Strong PMI Data Supports Dow Jones' Steady Ascent

Table of Contents

PMI Data: A Key Indicator of Economic Health

The Purchasing Managers' Index (PMI) is a crucial economic indicator that tracks the activity levels of purchasing managers within the manufacturing and services sectors. It's a composite index, calculated by surveying purchasing managers about various aspects of their businesses, including production, new orders, employment, supplier deliveries, and inventories. A PMI reading above 50 indicates expansion, while a reading below 50 suggests contraction.

There are different types of PMI reports, each offering a specific view of the economy:

- Manufacturing PMI: Tracks activity in the manufacturing sector, focusing on production, new orders, and employment within factories and related industries.

- Services PMI: Measures activity in the services sector, encompassing businesses like retail, hospitality, finance, and transportation.

- Composite PMI: A combined measure of both manufacturing and services PMI, providing a broader overview of the overall economy.

Recent PMI numbers paint a positive picture. For instance:

- Manufacturing PMI rose to 55.0 in [Month, Year], exceeding expectations and indicating robust growth in the sector. This is a significant increase compared to the 52.0 recorded in [Previous Month/Year].

- The Services PMI also showed strong growth, reaching [Number] in [Month, Year], further reinforcing the overall positive economic outlook. This growth was particularly strong in the [Specific Industry] sector.

- The Composite PMI, combining both manufacturing and services, reflected this positive trend, registering a value of [Number], showcasing a healthy and expanding economy.

The Dow Jones' Positive Response to Strong PMI

The correlation between strong PMI data and the Dow Jones' performance is undeniable. Positive PMI readings generally signal a healthy economy, boosting investor confidence and driving stock prices higher. The recent gains in the Dow Jones are strongly linked to this positive economic sentiment fueled by strong PMI data.

- The Dow Jones Industrial Average reached a new high of [Number] on [Date], reflecting investor optimism.

- Companies like [Company Name 1] and [Company Name 2], both components of the Dow Jones, have seen significant growth in their stock prices, directly benefiting from the positive PMI data.

- The technology and finance sectors, which hold significant weight within the Dow Jones, have particularly benefited from this strong economic indicator. Increased consumer spending, driven by a healthy economy (as reflected in the PMI), is boosting these sectors.

Factors Beyond PMI Contributing to Dow Jones' Ascent

While strong PMI data is a significant contributor to the Dow Jones' ascent, it's essential to acknowledge other influential factors:

- Interest Rate Decisions: The Federal Reserve's monetary policy decisions significantly impact the market. Lower interest rates can stimulate economic activity and boost investor confidence.

- Geopolitical Events: Global events and political stability play a crucial role. Reduced geopolitical uncertainty often leads to increased investor confidence.

- Corporate Earnings: Strong corporate earnings reports contribute positively to overall market sentiment. Positive earnings demonstrate the financial health of individual companies and the broader economy.

While these factors play a role, the consistently strong PMI data acts as a significant underlying support for the Dow Jones' upward trajectory. The positive economic outlook fostered by the PMI reinforces investor confidence, leading to increased investment and higher stock prices.

Future Outlook: Maintaining the Dow Jones' Upward Trajectory

Predicting the future is inherently challenging, but based on current PMI trends and other economic indicators, a cautiously optimistic outlook is warranted.

- Future PMI numbers are projected to remain above 50, indicating continued economic expansion. However, potential risks exist.

- Inflation remains a potential risk. High inflation can erode purchasing power and negatively impact economic growth.

- A potential recession, while not currently foreseen based on the current PMI data, remains a possibility that needs monitoring. However, the current strong numbers offer some buffer against such an event.

- Opportunities for growth exist in various sectors, particularly those benefitting from increased consumer spending, as indicated by the strong PMI data.

Maintaining the Dow Jones' upward trajectory will depend on several factors, including continued strong PMI readings, stable geopolitical conditions, and effective management of inflation.

Conclusion: Strong PMI Data Remains a Crucial Driver for the Dow Jones

In conclusion, the strong correlation between robust PMI data and the Dow Jones' continued ascent is undeniable. Strong PMI data acts as a crucial leading indicator of economic health, driving investor confidence and fueling the upward trend in the Dow Jones. The current positive PMI figures suggest a healthy and expanding economy, contributing significantly to the market's optimism.

Stay tuned for future updates on PMI data and its continuing influence on the Dow Jones' performance. Understanding strong PMI data is key to navigating the market. The future looks promising, provided the current positive trends continue and potential risks are effectively managed. The strength of the PMI remains a significant positive factor for future market performance.

