Should You Invest In Palantir Stock Before Their May 5th Earnings Report?

Table of Contents

Analyzing Palantir's Recent Performance and Trends

Palantir's recent performance is critical for evaluating its current Palantir stock valuation and future potential. Analyzing key metrics offers insights into the company's trajectory and helps determine the viability of a Palantir investment.

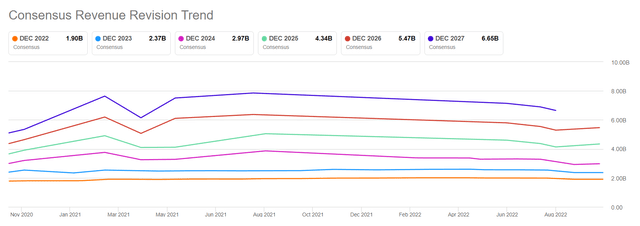

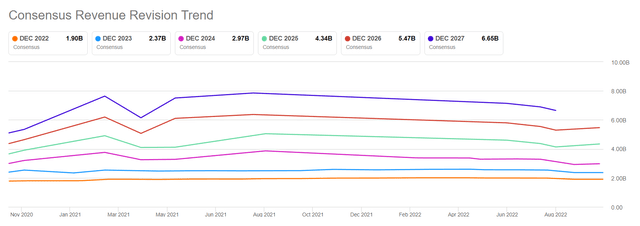

Revenue Growth and Projections

Palantir has experienced significant revenue growth in recent years, driven primarily by its government contracts and expanding commercial partnerships. However, understanding the sustainability of this growth is essential before investing in PLTR stock.

- Key Revenue Drivers: Government contracts (especially in defense and intelligence) have historically been a major revenue source. The growth of commercial partnerships across diverse sectors is crucial for long-term sustainability.

- Comparisons to Previous Quarters: Examining quarter-over-quarter and year-over-year revenue growth helps gauge the consistency of Palantir's performance and reveals potential growth trends. Any significant deviation from expectations needs careful consideration.

- Expectations for Future Growth: Analyst predictions for the upcoming quarter and the coming years are important indicators of market sentiment and future revenue potential. Comparing these predictions to past performance provides context.

Profitability and Margins

While Palantir shows revenue growth, evaluating its profitability and margins is crucial for assessing its long-term financial health and Palantir investment viability.

- Gross Margins: Analyzing gross profit margins reveals the efficiency of Palantir's operations and its ability to translate revenue into profit.

- Operating Expenses: Tracking operating expenses, including research and development, sales and marketing, and general administration, helps determine if the company is effectively managing its costs.

- Net Income and Free Cash Flow Trends: Consistent profitability and strong free cash flow are essential for a sustainable business model. Examining trends in net income and free cash flow gives a clear picture of Palantir's financial health.

Key Partnerships and Contracts

New partnerships and contracts significantly influence Palantir's future performance. Identifying these agreements helps predict potential revenue streams and growth.

- Specific Examples of Major Contracts: Highlighting large government contracts or significant commercial partnerships provides a strong indication of revenue pipelines. The nature and duration of these contracts should be considered.

- Strategic Alliances: Strategic partnerships can open up new markets and enhance Palantir's technological capabilities, impacting future performance.

- Potential Impact on Revenue Streams: Analyzing the potential revenue generated from new contracts and partnerships is crucial for predicting future Palantir stock performance.

Assessing the Risks and Uncertainties

Investing in Palantir stock involves several risks that investors must carefully consider before committing capital.

Market Competition and Disruption

Palantir faces increasing competition in the data analytics and software markets. Understanding this competitive landscape is vital.

- Key Competitors: Identifying and analyzing the strategies of key competitors helps assess Palantir's competitive advantages and potential vulnerabilities.

- Potential Technological Disruptions: The rapid pace of technological advancements presents risks. Evaluating Palantir's ability to adapt to these changes is crucial.

- Strategies to Mitigate Risks: Understanding how Palantir plans to maintain its competitive edge is crucial in determining if a Palantir investment is worthwhile.

Geopolitical Risks and Regulatory Concerns

Geopolitical events and regulatory changes can impact Palantir's operations.

- Specific Geopolitical Risks: International relations and global political instability can impact government contracts and business operations.

- Regulatory Hurdles: Data privacy regulations and other compliance requirements pose potential challenges.

- Potential Impact: Evaluating the potential impact of these risks on Palantir's financial performance is vital for a well-informed investment decision.

Valuation and Stock Price

Palantir's valuation relative to its growth prospects and risks is critical.

- Price-to-Sales Ratio: Comparing Palantir's price-to-sales ratio to industry peers helps evaluate if its current stock price is justified.

- Price-to-Earnings Ratio (if applicable): A P/E ratio, when applicable, offers another valuation metric for comparison.

- Comparison to Industry Peers: Assessing Palantir's valuation relative to its competitors provides context for its current stock price.

Interpreting the May 5th Earnings Report

The May 5th earnings report will provide crucial insights into Palantir's performance.

Key Metrics to Watch

Several key metrics are crucial for understanding Palantir's performance.

- Revenue Growth: The rate of revenue growth provides insight into the company's momentum.

- Profitability: Net income and operating margins indicate the company's ability to generate profits.

- Cash Flow: Free cash flow is a key indicator of financial health and sustainability.

- Customer Acquisition Cost: This metric reveals the efficiency of Palantir's sales and marketing efforts.

- Guidance for the Next Quarter: Management's outlook for the next quarter offers valuable insights into future performance.

Understanding the Earnings Call

Listening to the earnings call offers valuable insights beyond the numbers.

- Management Commentary: Management's commentary on key performance indicators provides context for the reported results.

- Answers to Analyst Questions: The responses to analyst questions can reveal valuable information about the company's strategies and challenges.

- Future Outlook: Management's outlook for the future provides crucial insights into their expectations.

Post-Earnings Stock Price Reaction

The market's reaction to the earnings report can be volatile.

- Potential Scenarios: The stock price could react positively, negatively, or neutrally depending on the results and market sentiment.

- Factors Influencing Stock Price Movement: Factors such as overall market conditions, analyst ratings, and investor sentiment influence stock price movement.

Conclusion: Should You Invest in Palantir Stock? A Final Verdict

Investing in Palantir stock before the May 5th earnings report requires careful consideration of its recent performance, future growth potential, and inherent risks. While Palantir exhibits significant growth potential in the data analytics market, geopolitical factors, competitive pressures, and valuation uncertainties present considerable risk. Therefore, a cautious approach is recommended. Don't solely rely on this article; conduct thorough due diligence, review analyst reports, and understand your own risk tolerance before making any investment decisions regarding Palantir stock. Revisit this article after the earnings report for a post-earnings analysis. Remember to always make informed decisions when considering Palantir stock or any other investment.

Featured Posts

-

Is Androids New Interface Enough To Capture The Gen Z Market

May 09, 2025

Is Androids New Interface Enough To Capture The Gen Z Market

May 09, 2025 -

Colapinto For Doohan In Imola Fact Or Fiction

May 09, 2025

Colapinto For Doohan In Imola Fact Or Fiction

May 09, 2025 -

Tracking The Billions Musk Bezos And Zuckerbergs Net Worth Decline Post Trump Inauguration

May 09, 2025

Tracking The Billions Musk Bezos And Zuckerbergs Net Worth Decline Post Trump Inauguration

May 09, 2025 -

3 6

May 09, 2025

3 6

May 09, 2025 -

The Impact Of Caravan Sites Is This Uk City Becoming A Ghetto

May 09, 2025

The Impact Of Caravan Sites Is This Uk City Becoming A Ghetto

May 09, 2025