Tesla's Rise Lifts US Stocks: Tech Giants Power Market Gains

Table of Contents

Tesla's Stellar Performance: Driving Force Behind Market Gains

Tesla's recent successes are undeniable, serving as a primary driver behind the current market rally. The company's strong sales figures, innovative product launches, and overwhelmingly positive investor sentiment have all contributed to its spectacular stock performance. Tesla's growth isn't just about selling cars; it's about shaping the future of transportation and influencing a broader shift towards sustainable energy.

- Record Sales Growth: Tesla reported a staggering X% increase in vehicle deliveries in Q[Quarter] [Year], exceeding analyst expectations and demonstrating robust demand for its electric vehicles (EVs).

- Innovative Product Launches: The introduction of the Cybertruck and advancements in autonomous driving technology have captivated consumers and investors alike, further fueling Tesla's growth and market capitalization.

- Positive Analyst Ratings: Numerous prominent financial analysts have increased their price targets for Tesla's stock, reflecting a strong belief in the company's long-term potential and its ability to maintain its market leadership in the EV sector. This positive sentiment spills over into broader investor confidence.

Ripple Effect on Other Tech Giants

Tesla's success isn't confined to its own market cap; it's having a significant ripple effect on other tech companies. Increased investor confidence in the broader tech sector, driven by Tesla's performance, is boosting the valuations of related companies. This positive sentiment spillover is a key factor in the current market rally.

- Related EV Companies: Companies involved in battery technology, charging infrastructure, and other EV-related technologies are experiencing a boost in their stock prices, benefiting from the overall positive sentiment surrounding the EV sector.

- Positive Investor Sentiment: Tesla's success acts as a catalyst, boosting overall investor confidence in the tech sector and encouraging investment in other innovative companies. This is a clear demonstration of market correlation.

- Portfolio Diversification: Investors are increasingly diversifying their portfolios, including exposure to companies associated with the burgeoning EV industry and other Tesla-related technologies.

Broader Market Implications: Tesla's Influence on the US Stock Market

The impact of Tesla's growth on the US stock market is undeniable. The correlation between Tesla's stock price and major US stock market indices, such as the S&P 500 and Nasdaq, is increasingly evident. This suggests a powerful influence on broader investor sentiment and market trends.

- Correlation with Market Indices: Data clearly shows a strong positive correlation between Tesla's stock performance and the performance of major US stock market indices. As Tesla's stock price rises, so do these indices.

- Investor Sentiment: Positive investor sentiment towards Tesla spills over into the broader market, influencing investment decisions and overall market confidence. This is a crucial factor driving market growth.

- Macroeconomic Factors: While Tesla's performance is a significant driver, it’s important to acknowledge the influence of macroeconomic factors, such as interest rates and economic growth, on the overall market performance.

Analyzing the Sustainability of Tesla's Impact

While Tesla's current impact on the US stock market is significant, the question of sustainability remains. Maintaining this level of influence depends on several factors, including continued innovation, competition, and the overall economic climate.

- Competitive Landscape: Increased competition in the EV market could pose a challenge to Tesla's continued dominance and sustained growth.

- Economic Downturns: A significant economic downturn could negatively impact consumer spending on luxury goods like Tesla vehicles, affecting its performance and market influence.

- Future Outlook: Experts generally agree that the long-term prospects for the EV market remain strong, suggesting potential for continued growth for Tesla and the broader sector. However, challenges remain.

Conclusion: Tesla's Rise and the Future of US Stocks

In conclusion, Tesla's phenomenal performance is undeniably lifting US stocks, significantly impacting other tech giants and the overall market sentiment. The strong correlation between Tesla's rise and market gains is evident. However, the sustainability of this influence hinges on factors such as sustained innovation, competitive pressures, and macroeconomic conditions.

Stay tuned for further updates on Tesla's impact and how its continued rise might lift US stocks in the future. Follow our insights for more on Tesla's rise and its market influence, and for further analysis on Tesla's stock and its effect on the US stock market performance.

