The BofA View: Why Current Stock Market Valuations Are Not A Cause For Alarm

Table of Contents

BofA's Macroeconomic Outlook: A Foundation for Bullish Sentiment

BofA's bullish sentiment on the stock market is grounded in its positive macroeconomic forecasts. Their analysts predict continued, albeit moderate, economic growth, creating a favorable environment for corporate earnings and stock market performance. This optimistic view is supported by several key factors:

- Projected GDP Growth and its Impact on Corporate Earnings: BofA projects sustained GDP growth, albeit at a slower pace than in previous years. This moderate growth, they argue, is still sufficient to drive corporate earnings, justifying current valuations. Stronger-than-expected GDP numbers could further boost stock prices.

- Inflation Expectations and the Federal Reserve's Monetary Policy: While inflation remains a concern, BofA anticipates a gradual decline as the Federal Reserve's monetary policy continues to tighten. This controlled inflation scenario should support market stability and prevent significant shocks to stock valuations. Changes in the Fed's interest rate targets will significantly impact market sentiment.

- Global Economic Growth Trends and their Influence on US Markets: BofA acknowledges global economic uncertainties but believes that the resilience of the US economy will help insulate domestic markets from significant negative impacts. Global economic headwinds, however, are a potential risk factor.

- Geopolitical Factors and their Potential Effect on Stock Valuations: Geopolitical risks, such as the ongoing conflict in Ukraine, are acknowledged as potential downside risks. However, BofA's analysis suggests that these risks are largely priced into current valuations. Keywords: macroeconomic outlook, GDP growth, inflation, Federal Reserve, geopolitical risk.

Earnings Growth: Outpacing Valuation Concerns

BofA's analysis emphasizes the importance of robust earnings growth in justifying current stock market valuations. Their projections show corporate earnings exceeding expectations, potentially offsetting concerns about high valuations.

- Sectors Expected to Outperform and Their Contribution to Overall Earnings Growth: BofA highlights specific sectors, such as technology and healthcare, which are expected to outperform and contribute significantly to overall earnings growth. Strong earnings in these sectors act as a significant market driver.

- Analysis of Specific Companies and Their Potential for Future Earnings: The firm’s analysts have carefully assessed individual companies, identifying those with strong growth potential and highlighting their contributions to overall market performance. Individual stock analysis is key to a robust investment strategy.

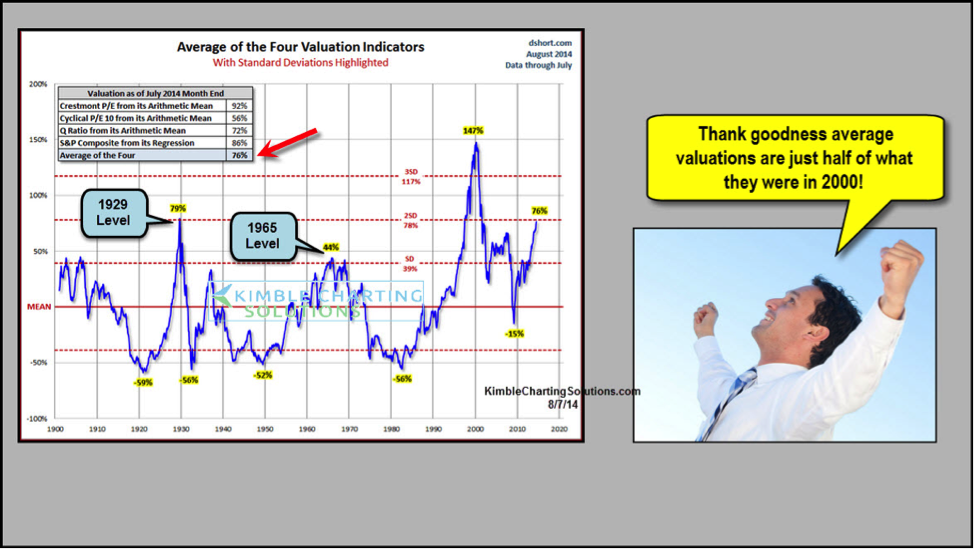

- Comparison of Current Earnings Growth to Historical Averages: BofA's research shows that current earnings growth, while perhaps slower than in some previous periods, still compares favorably to historical averages. Comparing the current situation with historical market data provides context.

