U.S. Penny Phase-Out: No More Pennies In Circulation By Early 2026

Table of Contents

The Economic Case for Eliminating the Penny

The core argument for the U.S. penny phase-out rests on simple economics: it costs more to make a penny than it's worth.

The Cost of Production vs. the Penny's Value

The U.S. Mint's production costs for a single penny consistently exceed its one-cent value. The composition of the penny (zinc coated with copper) and the manufacturing process contribute to this economic inefficiency. Consider these facts:

- Production Cost: The cost to produce a penny is estimated to be around 2 cents, meaning the government loses money on every coin minted.

- Material Costs: The price fluctuations of zinc and copper further exacerbate the cost-benefit imbalance.

- Transportation and Handling: The logistical costs of transporting and handling billions of pennies annually add to the overall economic burden.

Inefficiencies in Cash Transactions

Beyond production costs, pennies create significant inefficiencies in everyday transactions. Their low value makes them cumbersome to handle, leading to delays and logistical problems for businesses.

- Time wasted counting: Cashiers spend considerable time counting and sorting pennies, slowing down checkout lines and impacting overall productivity.

- Storage and transportation: Businesses need to allocate significant resources for storing and transporting large quantities of pennies.

- Increased labor costs: The extra time and effort required to handle pennies translate into increased labor costs for businesses.

- Security Concerns: Handling large amounts of cash, including pennies, presents security risks for both businesses and consumers.

Arguments Against the Penny Phase-Out

While the economic arguments for penny elimination are compelling, there are counterarguments to consider.

Concerns for Low-Income Individuals

One major concern revolves around the potential negative impact on low-income individuals who rely on pennies for small transactions. However, solutions exist to mitigate this concern:

- Price rounding: Many countries successfully transitioned away from low-denomination coins by rounding prices up or down to the nearest nickel.

- Digital payment expansion: Increased access to digital payment methods can lessen the reliance on physical cash for small transactions.

- Targeted assistance programs: Government programs could provide targeted support to vulnerable populations to offset any potential financial hardship.

The Sentimental Value of the Penny

The penny holds sentimental value for many Americans, representing a link to the past and a tangible piece of history. This emotional attachment should not be underestimated:

- Numismatic value: Once the penny is removed from circulation, certain rare or commemorative pennies could gain considerable collector's value.

- Historical significance: The penny has played a significant role in American history and culture, and its removal could be seen as a loss of a cultural artifact.

What Will Happen to Existing Pennies?

The fate of the billions of pennies currently in circulation is a key question surrounding the U.S. penny phase-out. Several scenarios are possible:

- Collector's Items: Pennies could become sought-after collector's items, particularly older or rare varieties.

- Bank Deposit Acceptance: Banks will likely continue to accept pennies for deposit for a transitional period, but this may change in the long term.

- Melting Program: A government-sponsored melting program could be implemented to reclaim the metal value of the coins.

The Future of Cash Transactions in a Pennyless America

Eliminating the penny will inevitably alter cash transactions. The most significant change will be price rounding:

- Rounding methods: Prices could be rounded up or down to the nearest nickel, with potential implications for consumer spending and business revenue. The specific rounding method will be crucial.

- Point-of-Sale systems: Point-of-sale systems will need to be updated to accommodate the absence of the penny.

- Increased digital payments: The transition could accelerate the shift towards digital payment methods, such as credit cards and mobile wallets.

Conclusion: Preparing for a Pennyless Future

The U.S. penny phase-out, potentially beginning as early as 2026, presents both challenges and opportunities. The economic benefits of eliminating the penny are considerable, but careful consideration must be given to the potential impacts on low-income individuals. The transition will require careful planning and the implementation of strategies to mitigate potential disruptions. Stay informed about the progress of the U.S. penny elimination, the removal of the penny, and the changes that will affect the U.S. coin phase-out. Consult official government websites and reputable news sources for the latest updates and prepare for a pennyless future.

