The Connection Between China's Steel Production And Iron Ore Prices

Table of Contents

China's Steel Production: The Engine of Iron Ore Demand

China's steel industry is a behemoth, driving global iron ore demand to unprecedented levels.

The Sheer Scale of Chinese Steel Production

China's annual steel production consistently accounts for a significant portion of global output.

- Annual Production: For years, China has produced well over 1 billion tonnes of steel annually. (Specific yearly figures should be inserted here, sourced from reputable statistics providers like the World Steel Association.)

- Global Dominance: China's steel production represents over half of the world's total.

- Key Producing Regions: Major steel production centers are located in Hebei, Jiangsu, Shandong, and other provinces, fueling regional economic growth and impacting local infrastructure needs.

The steel produced serves a vast array of applications: construction of skyscrapers and infrastructure projects (roads, bridges, railways), manufacturing of automobiles and appliances, and the production of various industrial goods. This diverse demand ensures China's steel mills remain busy, creating an insatiable appetite for iron ore.

Demand Drivers

Several factors fuel China's massive steel consumption:

- Infrastructure Projects: The ambitious Belt and Road Initiative, along with massive domestic infrastructure development, requires colossal amounts of steel.

- Real Estate Development: China's booming construction industry, including residential and commercial projects, contributes significantly to steel demand.

- Manufacturing Growth: China's vast manufacturing sector relies heavily on steel for machinery, tools, and components.

- Urbanization: The ongoing urbanization process, with millions migrating from rural areas to cities, necessitates the construction of new housing, infrastructure, and public facilities.

Economic growth directly correlates with steel demand. Government policies, such as stimulus packages focused on infrastructure development, further amplify this demand, creating a ripple effect across the global iron ore market.

The Supply Chain: From Iron Ore Mines to Steel Mills

The journey of iron ore from mine to steel mill is a complex and crucial aspect of the relationship between China's steel production and iron ore prices.

Major Iron Ore Suppliers to China

China relies heavily on several countries for its iron ore imports:

- Australia: Australia is a dominant supplier, with its high-quality iron ore playing a crucial role in China's steelmaking.

- Brazil: Brazil is another significant exporter, offering substantial volumes to the Chinese market.

- Other Suppliers: Other countries, such as South Africa and India, also contribute to China's iron ore imports, albeit to a lesser extent.

(Specific market share data for each supplier should be included here, along with details of transportation routes – primarily seaborne – and potential disruptions like weather events or geopolitical instability.)

Transportation and Logistics

Efficient and cost-effective transportation is paramount:

- Shipping Costs: Ocean freight costs significantly impact the final price of iron ore, influencing the profitability of steel production.

- Port Infrastructure: The capacity and efficiency of Chinese ports play a crucial role in handling the massive influx of iron ore.

- Potential Bottlenecks: Congestion at ports, rail transport limitations, or disruptions in shipping can cause delays and price fluctuations.

Price Dynamics: How Steel Production Impacts Iron Ore Prices

The correlation between China's steel production and iron ore prices is undeniable.

The Correlation Between Supply and Demand

Changes in Chinese steel production directly impact iron ore demand and subsequently its price:

- High Steel Production: Periods of robust steel production lead to increased iron ore demand, pushing prices upward.

- Low Steel Production: Conversely, a slowdown in steel production reduces demand, leading to lower iron ore prices.

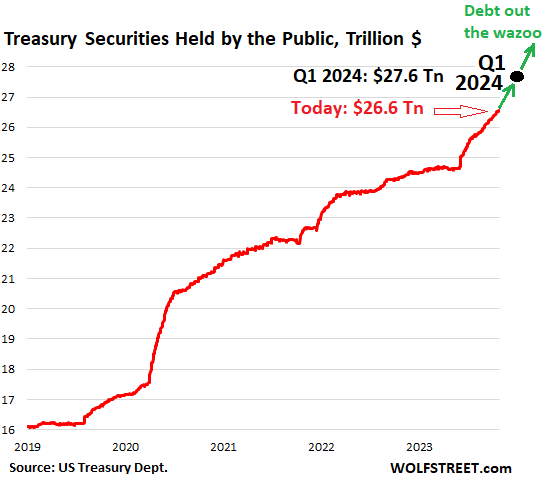

(Include a chart or graph here illustrating the historical correlation between China's crude steel production and iron ore prices. Data sources should be clearly cited.)

Speculation and Market Sentiment

Market sentiment and speculation play a significant role:

- Global Economic Conditions: Global economic growth or recession significantly influences investor confidence and iron ore prices.

- Geopolitical Events: Political instability in major iron ore producing or consuming countries can create uncertainty and price volatility.

- Market Expectations: Future expectations regarding China's steel production and economic growth influence trading activity and price fluctuations.

Government Policies and Their Influence

Chinese government policies exert a powerful influence on both steel production and iron ore demand.

Chinese Government's Role in Steel Production and Environmental Regulations

Government policies play a significant role:

- Environmental Regulations: Stringent environmental regulations aimed at curbing pollution from steel mills can lead to production cuts and impact iron ore demand.

- Production Quotas: Government-imposed production quotas or capacity restrictions can also influence steel output and iron ore consumption.

- Stimulus Packages: Conversely, government stimulus packages focused on infrastructure development can significantly boost steel production and iron ore demand.

(Specific examples of recent policies and their impact should be included here, along with an analysis of potential future policies and their likely effects on the market.)

Conclusion: Understanding the Dynamic Relationship Between China's Steel Production and Iron Ore Prices

The strong correlation between China's steel production and global iron ore prices is undeniable. China's massive steel industry acts as the primary engine of global iron ore demand. Fluctuations in steel production, influenced by economic growth, government policies, and global market conditions, directly impact iron ore prices. Careful monitoring of both steel production levels and government policies is crucial for predicting future price trends. Stay ahead of the curve by regularly monitoring changes in China's steel production and its impact on iron ore prices. Understanding this dynamic relationship is vital for informed decision-making in this critical global commodity market.

Featured Posts

-

Data Breach Nhs Staff Face Inquiry Over Access To Nottingham Stabbing Victims Records

May 10, 2025

Data Breach Nhs Staff Face Inquiry Over Access To Nottingham Stabbing Victims Records

May 10, 2025 -

Elon Musks Billions A Deep Dive Into The Recent Net Worth Decrease

May 10, 2025

Elon Musks Billions A Deep Dive Into The Recent Net Worth Decrease

May 10, 2025 -

Uncovering The Truth Does Us Funding Support Transgender Mouse Research

May 10, 2025

Uncovering The Truth Does Us Funding Support Transgender Mouse Research

May 10, 2025 -

Potential August Expiration Of Us Debt Limit Measures Treasury Alert

May 10, 2025

Potential August Expiration Of Us Debt Limit Measures Treasury Alert

May 10, 2025 -

Letartoztattak Egy Transznemu Not Floridaban A Noi Mosdo Hasznalataert

May 10, 2025

Letartoztattak Egy Transznemu Not Floridaban A Noi Mosdo Hasznalataert

May 10, 2025