Tariff Wars Freeze IPO Market: Examining The Impact On Global Finance

Table of Contents

Increased Uncertainty and Investor Hesitation

Tariffs create unpredictable business environments, deterring investors from participating in the IPO market. The instability introduced by fluctuating trade policies makes accurate financial forecasting incredibly difficult. This uncertainty significantly increases investment risk, a major concern for investors seeking stable returns.

-

Fluctuating import/export costs impact profitability projections: Companies reliant on international trade face unpredictable costs, making it challenging to project future profits accurately. This uncertainty directly impacts IPO valuations, as investors demand a higher risk premium to compensate for potential losses.

-

Uncertainty about future regulatory changes increases investment risk: The ever-changing landscape of trade policies creates a climate of fear and uncertainty. Investors are reluctant to commit capital when the potential for future tariffs or trade restrictions looms large.

-

Investors prefer stable markets for IPO investments: The IPO market thrives on investor confidence and stable market conditions. Tariff wars introduce volatility, making investors hesitant to participate, leading to a decrease in demand for IPO shares.

-

Examples of IPO postponements or cancellations due to tariff concerns: Several companies, particularly those heavily reliant on global supply chains, have postponed or even cancelled their IPOs in response to escalating trade tensions. For instance, [Insert Example 1 of a company and brief explanation] and [Insert Example 2 of a company and brief explanation] are prime examples of how tariff uncertainty can disrupt IPO plans. These cases highlight the real-world consequences of trade wars on business decisions and the overall health of the capital markets.

Impact on Valuation and Pricing

Tariffs significantly affect a company's valuation and, consequently, the pricing of its IPO. Reduced profits due to increased import costs directly translate into lower valuations.

-

Reduced profits due to tariffs lead to lower IPO valuations: Tariffs increase the cost of goods, squeezing profit margins. This directly impacts a company's perceived value, leading to lower IPO valuations.

-

Increased risk premiums demanded by investors further depress valuations: The increased uncertainty associated with tariff wars compels investors to demand higher risk premiums, further depressing IPO valuations. This means companies need to offer a lower price to attract investors.

-

Difficulty in accurately forecasting future earnings impacts pricing: The fluctuating nature of tariff policies makes accurate earnings forecasting virtually impossible. This unpredictability makes it challenging to determine a fair IPO price, creating additional hesitancy for both companies and investors.

-

Examples of companies whose IPO valuations were negatively affected: [Insert examples of companies and details about how tariffs impacted their IPO valuations]. These examples demonstrate the tangible impact of trade wars on the financial health and market positioning of businesses.

Geopolitical Implications and Regional Variations

Tariff wars affect different regions and countries differently, creating a complex and uneven global impact on the IPO market.

