Significant US Growth Slowdown Predicted By Deloitte

Table of Contents

Key Factors Contributing to the Predicted Slowdown

Several interconnected factors contribute to Deloitte's prediction of a significant US economic growth slowdown. These include persistent inflation, rising interest rates, lingering supply chain disruptions, and persistent geopolitical uncertainty, all impacting consumer spending and business investment.

Inflation's Persistent Impact

High inflation continues to significantly impact the US economy. Its persistent presence erodes consumer purchasing power and increases production costs for businesses, creating a double-edged sword.

- Reduced Consumer Purchasing Power: As prices rise faster than wages, consumers have less disposable income, leading to decreased demand for goods and services. This dampens economic activity.

- Increased Production Costs for Businesses: Businesses face higher costs for raw materials, energy, and labor, forcing them to either absorb these costs or pass them on to consumers, further fueling inflation.

- Federal Reserve's Response: The Federal Reserve (the Fed) is actively combatting inflation through interest rate hikes. While necessary to curb inflation, these hikes also have significant economic consequences.

Rising Interest Rates and Their Ripple Effect

The Fed's interest rate hikes, while aimed at curbing inflation, have a ripple effect across the economy. Higher interest rates increase borrowing costs for both businesses and consumers.

- Impact on the Housing Market: Higher mortgage rates make home purchases less affordable, potentially cooling down the already slowing housing market.

- Increased Borrowing Costs for Businesses: Businesses face higher costs for loans and credit, hindering investment in expansion, equipment, and hiring.

- Reduced Economic Activity: Tighter monetary policy, resulting from higher interest rates, can significantly reduce overall economic activity as borrowing and spending decrease.

Lingering Supply Chain Issues and Global Uncertainty

Global supply chains continue to face significant disruptions, exacerbated by geopolitical instability. This uncertainty adds another layer of complexity to the economic outlook.

- Disruptions to Global Trade Flows: Ongoing supply chain bottlenecks affect the availability and prices of goods, impacting businesses and consumers alike.

- Geopolitical Uncertainty (e.g., the War in Ukraine): The war in Ukraine has created significant uncertainty in global energy markets and commodity prices, further contributing to inflationary pressures.

- Risk of Further Bottlenecks: The potential for further disruptions to global trade flows poses a significant risk to economic growth.

Deloitte's Specific Projections for US Growth

Deloitte's forecast, while specific details may vary based on the release date of the report, generally projects a considerable slowdown in US GDP growth in the coming quarters and years. The firm typically provides detailed breakdowns by sector and offers insights into the potential duration of the slowdown. (Note: For precise numbers and timelines, refer to the most current Deloitte economic forecast report.)

Sector-Specific Impacts

The predicted slowdown is expected to impact different sectors of the US economy unevenly. For example:

- Technology: The technology sector, sensitive to interest rate changes and investment sentiment, may experience a pullback in venture capital funding and reduced hiring.

- Manufacturing: Manufacturing could be impacted by persistent supply chain issues and reduced consumer demand.

- Real Estate: The housing market, already facing headwinds, could experience a more pronounced slowdown due to higher mortgage rates.

Job Market Implications

The predicted economic slowdown could lead to a softening of the job market. While not necessarily predicting widespread job losses, the forecast suggests slower job growth or even potential layoffs in certain sectors. The unemployment rate might see a gradual increase, a key indicator of economic health.

Strategies for Navigating the Economic Slowdown

Businesses and individuals can adopt strategies to mitigate the impact of the predicted slowdown and enhance their economic resilience.

Business Strategies

Businesses should consider the following:

- Cost-Cutting Measures: Identify and eliminate unnecessary expenses to improve profitability and maintain financial stability.

- Diversification: Diversify product offerings and markets to reduce reliance on any single sector or customer base.

- Investment in Innovation: Invest in research and development to enhance competitiveness and adapt to changing market conditions.

Individual Strategies

Individuals can take these steps:

- Financial Planning: Review and adjust budgets, increase savings, and reduce debt to improve financial security.

- Emergency Fund: Build or replenish an emergency fund to cover unexpected expenses during economic uncertainty.

- Debt Management: Develop a plan to manage and reduce debt to minimize financial strain.

