The Thames Water Bonus Scandal: A Case Study In Corporate Governance

Table of Contents

Corporate governance refers to the system of rules, practices, and processes by which a company is directed and controlled. It's designed to ensure accountability, transparency, and ethical behavior, ultimately building public trust and protecting stakeholders' interests. The Thames Water scandal demonstrates a catastrophic failure of this system, highlighting the devastating consequences when corporate greed overshadows responsibility. This article will analyze the scandal, examining its various facets and drawing crucial lessons for future regulatory reform and improved corporate governance.

The Financial Performance and Bonus Structure of Thames Water

Thames Water's financial performance leading up to the scandal was characterized by increasing debt levels despite significant profits. While the company reported profitability, a closer examination reveals a concerning lack of investment in essential infrastructure upgrades, a crucial factor contributing to the environmental failings. This raises serious questions about the company's allocation of resources and its long-term strategic planning. The company's profitability was achieved while simultaneously accumulating substantial debt, a risky financial strategy that ultimately undermined its ability to address critical infrastructure needs.

The bonus structure implemented at Thames Water incentivized short-term gains over long-term sustainability. Executive compensation packages were heavily reliant on short-term performance metrics, failing to incorporate crucial factors such as environmental performance and customer satisfaction. This created a perverse incentive system that rewarded executives even as the company's environmental record deteriorated.

- Specific examples of financial data: Debt levels increased by X% over Y years, while profit margins remained relatively stable. Return on investment was prioritized over capital expenditure on infrastructure upgrades.

- Breakdown of the bonus structure: Bonuses were primarily based on short-term profit targets, with minimal weighting given to environmental performance indicators or customer service metrics.

- Comparison to industry benchmarks: A comparison with other water companies revealed that Thames Water's executive compensation packages were significantly higher, despite a worse performance record.

Environmental Failures and Regulatory Oversight

Thames Water's record of environmental violations is appalling. Numerous incidents of sewage discharge, high leakage rates, and persistent water pollution have severely damaged the environment and undermined public trust. These failures directly contradict the company's responsibility as a provider of essential services. The scale of these failures suggests a systematic disregard for environmental regulations and a lack of sufficient investment in infrastructure maintenance.

Ofwat, the regulatory body overseeing Thames Water, faced criticism for its perceived failure to adequately address the company's environmental failings. The effectiveness of Ofwat's enforcement actions was questioned, with some arguing that penalties levied were insufficient to deter future violations.

- Specific examples of pollution incidents: [Insert specific examples of pollution incidents, including dates, locations, and consequences].

- Analysis of Ofwat's response: Ofwat's response was often reactive rather than proactive, leading to accusations of insufficient oversight and inadequate enforcement.

- Discussion of potential loopholes: The regulatory framework may contain loopholes that allowed Thames Water to operate with a degree of impunity despite repeated violations.

Public Backlash and Political Response

The Thames Water bonus scandal ignited significant public outrage. Negative media coverage, public protests, and widespread condemnation forced the issue into the political spotlight. Public opinion polls revealed widespread dissatisfaction with both Thames Water's performance and the regulatory response.

The government responded with a mixture of announcements and investigations. However, the effectiveness of these measures remains debatable. The political pressure has spurred calls for significant regulatory reform, emphasizing greater accountability and transparency within the water industry.

- Examples of media headlines: [Insert examples of relevant headlines illustrating public outrage].

- Summary of government statements: The government pledged to strengthen regulations and enhance Ofwat's oversight capabilities.

- Discussion of long-term impacts: The scandal has raised profound questions about corporate governance and the regulation of essential services, potentially leading to substantial long-term changes.

Lessons Learned and Future Implications for Corporate Governance

The Thames Water scandal provides several crucial lessons for improving corporate governance and accountability within the water industry and beyond. Executive compensation structures must be redesigned to align incentives with long-term sustainability and environmental responsibility. Performance metrics should incorporate environmental and social factors alongside financial indicators.

Strengthening regulatory oversight is paramount. This includes enhancing Ofwat's enforcement capabilities and closing potential loopholes in existing regulations. Increased transparency is also essential to ensure accountability and build public trust.

- Recommendations for improving executive compensation: Bonuses should be tied to environmental performance and investment in infrastructure.

