Stock Market Valuations: BofA's Reassurance For Investors

Table of Contents

BofA's Current Market Outlook and Valuation Analysis

BofA generally maintains a cautiously optimistic outlook on the current market environment, leaning towards a neutral stance rather than outright bullish or bearish predictions. Their analysis incorporates a range of valuation metrics to arrive at a comprehensive assessment.

- Price-to-Earnings Ratio (P/E): BofA analyzes the P/E ratios of various sectors and the overall market to gauge whether stocks are trading at historically high or low multiples of their earnings.

- Price-to-Sales Ratio (P/S): This metric provides an alternative valuation measure, particularly useful for companies with negative earnings. BofA uses P/S ratios to assess relative valuations across different sectors.

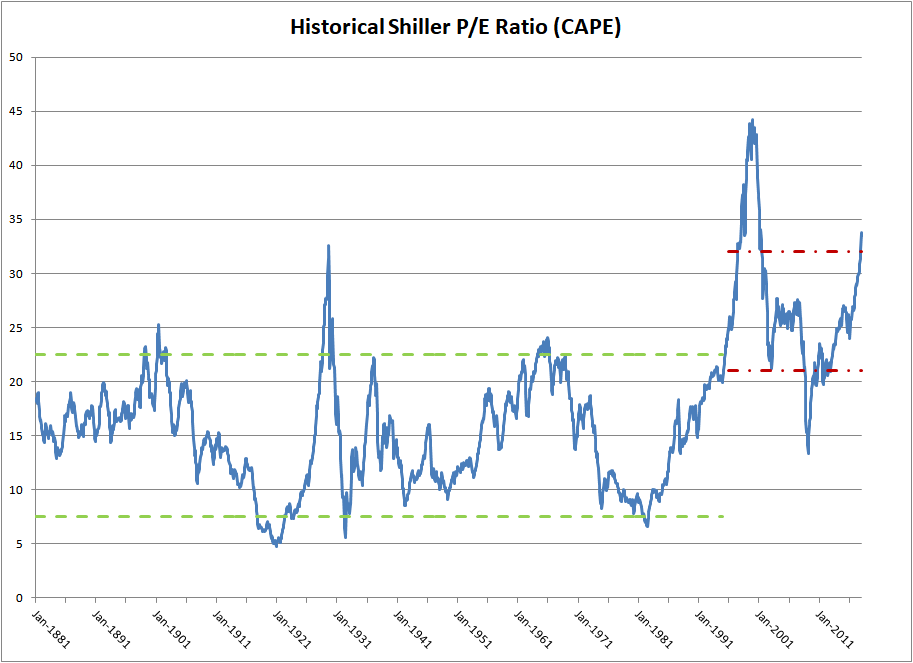

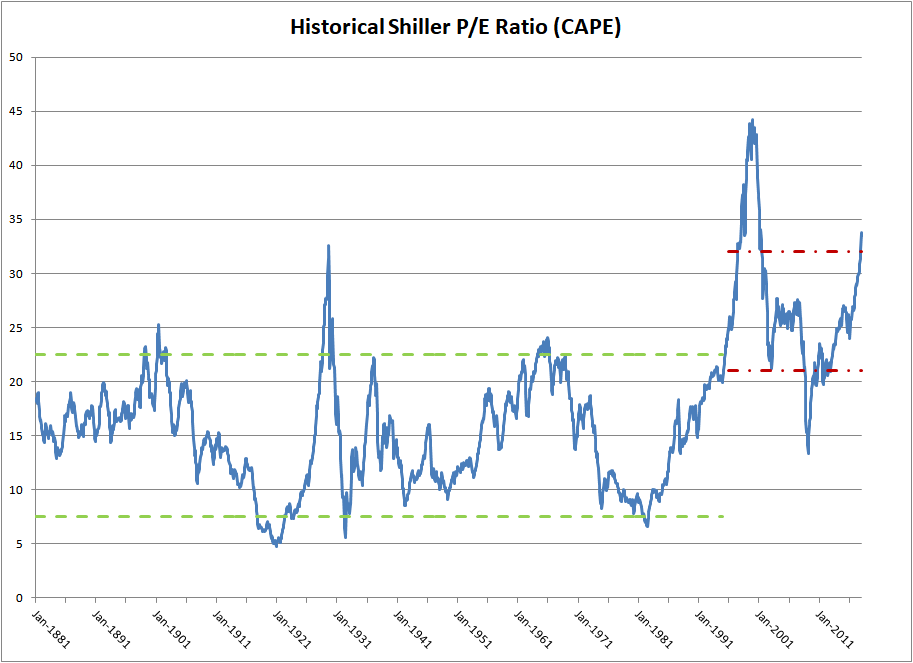

- Shiller PE Ratio (CAPE): BofA often incorporates the cyclically adjusted price-to-earnings ratio (CAPE) to account for long-term earnings trends and smooth out short-term fluctuations.

