Stock Market Today: Dow Futures Rise, Gold Surges Past $3500 Amid Tariff And Fed Concerns

Table of Contents

Dow Futures Rise: A Sign of Market Optimism or Temporary Relief?

Dow Futures have seen a considerable increase this morning, suggesting a potential upswing in investor sentiment. However, it's crucial to consider whether this represents genuine market optimism or merely a temporary reprieve from recent market anxieties.

- Specific Numbers: At the time of writing, Dow Futures are up by approximately 150 points, representing a 0.5% increase.

- Company Performances: Strong Q2 earnings reports from several tech giants, particularly in the semiconductor sector, have contributed positively to the rise.

- News and Events: Positive economic indicators, such as a lower-than-expected unemployment rate, have boosted investor confidence.

However, the sustainability of this upward trend remains questionable. Potential downsides include:

- Short-lived Relief: The rise could be a temporary correction in a broader bearish trend, driven by underlying economic concerns.

- Market Uncertainty: The ongoing tariff war and the Fed's future actions create considerable uncertainty, making this increase difficult to interpret.

Gold Surges Past $3500: Safe Haven Demand Amidst Uncertainty

The price of gold has dramatically broken the $3500 barrier today, a significant jump indicating a flight to safety among investors. This surge underscores the prevailing uncertainty in the market.

- Price Increase: Gold prices have increased by approximately 2.5% today, reaching a new high for the year.

- Safe Haven Asset: Gold is traditionally viewed as a safe-haven asset, its value rising during times of economic instability or geopolitical uncertainty. Investors often flock to gold as a hedge against inflation and market downturns.

- Inflationary Pressures: The current inflationary environment, fueled partly by ongoing supply chain disruptions, also contributes to the increased demand for gold.

- Geopolitical Factors: Ongoing geopolitical tensions, particularly in Eastern Europe, further fuel the demand for this precious metal.

Tariff Concerns Weigh on Investor Sentiment

Escalating tariff disputes continue to weigh heavily on investor sentiment, creating a climate of uncertainty and impacting various sectors.

- Specific Disputes: The ongoing trade tensions between major economies significantly impact global trade flows and supply chains. Industries like manufacturing and technology are particularly vulnerable.

- Impact on Trade: Tariffs increase the cost of goods, making them less competitive in the global market. This can lead to reduced trade volume and slower economic growth.

- Consequences for Businesses and Consumers: Businesses face higher input costs, potentially leading to price increases for consumers and reduced profit margins. Consumers ultimately bear the brunt of these tariffs through higher prices and reduced choices.

The Federal Reserve's Influence on Market Volatility

The Federal Reserve's monetary policy plays a significant role in shaping market volatility. The Fed's actions, particularly regarding interest rates, have a considerable influence on investor sentiment and overall market performance.

- Recent Fed Announcements: Recent statements from the Fed suggest a potential continuation of interest rate hikes to combat inflation.

- Interest Rate Impacts: Interest rate hikes typically increase borrowing costs for businesses and consumers, potentially slowing economic growth and impacting stock market valuations. Conversely, rate cuts can stimulate economic activity but also lead to inflation.

- Managing Inflation and Growth: The Fed walks a tightrope, aiming to control inflation without stifling economic growth. Its decisions significantly influence the trajectory of the stock market today and in the future.

Conclusion: Navigating the Complexities of the Stock Market Today

The "stock market today" presents a complex picture. The rise in Dow Futures needs to be considered cautiously, as it may not reflect sustainable market optimism. Meanwhile, the surge in gold prices to over $3500 showcases investor anxieties surrounding tariffs and the Fed’s policy. Tariff concerns and the Federal Reserve's actions continue to be major drivers of market volatility. The near-term outlook remains uncertain, highlighting the need for careful navigation and informed decision-making.

To stay informed about the ever-changing "stock market today" and make sound investment choices, subscribe to our regular updates. For further insights, explore resources on gold investment, Dow Jones analysis, and the tariff impact on the economy.

