Stock Market Today: Dow Futures, China's Economic Support, And Tariff Impacts

Table of Contents

Dow Futures: A Glimpse into Today's Market Sentiment

Dow Futures are contracts obligating the buyer to purchase the Dow Jones Industrial Average (DJIA) at a predetermined price on a future date. They serve as a crucial leading indicator, offering a glimpse into the anticipated direction of the broader stock market. Currently, Dow Futures are exhibiting [insert current trend: e.g., moderate volatility, a slight upward trend, significant downward pressure]. This suggests [insert interpretation of trend: e.g., investor caution in the face of inflation, growing optimism fueled by recent corporate earnings, concerns about potential economic slowdown].

Several factors are driving this movement:

- Economic Data Releases: Recent GDP growth figures and inflation reports have significantly influenced investor sentiment, impacting both the stock market and Dow Futures. High inflation, for example, often leads to increased interest rates, which can negatively affect stock valuations.

- Geopolitical Events: Global tensions, such as the ongoing conflict in [mention a relevant geopolitical event], introduce uncertainty and volatility into the market, influencing Dow Futures trading.

- Corporate Earnings Announcements: Strong earnings reports from major corporations can boost market confidence, while disappointing results can lead to downward pressure on Dow Futures.

- Changes in Interest Rates: Federal Reserve decisions regarding interest rates are paramount. Rate hikes typically increase borrowing costs for businesses, potentially slowing economic growth and impacting stock prices, reflected in Dow Futures movements.

[Include a relevant chart or graph illustrating recent Dow Futures trends]. Analyzing these futures contracts and market predictions based on index futures is vital for understanding the Stock Market Today.

China's Economic Support Measures and Global Market Repercussions

China's recent implementation of economic stimulus measures, including [mention specific measures, e.g., tax cuts, infrastructure spending], aims to counter slowing economic growth. The impact of these measures on global markets, particularly the US stock market, remains a subject of ongoing debate.

Potential implications for various sectors include:

- Technology: Increased Chinese domestic demand could benefit Chinese tech companies, potentially impacting US tech giants competing in the same market.

- Manufacturing: Stimulus-driven infrastructure projects could boost demand for raw materials and manufactured goods, potentially benefiting global manufacturing companies.

- Commodities: Increased industrial activity in China could lead to higher demand for commodities like oil and metals, affecting commodity prices globally.

However, uncertainties remain. Concerns about the effectiveness of these economic stimulus measures and the long-term health of the Chinese economy, coupled with ongoing global trade tensions and market volatility, contribute to uncertainty in the current Stock Market Today. The value of the yuan also plays a significant role in global market stability.

Tariff Impacts: Ongoing Trade Wars and their Stock Market Effects

Ongoing trade disputes and import tariffs and export tariffs continue to create significant uncertainty in the Stock Market Today. The impact varies across industries. For instance, [mention an example: e.g., the auto industry has faced increased costs due to tariffs on imported parts]. These trade wars and global trade tensions undermine trade agreements and negatively affect investor confidence. The long-term consequences could include reduced global trade, slower economic growth, and increased market instability. Companies heavily reliant on international trade, like [mention specific companies impacted], have experienced direct negative consequences from tariff impact.

Conclusion: Understanding the Stock Market Today and Planning Your Next Move

In summary, understanding the Stock Market Today requires a careful analysis of interconnected factors: Dow Futures offer a short-term outlook, China's economic policies influence global market sentiment, and ongoing tariff disputes introduce significant uncertainty. These factors highlight the need for diversified investment strategies and robust risk management. Consider focusing on sectors less susceptible to tariff impacts or those potentially benefitting from China's stimulus.

