Tracking The Net Asset Value Of The Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

Tracking your investments is crucial, especially when it comes to Exchange-Traded Funds (ETFs) that mirror major market indices like the Dow Jones. For investors in the Amundi Dow Jones Industrial Average UCITS ETF, understanding the Net Asset Value (NAV) is paramount for making informed decisions. This article will guide you on how to effectively track the NAV of this specific ETF, empowering you to manage your investments wisely. We'll cover where to find the data, the factors influencing it, how to interpret it, and the best tools to use for consistent monitoring. Keywords: Amundi Dow Jones Industrial Average UCITS ETF, NAV, Net Asset Value, ETF, Dow Jones Industrial Average, tracking, investment, index fund.

<h2>Where to Find the Amundi Dow Jones Industrial Average UCITS ETF NAV</h2>

Knowing where to find reliable NAV data is the first step. Several sources provide real-time and historical NAV information for the Amundi Dow Jones Industrial Average UCITS ETF:

- Official Amundi Website: The most reliable source is the official Amundi website. This is the primary location for accurate and up-to-date NAV figures. Look for dedicated fund pages or investor relations sections.

- Financial News Websites: Reputable financial news websites like Bloomberg, Yahoo Finance, and Google Finance often list ETF NAVs. These sites usually provide historical data as well, allowing you to track performance over time.

- Brokerage Platforms: If you hold the Amundi Dow Jones Industrial Average UCITS ETF through a brokerage account, the NAV will usually be displayed directly within your account portfolio. This is a convenient way to monitor your holdings.

- ETF Data Providers: Specialized data providers offer comprehensive ETF data, often including detailed historical NAVs and analytical tools. Research reputable providers to find a suitable service.

The NAV is typically updated at the end of the trading day, reflecting the closing prices of the underlying assets. However, minor discrepancies may exist between different sources due to slight delays in data aggregation or different calculation methods.

<h2>Factors Affecting the Amundi Dow Jones Industrial Average UCITS ETF NAV</h2>

The NAV of the Amundi Dow Jones Industrial Average UCITS ETF is primarily influenced by the performance of the underlying Dow Jones Industrial Average index. Several factors play a role:

- Dow Jones Industrial Average Performance: The most significant factor is the overall performance of the 30 companies included in the Dow Jones Industrial Average. Positive movements in the index generally lead to an increase in NAV, and vice versa.

- Currency Fluctuations: As a UCITS (Undertakings for Collective Investment in Transferable Securities) ETF, currency fluctuations between the Euro (or the ETF’s base currency) and the currencies of the underlying companies can impact the NAV. Any exchange rate differences will be reflected in the value of the ETF.

- Dividends: Dividends paid out by the companies in the Dow Jones Industrial Average are usually reinvested into the ETF, impacting the NAV positively. However, some ETFs distribute dividends, leading to a temporary decrease in NAV. Check the ETF's prospectus to understand its dividend policy.

- Expense Ratios and Management Fees: The ETF's expense ratio and management fees are deducted from the assets under management. These fees marginally reduce the NAV over time.

<h2>Interpreting and Using the NAV of the Amundi Dow Jones Industrial Average UCITS ETF</h2>

Understanding the NAV allows you to effectively track your investment performance and make informed decisions:

- Calculating Returns: By comparing the current NAV to your initial investment cost, you can calculate your return on investment (ROI). This provides a clear picture of your gains or losses.

- NAV vs. Market Price: The market price of the ETF may slightly differ from the NAV due to supply and demand. Bid-ask spreads contribute to this difference; buyers pay a slightly higher price (ask) than sellers receive (bid).

- Buy/Sell Decisions: While market price influences immediate transactions, the NAV provides a more fundamental valuation for long-term investment strategies. Analyzing NAV trends helps you identify potential buying or selling opportunities.