-

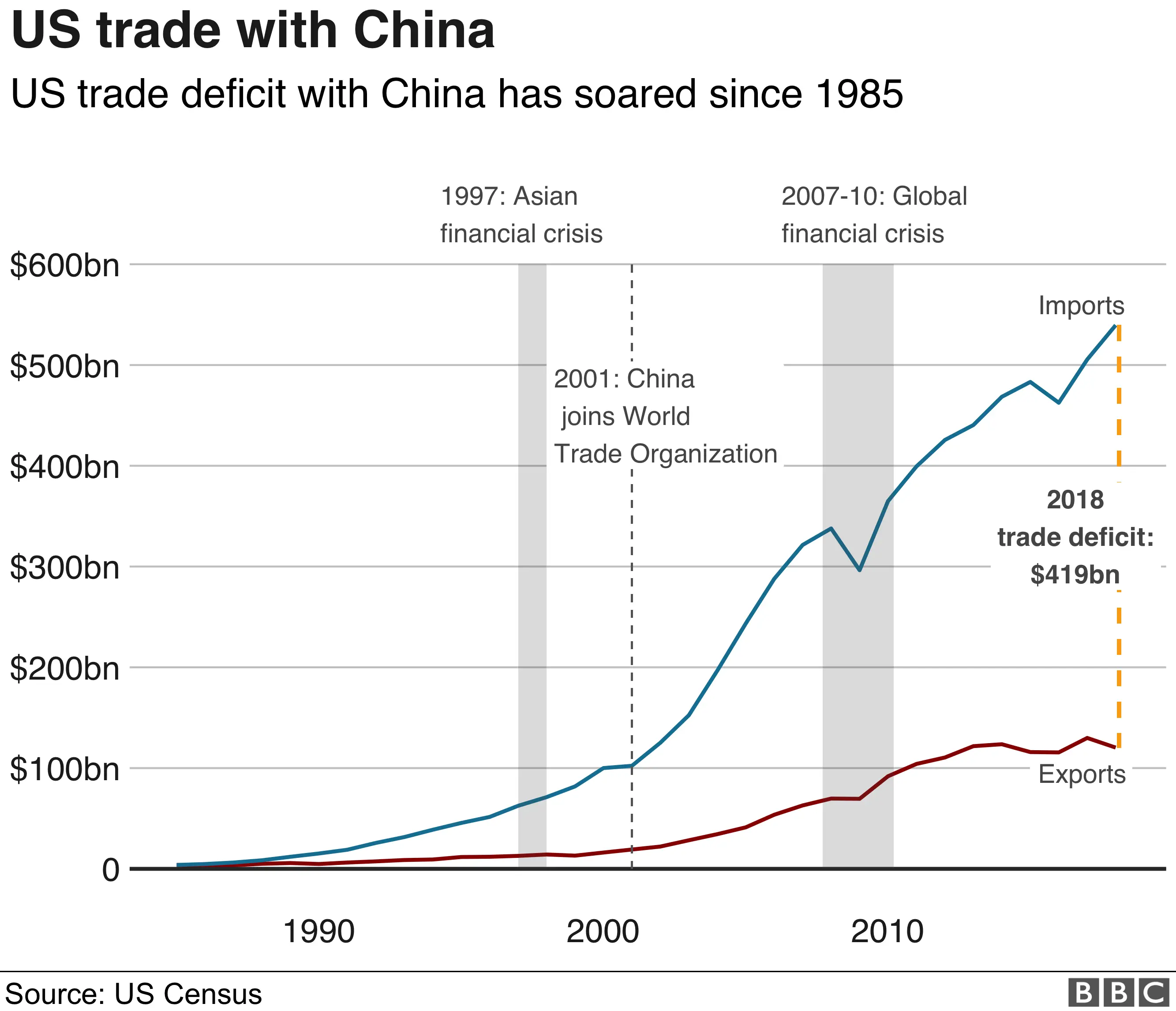

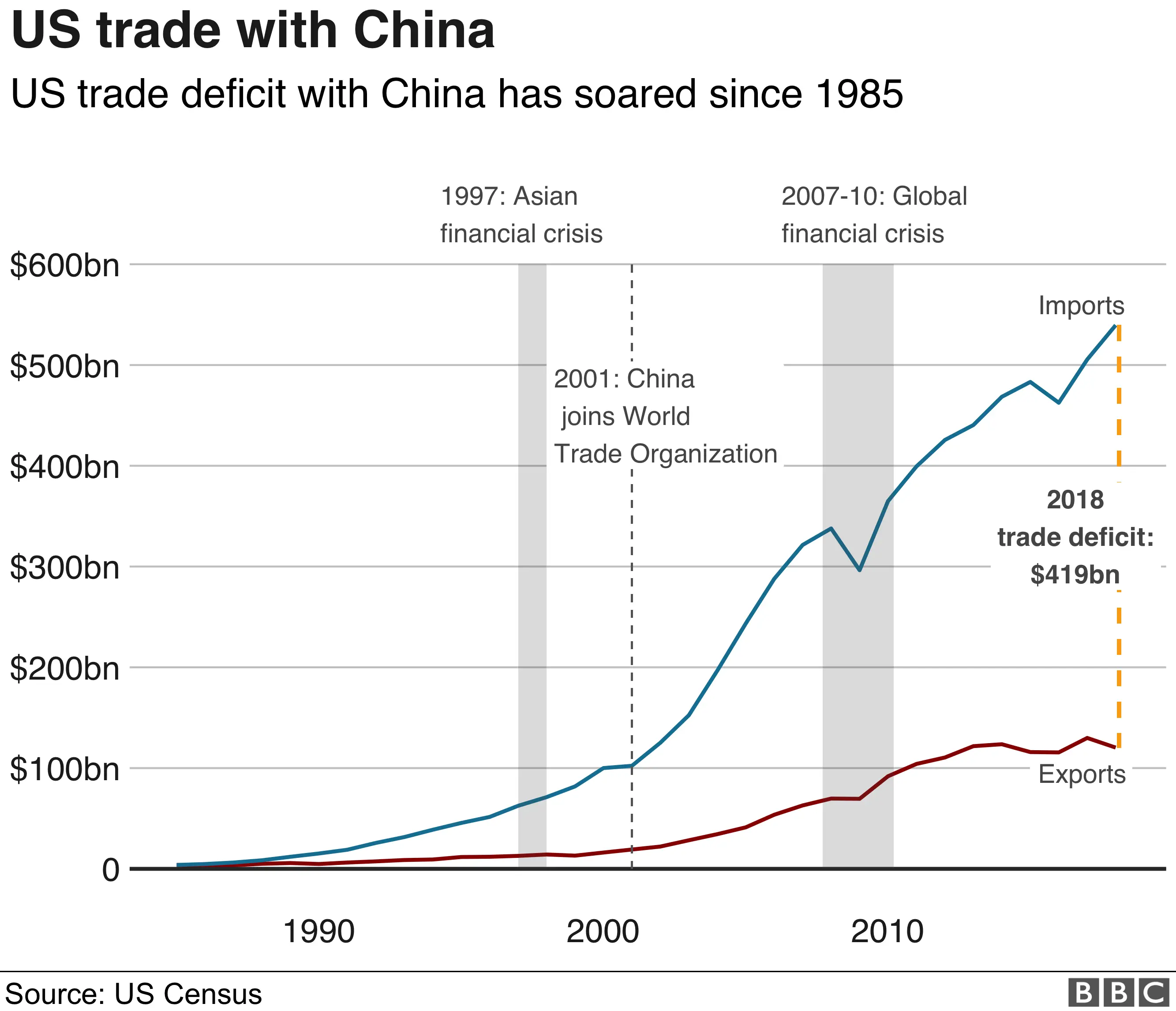

Impact on US IPO market vs. Asian or European markets: While the US IPO market is significantly affected, the impact varies across other regions. For example, Asian markets heavily reliant on exporting to the US may experience a more substantial slowdown in IPO activity than those in Europe.

-

Specific examples of countries severely affected by reduced IPO activity: [Insert examples of countries and explanation of their unique situations]. This highlights the uneven impact of trade wars on global financial markets.

-

How regional trade agreements influence the impact of tariffs: Existing regional trade agreements can mitigate or exacerbate the impact of tariff wars. Countries within strong regional blocs may be less affected than those operating in more isolated markets.

-

Discussion on the potential for shifting investment flows to less affected regions: As some regions become less attractive for IPO investments due to tariff uncertainties, investment flows may shift towards regions perceived as more stable. This creates a ripple effect in global capital allocation.

Case Studies: Specific Examples of Companies Affected

[Insert detailed case studies of at least two companies that have delayed or canceled their IPOs due to tariff wars. Include industry details and specific reasons for their decisions. Cite sources for all information.] For instance, a company in the [Industry Name] sector might have delayed its IPO due to the uncertainty created by tariffs on imported raw materials, while another company in the [Industry Name] sector might have canceled entirely due to the direct impact of tariffs on its primary export market. These detailed case studies provide concrete examples of the impact of tariff wars on specific business decisions.

Long-Term Effects on Global Capital Markets

The tariff-induced freeze on the IPO market carries significant long-term consequences for global capital markets.

-

Reduced access to capital for growth-oriented companies: A slowdown in IPO activity reduces the availability of crucial investment capital for growth-oriented companies. This stifles innovation and expansion, potentially hindering long-term economic growth.

-