To stay informed about the stock market today and future market movements, regularly check reputable financial news sources and conduct thorough research before making any investment decisions. Remember, informed decision-making is crucial for navigating the complexities of the stock market. [Link to a reputable financial news source]

Featured Posts

-

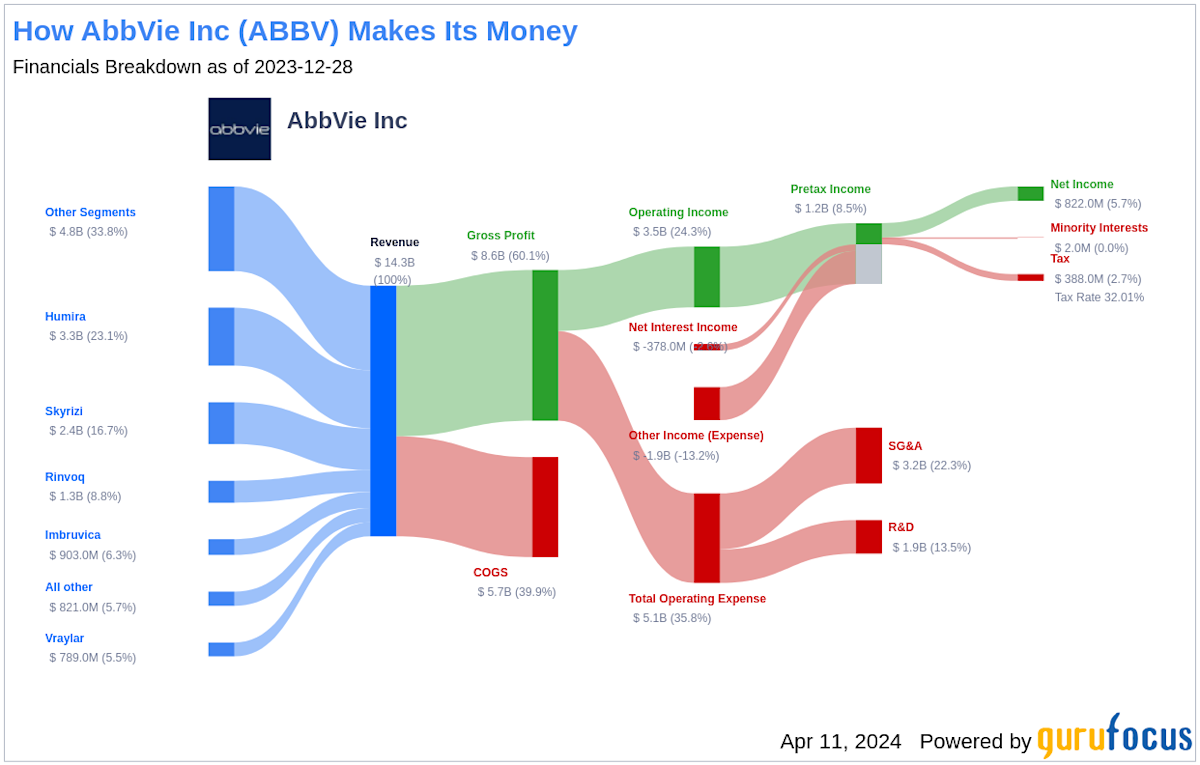

Abb Vie Abbv Stock Rises On Exceeding Sales Expectations And Revised Profit Forecast

Apr 26, 2025

Abb Vie Abbv Stock Rises On Exceeding Sales Expectations And Revised Profit Forecast

