Significant Drop In Amsterdam Stock Exchange: AEX Index Down Over 4%

Table of Contents

Causes of the AEX Index Decline

Several interconnected factors contributed to the significant drop in the AEX Index. Understanding these causes is crucial for investors to assess the situation and adapt their investment strategies.

Global Economic Uncertainty

The current global economic climate is characterized by considerable uncertainty, significantly impacting the AEX. Several key factors are at play:

- Impact of the war in Ukraine: The ongoing conflict continues to disrupt global supply chains, driving up energy prices and fueling inflation. This uncertainty significantly impacts investor confidence, leading to risk aversion and market downturns.

- Rising energy prices: Soaring energy costs, particularly natural gas, are placing a heavy burden on European economies, including the Netherlands. This increases production costs for businesses and reduces consumer spending, negatively affecting corporate profits and overall market performance.

- Inflation in Europe: High inflation rates erode purchasing power and increase the cost of borrowing, making it more expensive for businesses to invest and expand. The European Central Bank's efforts to control inflation through interest rate hikes further contribute to market volatility.

- Federal Reserve interest rate hikes: The Federal Reserve's aggressive interest rate increases in the US are impacting global markets. Higher interest rates make borrowing more expensive, reducing investment and potentially triggering a global recession, thus impacting the AEX Index. Data from the Federal Reserve shows a significant increase in interest rates over the past year, directly correlating with increased market instability.

Sector-Specific Performance

The AEX decline wasn't uniform across all sectors. Certain industries were hit harder than others:

- Energy: The energy sector, already grappling with price volatility, experienced a particularly sharp decline due to concerns about future energy demand and potential supply disruptions. Companies like Shell and BP, major constituents of the AEX, saw significant drops in their share prices.

- Technology: The technology sector, sensitive to interest rate hikes and economic uncertainty, also underperformed. Increased borrowing costs make expansion more challenging for tech companies, impacting their valuations.

- Financials: The financial sector felt the pressure from rising interest rates, which impact lending margins and increase the risk of loan defaults. The performance of major Dutch banks within the AEX reflects this sensitivity.

[Insert chart here visually representing the performance of different sectors within the AEX]

Investor Sentiment and Market Psychology

Investor sentiment played a crucial role in exacerbating the AEX decline. Fear and panic selling created a negative feedback loop:

- Analysis of trading volume: A significant increase in trading volume during the decline indicates a high level of investor activity, with many selling off their holdings.

- Significant sell-off events: Specific news events or announcements may have triggered large-scale sell-offs, further amplifying the downward pressure on the AEX.

- Impact of negative news headlines: Negative news coverage surrounding global economic issues and the AEX decline itself can fuel fear and uncertainty, leading to further selling.

Implications of the AEX Drop

The sharp drop in the AEX Index carries significant implications for the Dutch economy and investors.

Impact on Dutch Economy

The AEX Index serves as a key indicator of the Dutch economy's health. A significant decline like this has several potential consequences:

- Potential impact on GDP growth: A weakening stock market can negatively impact business investment and consumer confidence, slowing down overall economic growth.

- Effect on employment: Reduced economic activity can lead to job losses and increased unemployment rates.

- Impact on consumer spending: Uncertainty and declining asset values can cause consumers to reduce their spending, creating a further economic slowdown.

Investor Actions and Strategies

Navigating this volatile market requires careful consideration of investment strategies:

