Tech Billionaires' $194 Billion Losses: A 100-Day Analysis Of Inauguration Donations

Table of Contents

The $194 Billion Question: Quantifying the Losses

The sheer scale of the losses experienced by some of the world's wealthiest tech billionaires is staggering. This $194 billion figure represents a significant drop in their collective net worth within just 100 days following the inauguration. Let's break down the losses:

-

Elon Musk (Tesla): While precise figures fluctuate daily, Tesla's stock performance over this period significantly impacted Musk's net worth, contributing a substantial portion to the overall $194 billion loss. (Insert chart/graph visualizing Tesla's stock performance).

-

Jeff Bezos (Amazon): Amazon's stock experienced [insert percentage change] in the 100 days following the inauguration. This resulted in a considerable decrease in Bezos' net worth. (Insert chart/graph visualizing Amazon's stock performance).

-

Mark Zuckerberg (Meta): Meta, formerly Facebook, faced its own challenges during this period, leading to a significant decline in Zuckerberg's personal wealth. (Insert chart/graph visualizing Meta's stock performance).

Factors Contributing to the Losses:

- Percentage change in net worth: [Insert data on percentage change for each billionaire].

- Comparison to pre-inauguration net worth: [Insert data comparing current net worth to pre-inauguration net worth for each billionaire].

- Beyond political influence: It's crucial to acknowledge that factors beyond political donations contributed to these losses. Market corrections, economic downturns, and company-specific challenges all played a role.

Inauguration Donations: A Closer Look at the Investments

These tech titans made significant financial contributions around the inauguration. Examining these donations and their timing relative to subsequent market shifts is vital:

- Donation Amounts: Elon Musk contributed [amount], Jeff Bezos donated [amount], and Mark Zuckerberg gave [amount] to various political initiatives. (Insert a table summarizing the donations).

- Political Affiliations: These donations supported a range of political affiliations and initiatives, from [mention specific examples].

- Timing: The timing of these donations, relative to the start of the 100-day period analyzed, is a key consideration in understanding potential correlations.

Correlation or Causation? Exploring the Impact of Policy Changes

The question arises: is there a direct causal link between these inauguration donations and the subsequent market losses? While establishing direct causation is difficult, exploring potential correlations is essential.

- Policy Changes: [Insert examples of policy changes enacted post-inauguration and their potential impact on the tech sector]. These policies might include [mention specific policies and their effects on relevant companies].

- Expert Opinions: Financial analysts [mention names and sources] have offered varied perspectives on the relationship between political donations and market performance. Some argue that [quote expert opinion supporting a correlation], while others contend that [quote expert opinion suggesting other market forces were at play].

- Market Trends: It's crucial to analyze market trends independent of political influence. [Discuss broader market trends that could account for the losses].

The Ripple Effect: Implications for the Broader Tech Industry

The financial repercussions extend beyond the individual billionaires. The $194 billion loss has significant implications for the entire tech industry.

- Investor Confidence: The losses impacted investor confidence, leading to [describe the impact on investment in the tech sector].

- Investment Strategies: The market downturn likely caused a shift in investment strategies, with investors becoming [more/less] risk-averse.

- Broader Economic Impact: These events can ripple through the broader economy, influencing [mention potential effects on employment, consumer spending etc.].

Conclusion

This 100-day analysis reveals a striking correlation between the inauguration donations of tech billionaires and their subsequent market losses, totaling $194 billion. While definitively proving direct causation remains challenging, the data raises important questions about the interplay between political contributions and market performance in the tech industry. Further research is needed to fully understand this complex relationship.

Call to Action: Learn more about the intricacies of tech billionaire investments and their political influence. Stay updated on the evolving landscape of tech finance and policy by following our future analyses on the financial impact of tech billionaires. Continue the conversation using #TechBillionaireLosses and #InaugurationImpact.

