Significant Drop In Amsterdam Stock Exchange: Market Analysis

Table of Contents

Impact of Global Economic Uncertainty

The recent decline in the AEX is significantly linked to global economic uncertainty. Several interconnected factors have contributed to this volatility. The global economy is facing headwinds from multiple directions, directly impacting investor confidence and the AEX index.

-

Increased inflation eroding consumer spending power: High inflation rates across many countries are reducing consumer purchasing power, leading to decreased demand for goods and services. This, in turn, negatively impacts company profits and stock valuations.

-

Impact of rising interest rates on borrowing costs for businesses: Central banks worldwide are raising interest rates to combat inflation. This increases borrowing costs for businesses, making expansion and investment more challenging. Higher interest rates also make bonds more attractive to investors, potentially diverting capital away from the stock market.

-

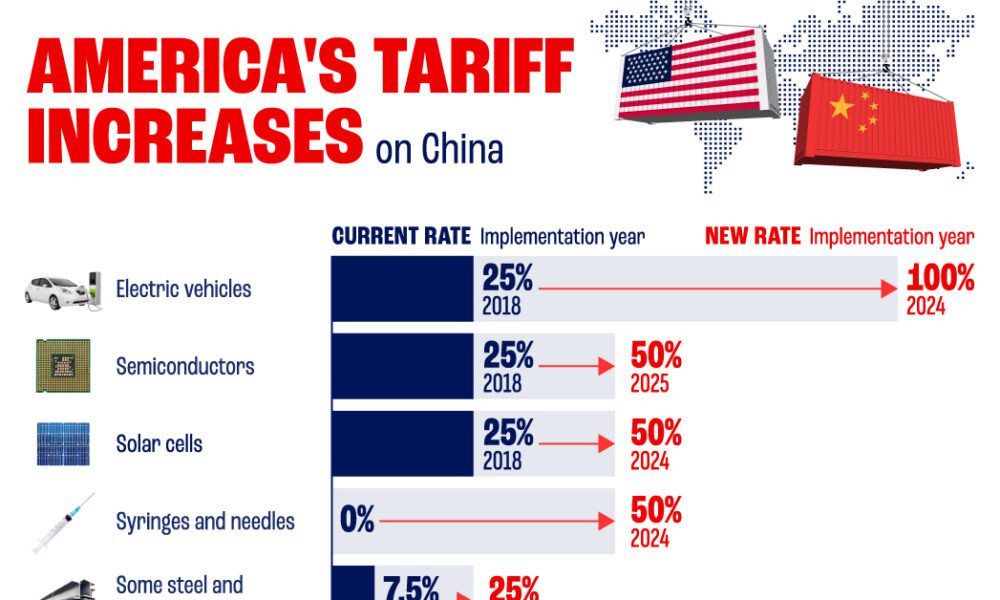

Geopolitical instability and its effect on investor confidence: Ongoing geopolitical tensions, such as the war in Ukraine and escalating trade disputes, create uncertainty and risk aversion among investors. This leads to capital flight from riskier assets, including stocks listed on the AEX.

-

Specific examples: The ongoing energy crisis, exacerbated by the war in Ukraine, has directly impacted energy sector stocks on the AEX. Furthermore, global supply chain disruptions continue to cause volatility and uncertainty across various sectors.

Sector-Specific Performance

Analyzing the performance of individual sectors within the AEX reveals varying degrees of impact from the recent downturn. Some sectors have weathered the storm better than others, highlighting the importance of sector-specific analysis when assessing market performance and risk.

-

Performance of energy sector stocks: While initially benefiting from high energy prices, the energy sector has recently shown some volatility due to price fluctuations and regulatory uncertainty.

-

Performance of technology stocks: Technology stocks on the AEX have been impacted by rising interest rates, which increase the cost of capital for growth-oriented companies. Concerns about future earnings growth have also contributed to the decline in valuations.

-

Performance of financial stocks: The financial sector has generally been more resilient compared to others, although increased interest rates can both benefit and harm financial institutions depending on their specific business model.

-

Over- and under-performing sectors: A detailed analysis reveals that cyclical sectors, heavily reliant on consumer spending, have underperformed, while more defensive sectors, such as utilities and consumer staples, have displayed relatively better resilience.

Analysis of Key AEX Companies

The overall decline in the AEX is also reflected in the performance of major companies listed on the exchange. Examining the individual stock performance of these key players offers a deeper understanding of the broader market trends.

-

Individual stock performance of leading AEX companies: Companies like ASML Holding, Unilever, and ING have all seen fluctuations in their share prices, reflecting the broader market volatility.

-

Reasons for the decline in specific company share prices: For example, disappointing earnings reports or negative company-specific news can lead to significant drops in share prices. Changes in consumer demand or regulatory changes can also have a dramatic impact.

-

Analysis of company fundamentals and their impact on stock prices: A thorough fundamental analysis of these companies, examining factors such as earnings per share, debt levels, and future growth prospects, is crucial for understanding their individual stock performance within the context of the broader AEX decline.

Potential Future Outlook and Investor Strategies

Predicting the future performance of the AEX is challenging, but analyzing current market conditions allows for potential future trends and informed investment strategies.

-

Predictions about future market performance: While uncertainty remains, the outlook depends significantly on global economic developments, inflation rates, and geopolitical stability. A cautious approach is warranted.

-

Strategies for investors to mitigate risk: Diversification across different asset classes and sectors is paramount. Hedging strategies, such as using options or futures contracts, can help to mitigate potential losses.

-

Opportunities that might arise from the current downturn: The current market downturn presents opportunities for long-term investors to acquire high-quality assets at discounted prices. Thorough due diligence is crucial.

-

Advice on long-term vs. short-term investment strategies: Long-term investors with a higher risk tolerance may consider this a buying opportunity, while short-term investors might prefer a more conservative approach.

Conclusion

The recent significant drop in the Amsterdam Stock Exchange (AEX) is a complex issue resulting from a confluence of factors. Global economic uncertainty, including high inflation and rising interest rates, combined with geopolitical instability, has significantly impacted investor confidence. The varying performance across different sectors within the AEX, and the performance of individual key companies, further highlights the market's volatility. Staying informed about fluctuations in the Amsterdam Stock Exchange and conducting thorough research before making any investment decisions is crucial. Regularly review your investment portfolio and consider diversifying your holdings to mitigate risk within the volatile AEX market. Understanding the dynamics of the AEX index is crucial for successful investing.

Featured Posts

-

Apple Stock Sell Off Tim Cooks Tariff Projection Hits Hard

May 25, 2025

Apple Stock Sell Off Tim Cooks Tariff Projection Hits Hard

May 25, 2025 -

Amsterdam Stock Exchange Falls 2 On Trumps New Tariffs

May 25, 2025

Amsterdam Stock Exchange Falls 2 On Trumps New Tariffs

May 25, 2025 -

Avrupa Borsalarinda Buguenkue Durum Karisik Bir Resim

May 25, 2025

Avrupa Borsalarinda Buguenkue Durum Karisik Bir Resim

May 25, 2025 -

55 Richchya Naomi Kempbell Naykraschi Foto Za Vsyu Kar Yeru

May 25, 2025

55 Richchya Naomi Kempbell Naykraschi Foto Za Vsyu Kar Yeru

May 25, 2025 -

Facing Retribution For Advocating Change A Guide To Resilience

May 25, 2025

Facing Retribution For Advocating Change A Guide To Resilience

May 25, 2025