- Discussion of Potential Risks to Earnings Growth: While optimistic, BofA acknowledges potential risks, such as supply chain disruptions or a potential economic slowdown, which could impact earnings growth. Recognizing and mitigating these risks is essential for effective investment management. Keywords: corporate earnings, earnings growth, stock market performance, sector analysis.

Interest Rates and Their Impact on Stock Valuations

Interest rates play a crucial role in determining stock valuations, affecting discounted cash flow models used to assess the intrinsic value of companies. BofA's view on interest rate movements is key to understanding their overall market outlook.

- Explanation of How Interest Rate Changes Affect Discounted Cash Flow Models: Higher interest rates generally lower the present value of future earnings, potentially reducing stock valuations. BofA's analysts account for this in their valuation models.

- BofA's Prediction for Future Interest Rate Movements: BofA’s projections for future interest rate movements are crucial in assessing the impact on stock valuations and the overall market. They consider a scenario of gradually rising interest rates, which they believe is already largely priced in.

- Comparison of Current Interest Rates to Historical Levels: The current interest rate environment is analyzed in the context of historical levels to provide a balanced perspective. This historical context provides valuable insight.

- Discussion of the Relationship Between Interest Rates and Market Risk: BofA’s analysis addresses the correlation between interest rates and market risk, particularly the potential impact on bond yields and their attractiveness as an alternative asset class. Keywords: interest rates, discounted cash flow, market risk, bond yields.

Alternative Investment Opportunities and Their Role in the Market

BofA also considers alternative investment opportunities and their influence on stock market valuations. The attractiveness of other asset classes impacts investor allocation and overall market dynamics.

- Discuss the Attractiveness of Other Asset Classes (e.g., Bonds, Real Estate): BofA acknowledges the appeal of other asset classes, such as bonds and real estate, particularly in times of economic uncertainty. Diversification is an essential element of risk management.

- How Investor Allocation Influences Stock Market Valuations: Investor allocation across different asset classes significantly impacts stock market valuations. BofA’s analysis considers this dynamic.

- Explain Why Current Stock Prices Aren't Necessarily Inflated Compared to Alternatives: BofA argues that, considering the potential returns and relative risk of other asset classes, current stock prices aren't necessarily overinflated. Keywords: alternative investments, asset allocation, risk diversification, bond market.

Conclusion: BofA's View: A Balanced Perspective on Stock Market Valuations

In conclusion, BofA's analysis suggests that while concerns about stock market valuations are understandable, they aren't necessarily a cause for alarm. Their positive macroeconomic outlook, projections for strong earnings growth, considered analysis of interest rate impacts, and a balanced view of alternative investment opportunities all contribute to their relatively bullish stance. Understand the BofA view on stock market valuations; don't be alarmed by current stock market valuations. Remember that a balanced approach to investment decision-making is crucial. Explore BofA's investment insights and review BofA's analysis of stock market valuations to inform your own investment strategy.

Featured Posts

-

Ai Transforms Repetitive Scatological Documents Into A Profound Poop Podcast

Apr 22, 2025

Ai Transforms Repetitive Scatological Documents Into A Profound Poop Podcast

Apr 22, 2025 -

Tik Toks Just Contact Us Tariff Workarounds Are They Legit

Apr 22, 2025

Tik Toks Just Contact Us Tariff Workarounds Are They Legit

Apr 22, 2025 -

Zuckerberg And Trump A New Era For Facebook And Politics

Apr 22, 2025

Zuckerberg And Trump A New Era For Facebook And Politics

Apr 22, 2025 -

Middle Managers The Unsung Heroes Of Business Growth And Employee Development

Apr 22, 2025

Middle Managers The Unsung Heroes Of Business Growth And Employee Development

Apr 22, 2025 -

Blue Origin Postpones Launch Details On Subsystem Failure

Apr 22, 2025

Blue Origin Postpones Launch Details On Subsystem Failure

Apr 22, 2025