Tax Code Update From HMRC: Addressing Savings Income

Table of Contents

New Savings Allowance Limits and Their Impact

The HMRC has updated the Personal Savings Allowance (PSA) for the current tax year, impacting how much savings income is tax-free. Understanding these changes is crucial for all taxpayers, regardless of their income bracket. The PSA allows you to earn a certain amount of interest on your savings without paying income tax. However, the amount you can earn tax-free depends on your tax band.

- Basic Rate Taxpayers (20%): The PSA remains at £1,000.

- Higher Rate Taxpayers (40%): The PSA remains at £500.

- Additional Rate Taxpayers (45%): The PSA remains at £0.

These limits apply to the total interest earned from all your savings accounts, including current accounts, savings accounts, and building society accounts. If you have multiple savings accounts, the interest earned across all accounts is aggregated to determine if the PSA limit has been exceeded. Exceeding your PSA limit will mean you'll pay income tax on the excess amount at your relevant tax band rate. This means that effective management of your savings is more important than ever to minimise your Savings Income Tax liability. Keywords: Personal Savings Allowance, PSA, Tax Bands, Savings Income Tax, HMRC Tax Changes

Understanding the New Tax Reporting Requirements

While the basic reporting requirements for savings income haven't drastically changed, it's essential to understand your responsibilities to HMRC. Generally, your bank or building society will report your interest directly to HMRC through the Real Time Information (RTI) system, but it’s crucial you remain aware of these reporting requirements.

- Simplified Reporting (Generally Automatic): Most savings interest is reported automatically through RTI. This simplifies the process for many taxpayers.

- Self-Assessment (for Complex Cases): If you have complex savings arrangements or your interest exceeds the PSA considerably, you may still need to report through your self-assessment tax return.

- Deadlines: Tax returns typically have a deadline of 31 January following the end of the tax year. Missing this deadline can result in significant penalties.

- Penalties for Non-Compliance: Failure to accurately report your savings income can lead to penalties from HMRC, including surcharges and interest charges on any unpaid tax. Keywords: HMRC Reporting, Self-Assessment, Tax Return, Savings Income Declaration, Tax Penalties

Impact on Different Types of Savings Accounts

The HMRC tax code update affects various savings vehicles differently. Understanding these differences is vital for effective tax planning.

- ISAs (Individual Savings Accounts): Interest earned within an ISA remains tax-free, up to the annual ISA allowance. The ISA allowance for 2024/25 is £20,000, representing a helpful strategy to reduce your Savings Income Tax bill.

- Savings Accounts & Bonds: Interest earned from these accounts is subject to the PSA and tax bands outlined above.

- Tax Implications of Withdrawals: While withdrawing savings doesn't directly incur tax, the interest already earned contributes towards your total savings income, potentially pushing it above the PSA and resulting in tax liability.

Keywords: ISA Allowance, Savings Accounts, Bonds, Tax-Efficient Savings, Investment Accounts

Planning and Mitigation Strategies for Tax on Savings Income

Effective tax planning is crucial to minimize your tax liability on savings income. Here are some strategies you can employ:

- Tax-Efficient Investment Options: Consider tax-efficient investment options like ISAs to maximize your tax-free savings.

- Managing Savings Income Below the PSA: Aim to keep your total savings interest below your PSA limit, ensuring you don't pay any tax on your savings.

- Seeking Professional Financial Advice: Consulting a financial advisor can provide personalized advice tailored to your circumstances. This will help you manage your Savings Income Tax more effectively.

