The Extreme Cost Of Broadcom's VMware Acquisition: AT&T's Perspective

Table of Contents

H2: Increased Licensing Costs for AT&T

The acquisition of VMware by Broadcom has raised serious concerns about increased licensing costs for existing clients, including AT&T. With reduced competition in the virtualization market, the potential for significantly higher VMware licensing fees is substantial. This could dramatically impact AT&T's IT budget, forcing difficult choices regarding resource allocation.

- Impact on AT&T's IT Budget: A sharp increase in VMware licensing fees could severely strain AT&T's already considerable IT budget, diverting funds from other critical projects and potentially impacting innovation within the company.

- Potential for Cost-Cutting Measures: To offset the rising costs, AT&T may be forced to implement significant cost-cutting measures across various departments, potentially impacting services and employee morale.

- Comparison with Pre-Acquisition Licensing Costs: While precise figures remain undisclosed, analysts predict a substantial increase compared to pre-acquisition licensing costs, posing a serious financial challenge for AT&T.

These rising costs associated with VMware licensing, coupled with the Broadcom acquisition cost, pose a significant threat to AT&T's long-term financial stability and operational efficiency. The enterprise software pricing landscape has shifted dramatically, and AT&T finds itself needing to navigate this new reality.

H2: Potential for Reduced Innovation and Feature Development

Concerns exist that Broadcom's acquisition may lead to a slowdown in VMware's innovation. Broadcom's primary focus on semiconductor technology might shift resources away from VMware's research and development, resulting in slower feature updates and reduced support for existing products. This could leave AT&T vulnerable to technological stagnation.

- Risk of Obsolescence for AT&T's Infrastructure: Slower innovation could render AT&T's infrastructure outdated, increasing its vulnerability to security threats and reducing its ability to leverage cutting-edge technologies.

- Impact on AT&T's Ability to Compete: Falling behind competitors in terms of technology could significantly impact AT&T's ability to compete effectively in the dynamic telecommunications market.

- Potential Need for AT&T to Invest in Alternative Solutions: Facing slower feature development and reduced support, AT&T may be forced to invest heavily in alternative virtualization solutions, incurring further substantial costs.

The potential for VMware innovation to suffer under Broadcom's ownership directly threatens AT&T's technological advantage, necessitating careful monitoring and potential contingency planning.

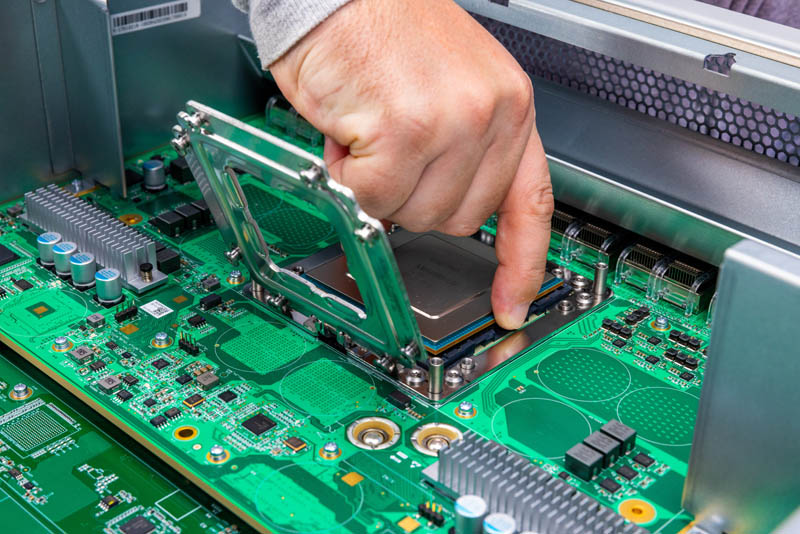

H2: Integration Challenges and Potential Downtime for AT&T

The integration of VMware into Broadcom's operations presents significant risks to AT&T's services. System incompatibility issues and potential system failures during the integration process could lead to prolonged service outages.

- Potential for Service Outages and their Impact on AT&T Customers: Extended downtime could severely impact AT&T's customer base, leading to dissatisfaction, lost revenue, and reputational damage.

- Cost of Potential Downtime for AT&T: The financial cost of downtime, including lost revenue, customer support expenses, and potential regulatory fines, could be substantial for AT&T.

- Increased IT Support Costs: Troubleshooting and resolving integration-related issues will require increased IT support, adding further financial strain on AT&T.