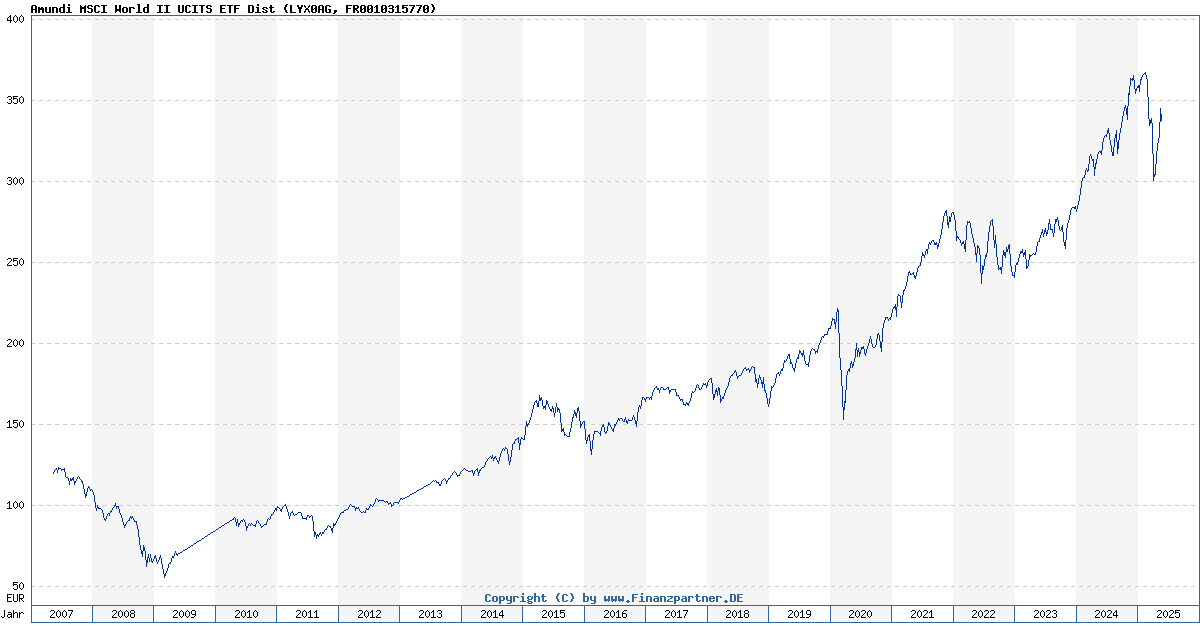

- Diversification strategies: Diversifying investments across different asset classes (stocks, bonds, real estate) and geographic regions is crucial to mitigate risk.

- Risk management techniques: Employing risk management techniques such as stop-loss orders and hedging strategies can help limit potential losses.

- Long-term investment horizons: Maintaining a long-term investment horizon can help weather short-term market fluctuations.

- Considering defensive stocks: Investing in defensive stocks, those less sensitive to economic downturns (e.g., consumer staples), can provide stability during periods of market volatility.

Government Response and Policy

The Dutch government may consider various policy interventions to stabilize the market:

- Potential policy responses: Fiscal stimulus measures (e.g., tax cuts, increased government spending) or adjustments to monetary policy (e.g., interest rate cuts) could be implemented to boost economic activity.

- Historical precedents: Examining past government responses to similar market downturns can inform potential policy decisions.

Conclusion

The significant drop in the AEX Index reflects a confluence of global economic uncertainties, sector-specific vulnerabilities, and the powerful influence of investor sentiment. The implications for the Dutch economy are substantial, potentially impacting growth, employment, and consumer confidence. Investors must adapt their strategies to navigate this volatile market, focusing on diversification, risk management, and a long-term perspective. Staying informed about AEX Index fluctuations is crucial for making informed investment decisions. Monitor market trends closely, diversify your portfolio wisely, and consider consulting a financial advisor for personalized guidance to effectively navigate the volatility of the AEX Index and other global markets. Learn more about protecting your investments during significant AEX Index declines.

Featured Posts

-

Annie Kilner And Kyle Walker A Diamond Ring And Relationship Update

May 24, 2025

Annie Kilner And Kyle Walker A Diamond Ring And Relationship Update

May 24, 2025 -

The Impact Of A Mishap Dylan Dreyers Relationships At The Today Show

May 24, 2025

The Impact Of A Mishap Dylan Dreyers Relationships At The Today Show

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Dist Nav Explained

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Dist Nav Explained

May 24, 2025 -

Planning Your Memorial Day Trip Best Flight Days In 2025

May 24, 2025

Planning Your Memorial Day Trip Best Flight Days In 2025

May 24, 2025 -

Porsche Cayenne 2025 A Complete Picture Gallery

May 24, 2025

Porsche Cayenne 2025 A Complete Picture Gallery

May 24, 2025