BofA's recent reports might highlight specific sectors, such as technology or energy, as potentially overvalued or undervalued based on their analysis of these metrics. (Note: Due to the dynamic nature of financial markets, specific sectors and valuations change frequently. Refer to the most up-to-date BofA reports for the latest information.) Ideally, this section would include relevant charts and graphs directly from BofA's reports to visualize their findings, but this requires access to their proprietary research.

Key Factors Driving BofA's Valuation Assessment

BofA's valuation assessment is significantly influenced by several macroeconomic factors:

- Interest Rates: Rising interest rates increase borrowing costs for businesses, potentially impacting earnings growth and stock valuations. BofA carefully considers the Federal Reserve's monetary policy and its potential impact on corporate profitability.

- Inflation: High inflation erodes purchasing power and can lead to higher input costs for businesses, affecting profitability and stock valuations. BofA closely monitors inflation indicators like the Consumer Price Index (CPI) and Producer Price Index (PPI).

- Geopolitical Events: Global events, such as wars or trade disputes, can create uncertainty in the markets and affect investor sentiment. BofA incorporates geopolitical risks into its overall valuation analysis.

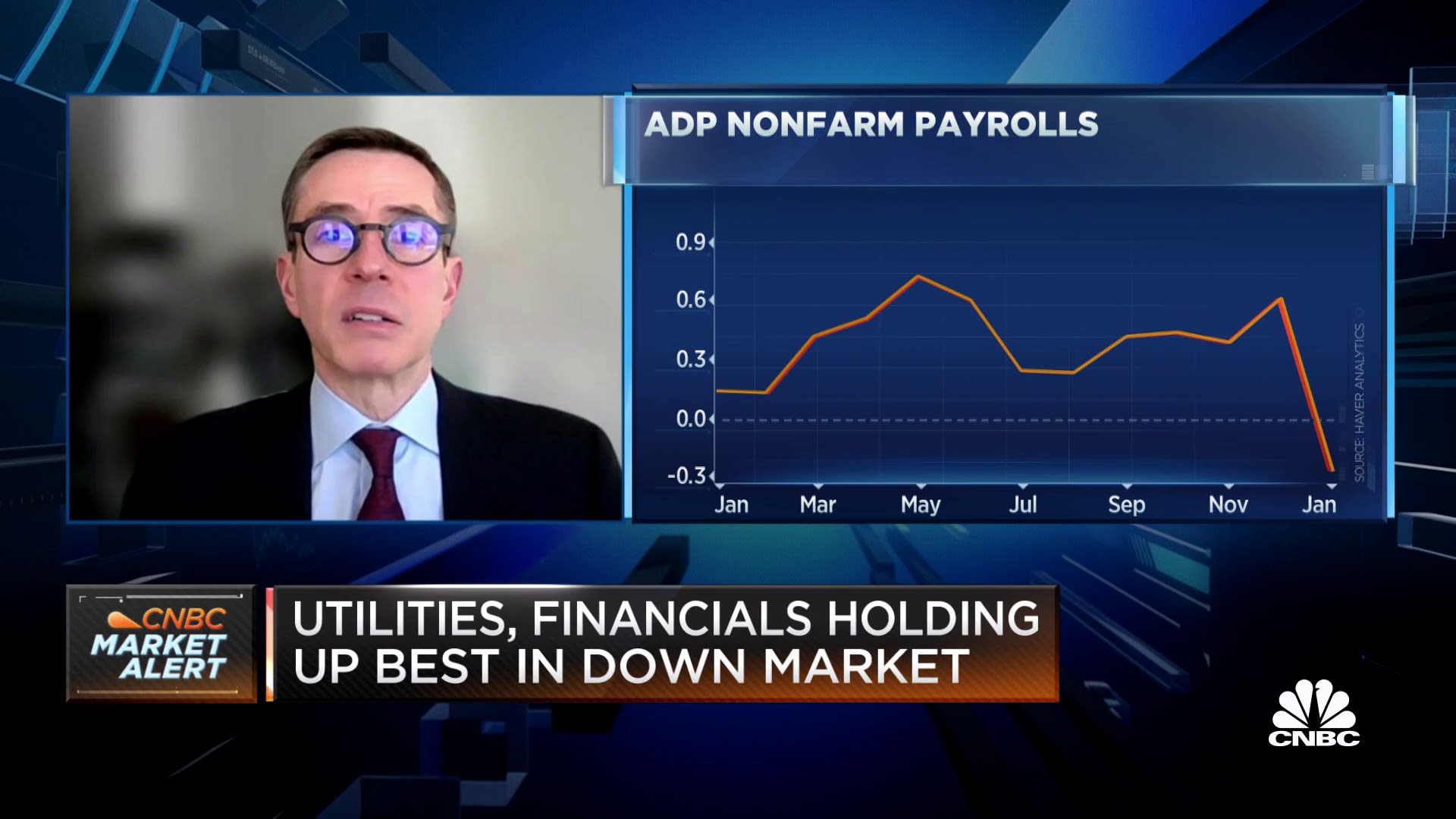

These factors influence valuation metrics by affecting corporate earnings, investor expectations, and the overall market environment. Other economic indicators, such as GDP growth and unemployment rates, also play a crucial role in BofA's analysis. For instance, strong GDP growth usually supports higher valuations, while high unemployment rates can signal economic weakness and potentially lower valuations.

BofA's Recommendations for Investors Based on Current Valuations

BofA's recommendations often depend on their current valuation assessment. While they might not explicitly state "buy," "hold," or "sell" for the entire market, their research suggests strategies for navigating the current landscape. These may include:

- Sector Rotation: Shifting investments from sectors deemed overvalued to those considered undervalued based on their valuation analysis.

- Diversification: Maintaining a diversified portfolio across different asset classes and sectors to mitigate risk.

Practical steps investors can take, according to BofA’s implied advice, might include reevaluating their portfolio allocations, focusing on long-term growth stocks in undervalued sectors, or considering defensive investments during periods of uncertainty.

Counterarguments and Alternative Perspectives on Stock Market Valuations