Slower economic growth due to reduced investment: The reduced availability of capital translates into slower economic growth. Companies unable to access capital through IPOs might reduce investments in research and development, impacting overall productivity.

-

Potential for market distortions and inefficiencies: The disruption caused by tariff wars can lead to distortions and inefficiencies within the capital markets. This creates an environment of greater risk and uncertainty, deterring long-term investment.

-

Long-term impact on innovation and technological advancements: The lack of access to capital could stifle innovation by preventing the funding of new technologies and ventures. This could create a long-term competitive disadvantage for affected economies.

Conclusion

The ongoing tariff wars have undeniably created a chilling effect on the global IPO market. Increased uncertainty, diminished valuations, and geopolitical implications have combined to significantly reduce IPO activity. This impacts not only companies seeking funding but also the broader global economy. Understanding the complex interplay between tariff wars and the IPO market is crucial for investors, businesses, and policymakers alike. Further research into the long-term effects of these "Tariff Wars" on the global IPO market is vital to navigate the complexities of international trade and finance. Stay informed about the ever-evolving landscape of global finance and the impact of trade policies on the IPO market.

Featured Posts

-

Chinas Lithium Export Restrictions A Potential Windfall For Eramet

May 14, 2025

Chinas Lithium Export Restrictions A Potential Windfall For Eramet

May 14, 2025 -

Cannonball U Your Complete Tv Guide

May 14, 2025

Cannonball U Your Complete Tv Guide

May 14, 2025 -

Snow Whites Box Office Flop A Turning Point For Disneys Live Action Strategy

May 14, 2025

Snow Whites Box Office Flop A Turning Point For Disneys Live Action Strategy

May 14, 2025 -

Nomme Vice President Executif Alexis Kohler Rejoint La Societe Generale

May 14, 2025

Nomme Vice President Executif Alexis Kohler Rejoint La Societe Generale

May 14, 2025 -

Chelseas Bid For Dean Huijsen A June 14th Decision

May 14, 2025

Chelseas Bid For Dean Huijsen A June 14th Decision

May 14, 2025