Conclusion

Deloitte's forecast predicts a significant slowdown in US economic growth, driven by persistent inflation, rising interest rates, lingering supply chain disruptions, and geopolitical uncertainty. Understanding this forecast is crucial for informed decision-making by both businesses and individuals. Businesses need to proactively adapt through cost-cutting, diversification, and innovation, while individuals should focus on robust financial planning, emergency funds, and debt management. To learn more about Deloitte's comprehensive report and develop your own strategies to mitigate the potential effects of this predicted US economic growth slowdown, visit [Link to Deloitte's Report]. Proactive planning and adaptation are key to navigating this potentially challenging economic period. Remember to regularly review the latest Deloitte forecasts and other economic indicators to stay informed and adjust your plans accordingly.

Featured Posts

-

Pegula Rallies Past Collins To Win Charleston Title

Apr 27, 2025

Pegula Rallies Past Collins To Win Charleston Title

Apr 27, 2025 -

Romantic Alaskan Escape Ariana Biermanns Holiday

Apr 27, 2025

Romantic Alaskan Escape Ariana Biermanns Holiday

Apr 27, 2025 -

Us Open 2024 Svitolinas Dominant Win Over Kalinskaya

Apr 27, 2025

Us Open 2024 Svitolinas Dominant Win Over Kalinskaya

Apr 27, 2025 -

Charleston Tennis Pegula Triumphs Over Collins

Apr 27, 2025

Charleston Tennis Pegula Triumphs Over Collins

Apr 27, 2025 -

Tesla Raises Canadian Prices Impact Of Tariff Changes And Inventory

Apr 27, 2025

Tesla Raises Canadian Prices Impact Of Tariff Changes And Inventory

Apr 27, 2025

Latest Posts

-

Ev Mandate Opposition Intensifies Car Dealers Push Back

Apr 28, 2025

Ev Mandate Opposition Intensifies Car Dealers Push Back

Apr 28, 2025 -

Court Rules On E Bays Liability For Banned Chemicals Under Section 230

Apr 28, 2025

Court Rules On E Bays Liability For Banned Chemicals Under Section 230

Apr 28, 2025 -

E Bay Faces Legal Action Section 230 And The Sale Of Banned Chemicals

Apr 28, 2025

E Bay Faces Legal Action Section 230 And The Sale Of Banned Chemicals

Apr 28, 2025 -

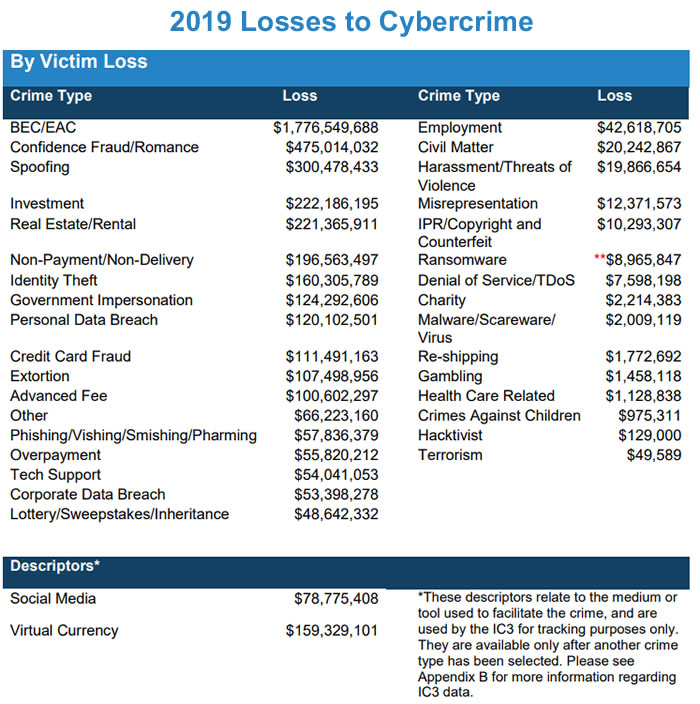

Individual Charged With Millions In Losses From Office365 Executive Account Hacks

Apr 28, 2025

Individual Charged With Millions In Losses From Office365 Executive Account Hacks

Apr 28, 2025 -

Massive Office365 Executive Account Compromise Results In Multi Million Dollar Loss

Apr 28, 2025

Massive Office365 Executive Account Compromise Results In Multi Million Dollar Loss

Apr 28, 2025