Featured Posts

-

90 Let So Dnya Rozhdeniya Sergeya Yurskogo Geniy Paradoksov Ostroumie I Intellekt

May 24, 2025

90 Let So Dnya Rozhdeniya Sergeya Yurskogo Geniy Paradoksov Ostroumie I Intellekt

May 24, 2025 -

Canadians Cut Corners On Car Security Due To Rising Living Costs

May 24, 2025

Canadians Cut Corners On Car Security Due To Rising Living Costs

May 24, 2025 -

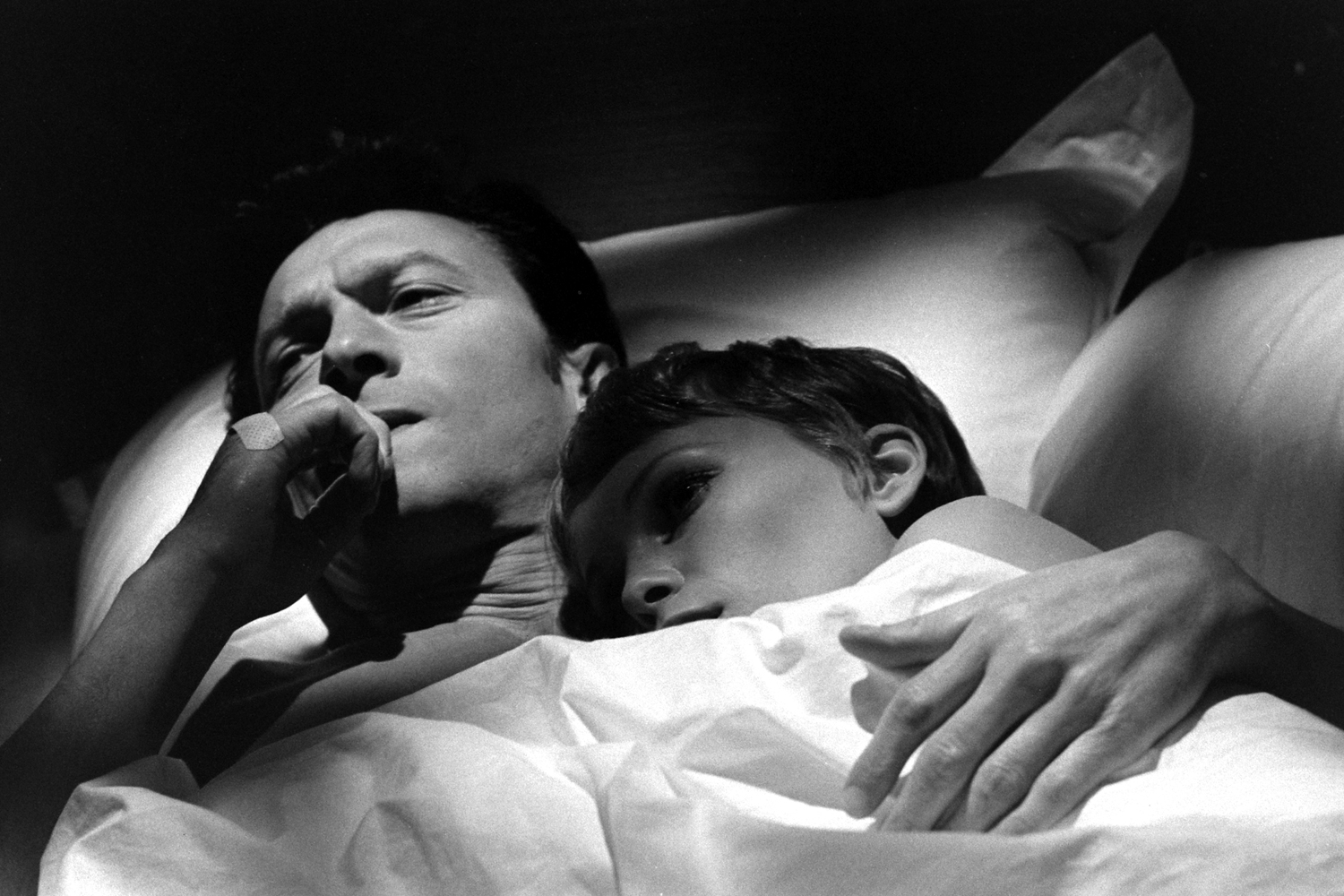

Michael Caines Unexpected On Set Visit During Mia Farrow Sex Scene Filming