Featured Posts

-

Michael Caines Unexpected On Set Visit During Mia Farrow Sex Scene Filming

May 24, 2025

Michael Caines Unexpected On Set Visit During Mia Farrow Sex Scene Filming

May 24, 2025 -

Kermits Commencement Speech University Of Maryland Class Of 2025

May 24, 2025

Kermits Commencement Speech University Of Maryland Class Of 2025

May 24, 2025 -

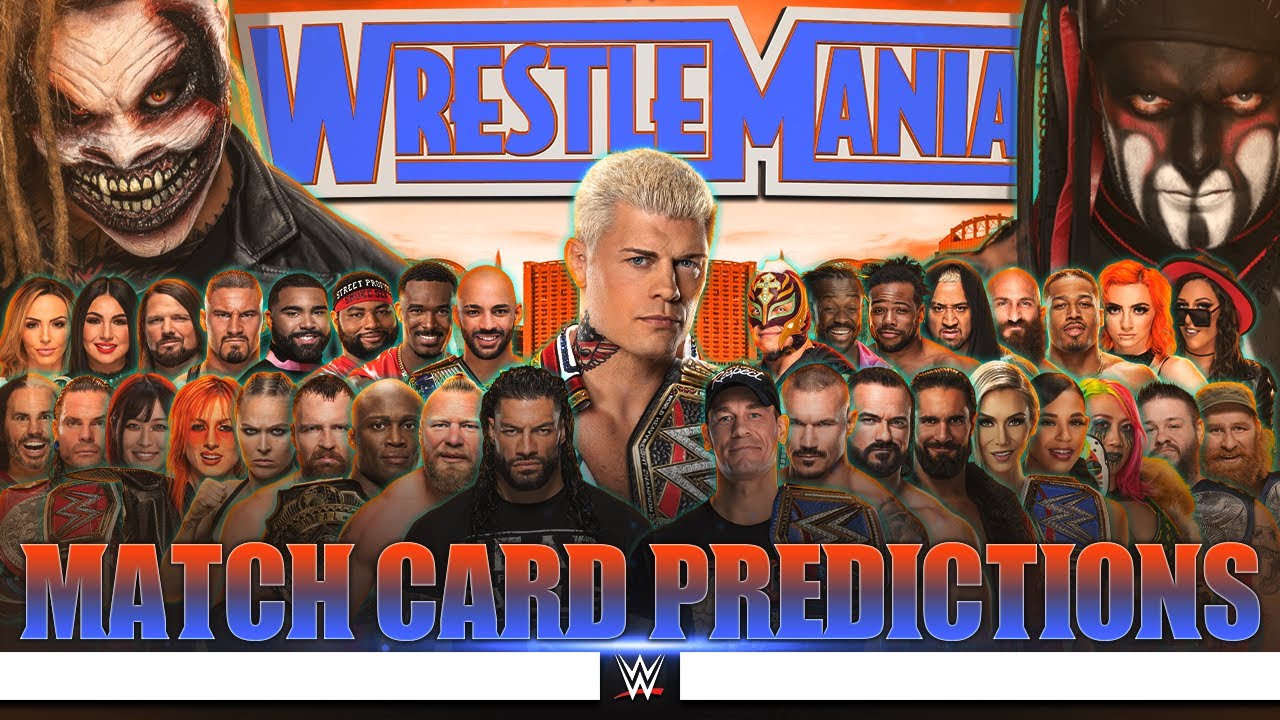

Wwe Wrestle Mania 41 Golden Belts Memorial Day Weekend Ticket Sale

May 24, 2025

Wwe Wrestle Mania 41 Golden Belts Memorial Day Weekend Ticket Sale

May 24, 2025 -

Amundi Msci World Ii Ucits Etf Dist Understanding Net Asset Value Nav

May 24, 2025

Amundi Msci World Ii Ucits Etf Dist Understanding Net Asset Value Nav

May 24, 2025 -

I Dazi E I Prezzi Della Moda Negli Stati Uniti Cosa Aspettarsi

May 24, 2025

I Dazi E I Prezzi Della Moda Negli Stati Uniti Cosa Aspettarsi

May 24, 2025