Stock Market Reaction: 8% Increase On Euronext Amsterdam Post-Tariff Announcement

Table of Contents

The Tariff Announcement and its Immediate Impact

The announcement of revised tariffs on imported goods from a major trading partner sent ripples across the Euronext Amsterdam market. These changes, effective [Insert Date], significantly impacted several sectors.

- Specific Tariff Changes:

- A 10% increase on tariffs for imported [Product Category A].

- A 5% reduction on tariffs for imported [Product Category B].

- Elimination of tariffs on [Product Category C].

The initial market reaction was a mix of panic selling followed by a rapid surge in buying, ultimately resulting in an 8% overall increase within the first trading hour. This volatility was evident in the increased trading volume and the wide price swings observed across various sectors. Official statements from Euronext Amsterdam highlighted the unusual trading activity and called for calm among investors. Several press releases from affected companies also provided commentary on the impact of these tariff changes on their business operations.

Sector-Specific Analysis of the 8% Increase

The 8% increase wasn't uniform across all sectors. Some experienced significant gains while others saw more moderate changes. Let's break down the performance by sector:

Technology Sector Performance

The technology sector on Euronext Amsterdam was one of the biggest beneficiaries of the tariff announcement, experiencing a remarkable 12% increase. This strong performance can be attributed to [explain reason, e.g., reduced reliance on imported components].

- Individual Stock Performances:

- Company X: +15%

- Company Y: +10%

- Company Z: +8%

[Insert a chart or graph visually representing the increase in tech stocks.]

Financial Sector Performance

The financial sector showed a more moderate response, with a 5% increase overall. This relatively subdued performance is likely due to [explain reason, e.g., concerns about potential economic slowdown].

- Financial Sector Reaction:

- Increased trading volume observed in banking stocks.

- Insurance companies showed less volatility.

- Investor sentiment was cautious, leading to moderate gains.

This sector's reaction reflects a complex interplay of investor sentiment and speculation surrounding the long-term effects of the tariff adjustments.

Energy Sector Performance

The energy sector on Euronext Amsterdam experienced a 3% increase, a response influenced by both the tariff announcement and global energy market dynamics. [Explain reason, e.g., increased demand from alternative energy sources].

- Individual Stock Performances:

- Company A: +4%

- Company B: +2%

- Company C: +1%

Geopolitical factors, such as [mention specific geopolitical events], further influenced the energy sector's response to the tariff adjustments, highlighting the interconnectedness of global markets.

Factors Contributing to the Market Surge

The 8% surge in the Euronext Amsterdam stock market wasn't solely due to the tariff announcement. Several factors contributed to this dramatic increase:

- Investor Sentiment: Positive investor sentiment, fueled by [mention factors, e.g., positive economic indicators], played a crucial role.

- Speculation: Market speculation about the long-term effects of the tariffs also contributed to the price increase.

- Global Market Trends: Positive global market trends further boosted investor confidence.

- Currency Fluctuations: Favorable currency exchange rates played a minor but positive role.

[Include relevant charts and graphs to support your analysis.]

Long-Term Implications and Future Outlook for Euronext Amsterdam

The long-term implications of this tariff announcement and the subsequent Euronext Amsterdam stock market reaction remain uncertain. While the short-term gains are significant, investors need to consider potential risks:

- Potential Risks: Further tariff adjustments, economic slowdown, and geopolitical instability pose risks.

- Opportunities: The increased investor confidence could attract further investment.

Experts predict [mention expert predictions and market analysis], suggesting a period of moderate growth for Euronext Amsterdam.

Conclusion

The Euronext Amsterdam stock market experienced an 8% increase following a recent tariff announcement. This surge resulted from a combination of factors, including sector-specific responses, positive investor sentiment, and speculation. While the short-term outlook is positive, investors should carefully consider both the opportunities and risks associated with this market volatility. Understanding the Euronext Amsterdam stock market reaction to such events is critical for informed investment decisions. Stay informed about the dynamic Euronext Amsterdam stock market and its reaction to future announcements. Continue to monitor the Euronext Amsterdam stock market reaction for further insights and opportunities. Subscribe to our newsletter for regular updates on Euronext Amsterdam market trends.

Featured Posts

-

Live M56 Traffic Updates Motorway Closure After Serious Crash

May 24, 2025

Live M56 Traffic Updates Motorway Closure After Serious Crash

May 24, 2025 -

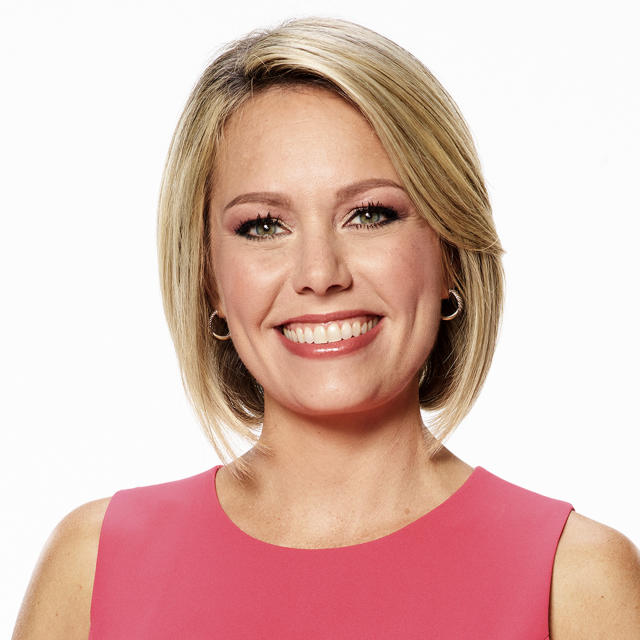

Unexpected Obstacle Why Dylan Dreyer Nearly Didnt Host The Today Show

May 24, 2025

Unexpected Obstacle Why Dylan Dreyer Nearly Didnt Host The Today Show

May 24, 2025 -

Change At The Top Guccis Supply Chain Leadership Transition

May 24, 2025

Change At The Top Guccis Supply Chain Leadership Transition

May 24, 2025 -

Broadways Just In Time Star Studded Opening Night For Jonathan Groff

May 24, 2025

Broadways Just In Time Star Studded Opening Night For Jonathan Groff

May 24, 2025 -

U S Penny Phase Out No More Pennies In Circulation By Early 2026

May 24, 2025

U S Penny Phase Out No More Pennies In Circulation By Early 2026

May 24, 2025