The risks associated with VMware integration challenges are considerable, and AT&T must be prepared for potential disruptions and their associated financial implications. The Broadcom acquisition risks extend far beyond simply increased licensing fees.

H2: Strategic Implications for AT&T's Long-Term Strategy

The Broadcom acquisition forces AT&T to reassess its long-term virtualization strategy. The increased costs and potential for reduced innovation necessitate a careful evaluation of VMware's continued relevance within AT&T's infrastructure.

- Long-Term Cost Analysis for AT&T: AT&T needs to conduct a thorough long-term cost analysis, weighing the costs of remaining with VMware against the potential costs of migrating to alternative solutions.

- Evaluation of Alternative Virtualization Technologies: Exploring and evaluating alternative virtualization technologies becomes a crucial aspect of AT&T's strategic planning, considering factors like cost, scalability, and integration capabilities.

- Potential Impact on AT&T's Competitive Landscape: AT&T's ability to maintain a competitive edge will depend heavily on its ability to adapt to the changing landscape and effectively address the challenges presented by Broadcom's acquisition of VMware.

Conclusion:

The extreme cost of Broadcom's VMware acquisition presents significant challenges for AT&T. Increased licensing fees, reduced innovation, and integration risks all threaten the company's financial stability and operational efficiency. AT&T, along with other businesses reliant on VMware solutions, must closely monitor the situation and carefully assess its long-term implications. Further research into the extreme cost of Broadcom's VMware acquisition is crucial for understanding its long-term impact. Businesses should proactively evaluate their dependence on VMware and explore potential alternative virtualization solutions to mitigate risks and ensure future competitiveness. Ignoring the potential ramifications of this acquisition could prove extremely costly.

Featured Posts

-

Moysiki Bradia Synaylia Kathigiton Dimotikoy Odeioy Rodoy Stin Dimokratiki

May 20, 2025

Moysiki Bradia Synaylia Kathigiton Dimotikoy Odeioy Rodoy Stin Dimokratiki

May 20, 2025 -

Suki Waterhouse Calls Out Twinks In Hilarious Tik Tok Video

May 20, 2025

Suki Waterhouse Calls Out Twinks In Hilarious Tik Tok Video

May 20, 2025 -

Pasxa Kai Protomagia Sto Oropedio Evdomos Protaseis Gia Diamoni Kai Drastiriotites

May 20, 2025

Pasxa Kai Protomagia Sto Oropedio Evdomos Protaseis Gia Diamoni Kai Drastiriotites

May 20, 2025 -

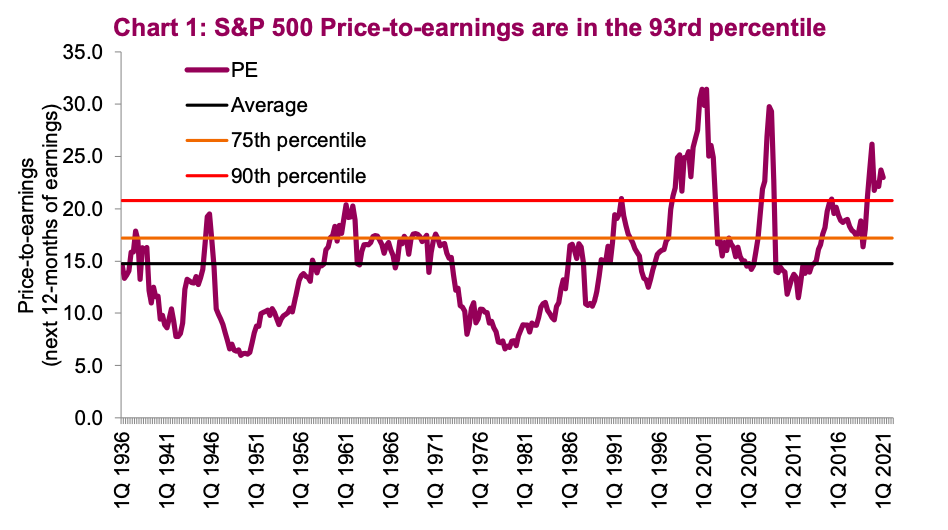

Bof A On Stock Market Valuations A Reason For Calm

May 20, 2025

Bof A On Stock Market Valuations A Reason For Calm

May 20, 2025 -

Mega Tampoy Leptomereies Gia To Simerino Epeisodio

May 20, 2025

Mega Tampoy Leptomereies Gia To Simerino Epeisodio

May 20, 2025