Tesla Stock Plunge: How Elon Musk's Actions Impact Dogecoin

Table of Contents

Elon Musk's Influence on Dogecoin

Elon Musk's pronouncements on Dogecoin have a demonstrably significant impact on its price. His tweets, often cryptic or playful, have sent the cryptocurrency on wild swings, demonstrating the immense power of social media and celebrity endorsements in the crypto world. This influence stems from a combination of factors: speculation driven by Musk's unpredictable behavior, the meme-based culture surrounding Dogecoin, and the widespread fear of missing out (FOMO) that grips many investors.

-

Examples of significant Musk tweets affecting Dogecoin: A simple tweet mentioning Dogecoin can trigger a surge in buying, while a less enthusiastic statement can lead to a sharp drop. Analyzing these events reveals a direct correlation between Musk's social media activity and Dogecoin's price movements.

-

Market reaction analysis: Charts illustrating the price spikes and dips immediately following Musk's tweets clearly demonstrate this causal relationship. (Ideally, this section would include relevant charts and graphs showcasing this correlation).

-

Social media's role: Social media platforms like Twitter have become primary channels for disseminating information – and misinformation – about Dogecoin, amplifying Musk's influence and fostering a speculative frenzy.

Tesla Stock Performance and Investor Sentiment

The recent Tesla stock plunge is attributable to a confluence of factors, including weakening economic conditions, intensifying competition in the electric vehicle market, and concerns surrounding Musk's other ambitious ventures, such as SpaceX and his acquisition of Twitter (now X). This negative sentiment surrounding Tesla indirectly impacts investor perception of Musk's other endeavors, including Dogecoin. A decline in confidence in Tesla can translate into a less bullish outlook on any asset associated with Musk.

-

Key factors influencing Tesla's stock price: Economic downturns, production challenges, increased competition, and regulatory scrutiny are all factors affecting Tesla's stock performance.

-

Investor sentiment analysis: Negative news about Tesla often correlates with a drop in both Tesla's stock price and investor confidence in related ventures like Dogecoin. Sentiment analysis tools can provide valuable insights into this connection.

-

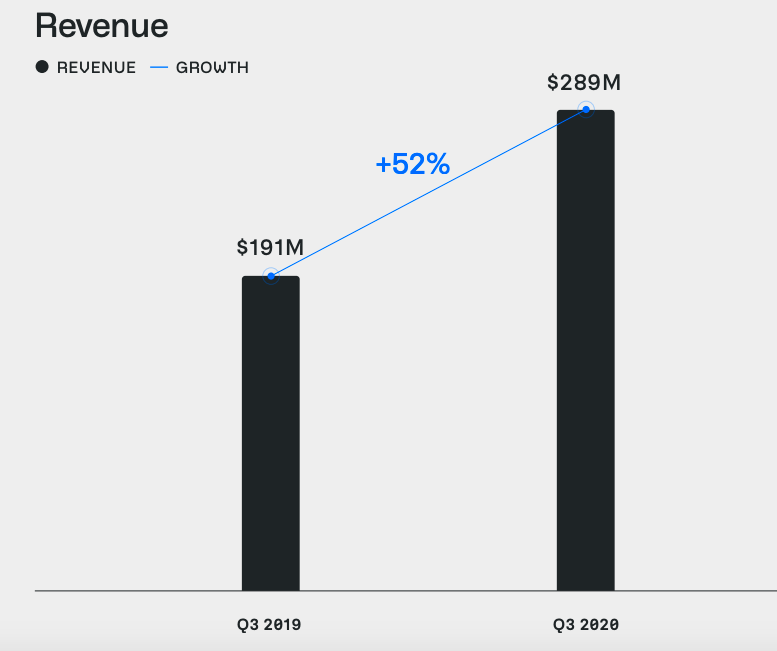

Statistical data comparison: A statistical analysis comparing Tesla's stock price movements with Dogecoin's price fluctuations over time could reveal a correlation, though it's likely to be complex and not always direct.

The Risks of Investing in Dogecoin (and Tesla)

Both Tesla stock and Dogecoin are exceptionally volatile assets. Their prices are subject to dramatic swings driven by market sentiment, news events, and – in Dogecoin's case – the unpredictable pronouncements of a single individual. Investing in assets so heavily reliant on one person's actions presents significant risk.

-

Volatility's impact: Extreme price volatility can lead to substantial losses for investors who are not prepared for sudden and drastic market fluctuations.

-

Past Dogecoin crashes: Analyzing past instances of sharp Dogecoin price declines provides valuable insight into the potential for significant losses.

-

Responsible investing and risk management: Diversification is crucial for mitigating risk. Investors should only allocate a small percentage of their portfolio to highly speculative assets like Dogecoin and thoroughly research any investment before committing funds.

Alternative Cryptocurrencies Less Dependent on Musk

While Dogecoin's appeal partly lies in its connection to Elon Musk, investors seeking less volatile options might consider alternative cryptocurrencies with more established fundamentals and a broader range of use cases, minimizing reliance on the influence of a single individual. Researching cryptocurrencies with robust technology and strong community support is vital for making informed investment decisions.

Conclusion: Navigating the Tesla-Dogecoin Correlation – A Call to Action

The relationship between Tesla's stock performance and Dogecoin's price is complex, but the significant influence of Elon Musk on both is undeniable. While there may be some correlation, it's far from a direct or predictable one. Investing in either Tesla stock or Dogecoin involves considerable risk due to their volatile nature and dependence on market sentiment.

Before investing in any asset, especially volatile ones like Tesla stock and Dogecoin, thorough research is paramount. Understand the inherent risks, diversify your portfolio, and only invest what you can afford to lose. Further reading on responsible investment strategies and risk management can significantly enhance your understanding of the complexities of the financial markets and protect your investment.

Featured Posts

-

Kh Stiven King Vislovivsya Pro Trampa Ta Maska

May 09, 2025

Kh Stiven King Vislovivsya Pro Trampa Ta Maska

May 09, 2025 -

Vu Viec O Tien Giang Bao Ve Tre Em Khoi Bao Luc Tai Cac Co So Giu Tre

May 09, 2025

Vu Viec O Tien Giang Bao Ve Tre Em Khoi Bao Luc Tai Cac Co So Giu Tre

May 09, 2025 -

A Data Driven Look At The Countrys New Business Hot Spots

May 09, 2025

A Data Driven Look At The Countrys New Business Hot Spots

May 09, 2025 -

Is Palantir Technologies Stock A Buy Now A Comprehensive Analysis

May 09, 2025

Is Palantir Technologies Stock A Buy Now A Comprehensive Analysis

May 09, 2025 -

Large Scale Alaska Protest Targets Doge And Trump Administration Initiatives

May 09, 2025

Large Scale Alaska Protest Targets Doge And Trump Administration Initiatives

May 09, 2025