The Connection Between China's Steel Cuts And Falling Iron Ore Prices

Table of Contents

China's Steel Production Slowdown: The Driving Force

China's steel production cuts are the primary catalyst for the falling iron ore prices. Several factors contribute to this slowdown:

-

Environmental Regulations: The Chinese government has implemented increasingly stringent environmental regulations to combat air pollution and carbon emissions. These regulations have forced many steel mills to curb production or even shut down altogether, significantly impacting overall output. The stricter emission standards target particularly high-pollution processes in steel manufacturing.

-

Real Estate Market Slowdown: China's once-booming real estate sector has experienced a significant slowdown. This decrease in construction activity directly translates to reduced demand for steel, a crucial component in buildings and infrastructure. The property market downturn has had a domino effect, impacting the demand for steel across various sectors.

-

Government Policies: The Chinese government has actively pursued policies aimed at controlling overcapacity in its steel industry. This includes imposing production quotas and encouraging mergers and acquisitions to consolidate the sector and enhance efficiency. These measures, while aimed at long-term sustainability, have resulted in a short-term reduction in steel output.

-

Specific Data: Reports indicate a decrease of X% in China's steel production in the last quarter (insert specific data here, referencing reputable sources). Government announcements regarding production quotas and environmental policies (cite specific announcements and links) have further fueled this decline. Regions like Hebei, a major steel-producing province, have experienced particularly sharp production cuts.

The Impact on Iron Ore Demand and Prices

The reduction in China's steel production has had an immediate and significant impact on global iron ore demand. As China accounts for a vast majority of global iron ore consumption, any decrease in its steel output directly translates to lower demand for this essential raw material.

-

Supply and Demand Dynamics: The reduced demand from China has created a surplus of iron ore in the global market. This oversupply is the primary driver behind the sharp decline in iron ore prices. Basic economic principles of supply and demand are clearly at play.

-

Market Reaction: Iron ore prices have plummeted in response to China's steel production cuts. (Include a chart or graph illustrating the price fluctuation, clearly showing the correlation between steel production cuts and iron ore price drops). The price volatility underscores the sensitivity of the iron ore market to changes in Chinese steel production.

-

Impact on Producers: Major iron ore producers in Australia and Brazil have been significantly affected by the price drop. They have responded with various strategies, including production adjustments and cost-cutting measures, to mitigate the impact on their profitability. Future price predictions remain uncertain, but analysts anticipate continued volatility in the short term.

Global Implications of the Price Drop

The falling iron ore prices have far-reaching global implications, impacting various sectors and economies.

-

Impact on Mining Companies: The decreased iron ore prices pose significant financial challenges for mining companies, leading to potential job losses and reduced investment in new projects. This ripple effect is felt throughout their supply chains and related industries.

-

Effect on Global Steel Production: While lower iron ore prices might seem beneficial for steel producers in other countries, the reduced demand and price instability in the market create uncertainty, potentially leading to cautious investment decisions in the global steel industry.

-

Geopolitical Considerations: China's actions and their impact on global commodity markets have significant geopolitical ramifications. The price volatility could strain trade relationships and increase competition for resources.

-

Impact on Different Economies: Countries heavily reliant on iron ore exports, like Australia and Brazil, face economic repercussions. The decreased revenue from iron ore sales can impact their trade balances and overall economic growth.

Conclusion

In conclusion, China's steel production cuts are directly causing a significant decline in iron ore prices, with considerable global implications. The interplay of environmental regulations, economic slowdown, government policies, and global market forces is shaping the future of both the steel and iron ore industries. The impact on mining companies, global steel production, and international trade relations is substantial and ongoing.

Stay updated on the latest developments in the dynamic relationship between China's steel cuts and iron ore prices. Follow our updates for further analysis and insights into this crucial market.

Shifting Sands Chinas Canola Supply Chain After Canada Relations Sour

Shifting Sands Chinas Canola Supply Chain After Canada Relations Sour

Why The Fed Remains Cautious On Interest Rate Cuts

Why The Fed Remains Cautious On Interest Rate Cuts

Hertls Two Hat Tricks Fuel Golden Knights Win Against Red Wings

Hertls Two Hat Tricks Fuel Golden Knights Win Against Red Wings

Living Legends Of Aviation Honors Firefighters And Other Heroes

Living Legends Of Aviation Honors Firefighters And Other Heroes

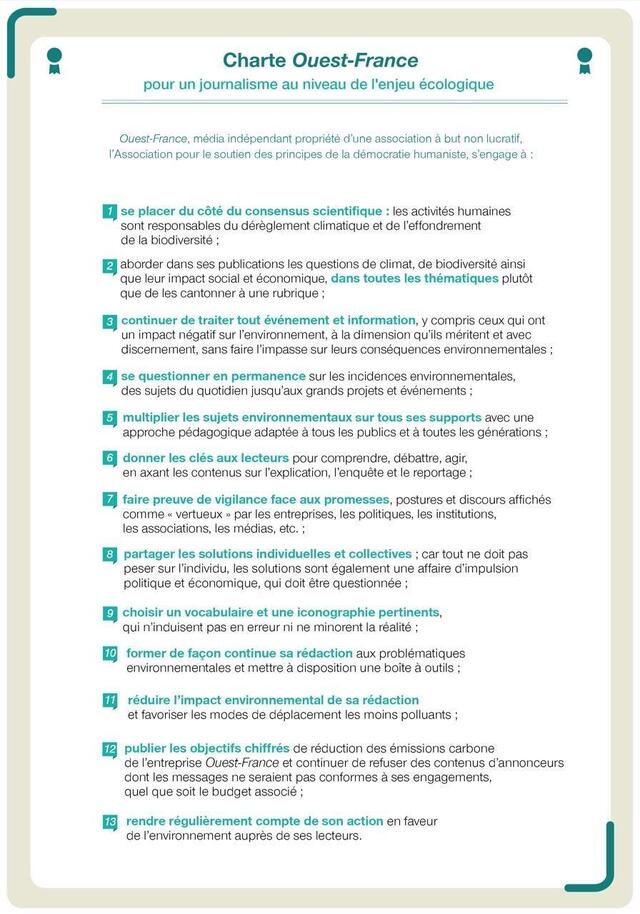

Dijon 2026 L Enjeu Ecologique Des Municipales

Dijon 2026 L Enjeu Ecologique Des Municipales