Tech Firms Delay IPOs: Tariff Uncertainty Creates Headwinds

Table of Contents

The Impact of Tariffs on Tech Valuations

Tariffs are significantly impacting tech valuations, creating a challenging environment for companies considering an IPO. The increased costs and uncertainty they generate are deterring investors and forcing companies to reassess their strategies.

Increased Costs and Reduced Profit Margins

Tariffs directly increase the cost of imported components crucial for tech manufacturing, squeezing profit margins and impacting investor confidence. This is particularly true for companies heavily reliant on global supply chains.

- Example: Increased tariffs on essential components like semiconductors can significantly increase the cost of production for smartphones and other electronics, reducing profitability.

- Example: Higher tariffs can also lead to price increases for consumers, reducing demand and further impacting profitability. This can create a domino effect, impacting the entire tech ecosystem. Companies need to consider how to absorb these increased costs without significantly impacting their bottom line.

Supply Chain Disruptions

Tariff uncertainty leads to supply chain disruptions, creating delays and increasing unpredictability for businesses. This uncertainty makes it difficult for companies to accurately forecast production costs and timelines.

- Bullet Points:

- Difficulty in sourcing components from reliable suppliers due to changing regulations and trade restrictions.

- Increased shipping costs and lead times as companies navigate complex trade routes and customs procedures.

- Uncertainty in production planning, making it challenging to accurately forecast demand and manage inventory. This can lead to increased warehousing costs and potential losses from unsold inventory.

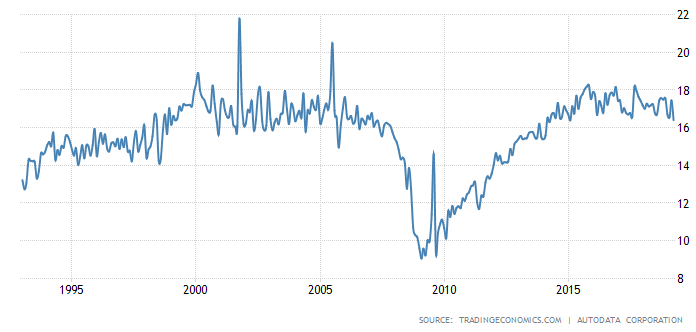

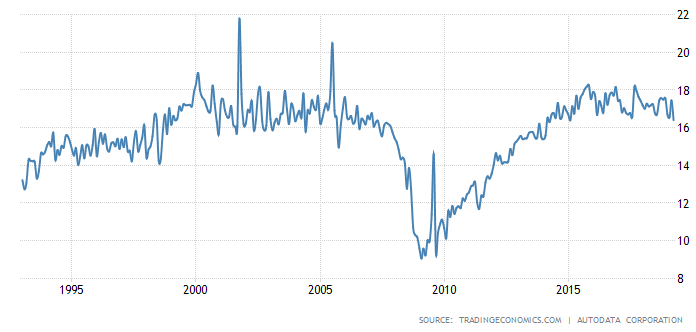

Investor Sentiment and Market Volatility

The uncertainty surrounding tariffs creates volatile market conditions, making it difficult for companies to accurately assess their valuation and attract investors. Investors are risk-averse and prefer stable, predictable markets.

- Bullet Points:

- Investors are hesitant to commit capital in uncertain market conditions, preferring to wait for greater clarity on trade policies.

- Volatility makes accurate valuation challenging, making it difficult for companies to determine a fair IPO price.

- Reduced investor confidence leads to delayed IPOs as companies wait for more favorable market conditions.

Strategic Decisions of Tech Firms

Facing these challenges, tech firms are adopting various strategies to navigate the current climate and protect their financial interests.

Postponing IPOs to Await Clarity

Many tech companies are delaying their IPOs, opting to wait for greater clarity on future trade policies before entering the public market. This allows them to mitigate potential risks and ensure a more successful launch.

- Bullet Points:

- Avoiding potential negative impacts on valuation due to market uncertainty.

- Allowing time to adjust to changing market conditions and develop strategies to mitigate the impact of tariffs.

