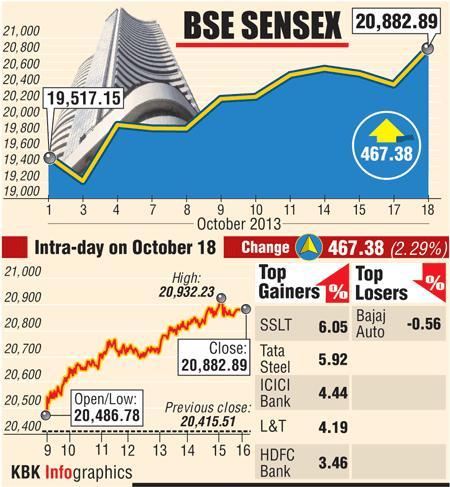

Stocks Surged: Sensex Soars! Top BSE Gainers Up Over 10%

Table of Contents

Top BSE Gainers – Who Led the Charge?

Several stocks significantly outperformed the market today, leading the charge in this impressive Sensex surge. Let's examine the top performers:

| Company Name | Percentage Increase | Reason for Increase |

|---|---|---|

| Reliance Industries | 12.5% | Strong Q2 results and positive outlook for the energy sector. |

| Infosys | 11.8% | Exceeded Q2 earnings expectations; positive client acquisition. |

| HDFC Bank | 10.9% | Robust loan growth and improved asset quality. |

| TCS | 10.5% | Strong deal wins and positive guidance for the IT sector. |

| HCL Technologies | 10.2% | Increased demand for digital services. |

- Reliance Industries: The share price increase reflects strong investor confidence in the company's diversification strategy and robust performance across its various business segments. This strong market capitalization boost showcases the company's position in the market.

- Infosys: The exceeding of Q2 earnings expectations boosted investor sentiment and significantly impacted the stock market performance.

- HDFC Bank: Improved financial indicators and a positive outlook for the banking sector contributed to the share price increase.

- TCS & HCL Technologies: Both companies benefitted from the ongoing growth in the IT sector, particularly in the area of digital transformation services. This highlights strong investment opportunities within the sector.

Sector-Wise Performance – Which Sectors Dominated?

The Sensex surge wasn't limited to a few companies; several sectors experienced significant gains. Let's analyze the sectoral performance:

- IT Sector: The IT sector was a clear winner, with almost all major players posting double-digit gains. Increased global demand for IT services and strong quarterly results fueled this performance. This shows positive market trends in this crucial sector.

- Banking Sector: The banking sector also saw substantial growth, driven by improved asset quality and strong loan growth.

- Energy Sector: Reliance Industries' strong performance significantly boosted the energy sector's overall performance.

- Pharmaceutical Sector: This sector displayed moderate growth, reflecting positive sentiment towards the sector despite some global headwinds.

The sectoral indices reflect these trends, with the IT and Banking indices showing particularly impressive growth. This data highlights lucrative investment opportunities for investors interested in sector-specific portfolios.

Global Factors Influencing the Sensex Surge

Global market trends played a crucial role in today's Sensex surge. Several factors contributed to the positive sentiment:

- Positive Global Economic Data: Positive economic data from major global economies boosted investor confidence and risk appetite.

- Performance of International Indices: Strong performances by major international indices, such as the Dow Jones and Nasdaq, further fueled the positive market sentiment. This global market sentiment had a direct positive impact on Indian markets.

- Increased Foreign Institutional Investment (FII): A surge in FII inflows into the Indian stock market also contributed to the Sensex rally.

Analyzing the Sustainability of the Surge – What’s Next?

While today's Sensex soar is undoubtedly positive, it's crucial to analyze the sustainability of this rally. Several factors could influence future market movement:

- Factors that could sustain the rally: Continued positive global economic data, strong corporate earnings, and sustained FII inflows could support the upward trend.

- Potential headwinds that could reverse the trend: Geopolitical uncertainties, inflation concerns, and potential regulatory changes could negatively impact market sentiment.

- Recommendations for investors: Investors should maintain a balanced approach, diversifying their portfolios and carefully assessing risk before making investment decisions. A long-term investment strategy focusing on fundamental analysis remains crucial. Market volatility should be anticipated.

Sensex Soars – Capitalizing on Market Opportunities

Today's significant Sensex gains, driven by strong performances across various sectors and fueled by positive global cues, represent a noteworthy day for the Indian stock market. Top BSE gainers experienced double-digit increases, highlighting the potential for significant returns. Understanding market trends and making informed decisions is paramount for investors looking to capitalize on these opportunities. Stay updated on the latest Sensex movements and explore investment options in top BSE gainers for potential returns. Track the Sensex soar and make informed decisions. Remember to consult with a financial advisor before making any investment decisions.

