Stock Market Analysis: Bonds, Dow, Bitcoin — Latest Market Movements

Table of Contents

Bond Market Analysis: Assessing Fixed-Income Investments

The bond market, a cornerstone of fixed-income investments, has experienced significant shifts recently. Understanding these movements is critical for investors seeking stability and predictable returns. Recent trends in bond yields are largely influenced by interest rate changes and inflation. The yield curve, a graphical representation of bond yields across different maturities, provides valuable insights into the health of the economy.

-

Analysis of the 10-year Treasury yield and its correlation with inflation expectations: The 10-year Treasury yield serves as a benchmark for interest rates and is closely watched for its correlation with inflation expectations. A rising yield often signals expectations of higher inflation, potentially impacting bond prices.

-

Discussion of the impact of central bank policies on bond prices: Central banks play a crucial role in influencing bond prices through monetary policy. For example, increases in interest rates generally lead to a decrease in bond prices, while decreases in interest rates typically lead to an increase in bond prices.

-

Overview of different types of bonds and their relative risk profiles: The bond market offers diverse options, including government bonds (considered relatively low-risk), corporate bonds (with varying risk levels depending on the issuer's creditworthiness), and municipal bonds (offering tax advantages). Understanding these differences is key to managing risk effectively.

-

Assessment of the attractiveness of bond investments in the current market environment: The current economic climate heavily influences the attractiveness of bond investments. High inflation might make bonds less attractive, while periods of economic uncertainty could increase their appeal as a safer investment. Investors must carefully weigh risk and potential returns based on prevailing conditions and their individual financial goals.

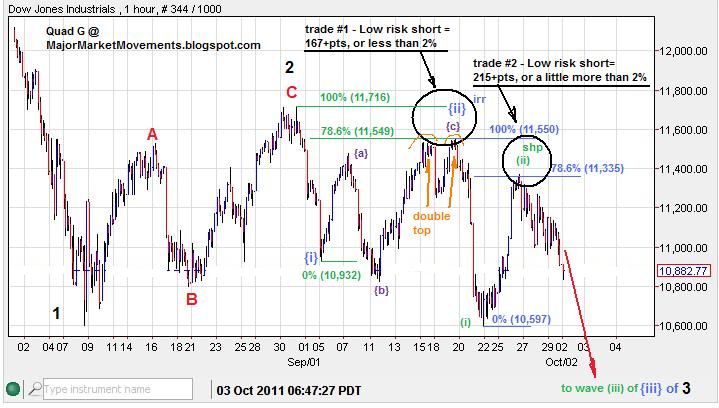

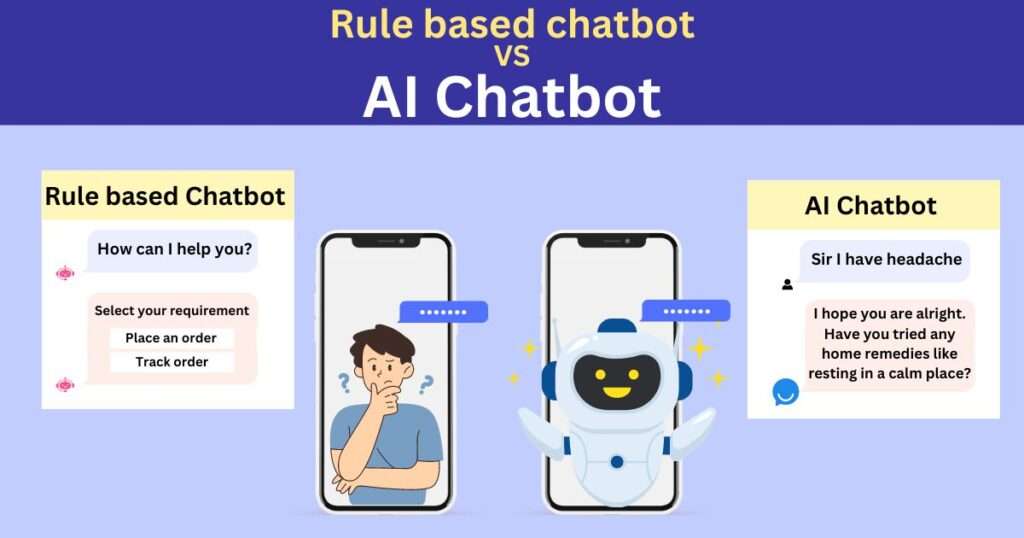

Dow Jones Industrial Average: Gauging the Health of the US Economy

The Dow Jones Industrial Average (DJIA), a widely followed stock market index, serves as a key indicator of the health of the US economy. Analyzing its recent performance requires considering various factors, including corporate earnings, economic indicators, and investor sentiment.