- Protecting investor relations by avoiding a potentially disappointing public debut due to unforeseen tariff-related challenges.

Exploring Alternative Funding Options

Companies are seeking alternative funding strategies, such as private equity or venture capital, to avoid the risks associated with a public offering during this period of uncertainty.

- Bullet Points:

- Private equity provides more stable funding, allowing companies to weather the storm without the pressure of public market scrutiny.

- Venture capital offers flexibility, allowing companies to adapt their strategies as the situation evolves.

- Avoiding the scrutiny of the public market during a period of high volatility and uncertainty.

Restructuring Supply Chains

Some companies are actively restructuring their supply chains to reduce reliance on affected regions or components. This involves diversifying sourcing strategies and potentially investing in domestic manufacturing.

- Bullet Points:

- Shifting production to other countries with more stable trade relationships or lower tariff rates.

- Diversifying sourcing strategies to mitigate risks associated with reliance on single suppliers or regions.

- Investing in domestic manufacturing to reduce dependence on imported components and lessen the impact of tariffs.

The Future Outlook for Tech IPOs

The future of tech IPOs hinges on several factors, including the resolution of trade tensions and the broader global economic climate.

Dependence on Trade Policy Resolution

The future of tech IPOs heavily depends on the resolution of trade tensions and the establishment of more predictable trade policies. A stable and transparent trade environment is crucial for restoring investor confidence.

Potential for a Rebound

Once the uncertainty subsides, a surge in tech IPOs is anticipated as companies seek to capitalize on pent-up demand. Many companies are delaying their IPOs, not abandoning them entirely.

Long-Term Impact on Global Tech Landscape

The current situation may lead to a reshaping of the global tech landscape, with companies adapting their strategies to navigate trade complexities. This may involve a shift toward regionalization and greater diversification of supply chains.

Conclusion

Tariff uncertainty is significantly impacting the tech industry, causing many firms to delay their IPOs. Increased costs, supply chain disruptions, and volatile market conditions have created significant headwinds. Companies are strategically responding by postponing IPOs, exploring alternative funding, and restructuring supply chains. While the future remains uncertain, the resolution of trade tensions is crucial for a potential rebound in tech IPOs. Understanding the impact of tariff uncertainty on tech IPOs is critical for investors and businesses alike. Stay informed about trade policy developments and monitor the tech sector closely to make well-informed decisions. The impact of tariff uncertainty on the future of tech remains a key factor to watch. Understanding the intricacies of tariff uncertainty and its effect on tech IPOs is vital for navigating this dynamic market.

