The Financial Implications Of Public Sector Pensions: A Taxpayer's Analysis

Table of Contents

The Growing Burden of Public Sector Pension Liabilities

The escalating cost of public sector pensions is driven by several interconnected factors, creating a substantial financial challenge for governments worldwide. Let's examine the key contributors:

Defined Benefit Plans and their Impact

Many public sector employees are enrolled in defined benefit (DB) pension plans. These plans guarantee a specific income stream upon retirement, calculated based on factors like salary and years of service. While providing crucial retirement security, DB plans create significant long-term financial obligations for governments.

- Guaranteed income for retirees: This inherent guarantee means governments are responsible for making up any shortfalls in the pension fund.

- Impact of increasing life expectancy: People are living longer, leading to increased pension payouts over a longer period.

- Unfunded liabilities: Many public sector pension funds face substantial unfunded liabilities – the difference between the promised benefits and the assets available to pay them.

- Impact of employee salary increases on future pension payouts: Higher salaries translate directly into higher pension payments in the future, exacerbating the long-term financial burden.

Escalating Healthcare Costs for Retirees

Beyond pension payments themselves, the cost of providing healthcare benefits to retired public sector employees is a significant and often underestimated expense.

- Rising healthcare costs: The ever-increasing cost of healthcare services places a considerable strain on public sector pension funds.

- Long-term care expenses: The demand for long-term care increases with age, adding a substantial layer of expense to the overall cost of retiree benefits.

- Impact of an aging population: As the population ages, the number of retirees drawing pensions and healthcare benefits grows, increasing the overall financial burden.

Investment Returns and their Volatility

The financial health of public sector pension funds is heavily reliant on investment returns. However, market fluctuations introduce significant volatility and risk.

- Pension fund investment strategies: The strategies employed to manage pension fund assets play a critical role in determining long-term sustainability.

- Impact of low interest rates: Low interest rates reduce the returns on investments, making it more challenging to meet future pension obligations.

- Risk management: Effective risk management strategies are crucial to mitigate the impact of market downturns and protect the long-term solvency of pension funds.

- Potential investment losses: Poor investment performance can lead to significant losses, further increasing the financial burden on taxpayers.

The Taxpayer's Share of the Cost

The financial responsibility for public sector pensions ultimately falls on the taxpayer. This burden manifests in both direct and indirect ways:

Direct Taxation

A significant portion of public sector pension costs is funded through direct taxation, such as income tax and sales tax.

- Tax burden distribution: The tax burden is distributed across the population, impacting individuals and businesses alike.

- Impact on disposable income: Higher taxes to fund pensions reduce disposable income, potentially hindering economic growth.

- Tax increases to cover pension shortfalls: When pension funds underperform, governments often resort to tax increases to cover the shortfall.

Indirect Costs

Beyond direct taxation, taxpayers bear indirect costs associated with public sector pension obligations.

- Opportunity cost of funding pensions: Resources allocated to pensions could have been used for other vital public services.

- Reduced spending on education, healthcare, and infrastructure: The need to fund pensions often leads to reduced government spending in other crucial areas.

- Impact on economic growth: Reduced investment in education and infrastructure can negatively impact long-term economic growth.

Intergenerational Equity

The current structure of many public sector pension systems raises concerns about intergenerational equity.

- Long-term sustainability concerns: The current systems' long-term financial sustainability is questionable due to demographic shifts and economic uncertainties.

- Burden on future generations: Future generations may face higher taxes to fund the pensions of current retirees, creating an inequitable burden.

- Potential reforms to address intergenerational equity issues: Reforms are necessary to ensure fairness across generations and long-term sustainability.

Potential Solutions and Reforms

Addressing the challenges posed by public sector pensions requires a multi-faceted approach encompassing reforms, improved management, and increased transparency.

Pension Reform Strategies

Several strategies can help ensure the long-term sustainability of public sector pension systems:

- Shifting to defined contribution plans: Moving towards defined contribution plans, where employee and employer contributions are invested, shifts the investment risk to the employee.

- Increasing employee contributions: Increasing the contribution rate of employees can help alleviate the financial burden on taxpayers.

- Adjusting retirement ages: Gradually increasing the retirement age can reduce the duration of pension payments.

- Reforming healthcare benefits for retirees: Reforming healthcare benefits to control costs can significantly impact the overall pension expense.

Improved Investment Management

Effective investment management is critical for maximizing returns and minimizing risk in public sector pension funds.