Keywords: Tax Planning, Savings Optimization, Investment Strategies, Financial Advice, Tax Minimization

Conclusion: Staying Informed About the HMRC Tax Code Update on Savings Income

This article highlighted key changes in the HMRC tax code update concerning savings income, including revised PSA limits and ongoing reporting requirements. Understanding these updates is essential for managing your personal finances effectively and minimizing your tax liability. Remember to stay informed about further updates from HMRC by regularly checking their website. For personalized advice on optimizing your savings and investments, consult a qualified financial advisor to further minimise your Savings Income Tax. Keywords: HMRC Tax Updates, Savings Income Tax, Tax Planning, Financial Advice, Stay Informed

Featured Posts

-

The Impact Of Recent Performances On Giorgos Giakoumakis Mls Prospects

May 20, 2025

The Impact Of Recent Performances On Giorgos Giakoumakis Mls Prospects

May 20, 2025 -

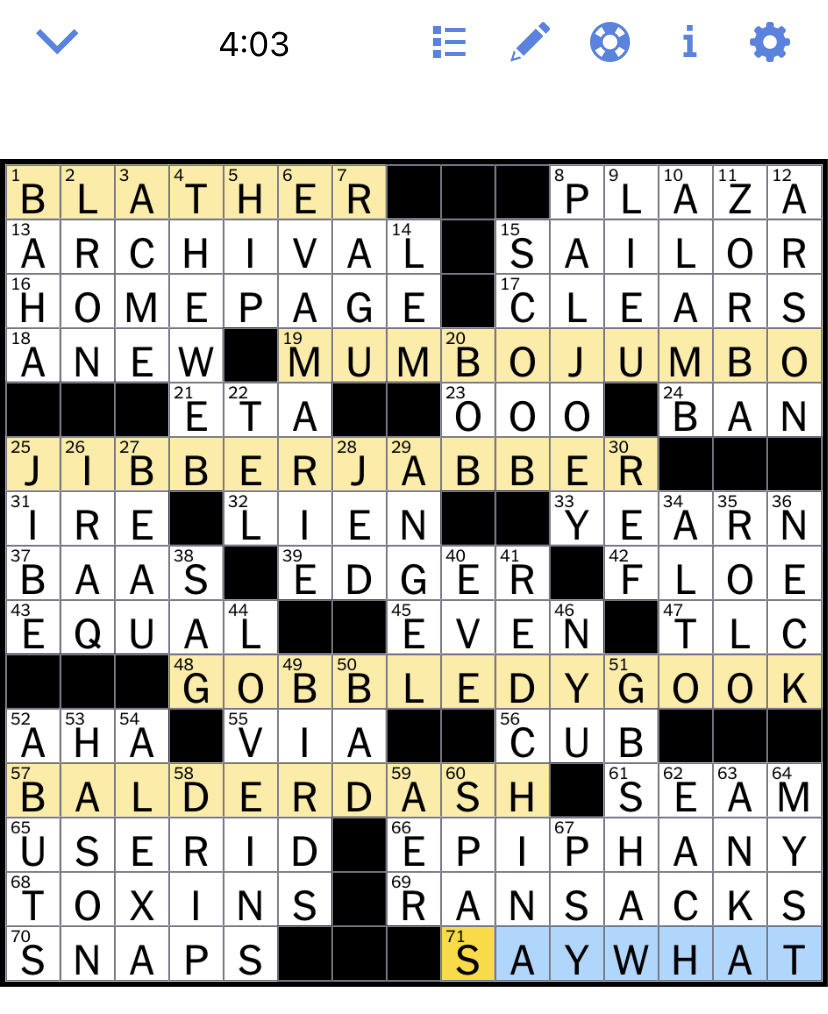

Nyt Mini Crossword Solution March 8th Puzzle Answers

May 20, 2025

Nyt Mini Crossword Solution March 8th Puzzle Answers

May 20, 2025 -

Sell America Bonds Now Moodys Rating And Market Volatility

May 20, 2025

Sell America Bonds Now Moodys Rating And Market Volatility

May 20, 2025 -

Suki Waterhouse Showcases Michael Kors New Amazon Luxury Line

May 20, 2025

Suki Waterhouse Showcases Michael Kors New Amazon Luxury Line

May 20, 2025 -

How To Dress For Breezy And Mild Weather A Practical Guide

May 20, 2025

How To Dress For Breezy And Mild Weather A Practical Guide

May 20, 2025