Spot Market For Russian Gas: EU's Phaseout Strategy Under Scrutiny

Table of Contents

The EU's Dependence on Russian Gas & the Phaseout Plan

For many years, the European Union was heavily reliant on Russian natural gas imports, with Russia being a major supplier. This dependence was fostered through long-term contracts, providing a degree of price stability but also leaving the EU vulnerable to geopolitical pressures. The invasion of Ukraine acted as a catalyst, prompting the EU to accelerate its plans to diversify its energy sources and dramatically reduce its reliance on Russian gas.

The EU's phaseout plan aims to significantly reduce, and ultimately eliminate, its reliance on Russian gas imports within a specific timeframe. This ambitious goal faces considerable hurdles.

- Countries Most Heavily Reliant: Germany, Italy, and Poland were among the EU nations most heavily reliant on Russian gas imports before the conflict.

- Key Milestones: The phaseout plan involves several key milestones, including the diversification of gas supplies, increased investment in renewable energy, and the development of efficient energy storage solutions. These milestones, however, have faced delays and unexpected challenges.

- Challenges in Achieving Goals: The complexity of swiftly transitioning away from a major energy supplier, coupled with the volatility of global energy markets, poses significant challenges to the plan's successful implementation. Securing alternative supply routes and ensuring energy security for all member states are key obstacles.

The Rise of the Spot Market for Russian Gas

The EU's phaseout strategy has inadvertently accelerated the growth of the spot market for Russian gas. As long-term contracts are terminated, a greater portion of gas trading happens on short-term, fluctuating markets. This spot market operates differently than long-term contracts. It's characterized by daily or hourly price determination based on supply and demand, introducing significant price volatility.

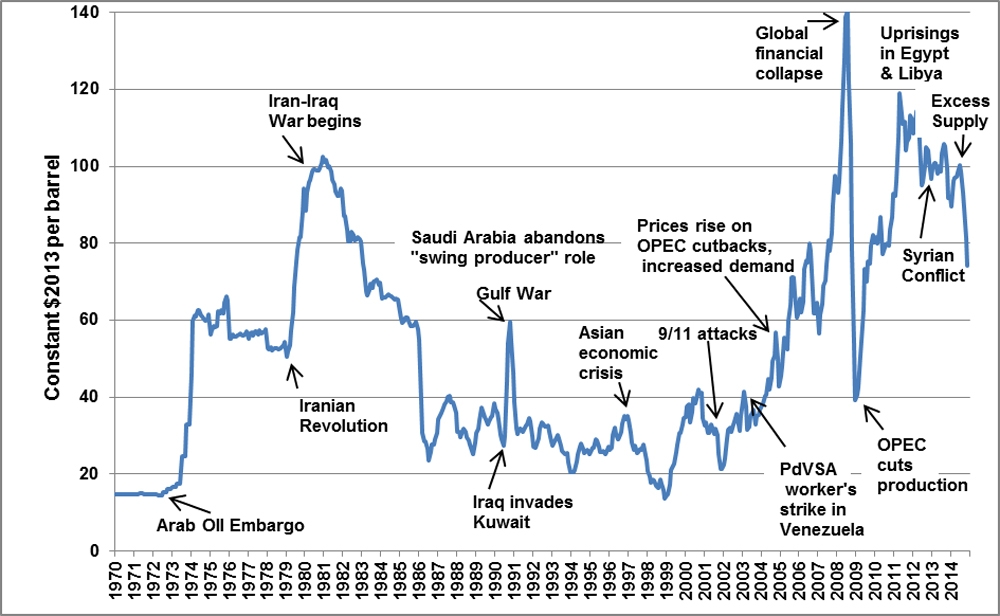

- Increased Price Volatility: Prices in the spot market fluctuate drastically based on geopolitical events, weather patterns, and overall global supply and demand. This introduces significant uncertainty for businesses and consumers.

- The Role of Gas Hubs and Trading Platforms: Various gas hubs and trading platforms facilitate spot market transactions, connecting buyers and sellers across the EU and internationally. The Netherlands’ Title Transfer Facility (TTF) is a notable example, acting as a major benchmark for European gas prices.