- Suggestions for strengthening regulatory oversight: Increased monitoring, more stringent penalties for violations, and proactive engagement with water companies are necessary.

- Call for increased transparency: Companies should be required to publish detailed environmental performance data and demonstrate their commitment to sustainable practices.

Conclusion: Reforming Corporate Governance in the Wake of the Thames Water Scandal

The Thames Water bonus scandal stands as a stark illustration of corporate governance failure, highlighting the devastating consequences when financial incentives override ethical considerations and environmental responsibility. The scandal underscores the urgent need for comprehensive reform to prevent similar events in the future. This includes not just strengthening regulatory oversight and enforcement but also promoting a cultural shift towards ethical corporate governance, prioritizing long-term sustainability, and actively engaging with stakeholders. We must learn from this case to improve water company governance, fostering greater accountability and transparency in the sector. Learn more about advocating for stronger water industry regulations and holding water companies accountable at [link to relevant organization]. Demand better – demand improved water company accountability.

Featured Posts

-

Dax Falls Below 24 000 Frankfurt Stock Market Closing Losses

May 24, 2025

Dax Falls Below 24 000 Frankfurt Stock Market Closing Losses

May 24, 2025 -

University Of Maryland Graduation Kermit The Frogs Inspiring Speech

May 24, 2025

University Of Maryland Graduation Kermit The Frogs Inspiring Speech

May 24, 2025 -

Mamma Mia A Look At The New Ferrari Hot Wheels Collection

May 24, 2025

Mamma Mia A Look At The New Ferrari Hot Wheels Collection

May 24, 2025 -

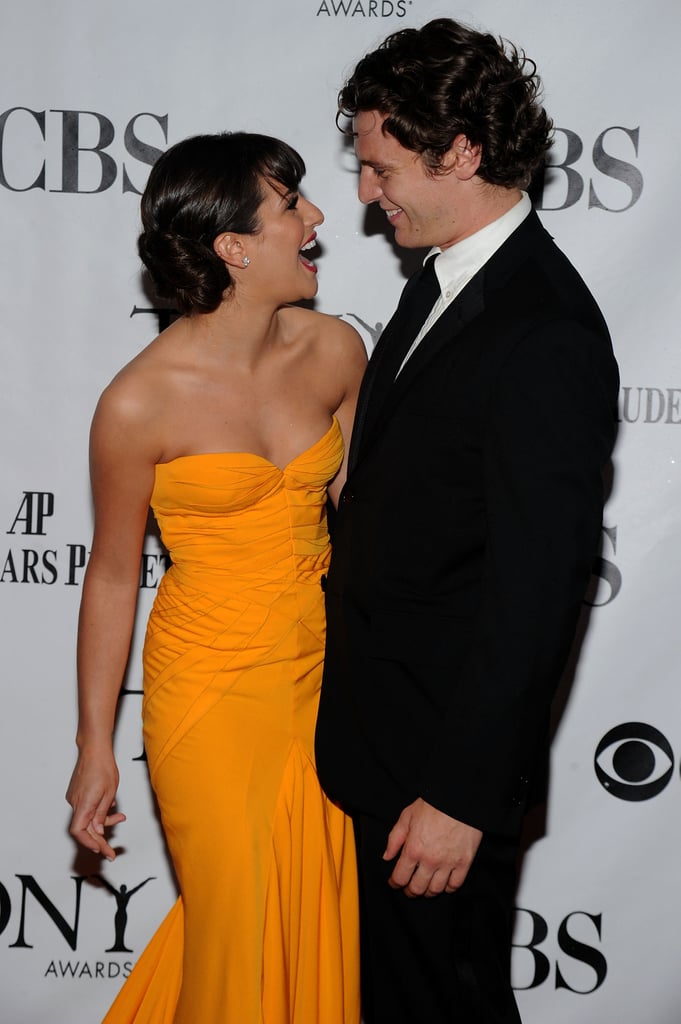

Broadways Best Jonathan Groffs Opening Night With Lea Michele And Friends

May 24, 2025

Broadways Best Jonathan Groffs Opening Night With Lea Michele And Friends

May 24, 2025 -

Mia Farrow Seeks Legal Recourse Against Trump Over Venezuelan Deportations

May 24, 2025

Mia Farrow Seeks Legal Recourse Against Trump Over Venezuelan Deportations

May 24, 2025