The Country's Newest Business Hotspots: Where To Invest Now

Table of Contents

H2: Emerging Tech Hubs: Silicon [Region Name] and Beyond

The rise of innovative technology is reshaping the economic landscape, and several regions are emerging as leading tech hubs. Understanding these emerging areas is crucial for investors seeking high-growth opportunities.

H3: The Rise of [Specific City/Region]: (e.g., The Rise of Austin, Texas)

Austin, Texas, exemplifies the explosive growth of a modern tech hub. Several factors fuel its success:

- High concentration of tech startups and venture capital funding: Austin boasts a thriving ecosystem of startups attracting significant venture capital investment, creating a fertile ground for innovation and high returns. This concentration attracts both domestic and international investors.

- Strong university partnerships fostering innovation: The University of Texas at Austin, along with other institutions, fuels the city's innovation engine through research collaborations, talent pipelines, and the creation of spin-off companies. This creates a self-sustaining cycle of innovation and growth.

- Developing smart city initiatives attracting tech giants: Austin's commitment to smart city technologies is attracting major tech companies seeking to establish a presence in a forward-thinking environment. This contributes to infrastructure improvements and job creation.

H3: [Another Emerging Tech Hub]: (e.g., The Rise of Seattle's Biotech Corridor)

Seattle's biotech corridor presents a different, but equally compelling, investment opportunity. While also benefiting from a strong university presence (University of Washington), Seattle's focus on biotechnology offers a unique niche:

- Focus on specific industry niches driving economic growth: Seattle’s biotech sector is highly specialized, focusing on cutting-edge areas like gene therapy and personalized medicine. This concentration allows for deeper expertise and attracts targeted investment.

- Analysis of local talent pool and skill sets: The region boasts a highly skilled workforce with expertise in biotechnology, pharmaceuticals, and related fields, reducing the need for expensive recruitment efforts.

- Comparison with other tech hubs, identifying competitive advantages: Unlike Silicon Valley's high cost of living and competition, Seattle offers a more affordable and less saturated market, potentially yielding higher returns on investment.

H2: Booming Renewable Energy Sectors: Investing in a Green Future

The shift towards renewable energy presents a significant investment opportunity. Government policies and increasing environmental awareness are driving substantial growth in this sector.

H3: [Specific Region/State] Leading the Charge: (e.g., California's Solar Power Boom)

California's commitment to renewable energy is setting the standard. Government incentives and supportive policies are fostering significant growth:

- Analysis of renewable energy projects underway (solar, wind, etc.): Numerous large-scale solar and wind energy projects are underway, creating ample opportunities for investors in both development and infrastructure.

- Potential for return on investment in this sector: The increasing demand for renewable energy translates into significant potential returns on investment, particularly for long-term strategies.

- Discussion of environmental, social, and governance (ESG) aspects: Investing in renewable energy aligns with ESG criteria, attracting investors increasingly focused on sustainable and responsible practices.

H3: Opportunities in Green Technology:

Beyond direct energy generation, related technologies are experiencing explosive growth:

- Identification of key players and investment opportunities: Companies developing advanced battery technology, energy storage solutions, and smart grids are key players in this growing market.

- Analysis of market trends and future projections: The market for green technologies is expected to expand exponentially, creating sustained opportunities for investors.

- Discussion of potential risks and challenges: While promising, investors should also consider potential risks such as technological disruptions and fluctuating government policies.

H2: Resurgent Manufacturing and Logistics Centers: Supply Chain Strength

The resurgence of manufacturing and the strategic importance of efficient logistics are creating new investment opportunities.

H3: [Specific City/Region] – A Manufacturing Powerhouse: (e.g., The Resurgence of Manufacturing in the Midwest)

The Midwest is experiencing a manufacturing renaissance driven by automation and reshoring:

- Analysis of available infrastructure (ports, transportation networks): The region boasts a well-established infrastructure, including access to major transportation routes and improved port facilities.

- Discussion of skilled labor availability: While some skills gaps exist, initiatives to retrain workers and attract skilled labor are addressing these challenges.

- Focus on specific manufacturing sectors experiencing growth: Specific sectors like automotive manufacturing and advanced materials are experiencing particularly strong growth.

H3: Strategic Logistics Hubs:

Efficient logistics are crucial for global competitiveness:

- Analysis of key transportation routes and access to major markets: Strategic locations near major transportation hubs and close proximity to large consumer markets are highly attractive.

- Discussion of investment opportunities in warehousing and logistics companies: Investment in warehousing, distribution centers, and logistics technology companies offers strong growth potential.

- Consideration of e-commerce growth and its impact: The explosive growth of e-commerce is driving demand for advanced logistics solutions, creating significant opportunities.

3. Conclusion:

The country's newest business hotspots offer a diverse range of lucrative investment opportunities. From the dynamic growth of tech hubs to the burgeoning renewable energy sector and the resurgence of manufacturing and logistics, investors have ample choices. The key is to identify the areas best aligned with your investment strategy and risk tolerance. These hotspots represent not just promising financial returns but also a chance to contribute to the country's economic transformation.