Apr 26, 2025 -

A Game Stop Visit Securing My Nintendo Switch 2 Preorder

Apr 26, 2025

A Game Stop Visit Securing My Nintendo Switch 2 Preorder

Apr 26, 2025 -

Chelsea Handlers New Book I Ll Have What Shes Having Buy Online Now

Apr 26, 2025

Chelsea Handlers New Book I Ll Have What Shes Having Buy Online Now

Apr 26, 2025 -

Royal Netherlands Navy Enhanced By Fugro And Damen Collaboration

Apr 26, 2025

Royal Netherlands Navy Enhanced By Fugro And Damen Collaboration

Apr 26, 2025 -

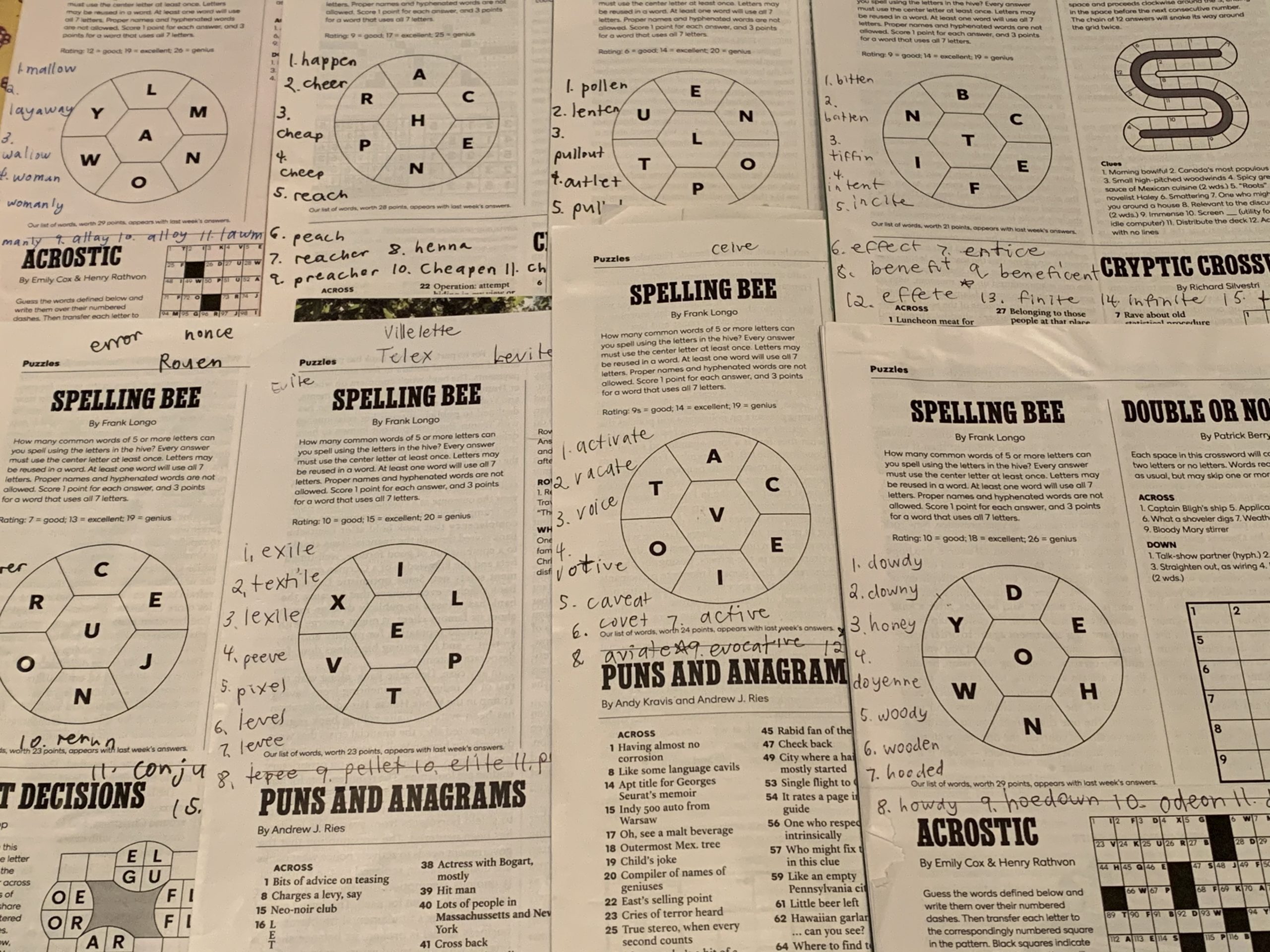

Nyt Spelling Bee Answers And Clues February 26th Puzzle 360

Apr 26, 2025

Nyt Spelling Bee Answers And Clues February 26th Puzzle 360

Apr 26, 2025