Featured Posts

-

Your Guide To Getting Capital Summertime Ball 2025 Tickets

Apr 29, 2025

Your Guide To Getting Capital Summertime Ball 2025 Tickets

Apr 29, 2025 -

Wnba Bound Diamond Johnson Of Norfolk State Heads To Minnesota Lynx Camp

Apr 29, 2025

Wnba Bound Diamond Johnson Of Norfolk State Heads To Minnesota Lynx Camp

Apr 29, 2025 -

Understanding The Surge In The Venture Capital Secondary Market

Apr 29, 2025

Understanding The Surge In The Venture Capital Secondary Market

Apr 29, 2025 -

Pre Owned Porsche 911 S T In Riviera Blue Pts

Apr 29, 2025

Pre Owned Porsche 911 S T In Riviera Blue Pts

Apr 29, 2025 -

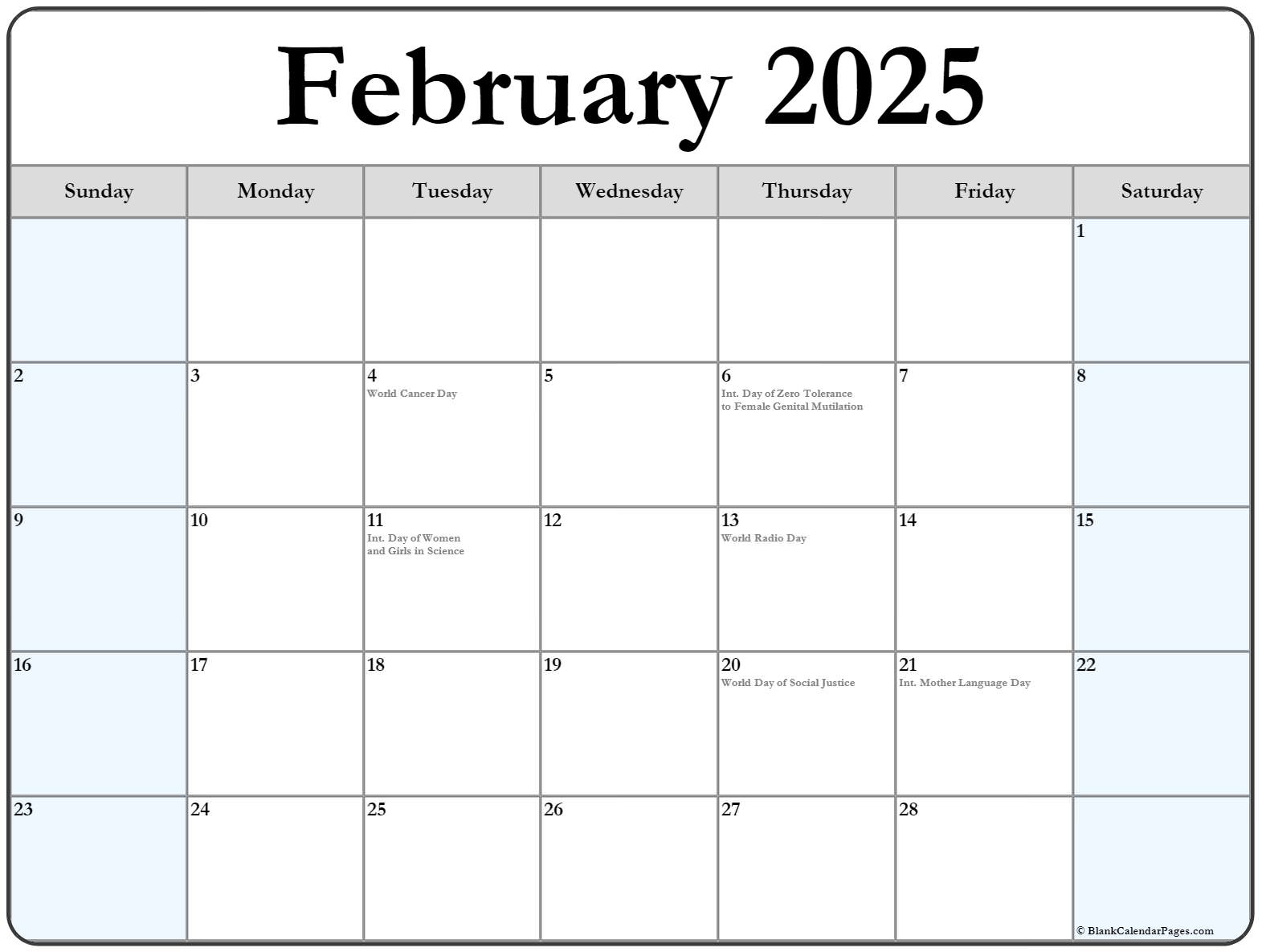

February 20 2025 Ideas For A Happy Day

Apr 29, 2025

February 20 2025 Ideas For A Happy Day

Apr 29, 2025