-

Examination of key sectors driving the Dow's performance (e.g., technology, finance): The performance of the Dow is influenced by the performance of its 30 constituent companies, which are primarily large-cap companies across various sectors. Strong performance in key sectors like technology or finance can significantly impact the overall index.

-

Analysis of the impact of geopolitical events on the Dow: Geopolitical events, such as international conflicts or trade disputes, can significantly impact market sentiment and, consequently, the Dow's performance. Uncertainty often leads to market volatility.

-

Discussion of potential catalysts for future growth or decline: Future growth or decline in the Dow can be influenced by several factors, including economic growth forecasts, corporate profit expectations, interest rate changes, and shifts in investor sentiment.

-

Comparison of the Dow's performance against other major market indices: Comparing the Dow's performance with other major market indices, such as the S&P 500 or NASDAQ Composite, provides a broader perspective on market trends and helps in identifying potential divergences or correlations.

Bitcoin and Cryptocurrency Market: Navigating the Volatile Digital Asset Landscape

Bitcoin and the broader cryptocurrency market have experienced substantial price fluctuations, attracting significant attention from investors and regulators alike. The volatility inherent in this asset class demands a thorough understanding of the factors influencing its price.

-

Analysis of Bitcoin's price correlation with traditional markets: While Bitcoin is often touted as a decentralized asset, its price can still exhibit correlations with traditional markets, influenced by factors such as overall market sentiment and macroeconomic conditions.

-

Discussion of the impact of regulatory changes on cryptocurrency prices: Regulatory developments worldwide significantly impact cryptocurrency prices. Changes in regulations, such as those related to taxation or trading, can trigger price increases or decreases.

-

Overview of other significant cryptocurrencies and their market capitalization: The cryptocurrency landscape extends beyond Bitcoin, encompassing numerous altcoins with varying functionalities and market capitalizations. Understanding the relative strengths and weaknesses of different cryptocurrencies is crucial for informed investment decisions.

-

Assessment of the risks and potential rewards of investing in cryptocurrencies: Cryptocurrency investing offers substantial potential rewards but also carries significant risks. The high volatility and regulatory uncertainty make it a speculative asset class that requires careful consideration.

Conclusion

This analysis provides a snapshot of the current state of the market, covering key indicators like bonds, the Dow Jones Industrial Average, and Bitcoin. Understanding the interplay between these assets is vital for informed investment decisions. The market continues to demonstrate its inherent volatility and the need for careful analysis before investing. Conducting thorough stock market analysis is crucial for success.

Call to Action: Stay informed about the latest market movements by regularly reviewing our comprehensive stock market analysis. Gain a deeper understanding of bonds, the Dow, and Bitcoin to refine your investment strategy and navigate the complexities of the financial world. Continue your journey with us and perform your own thorough stock market analysis.

Featured Posts

-

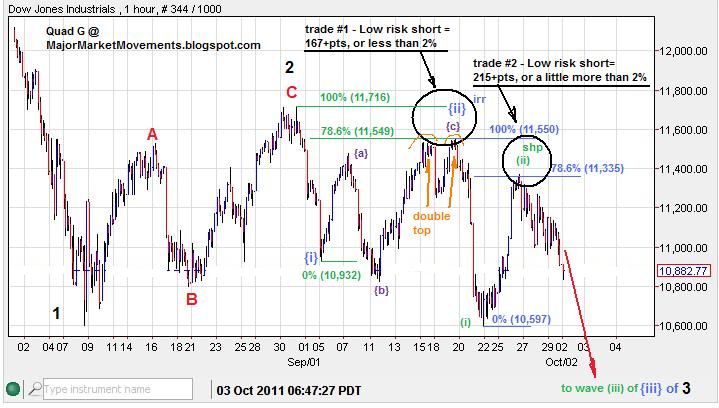

Are Character Ais Chatbots Protected Speech One Courts Uncertainty

May 24, 2025

Are Character Ais Chatbots Protected Speech One Courts Uncertainty

May 24, 2025 -

Tracking The Net Asset Value Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

Tracking The Net Asset Value Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025 -

Escape To The Country Securing A Peaceful And Rewarding Lifestyle

May 24, 2025

Escape To The Country Securing A Peaceful And Rewarding Lifestyle

May 24, 2025 -

Jonathan Groffs Broadway Performance In Just In Time Tony Prospects

May 24, 2025

Jonathan Groffs Broadway Performance In Just In Time Tony Prospects

May 24, 2025 -

Low Gas Prices Forecast For Memorial Day Weekend Travel

May 24, 2025

Low Gas Prices Forecast For Memorial Day Weekend Travel

May 24, 2025