Stock Market Pain: Investors Push Prices Higher Despite Risks

Table of Contents

Ignoring the Warning Signs: Why Investors Are Pushing Prices Up Despite Risks

The current economic climate presents a paradox: while risks abound, stock prices climb. We face high inflation eroding purchasing power, rising interest rates increasing borrowing costs for businesses, persistent geopolitical tensions causing market volatility, and recessionary predictions from leading economists. So why the seemingly unstoppable rise?

- High inflation eroding purchasing power: Inflation is squeezing household budgets and impacting consumer spending, a key driver of economic growth.

- Rising interest rates increasing borrowing costs for businesses: Higher interest rates make it more expensive for companies to borrow money, potentially hindering investment and expansion.

- Geopolitical tensions causing market volatility: The ongoing war in Ukraine, tensions with China, and other geopolitical flashpoints create uncertainty and market instability.

- Recessionary predictions from leading economists: Many experts predict a recession, leading to concerns about corporate earnings and stock valuations.

However, investor behavior is defying these warning signs. Fear of missing out (FOMO) is rampant, with many investors unwilling to sit on the sidelines and potentially miss out on further gains. Furthermore, a belief in continued market growth, fueled by past performance and the influence of institutional investors, is pushing prices higher. This disconnect between economic fundamentals and market performance is a significant source of "Stock Market Pain."

The Role of Corporate Earnings and Market Sentiment

Despite the gloomy economic outlook, strong corporate earnings reports continue to fuel market optimism. Many companies have exceeded expectations, and positive earnings guidance further bolsters investor confidence.

- Discussion of specific companies exceeding expectations: [Insert examples of specific companies and their earnings reports. This section should be updated regularly to reflect current market conditions.]

- The influence of positive earnings guidance on investor confidence: Positive future projections from companies can outweigh negative macroeconomic indicators in the short term, driving stock prices upwards.

- How positive news outweighs negative economic indicators in the short term: The market often focuses on short-term gains and positive news cycles, temporarily ignoring long-term risks.

This relationship between robust earnings, positive market sentiment, and rising stock prices contributes to the current "Stock Market Pain." The feeling of unease persists because the positive short-term outlook doesn't fully address the underlying economic challenges.

The Impact of Monetary Policy and Central Bank Actions

Central banks, such as the Federal Reserve, play a crucial role in shaping market behavior through monetary policy. Their actions, while intended to curb inflation, can inadvertently impact stock market performance.

- Analysis of recent interest rate decisions: [Insert analysis of recent interest rate hikes or cuts by the relevant central bank. This section requires regular updates.]

- The impact of quantitative easing (or tightening) on liquidity: Changes in monetary policy influence the availability of credit and liquidity in the market, directly affecting stock prices.

- How central bank communication shapes investor expectations: Central bank statements and press conferences can significantly influence investor sentiment and market direction.

Even actions aimed at cooling the economy, such as interest rate hikes, can initially boost stock prices in the short term due to factors like market speculation and investor psychology. This adds to the "Stock Market Pain" experienced by investors who are unsure whether this is a sustainable trend.

Potential Consequences and Future Outlook: Navigating Stock Market Pain

Ignoring the inherent risks in the current market could lead to significant consequences. A sharp market correction remains a possibility, potentially impacting investor portfolios significantly.

- The risk of a sharp market downturn: The current disconnect between market performance and economic fundamentals makes a market correction a real possibility.

- Potential impact on individual investors' portfolios: A downturn could lead to significant losses for investors who haven't adequately diversified their holdings.

- Strategies for mitigating risk (diversification, hedging, etc.): Diversification, hedging strategies, and careful risk management are crucial for navigating the current market volatility.

The future outlook remains cautious. While strong corporate earnings may temporarily support market gains, the underlying economic risks remain significant. Careful investment strategies and a realistic assessment of risk are essential for successfully navigating this period of "Stock Market Pain."

Conclusion

Investors are pushing stock prices higher despite significant economic risks, driven by a combination of strong corporate earnings, central bank actions, and investor psychology. This creates a paradox of "Stock Market Pain" – the feeling of unease despite market gains. Understanding the intricacies of “Stock Market Pain” is crucial for informed investment decisions. Take time to thoroughly research your investment options and consider consulting a financial advisor to develop a robust strategy that aligns with your risk tolerance and long-term financial goals. Proactive risk management is key to mitigating the potential negative impacts of this challenging market environment. Don't let "Stock Market Pain" lead to uninformed decisions; plan wisely.