Featured Posts

-

Ftc Launches Investigation Into Open Ai And Chat Gpt

Apr 23, 2025

Ftc Launches Investigation Into Open Ai And Chat Gpt

Apr 23, 2025 -

Yankee Success A Testament To Team Cohesion Not Just Home Runs

Apr 23, 2025

Yankee Success A Testament To Team Cohesion Not Just Home Runs

Apr 23, 2025 -

Is William Contreras The Key To Brewers Success

Apr 23, 2025

Is William Contreras The Key To Brewers Success

Apr 23, 2025 -

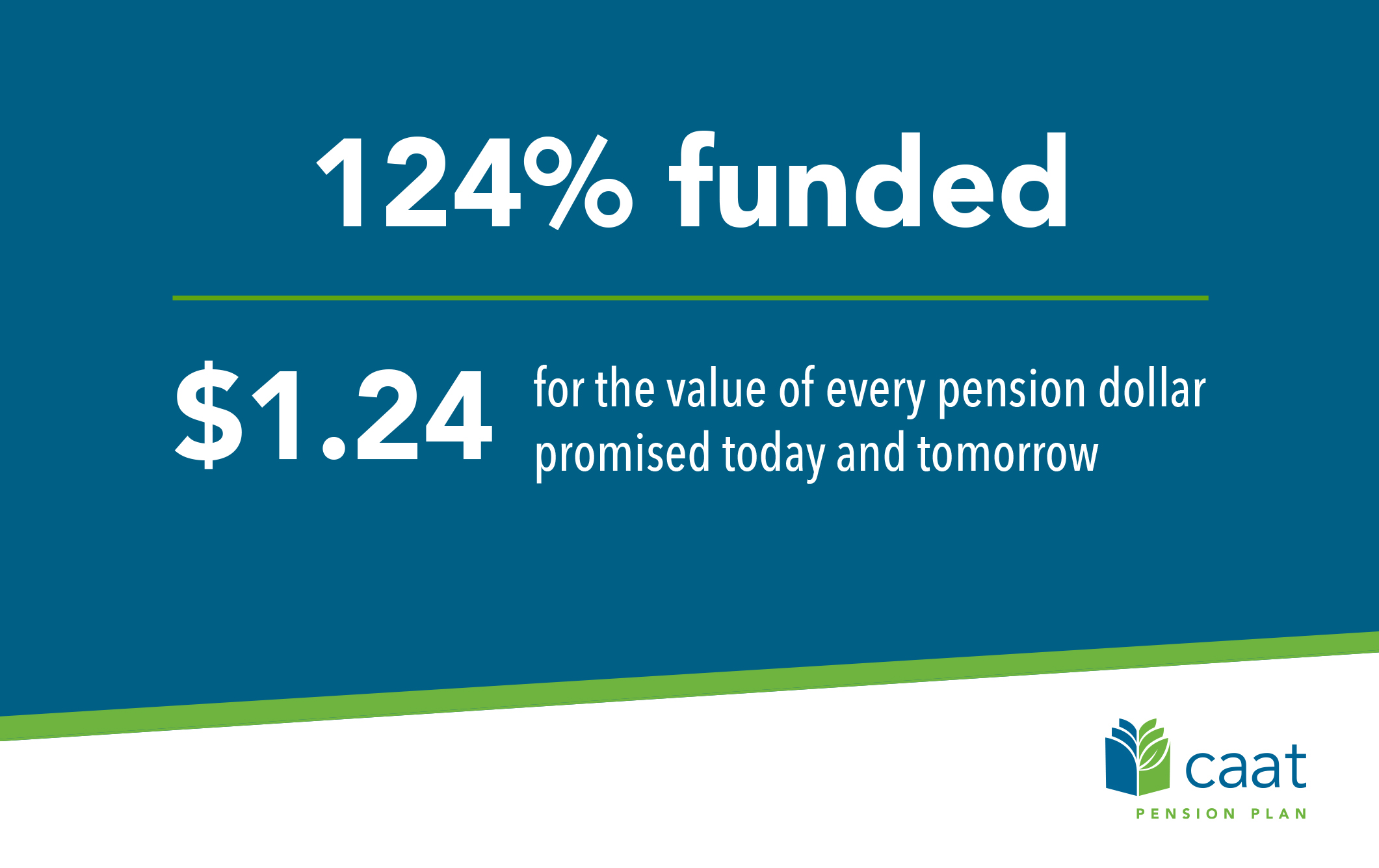

Caat Pension Plan Seeks Increased Canadian Private Investment

Apr 23, 2025

Caat Pension Plan Seeks Increased Canadian Private Investment

Apr 23, 2025 -

Canadian Households Face Economic Fallout From Trumps Tariffs

Apr 23, 2025

Canadian Households Face Economic Fallout From Trumps Tariffs

Apr 23, 2025