Stock Market Valuations: BofA's Case For Why Investors Shouldn't Worry

Table of Contents

Keywords: Stock market valuations, BofA, Bank of America, market valuation, stock market analysis, investment strategy, investor sentiment, market outlook, equity valuations, stock market forecast, P/E ratio, Price-to-Sales, Price-to-Book, free cash flow yield.

Concerns about high stock market valuations are rampant. Many investors are questioning whether the current market represents a bubble, prompting fear and uncertainty. Headlines scream "Overvalued!" and "Market Crash Imminent!", fueling a sense of impending doom. However, Bank of America (BofA), a financial giant with extensive market analysis capabilities, presents a persuasive case suggesting these fears may be overblown. This article explores BofA's key arguments, examining why they believe investors shouldn't panic despite elevated valuations. We'll delve into their reasoning, exploring the nuances of market valuation and offering insights into a more balanced perspective on the current market outlook.

BofA's Argument: Earnings Growth Outpaces Valuation Concerns

BofA's core argument rests on the premise that robust corporate earnings growth is currently outpacing concerns about high stock market valuations. They contend that the current valuations, while seemingly high based on simplistic metrics, are justified by the underlying strength of the economy and corporate performance.

Strong Corporate Earnings

BofA highlights robust corporate earnings growth as a key justification for current valuations. This isn't just about a few high-flying tech companies; the strength is broader-based.

- Increased profitability across various sectors is supporting higher stock prices. Many industries are experiencing significant improvements in their bottom lines, driven by factors like increased demand, improved efficiency, and strategic cost-cutting measures.

- Strong revenue growth and improved margins are contributing factors. This indicates a healthy underlying economic environment and suggests that companies are not just squeezing profits but genuinely seeing increased demand for their products and services.

- Analysis of specific sectors showing robust earnings growth: BofA's reports often highlight sectors like technology, healthcare, and consumer staples as exhibiting particularly robust earnings growth. For instance, they may point to the sustained growth in cloud computing driving tech valuations or the aging population fueling demand in the healthcare sector.

Low Interest Rates Support Higher Valuations

The current low-interest-rate environment plays a significant role in BofA's assessment. These low rates make equities a more attractive investment relative to bonds and other fixed-income instruments.

- Lower borrowing costs for businesses fuel investment and growth. Cheap credit allows companies to expand operations, invest in research and development, and ultimately drive earnings growth.

- Reduced returns on bonds encourage investors to seek higher returns in the stock market. When bond yields are low, investors are naturally drawn to the potentially higher returns offered by equities, even if valuations appear elevated on a surface level.

- Comparison of bond yields versus equity returns, supporting BofA's argument: BofA likely presents a comparison showing that even with seemingly high equity valuations, the potential return relative to the low yields on bonds remains attractive, justifying the higher valuations in a comparative context.