Featured Posts

-

Analyzing The Economic Fallout Of Trumps Policies

Apr 22, 2025

Analyzing The Economic Fallout Of Trumps Policies

Apr 22, 2025 -

Trump Defends Obamacare At Supreme Court A Win Could Boost Rfk Jr S Influence

Apr 22, 2025

Trump Defends Obamacare At Supreme Court A Win Could Boost Rfk Jr S Influence

Apr 22, 2025 -

The Karen Read Case A Chronological Overview Of The Trials

Apr 22, 2025

The Karen Read Case A Chronological Overview Of The Trials

Apr 22, 2025 -

Overcoming The Technological Barriers To Robotic Nike Sneaker Manufacturing

Apr 22, 2025

Overcoming The Technological Barriers To Robotic Nike Sneaker Manufacturing

Apr 22, 2025 -

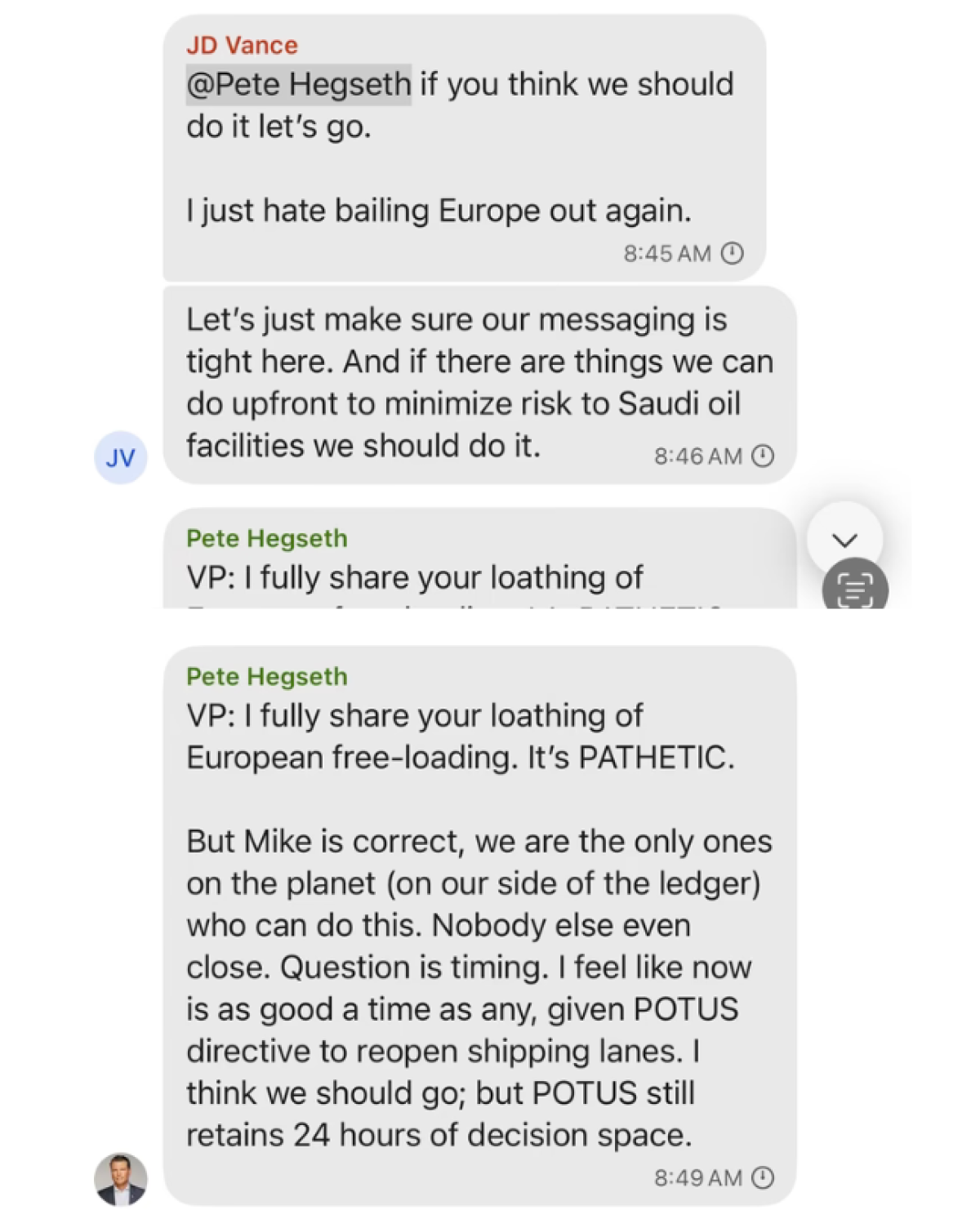

Hegseths Signal Chats Military Plans Disclosed To Family

Apr 22, 2025

Hegseths Signal Chats Military Plans Disclosed To Family

Apr 22, 2025