tariffs Warners Assessment

May 10, 2025 -

Infineon Ifx Stock Sales Guidance Disappoints Citing Tariff Concerns

May 10, 2025

Infineon Ifx Stock Sales Guidance Disappoints Citing Tariff Concerns

May 10, 2025

Latest Posts

-

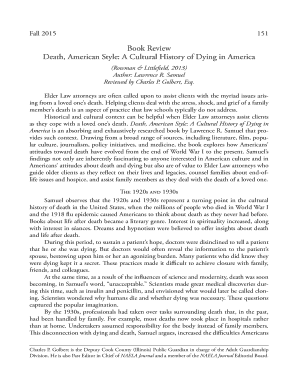

U S Federal Reserve Rate Decision Economic Uncertainty And Policy Implications

May 10, 2025

U S Federal Reserve Rate Decision Economic Uncertainty And Policy Implications

May 10, 2025 -

U S And China Seek Trade De Escalation In Crucial Talks

May 10, 2025

U S And China Seek Trade De Escalation In Crucial Talks

May 10, 2025 -

Suncor Production Hits Record High Amidst Inventory Build And Sales Slowdown

May 10, 2025

Suncor Production Hits Record High Amidst Inventory Build And Sales Slowdown

May 10, 2025 -

Will The Fed Hold Rates Analyzing Current Economic Pressures

May 10, 2025

Will The Fed Hold Rates Analyzing Current Economic Pressures

May 10, 2025 -

Trumps Reluctance To Drop Tariffs Warners Assessment

May 10, 2025

Trumps Reluctance To Drop Tariffs Warners Assessment

May 10, 2025