May 24, 2025

Michael Caines Unexpected On Set Visit During Mia Farrow Sex Scene Filming

May 24, 2025 -

The Thames Water Bonus Scandal A Case Study In Corporate Governance

May 24, 2025

The Thames Water Bonus Scandal A Case Study In Corporate Governance

May 24, 2025 -

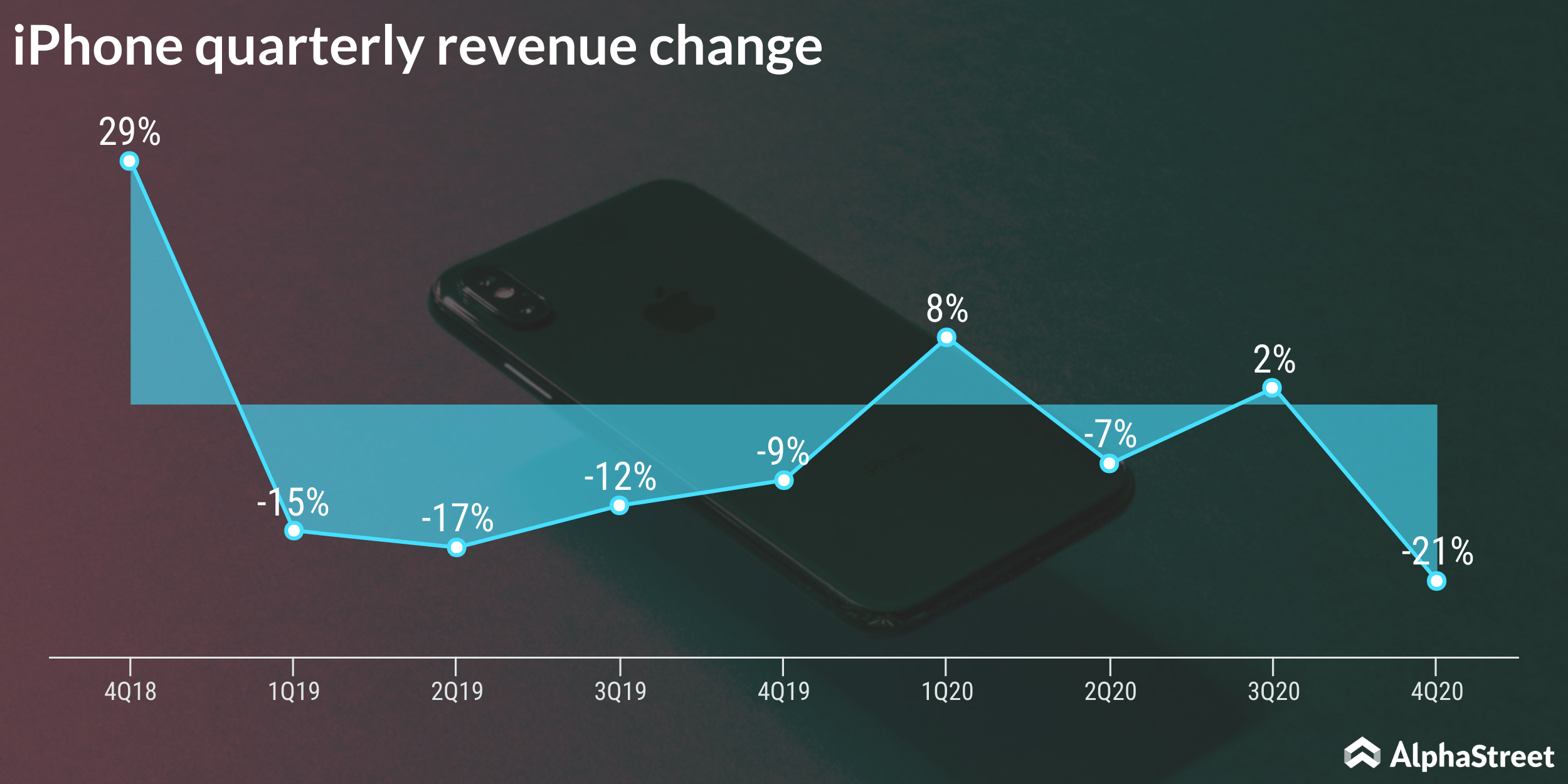

I Phone Sales Boost Apple Stock In Fiscal Q2 Results

May 24, 2025

I Phone Sales Boost Apple Stock In Fiscal Q2 Results

May 24, 2025