Tesla Q1 Earnings: Net Income Down 71% Amidst Political Headwinds

Table of Contents

Deep Dive into Tesla's Q1 2024 Financial Performance

Tesla's Q1 2024 financial performance paints a concerning picture. While precise figures will vary depending on the final reporting, preliminary data suggests a significant drop in profitability. Comparing Q1 2024 to Q1 2023 reveals a stark contrast. We can visualize this decline using charts and graphs that clearly illustrate the year-over-year changes.

- Revenue: While exact figures are pending official release, initial reports indicate a slowdown in revenue growth compared to the previous year and even previous quarters. This needs further analysis to determine if it's a temporary dip or a more concerning trend.

- Operating Expenses: A breakdown of operating expenses is crucial. Areas like Research & Development (R&D), sales, marketing, and general administration all contribute to the overall cost structure. Understanding the proportion of each expense category will help determine where cost-cutting measures might be most effective.

- Gross Margin: The gross margin, a key indicator of profitability, is expected to have decreased significantly in Q1 2024. Analyzing the reasons for this decline – increased input costs, pricing pressure, or production inefficiencies – is vital for assessing Tesla's future financial health.

- Earnings Per Share (EPS): The EPS figure is likely to reflect the significant drop in net income, painting a picture of reduced profitability for shareholders. Comparing this quarter's EPS to the previous quarter and the same quarter last year provides a clear view of the extent of the downturn.

Impact of Political Headwinds on Tesla's Q1 Performance

The significant decline in Tesla's Q1 net income cannot be solely attributed to internal factors. Political headwinds have played a significant role, creating considerable challenges for the company's operations and profitability.

- Government Regulations: New or stricter emissions regulations in key markets can increase production costs and potentially impact sales. Furthermore, evolving regulatory landscapes surrounding autonomous driving technology add complexity and uncertainty.

- Trade Wars and Tariffs: International trade disputes and tariffs can directly impact the cost of importing raw materials and exporting finished vehicles, squeezing profit margins.

- Geopolitical Instability: Political instability in regions crucial for Tesla's supply chain or sales can disrupt operations and negatively impact production and delivery schedules.

Analyzing the specific impact of each of these political factors requires a granular examination of Tesla's operations across various geographical markets. Identifying these effects and assessing potential mitigation strategies are essential for understanding the company's future prospects.

Analysis of Tesla's Production and Delivery Figures for Q1 2024

Tesla's production and delivery figures offer valuable insights into the operational challenges faced during Q1 2024. Comparing these figures to previous quarters and analysts’ expectations reveals areas of strength and weakness.

- Total Vehicle Production: The total number of vehicles produced in Q1 2024 needs to be compared to Q4 2023 and Q1 2023 to gauge the rate of production and identify any potential slowdowns.

- Production Breakdown by Model: Analyzing production figures for individual models (Model 3, Model Y, Model S, Model X) helps to understand whether production bottlenecks exist for specific vehicles.

- Delivery Numbers: Comparing delivery numbers to production figures indicates the efficiency of the supply chain and distribution network. Any significant discrepancies between production and delivery could signal logistical issues.

- Production Challenges: Identifying challenges like supply chain disruptions, factory shutdowns, or labor issues are vital for understanding any production shortfalls.

Investor Sentiment and Future Outlook for Tesla Stock

The market's reaction to Tesla's Q1 earnings report was immediate and significant. The drop in net income impacted Tesla stock, leading to considerable volatility.

- Stock Price Movement: Tracking the changes in Tesla's stock price following the earnings release provides a clear picture of investor sentiment.

- Analyst Ratings and Price Targets: Analyzing analyst ratings and price targets offers insight into future expectations for Tesla's performance and its stock valuation.

- Future Risks and Opportunities: Several factors could influence Tesla's future performance, including new product launches, intensifying competition from established and emerging EV manufacturers, and overall economic conditions.

Conclusion: Understanding the Implications of Tesla's Q1 Earnings Decline

Tesla's Q1 2024 earnings report highlights a significant 71% drop in net income, largely influenced by various internal factors and external political headwinds. Understanding these challenges is critical for investors evaluating Tesla stock and for the broader automotive industry observing the impact of political uncertainty on the EV market. Stay tuned for our ongoing coverage of Tesla's performance and the impact of political headwinds on the electric vehicle industry. Follow us for updates on future Tesla earnings and market analysis regarding Tesla stock and the evolving electric vehicle market.