- Risks Associated with Spot Markets: Over-reliance on the spot market exposes the EU to considerable risks, including price manipulation, supply disruptions, and overall market instability. This necessitates careful monitoring and strategic planning.

Challenges and Risks of the EU's Strategy

The EU's rapid shift towards the spot market for Russian gas, while necessary for reducing dependence on a single supplier, carries significant challenges and risks.

- Vulnerability to Supply Disruptions and Price Manipulation: The spot market's nature makes the EU vulnerable to supply disruptions caused by geopolitical instability or unexpected events. Furthermore, price manipulation by market players is a genuine concern.

- Potential for Energy Insecurity: Certain EU member states, especially those that were highly dependent on Russian gas, face the risk of energy insecurity if alternative supply sources are not secured promptly and efficiently.

- Impact on Industries Heavily Reliant on Natural Gas: Industries that heavily rely on natural gas for production will face increased energy costs and potential disruptions in their operations, impacting economic growth and stability.

Diversification of Energy Sources

The EU is actively pursuing strategies to diversify its energy sources to lessen reliance on Russian gas. This involves investing in renewable energy infrastructure, such as wind and solar power, and exploring alternative gas suppliers.

- Progress Made in Diversifying Gas Supply: The EU has made strides in sourcing gas from Norway, the US, and other regions. However, these new supply routes require investments in infrastructure.

- Challenges and Limitations: Rapidly shifting away from Russian gas presents considerable logistical and financial challenges. Building new infrastructure, negotiating new contracts, and adapting to new supply dynamics takes time.

- Investment in Renewable Energy Infrastructure: Massive investments in renewable energy are crucial to long-term energy security and independence from fossil fuel imports. This involves transitioning to renewable energy sources and improving energy efficiency.

The Impact on Energy Prices and Consumers

The shift away from long-term contracts and towards the spot market for Russian gas has significantly impacted energy prices for businesses and consumers. Fluctuations in spot market prices have led to increased energy bills and contributed to inflation.

- Analysis of Price Fluctuations: The past years have witnessed significant price volatility in gas markets, impacting energy costs across the EU. These price fluctuations often amplify the effects on consumer wallets.

- Impact on Consumer Energy Bills: Soaring gas prices have directly translated into increased household energy bills, placing a financial strain on households across Europe.

- Government Policies: Governments are implementing various measures to mitigate the impact on consumers, including subsidies and price caps. These are temporary solutions requiring long-term planning to address broader energy security concerns.

Conclusion

The EU's move away from Russian gas, while necessary, has significantly increased its reliance on the volatile spot market for Russian gas. This creates vulnerabilities to price swings and supply disruptions. The transition to a more diversified energy mix, including increased investment in renewable energy sources, is crucial for long-term energy security and price stability. Understanding the complexities of the spot market for Russian gas and its implications is crucial for navigating the current energy crisis and promoting sustainable energy solutions. Stay informed about the latest developments and advocate for policies that enhance energy security and facilitate a smooth transition to a more sustainable energy future, minimizing dependence on the volatile spot market for Russian gas.

Featured Posts

-

Recent Oil Price Changes April 23rd Market Analysis

Apr 24, 2025

Recent Oil Price Changes April 23rd Market Analysis

Apr 24, 2025 -

Blazers Fall To Warriors Hield And Paytons Impact Off The Bench

Apr 24, 2025

Blazers Fall To Warriors Hield And Paytons Impact Off The Bench

Apr 24, 2025 -

The Destruction Of Pope Francis Ring A Papal Tradition Explained

Apr 24, 2025

The Destruction Of Pope Francis Ring A Papal Tradition Explained

Apr 24, 2025 -

Fox News Faces Defamation Lawsuit From Ray Epps Regarding January 6th Allegations

Apr 24, 2025

Fox News Faces Defamation Lawsuit From Ray Epps Regarding January 6th Allegations

Apr 24, 2025 -

Miami Heats Herro Claims Nba 3 Point Contest Title

Apr 24, 2025

Miami Heats Herro Claims Nba 3 Point Contest Title

Apr 24, 2025