- Diversification: Diversifying investments across various asset classes can reduce risk.

- Risk assessment: Thorough risk assessment is essential to manage potential losses.

- Active vs. passive investment strategies: Careful consideration should be given to the choice between active and passive investment management strategies.

Transparency and Accountability

Transparency and accountability are crucial for building public trust and ensuring responsible management of public sector pension funds.

- Independent audits: Regular independent audits provide assurance of financial integrity.

- Public reporting of financial data: Openly reporting financial data allows for public scrutiny and oversight.

- Stronger oversight mechanisms: Robust oversight mechanisms are necessary to prevent mismanagement and ensure accountability.

Conclusion

The financial implications of public sector pensions are far-reaching and demand careful consideration. The growing burden of pension liabilities poses a significant challenge to taxpayers and necessitates a proactive approach to address long-term sustainability. Understanding the various factors contributing to this cost, including defined benefit plans, healthcare expenses, and investment returns, is essential for informed debate and policymaking. Reforms including shifting to defined contribution plans, increasing employee contributions, improving investment management, and enhancing transparency are crucial to ensuring the long-term financial health of public sector pension systems and mitigating the impact on taxpayers. We need a thorough discussion and implementation of comprehensive solutions to effectively manage the financial burden of public sector pensions and secure a stable future for all.

Featured Posts

-

How You Tube Caters To The Preferences Of Older Viewers

Apr 29, 2025

How You Tube Caters To The Preferences Of Older Viewers

Apr 29, 2025 -

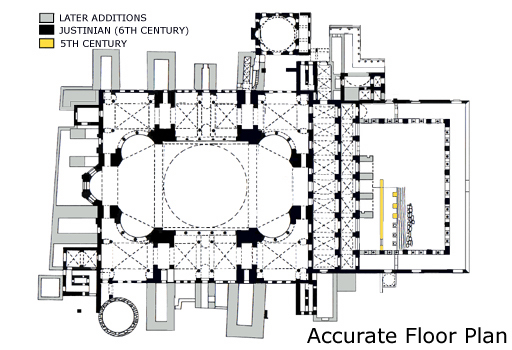

Hagia Sophia A 1600 Year History Of Survival

Apr 29, 2025

Hagia Sophia A 1600 Year History Of Survival

Apr 29, 2025 -

Porsche Macan Fyrsta 100 Rafutgafan Kynnt

Apr 29, 2025

Porsche Macan Fyrsta 100 Rafutgafan Kynnt

Apr 29, 2025 -

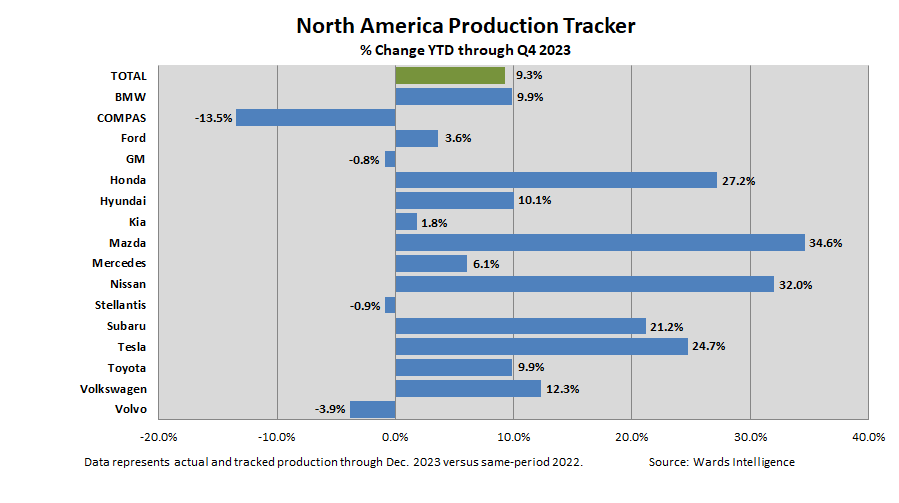

Understanding The Difficulties Of All American Production

Apr 29, 2025

Understanding The Difficulties Of All American Production

Apr 29, 2025 -

Ce Schimbari Fiscale Ne Asteapta In 2025 Eveniment Pw C

Apr 29, 2025

Ce Schimbari Fiscale Ne Asteapta In 2025 Eveniment Pw C

Apr 29, 2025