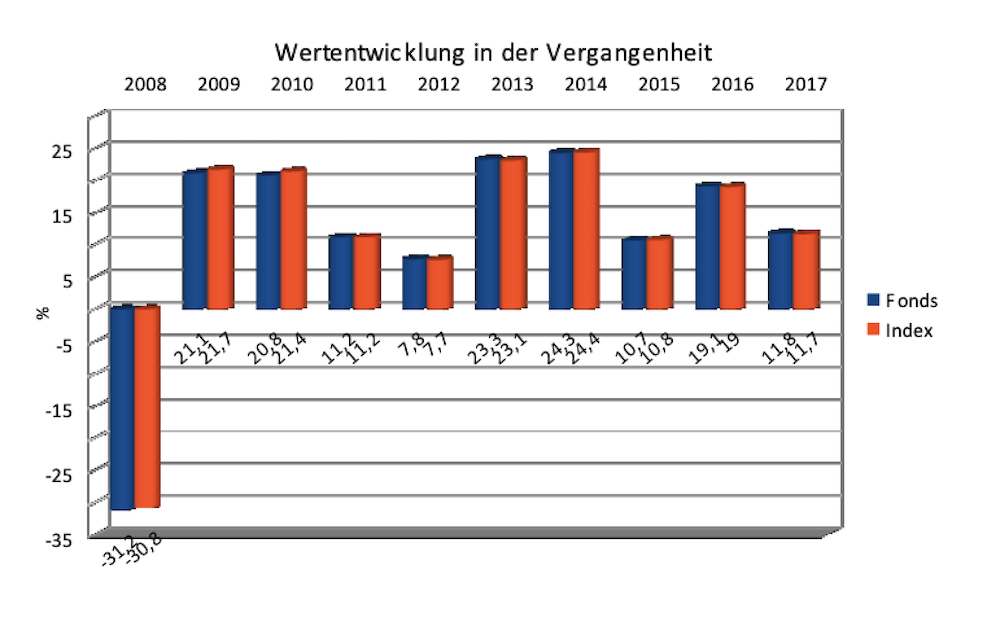

- Benchmarking: Compare the NAV performance of the Amundi Dow Jones Industrial Average UCITS ETF against the Dow Jones Industrial Average itself or other similar ETFs to gauge its relative performance.

<h2>Tools and Techniques for Tracking the Amundi Dow Jones Industrial Average UCITS ETF NAV</h2>

Several tools can simplify the process of tracking the NAV:

- Spreadsheets: Create a spreadsheet to manually record the daily or weekly NAV data you gather from your chosen sources. This allows for customized tracking and analysis.

- Financial Software: Many personal finance software packages include features to track investments, including ETFs. These often provide automated downloads of data.

- Mobile Apps: Several mobile apps offer real-time ETF data, including NAVs, charts, and other relevant information.

- Charting Tools: Utilize charting tools to visualize NAV trends over time. This allows you to quickly identify patterns and potential turning points. Many brokerage platforms and financial websites offer these charting functionalities.

<h2>Conclusion: Mastering NAV Tracking for the Amundi Dow Jones Industrial Average UCITS ETF</h2>

Regularly tracking the Net Asset Value of your Amundi Dow Jones Industrial Average UCITS ETF is crucial for effective investment management. By using the resources and techniques outlined in this article—including accessing the NAV from official sources like the Amundi website and financial news platforms, understanding the factors that influence the NAV, and employing tools like spreadsheets or financial software—you can effectively monitor performance, calculate returns, and make informed investment decisions. Stay informed and make smart investment choices by consistently tracking the Net Asset Value of your Amundi Dow Jones Industrial Average UCITS ETF holdings.

[Link to Amundi Website] [Link to Bloomberg] [Link to Yahoo Finance]

Featured Posts

-

M56 Car Crash Overturned Vehicle Casualty Treated On Motorway

May 24, 2025

M56 Car Crash Overturned Vehicle Casualty Treated On Motorway

May 24, 2025 -

Aubrey Wurst And Maryland Softball Dominate Delaware In 11 1 Win

May 24, 2025

Aubrey Wurst And Maryland Softball Dominate Delaware In 11 1 Win

May 24, 2025 -

First Look 2026 Porsche Cayenne Ev Spy Photos Unveiled

May 24, 2025

First Look 2026 Porsche Cayenne Ev Spy Photos Unveiled

May 24, 2025 -

Mest Myagkovu Kak Brezhnev Spas Garazh Ryazanova Ot Tsenzury

May 24, 2025

Mest Myagkovu Kak Brezhnev Spas Garazh Ryazanova Ot Tsenzury

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf A Guide To Net Asset Value

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf A Guide To Net Asset Value

May 24, 2025