Addressing the "Overvalued" Narrative: A Deeper Look at Valuation Metrics

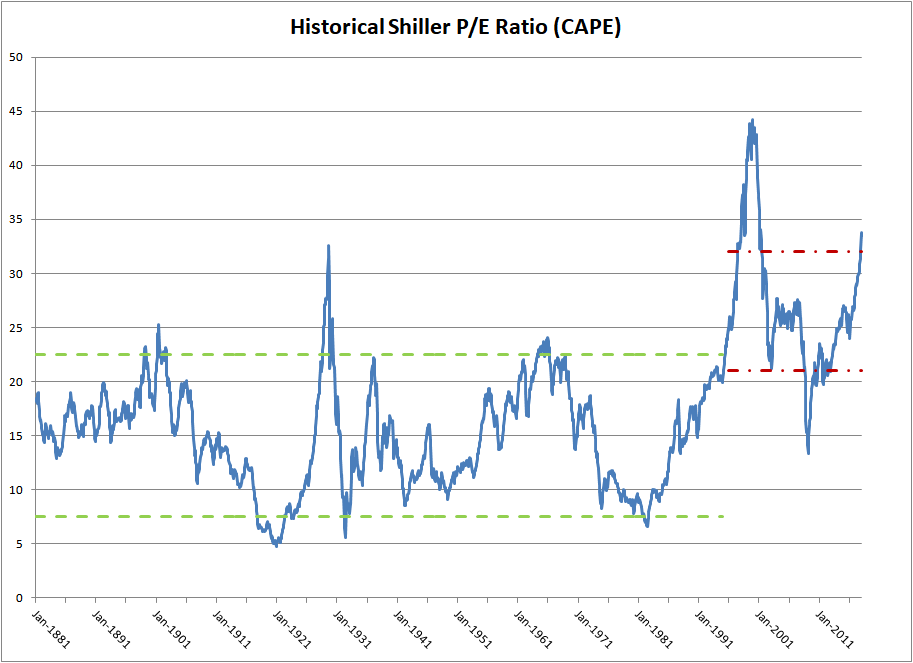

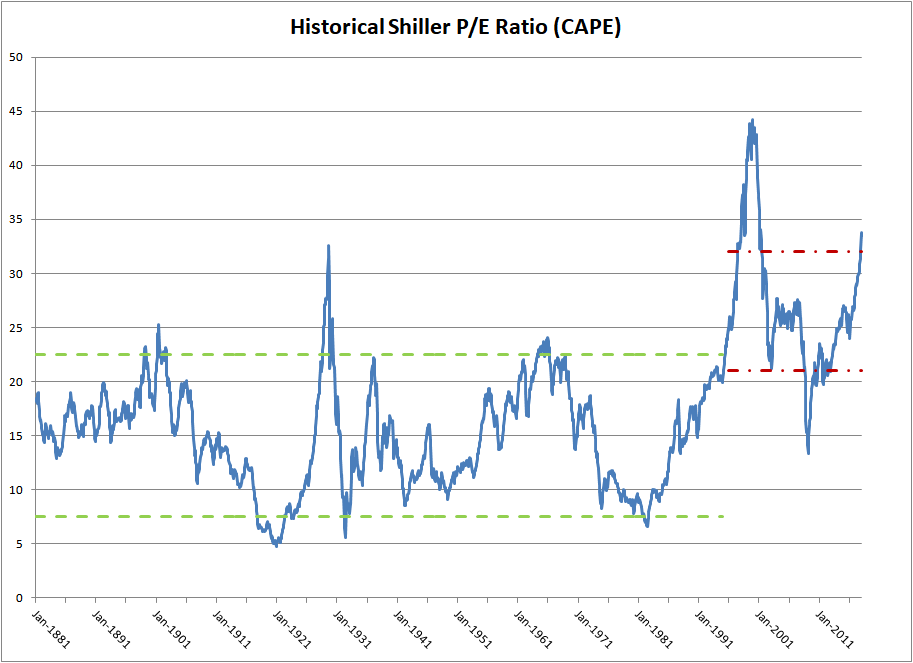

BofA cautions against relying solely on simplistic metrics like the Price-to-Earnings (P/E) ratio when assessing stock market valuations. They advocate a more nuanced approach, considering a broader range of factors and valuation metrics.

Beyond Simple P/E Ratios

The P/E ratio, while widely used, can be misleading, especially when considering long-term growth potential. BofA likely promotes the use of other key valuation metrics for a more comprehensive picture.

- Discussion of other valuation metrics like Price-to-Sales (P/S), Price-to-Book (P/B), and free cash flow yield. These metrics offer different perspectives on a company's valuation, helping to mitigate the limitations of relying on a single metric.

- Explanation of how these metrics provide a more nuanced understanding of valuations. For example, the P/S ratio is useful for valuing companies with negative earnings, while the P/B ratio offers insight into a company's net asset value. Free cash flow yield is a measure of how much cash flow a company generates relative to its market capitalization.

- Specific examples of how these alternative metrics support BofA’s less pessimistic view. They might demonstrate that while P/E ratios seem high, other metrics paint a less alarming picture, suggesting that the market isn't as overvalued as some suggest.

Considering Long-Term Growth Potential

BofA emphasizes the critical importance of considering future growth prospects when evaluating valuations. Current valuations should not be viewed in isolation; future earnings power is key.

- Discussion of long-term growth projections for the economy and specific sectors. BofA's analysts likely provide forecasts that justify current valuations based on expected future earnings growth.

- Explanation of how long-term growth potential justifies current valuations. They would argue that even with high current valuations, the anticipated future growth will make those valuations reasonable over the long term.

- Reference to BofA's long-term market forecasts supporting their position. Their long-term market forecasts provide a context for understanding current valuations, suggesting a more optimistic outlook than the short-term, headline-driven narrative.

Managing Risk in a Potentially Volatile Market

Even with BofA's positive outlook, acknowledging market volatility is crucial. Risk management remains paramount, regardless of market sentiment.

Diversification as a Key Strategy

BofA likely stresses the importance of diversification as a core risk management strategy. Diversification helps to mitigate potential losses from any single investment.

- Importance of diversifying across sectors and asset classes. This helps to reduce the impact of any single sector downturn on the overall portfolio.

- Specific examples of diversification strategies. This could include allocating investments across different sectors (e.g., technology, healthcare, financials), geographic regions, or asset classes (e.g., stocks, bonds, real estate).

- Mention of BofA's recommended asset allocation models. They might suggest model portfolios designed to achieve specific risk and return objectives based on individual investor profiles.

Long-Term Investment Horizon

BofA almost certainly recommends a long-term investment strategy. Short-term market fluctuations are normal; focusing on long-term goals is essential.

- Importance of avoiding emotional decision-making. Panic selling during market downturns can lead to significant losses.

- Focus on long-term investment goals. Investors should define their long-term financial objectives and stick to their investment plan, regardless of short-term market noise.

- Advice on creating a robust investment plan. This would include setting realistic goals, understanding risk tolerance, and constructing a diversified portfolio aligned with those goals.

Conclusion

While concerns surrounding high stock market valuations are understandable, Bank of America's analysis provides a reassuring perspective. By examining robust earnings growth, considering a broader range of valuation metrics beyond simple P/E ratios, and emphasizing a long-term investment approach, investors can navigate the current market with a more balanced view. BofA's arguments suggest that the current valuations, while high, may not be as alarming as initially perceived, especially when considering long-term growth projections and the low-interest-rate environment.

Call to Action: Don't let anxiety about stock market valuations dictate your investment decisions. Understand BofA's reasoning and consider a well-diversified, long-term investment strategy to navigate the market effectively. Learn more about managing your stock market valuations and building a robust portfolio. Take control of your financial future and make informed investment choices based on a comprehensive understanding of market dynamics.

Featured Posts

-

Stock Market Valuations Bof As Case For Why Investors Shouldnt Worry

May 02, 2025

Stock Market Valuations Bof As Case For Why Investors Shouldnt Worry

May 02, 2025 -

The Disturbing Reality Of Betting On The La Wildfires

May 02, 2025

The Disturbing Reality Of Betting On The La Wildfires

May 02, 2025 -

La Laport 3 20

May 02, 2025

La Laport 3 20

May 02, 2025 -

Daily Lotto Results Friday 18 April 2025

May 02, 2025

Daily Lotto Results Friday 18 April 2025

May 02, 2025 -

U S Armys Expanding Drone Fleet An Exclusive Analysis

May 02, 2025

U S Armys Expanding Drone Fleet An Exclusive Analysis

May 02, 2025