Featured Posts

-

Suncors Record Production Inventory Build Impacts Sales Volumes

May 10, 2025

Suncors Record Production Inventory Build Impacts Sales Volumes

May 10, 2025 -

Beyonces Cowboy Carter Tour Boosts Streaming Numbers

May 10, 2025

Beyonces Cowboy Carter Tour Boosts Streaming Numbers

May 10, 2025 -

Analyzing Russias Military Display At Putins Victory Day Parade

May 10, 2025

Analyzing Russias Military Display At Putins Victory Day Parade

May 10, 2025 -

Hundreds Of Caravans Is This Uk City Becoming A Ghetto

May 10, 2025

Hundreds Of Caravans Is This Uk City Becoming A Ghetto

May 10, 2025 -

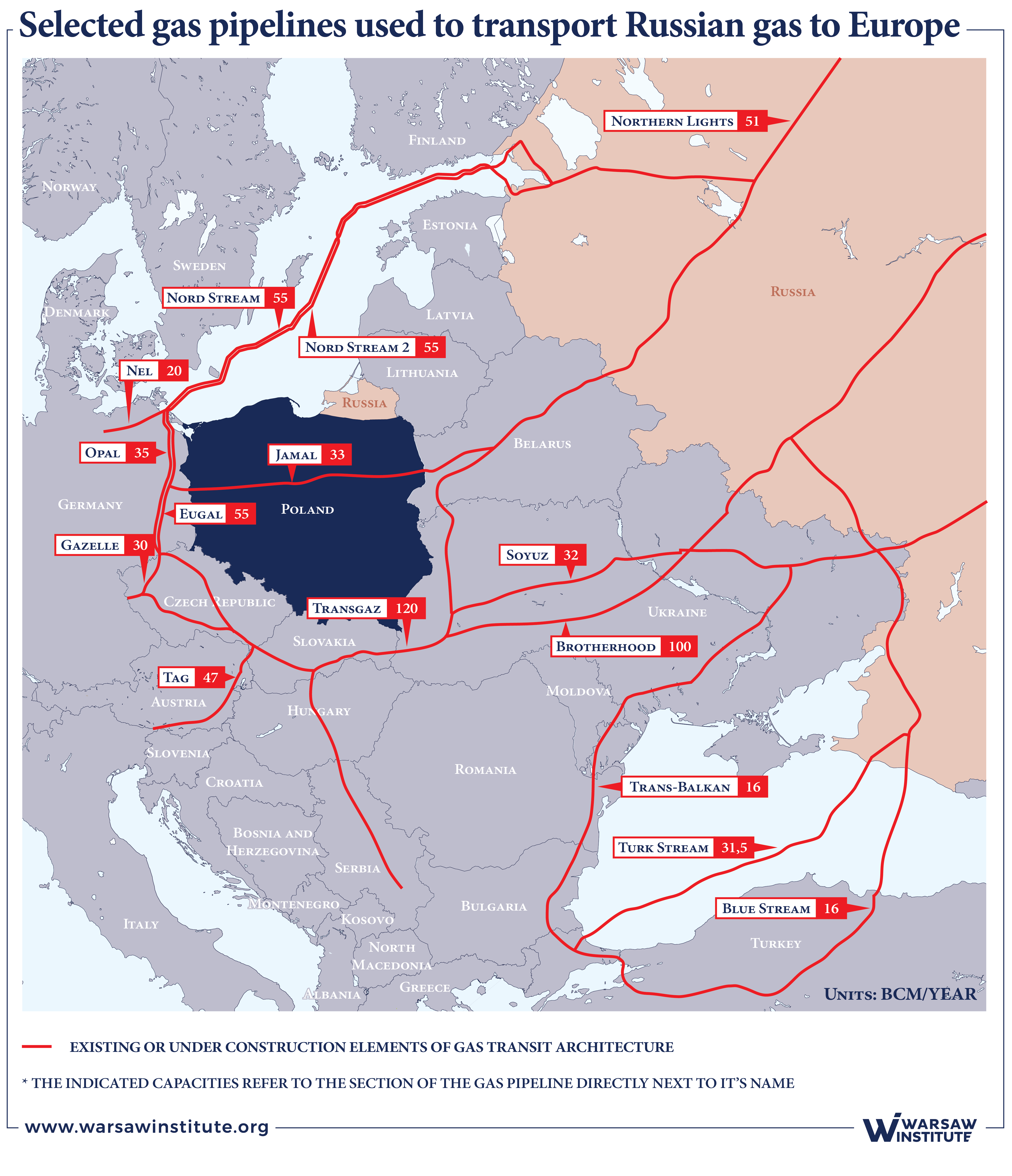

Exclusive Elliott Managements Stake In Russian Gas Pipeline

May 10, 2025

Exclusive Elliott Managements Stake In Russian Gas Pipeline

May 10, 2025