Explore the country's newest business hotspots today and secure your future investment success! Further research can be conducted through government websites such as [link to relevant government website] and industry reports from [link to industry reports]. Act quickly to capitalize on these emerging opportunities before they reach full maturity.

Featured Posts

-

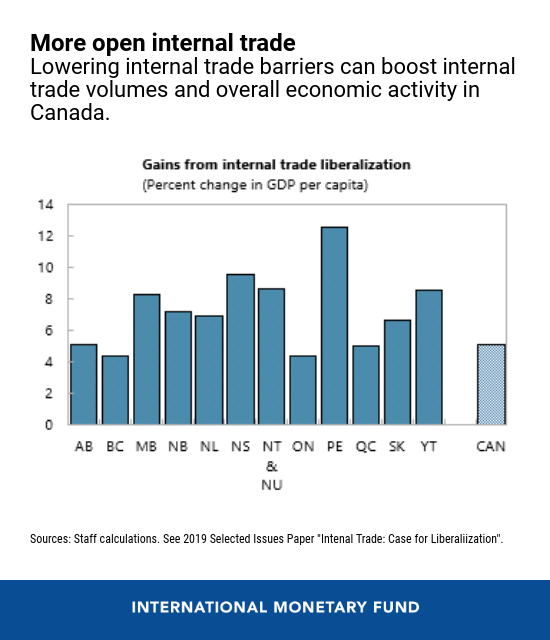

Canadas Economic Outlook The Urgent Need For Fiscal Prudence From Liberals

Apr 24, 2025

Canadas Economic Outlook The Urgent Need For Fiscal Prudence From Liberals

Apr 24, 2025 -

Bold And The Beautiful Recap April 16 Hopes Worries And Bridgets Unexpected News

Apr 24, 2025

Bold And The Beautiful Recap April 16 Hopes Worries And Bridgets Unexpected News

Apr 24, 2025 -

The China Market Navigating Challenges For Bmw Porsche And Other Automakers

Apr 24, 2025

The China Market Navigating Challenges For Bmw Porsche And Other Automakers

Apr 24, 2025 -

Miami Steakhouse John Travoltas Pulp Fiction Culinary Experience

Apr 24, 2025

Miami Steakhouse John Travoltas Pulp Fiction Culinary Experience

Apr 24, 2025 -

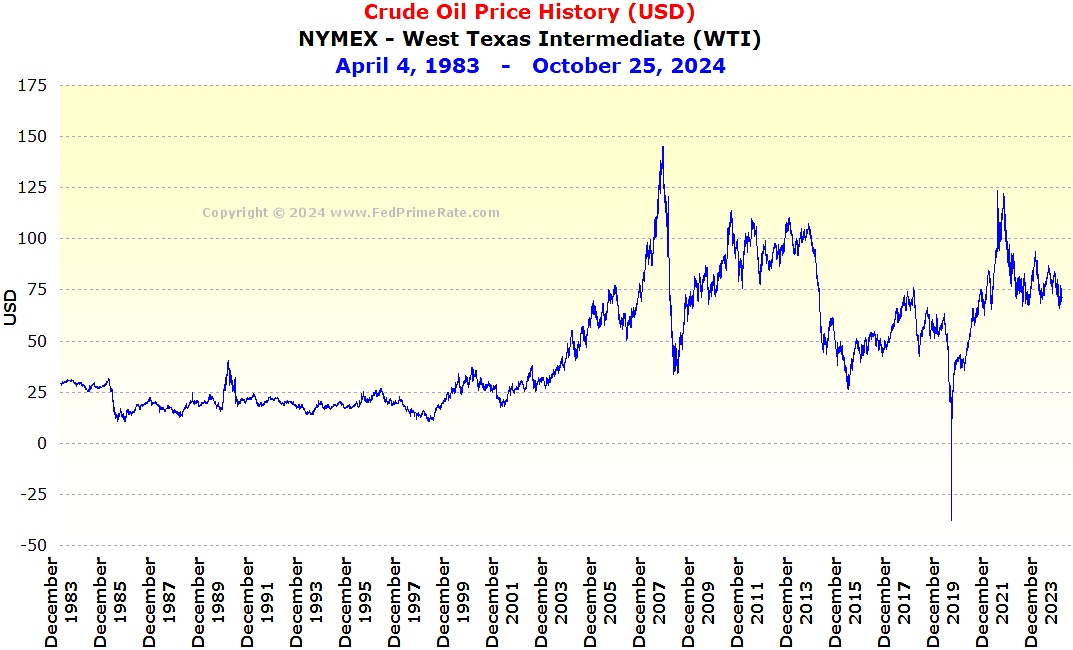

Crude Oil Price Report April 23rd Market News And Insights

Apr 24, 2025

Crude Oil Price Report April 23rd Market News And Insights

Apr 24, 2025