It's crucial to acknowledge that different analysts hold varying perspectives on stock market valuations. While BofA offers valuable insights, not everyone agrees with their assessment. Other investment firms and economists may have differing opinions based on their methodologies and assumptions. It is important to understand that the stock market is complex and influenced by numerous unpredictable factors. Relying solely on any single analyst's opinion can be risky.

The Importance of Long-Term Investing Strategies

Regardless of short-term market fluctuations and differing opinions on stock market valuations, a long-term investment strategy is paramount. Dollar-cost averaging, a strategy of investing fixed amounts at regular intervals, helps mitigate the risk of market timing.

- Avoid emotional decision-making: Short-term market sentiment often leads to impulsive buying or selling, potentially resulting in losses.

- Focus on fundamental analysis: Long-term investors should focus on the fundamental strength of companies and their long-term growth potential rather than reacting to daily market movements.

Conclusion: Understanding Stock Market Valuations and BofA's Insights

BofA's analysis provides a valuable perspective on current stock market valuations, suggesting a cautious but generally neutral outlook. Their assessment is shaped by macroeconomic factors such as interest rates, inflation, and geopolitical events, impacting their recommendations for investors. However, it's vital to remember that alternative viewpoints exist, and thorough research is essential. Before making any investment decisions, consider multiple perspectives, conduct your own due diligence, and understand the inherent risks involved. Assessing stock market valuations requires careful consideration of various factors and a long-term outlook. To navigate stock market valuations effectively, consider seeking professional financial advice tailored to your individual circumstances and risk tolerance. Informed investment decisions are crucial for achieving your financial goals.

Featured Posts

-

Ryujinx Emulator Project Halted After Reported Nintendo Contact

Apr 26, 2025

Ryujinx Emulator Project Halted After Reported Nintendo Contact

Apr 26, 2025 -

American Cyclist Jorgenson Wins Paris Nice Race

Apr 26, 2025

American Cyclist Jorgenson Wins Paris Nice Race

Apr 26, 2025 -

Were In Nepo Hell Nepotism At The Oscars After Party Sparks Outrage

Apr 26, 2025

Were In Nepo Hell Nepotism At The Oscars After Party Sparks Outrage

Apr 26, 2025 -

Ecb Official Holzmann On The Disinflationary Implications Of Trumps Tariffs

Apr 26, 2025

Ecb Official Holzmann On The Disinflationary Implications Of Trumps Tariffs

Apr 26, 2025 -

American Jorgenson Retains Paris Nice Championship

Apr 26, 2025

American Jorgenson Retains Paris Nice Championship

Apr 26, 2025