Featured Posts

-

Which Grass Starter Pokemon Is The Best A Detailed Analysis

May 14, 2025

Which Grass Starter Pokemon Is The Best A Detailed Analysis

May 14, 2025 -

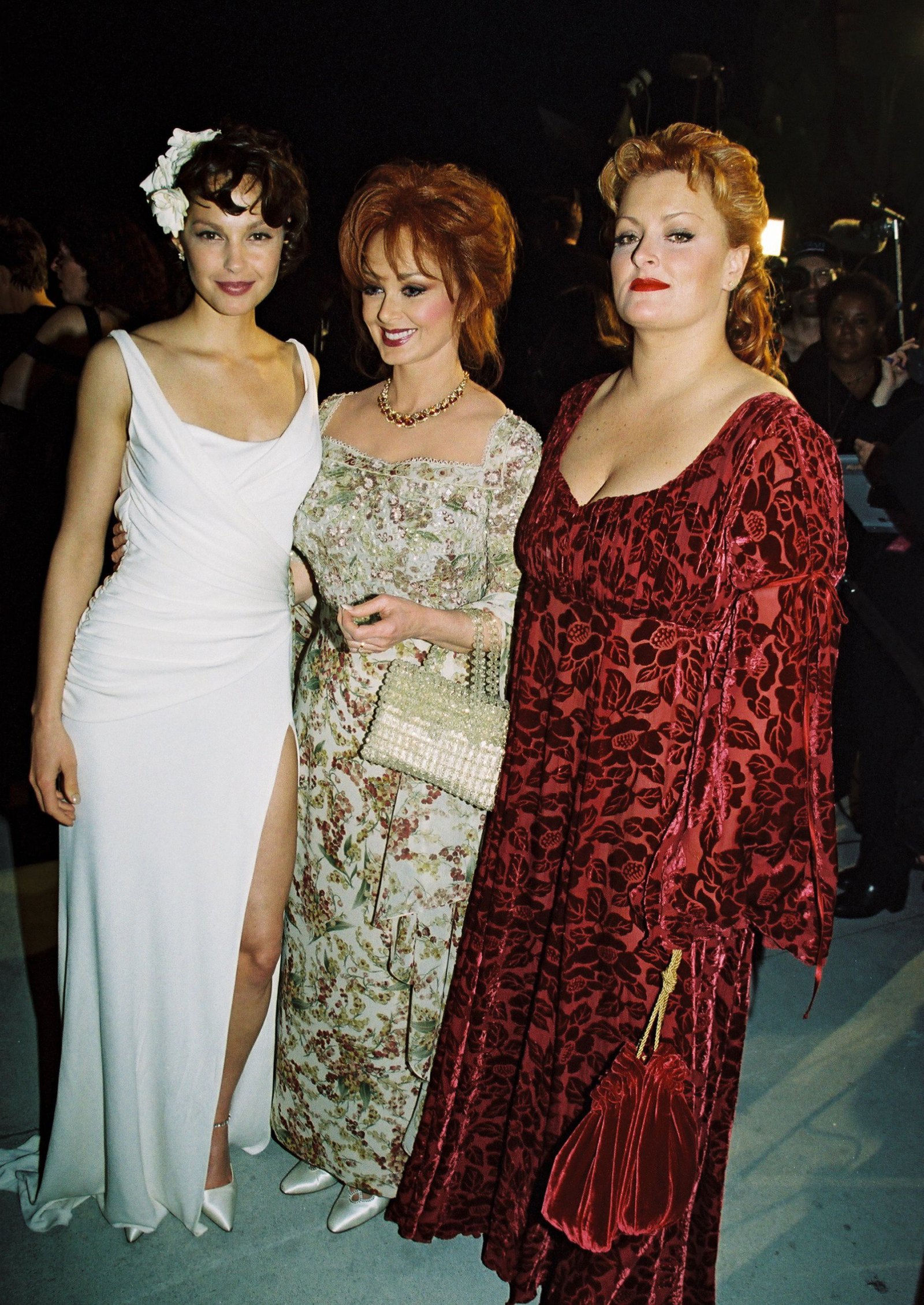

Untold Judd Family Stories Wynonna And Ashleys New Docuseries

May 14, 2025

Untold Judd Family Stories Wynonna And Ashleys New Docuseries

May 14, 2025 -

Hoge Prijs Voor Bayerns Informatie Over Nederlander

May 14, 2025

Hoge Prijs Voor Bayerns Informatie Over Nederlander

May 14, 2025 -

Wegmans Product Recall Action Plan For Braised Beef Purchase

May 14, 2025

Wegmans Product Recall Action Plan For Braised Beef Purchase

May 14, 2025 -

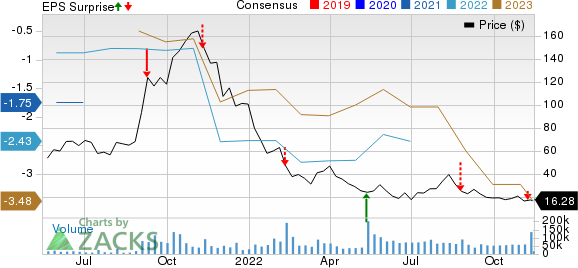

Analysis Did Trump Tariffs Kill The Affirm Holdings Afrm Ipo

May 14, 2025

Analysis Did Trump Tariffs Kill The Affirm Holdings Afrm Ipo

May 14, 2025