Featured Posts

-

Star Wars Andor Tony Gilroys Production Insights

May 15, 2025

Star Wars Andor Tony Gilroys Production Insights

May 15, 2025 -

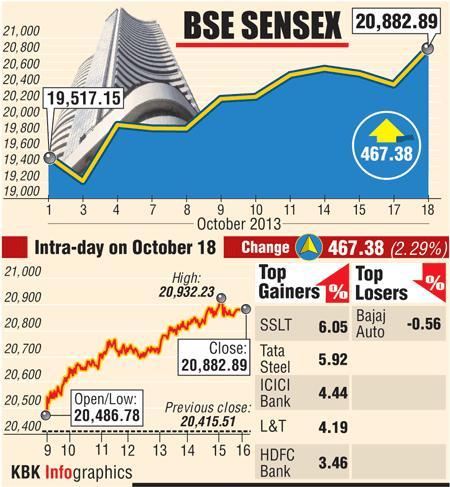

Trumps Second Term An Examination Of Presidential Pardons

May 15, 2025

Trumps Second Term An Examination Of Presidential Pardons

May 15, 2025 -

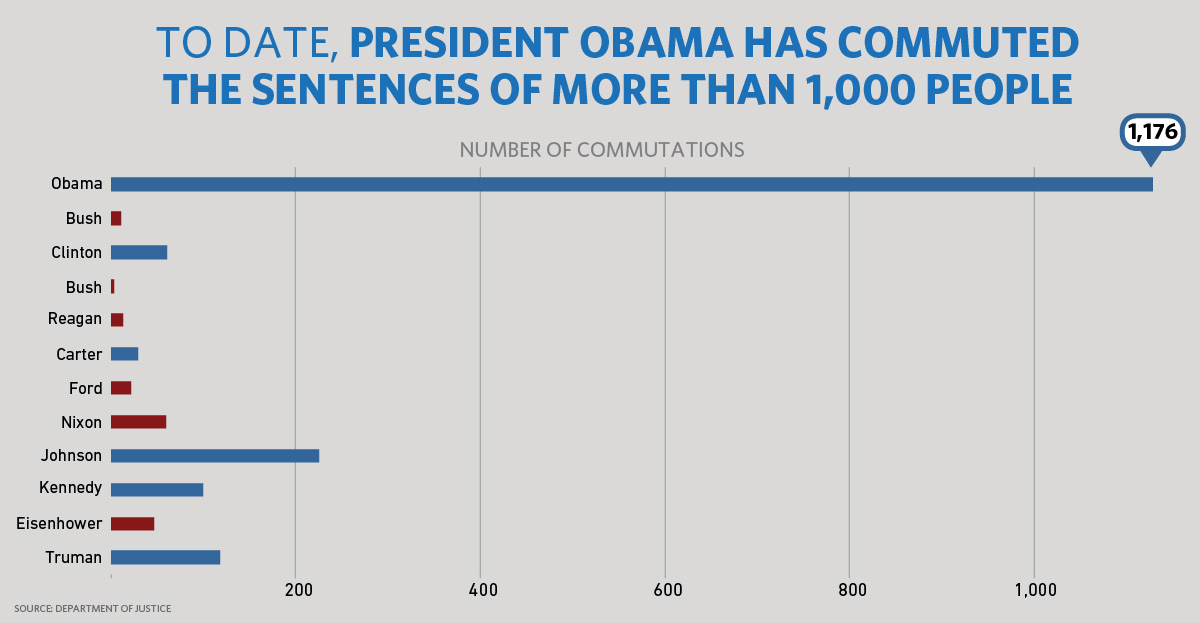

Ai Therapy Privacy Concerns And Potential For Surveillance

May 15, 2025

Ai Therapy Privacy Concerns And Potential For Surveillance

May 15, 2025 -

Analyzing The Impact Of Jalen Brunsons Injury On The Knicks

May 15, 2025

Analyzing The Impact Of Jalen Brunsons Injury On The Knicks

May 15, 2025 -

Fan Anxiety Mounts As Andor Season 2 Trailer Release Remains Unannounced

May 15, 2025

Fan Anxiety Mounts As Andor Season 2 Trailer Release Remains Unannounced

May 15, 2025