Featured Posts

-

Future Of Utac Chip Tester A Chinese Buyout Firms Decision

Apr 24, 2025

Future Of Utac Chip Tester A Chinese Buyout Firms Decision

Apr 24, 2025 -

Is The Liberal Platform Right For You A Detailed Review

Apr 24, 2025

Is The Liberal Platform Right For You A Detailed Review

Apr 24, 2025 -

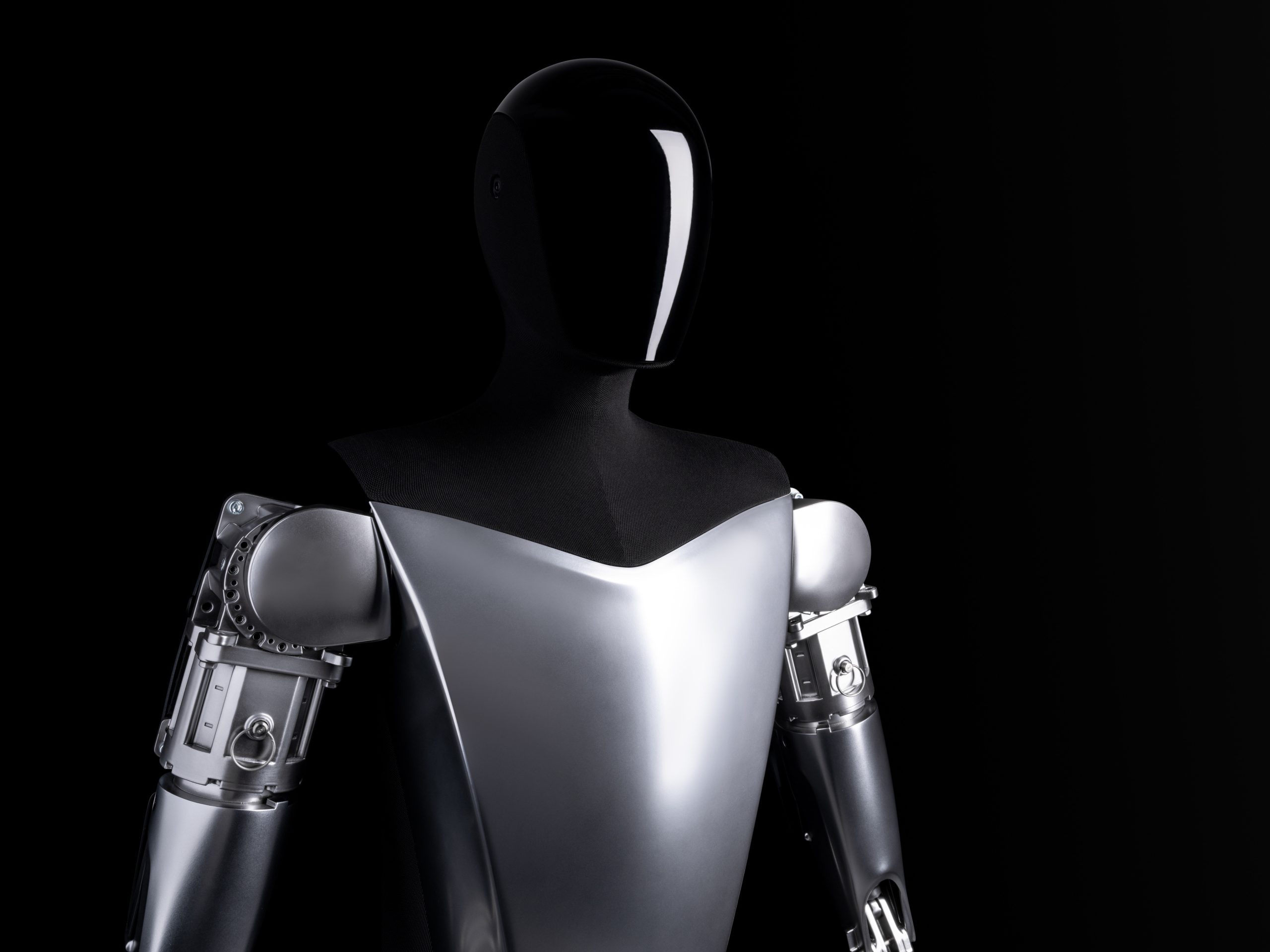

Teslas Optimus Robot Chinas Rare Earth Restrictions Cause Delays

Apr 24, 2025

Teslas Optimus Robot Chinas Rare Earth Restrictions Cause Delays

Apr 24, 2025 -

A Responsible Fiscal Plan For Canada Moving Beyond Liberal Spending

Apr 24, 2025

A Responsible Fiscal Plan For Canada Moving Beyond Liberal Spending

Apr 24, 2025 -

Lab Owner Pleads Guilty To Covid Test Result Fraud

Apr 24, 2025

Lab Owner Pleads Guilty To Covid Test Result Fraud

Apr 24, 2025